M. Shefeer Shereef

advertisement

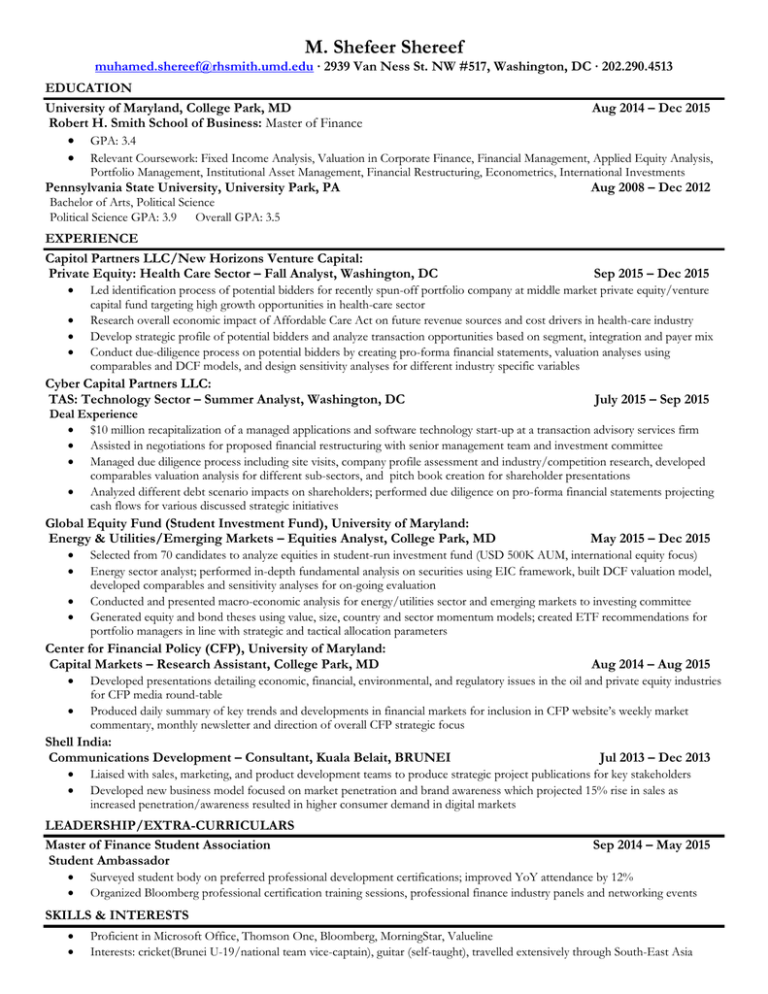

M. Shefeer Shereef muhamed.shereef@rhsmith.umd.edu ∙ 2939 Van Ness St. NW #517, Washington, DC ∙ 202.290.4513 EDUCATION University of Maryland, College Park, MD Aug 2014 – Dec 2015 Robert H. Smith School of Business: Master of Finance GPA: 3.4 Relevant Coursework: Fixed Income Analysis, Valuation in Corporate Finance, Financial Management, Applied Equity Analysis, Portfolio Management, Institutional Asset Management, Financial Restructuring, Econometrics, International Investments Pennsylvania State University, University Park, PA Aug 2008 – Dec 2012 EXPERIENCE Capitol Partners LLC/New Horizons Venture Capital: Private Equity: Health Care Sector – Fall Analyst, Washington, DC Sep 2015 – Dec 2015 Bachelor of Arts, Political Science Political Science GPA: 3.9 Overall GPA: 3.5 Led identification process of potential bidders for recently spun-off portfolio company at middle market private equity/venture capital fund targeting high growth opportunities in health-care sector Research overall economic impact of Affordable Care Act on future revenue sources and cost drivers in health-care industry Develop strategic profile of potential bidders and analyze transaction opportunities based on segment, integration and payer mix Conduct due-diligence process on potential bidders by creating pro-forma financial statements, valuation analyses using comparables and DCF models, and design sensitivity analyses for different industry specific variables Cyber Capital Partners LLC: TAS: Technology Sector – Summer Analyst, Washington, DC July 2015 – Sep 2015 Deal Experience $10 million recapitalization of a managed applications and software technology start-up at a transaction advisory services firm Assisted in negotiations for proposed financial restructuring with senior management team and investment committee Managed due diligence process including site visits, company profile assessment and industry/competition research, developed comparables valuation analysis for different sub-sectors, and pitch book creation for shareholder presentations Analyzed different debt scenario impacts on shareholders; performed due diligence on pro-forma financial statements projecting cash flows for various discussed strategic initiatives Global Equity Fund (Student Investment Fund), University of Maryland: Energy & Utilities/Emerging Markets – Equities Analyst, College Park, MD Center for Financial Policy (CFP), University of Maryland: Capital Markets – Research Assistant, College Park, MD Jul 2013 – Dec 2013 Liaised with sales, marketing, and product development teams to produce strategic project publications for key stakeholders Developed new business model focused on market penetration and brand awareness which projected 15% rise in sales as increased penetration/awareness resulted in higher consumer demand in digital markets LEADERSHIP/EXTRA-CURRICULARS Master of Finance Student Association Student Ambassador Aug 2014 – Aug 2015 Developed presentations detailing economic, financial, environmental, and regulatory issues in the oil and private equity industries for CFP media round-table Produced daily summary of key trends and developments in financial markets for inclusion in CFP website’s weekly market commentary, monthly newsletter and direction of overall CFP strategic focus Shell India: Communications Development – Consultant, Kuala Belait, BRUNEI May 2015 – Dec 2015 Selected from 70 candidates to analyze equities in student-run investment fund (USD 500K AUM, international equity focus) Energy sector analyst; performed in-depth fundamental analysis on securities using EIC framework, built DCF valuation model, developed comparables and sensitivity analyses for on-going evaluation Conducted and presented macro-economic analysis for energy/utilities sector and emerging markets to investing committee Generated equity and bond theses using value, size, country and sector momentum models; created ETF recommendations for portfolio managers in line with strategic and tactical allocation parameters Sep 2014 – May 2015 Surveyed student body on preferred professional development certifications; improved YoY attendance by 12% Organized Bloomberg professional certification training sessions, professional finance industry panels and networking events SKILLS & INTERESTS Proficient in Microsoft Office, Thomson One, Bloomberg, MorningStar, Valueline Interests: cricket(Brunei U-19/national team vice-captain), guitar (self-taught), travelled extensively through South-East Asia