Document 13129229

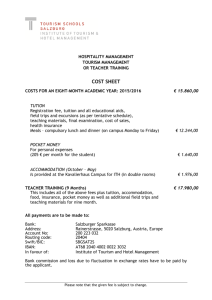

advertisement