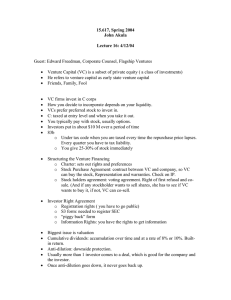

Giovanni Finocchio

Giovanni Finocchio

Agenda

• Quick intro

• Our funding

• What is VC & what do we like?

• The business plan

• The investment process

• Q&A

Who are we

• FCA authorised venture capital fund manager, established over 20 years

• Generalist, early stage investor

• 21 staff, owner-managed business

• £80m under management

• c.90 portfolio companies

• Invest from £50k to £500k

Partnering with

Our Funds

What is Venture Capital?

• Money at risk

• Ownership (shares) for a cash investment

• Investor objective - capital gain

VC - Why and When?

• Cash needed to expand

• Little or no revenue

• Unprofitable

• Friends and family exhausted

• Too risky for a bank

• Little or no assets

• Planning to grow rapidly

VC – What do we like investing in?

• Large market potential

• No cap on growth

•

Good management team

• Demonstrated commitment

• Invested own cash or salary sacrifice

• Protectable IP

Who do VC and Angels get to see ?

• Lack of understand what equity funding is about

•

Flaky business models and plans

• Incomplete/inappropriate management

• Unrealistic valuations

Investment ready

• Business plan & financial forecasts

• History

• The product, IP

• The market and the competition

• Managers’ CVs

• Route to market

• Required funds and use

• Revenue model, financials including P&L, cashflows and balance sheets

• Planned Exit – who will buy business and why

The investment process

• Send in business plan

• Invited for presentation

• Follow up

• Outline Proposal

• Investment Committee approval

• Due diligence

• Legal documents & Completion

• 6 – 8 weeks depending on co-investment

Some of our portfolio companies

What often we hear

1. Our projections are conservative.

2. A consulting firm (Yankee Group, Jupiter, IDC...take your pick) predicts our market will swell to $50 billion by 2003.

3. Amazon (or Oracle, or AOL, or another huge company) is about to sign a sales contract with us.

4. Key employees will join our startup as soon as we get funded.

5. We have first-mover advantage.

6. Several VCs are already interested.

7. Oracle (or Microsoft, or some other big company) is too slow to be a threat.

8. We're glad the bubble has burst.

9. Our patents make our business defensible.

10. All we have to do is get 1% of the market.

Guy Kawasaki, CEO of Garage.com

http://www.businessweek.com/smallbiz/content/dec2000/sb20001229_421.htm

How to contact us

• Midven Limited

Cavendish House

39-41 Waterloo Street

Birmingham, B2 5PP

Tel: 0121 710 1990

• Email:

Giovanni.Finocchio@midven.co.uk