Entrepreneurship and Business History: Renewing the Research Agenda

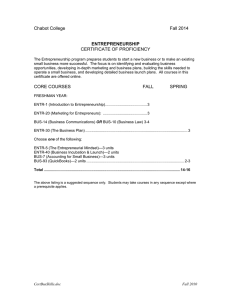

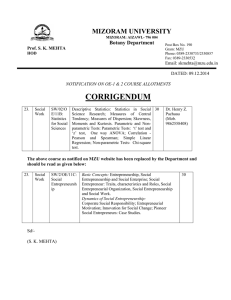

advertisement