UNDERGRADUATE AND GRADUATE COURSE AND CURRICULUM CHANGES Previously Approved by the

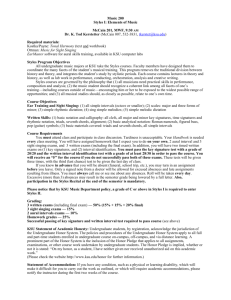

advertisement