Motivating Consumer Financial Behavior Through Choice-Set Characteristics by Sheena S. Iyengar

advertisement

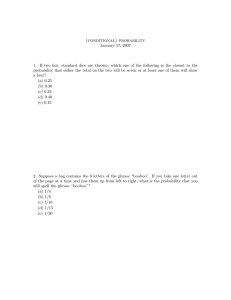

BeFi Web Seminar for January 30, 2007 Motivating Consumer Financial Behavior Through Choice-Set Characteristics © BeFi Forum 2007 by Sheena S. Iyengar Professor Columbia Business School Motivating Consumer Financial Behavior Through Choice-Set Characteristics Sheena S. Iyengar Columbia University Business School About Me Education PhD in Social Psychology, Stanford University 1997 Undergraduate: University of Pennsylvania BS Economics, Wharton School of Business - 1992 BA Psychology, College of Arts & Sciences – 1992 Awards and Honors Presidential Early Career Award Full Grant, Citigroup Behavioral Sciences Research Council Invited Fellow, Institute for Advanced Studies, Princeton My Research Interests What are the consequences when people face choice sets with increasing numbers of options? How does it affect people’s Decision quality Satisfaction with choices made Choice Then and Now New York Stock Exchange 3500 3000 2500 2000 1500 1000 500 00 20 95 90 19 19 85 19 80 19 75 70 19 19 65 19 60 19 55 50 19 45 19 19 40 35 19 19 30 0 19 Number of Companies Listed Increase in Options and Combinations of Options Number of Mutual Funds 9,000 8,000 7,000 6,000 5,000 4,000 3,000 2,000 1,000 0 1940 1945 1950 1955 1960 1965 1970 1975 1980 1985 1990 1995 2000 6 Jams 24 Jams More Choice: Appealing But Debilitating Number of people who ACTUALLY BOUGHT 6 JAMS 24 JAMS Graphics source: Simon Fraser, Fidelity International What if choosers are given incentives for choosing? Consider retirement savings programs in which not choosing is financially detrimental Vanguard Data Individual-Level Characteristics Number of employees 793,794 Participation rate 71% Average contribution $3,848 Max out rate 12% Median annual income $47,430 Gender distribution 63% male Mean age 42 yrs Vanguard Data Plan-Level Characteristics 124 include company stock as an option 647 Plans 47 match in company stock only 316 offer Defined Benefit plans 2-59 Funds Offered 90% offer between 6 and 22 funds 18 offer more than 30 funds The Effect of Choice on Savings Behavior 75% 70% 65% 60% 55% # Funds Offered 59 56 53 50 47 44 41 38 35 32 29 26 23 20 17 14 11 8 5 50% 2 Predicted Participation 80% + 10 Funds = + Money Market Percent Change in Allocation 10 8 % 6 4 2 0 -2 Allocation to Cash Funds Probability of Allocating More than 50% +10 Funds = + Money Market & Bond Percent Change in Allocation 10 8 % 6 4 2 0 1 2 Allocation to Cash & Bond Funds Probability of Allocating More than 50% +10 Funds = - Equity Allocation to Equity Funds 0 Probability of Allocating to Equity Funds -2 -4 % -6 -8 -10 -12 -14 Percent Change in Allocation Asset Allocation Participants generally allocated their contributions to 3 or 4 funds, regardless of the number in their plan Allocated evenly between plans – the “conditional 1/N rule” Allocation to equities did not increase with number/proportion of equity funds in plan Huberman and Jiang, Journal of Finance April 2006 Choosing From 3 Gambles Thank you for participating in the experiment. For compensation, please select one of the gambles below. The experimenter will then flip a coin. Should the coin land on “heads,” you will receive the amount specified in the left column. Should the coin land on “tails,” you will receive the amount specified in the right column. Please check off the desired gamble and the experimenter will proceed to flip the coin. Please place a check next to the desired option If the coin indicates “heads” If the coin indicates “tails” $5.00 $5.00 $13.50 $0.00 $8.75 $3.50 Choosing From 11 Gambles Please place a check next