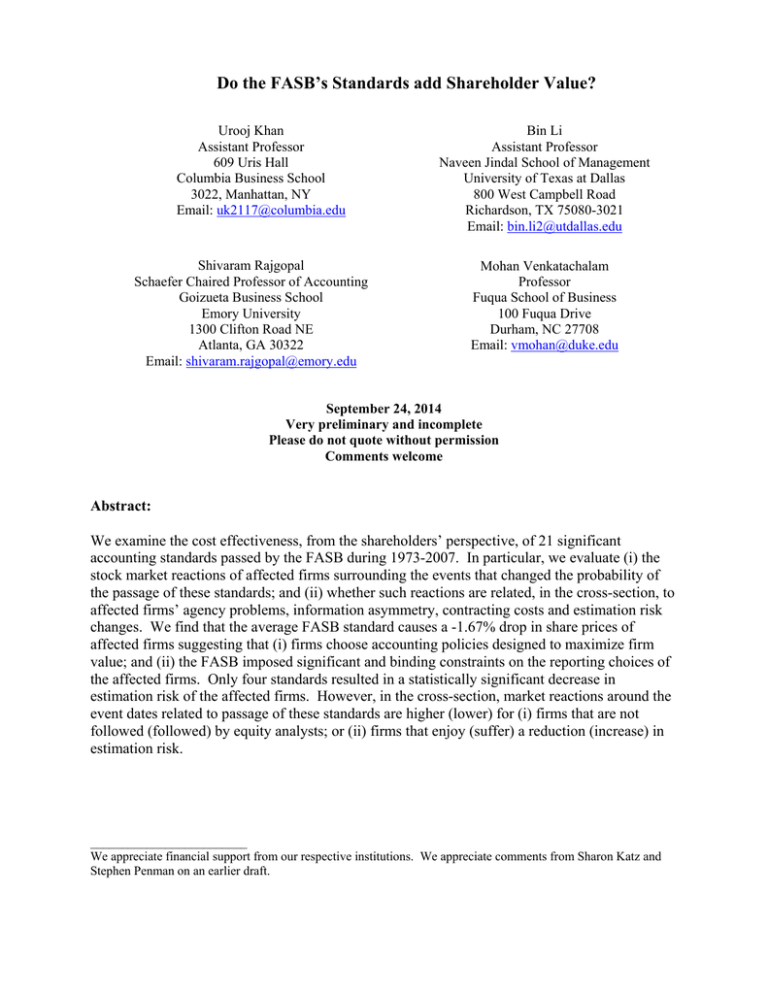

Do the FASB’s Standards add Shareholder Value?

advertisement