to the desired option If the coin indicates “heads” If the coin indicates “tails” $4.00 $8.25 $11.75 $1.00 $5.00 $5.00 $4.50 $7.75 $1.50 $11.25 $13.50 $0.00 $8.75 $3.50 $9.50 $3.00 $12.50 $0.50 $2.50 $10.00 $10.50 $2.00 Effect of Choice Set Size on Gambling Gamble Chosen by Participants (%) Low Choice High Choice 80 70 60 50 40 30 20 10 0 Sure Bet Risky Gamble 3 Gambles, 6 Payoffs Each Thank you for participating in the experiment. For compensation, please select one of the gambles below. The experimenter will provide you with a die. You will cast the die and, depending on how the die falls, receive the amount of money indicated in the table below. Please check off the desired gamble. Please place a check next to the desired option If the die falls on 1, you receive If the die falls on 2, you receive $0.00 $0.00 If the die falls on 3, you receive $0.00 If the die falls on 4, you receive $10.00 If the die falls on 5, you receive $10.00 If the die falls on 6, you receive $10.00 $9.25 $7.00 $0.75 $8.75 $1.25 $1.50 $9.75 $8.50 $0.75 $0.00 $4.25 $5.50 11 Gambles, 6 Payoffs Each Please place a check next to the desired option If the die falls on 1, you receive If the die falls on 2, you receive If the die falls on 3, you receive If the die falls on 4, you receive If the die falls on 5, you receive If the die falls on 6, you receive $7.00 $1.50 $9.25 $0.75 $8.75 $1.25 $4.25 $5.50 $0.00 $8.50 $0.75 $9.75 $1.00 $2.00 $6.75 $7.50 $5.75 $4.75 $0.00 $0.00 $0.00 $10.00 $10.00 $10.00 $5.50 $7.50 $0.75 $6.75 $1.00 $6.50 $9.75 $8.00 $0.00 $0.00 $2.75 $8.75 $3.00 $1.50 $6.50 $9.75 $7.00 $0.50 $3.25 $1.50 $1.50 $2.50 $9.50 $10.00 $3.25 $8.50 $5.50 $8.50 $0.00 $2.50 $3.75 $7.75 $2.00 $9.25 $3.25 $2.00 $1.25 $0.75 $4.50 $8.75 $4.50 $8.50 Gamble Chosen by Participants (%) Preference for the Binary Gamble 60 50 40 30 20 10 0 Low Choice High Choice Branching Out Future research need not be limited to 401(k) plans, but could include Mutual funds Lending Insurance Credit cards Further Directions Consumer Choice Over Time Does choice overload have a persistent or temporary effect on participation rates? What effect does increasing or decreasing the number of funds in a plan have on consumer behavior? Data requirements: Multi-year data on customers’ decisions, ideally longitudinal Further Directions Option Presentation As the number of options rises, which attributes remain/become predictive of consumer choice? Order of presentation Clarity Similarity or distinctness from other options Data requirements: Choice data linked to arrangement and characteristics of choice-set items Further Directions Optimal Number of Options What number of options results in the highest consumer participation? How does this number vary by Domain (e.g. mutual funds vs. insurance policies vs. insurance policies) Customer (e.g. age, expertise) Time horizon (e.g. short-term vs. mortgage loans) Data requirements: Data on a variety of products/services, or could be addressed through field studies and questionnaire data Further Directions Multiple-Domain Choice Interaction How do choices in one domain (e.g. mutual funds) affect choices made in another (e.g. insurance policies)? Are people consistent across domains in their responses to choice? Data requirements: Data from providers of comprehensive financial services Questions? Contact Information Until June 2007 Permanent Organizational Behaviour A303 London Business School Regent's Park London NW1 4SA United Kingdom Uris Hall 714 Columbia University Business School 3022 Broadway New York, NY 10027 siyengar@london.edu ss957@columbia.edu Switchboard: +44 (0)20 7000 7000 Direct line: +44 (0)20 7000 8931 Extension: 8931 Phone: (212) 854 8308 http://www.columbia.edu/~ss957