THE CRUDE OIL WINDFALL PROFIT ... AN OVERVIEW Submitted to Dean Hemingway

advertisement

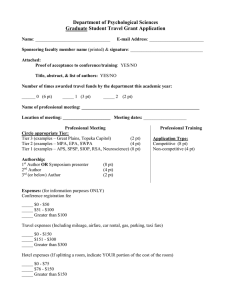

THE CRUDE OIL WINDFALL PROFIT TAX ACT OF 1980 AN OVERVIEW

Submitted to

Dean Hemingway

Independent Research

One Hour

Marc H. Robert

May 11, 1981

On March 7,

1980, an effort which had begun with Richard

Nixon and the Arab oil embargo of 1973 came to a denouement when

Congressional conferees finished final revision of the Crude

Oil Windfall Profit Tax Act of 1980 (P.L.

The Act,

96-223)("the Act").

signed by President Carter on April 2, 1980, was con-

ceivedand formed in a political climate dominated by a Democratic legislature and executive;

"

the result of political

compromise in a system described by Theodore Parker as

science of exigencies.'" 1

'the

The measure came as a consequence..:

of the announcement by President Carter in 1979 of a program of

phased decontrol of domestic crude oil prices, prices which had

regulated by one government agency or another since President

Nixon's 1971 wage and price freeze.

Windfall profit taxation,

as applied to the petroleum ind-

ustry, was not a new concept in 1979.

A form of the tax was pro-

posedby Nixon after the 1973 embargo, but the 93rd,

94th and 95th

Congresses all failed to impose a windfall profits tax.

The

clamor against the major integrated oil companies had risen to

r

a high enough level, however,

for passage of the legislation to

become a reality in 1980.

The decontrol of crude oil prices is at the heart of the

Act.

The old crude oil price control regulations were superceded

on June 1. 1979, by President Carter's phased decontrol program.

Under that program, Department of Energy

(DOE) price regulations

Will phase out remaining price controls by September 30, 1981,

When the legal authority to control oil prices will expire.

Newly discovered oil, oil from an~ Pfoperty which had no pro-

},<

.1

V·· "-

-2-

duction during 1978 (onshore)

January 1,

or offshore leases executed after

1979 from which there was no production during 1978,

re ceived decontrolled prices after June 1 , 1979

.

To accomplish the decontrol process for crude oil which

was still subject to the DOE pricing regulations on June 1, 1979,

producers were allowed to reduce their base production control

levels

(BCPLs) by one-and-one-half percent for each month in

1979, and three percent per month in 1980,

the last nineteen

percent to be eliminated in September of this year.

The BCPLs

established a level of production below which the prices at

which the petroleum was sold were controlled by the DOE.

A full

explanation of the DOE regulations is beyond the scope of this

undertaking;

simply stated, however,

the monthly reduction of

the BCPLs permits progressively more crude oil to be sold at uncontrolled,

or market,

prices. 2

In the discussion of the Act contained herein,

the great-

est emphasis will be given to the. mechanical or computational

aspects of the tax.

Attention will also be given to some prac-

tical suggestions regarding compliance with the tax,

and finally

to the question of the constitutionality of the Zct as attacked

by a number

of interested parties.

numerous other provisions,

While the Act also contained

or riders,

practical constraints

preclude their consideration here.

The Act imposes a complicated burden on affected taxpayers

the full brunt of which will not be felt until those taxpayers

attempted compliance with its terms.

however,

Due to the Act's youth,

there is a dearth of judicial interpretation by which

-3-

befuddled producers and royalty owners might guide their actions.

Simply stated,

the Windfall Profits Tax ("WPT")

is assessed ag-

ainst the "windfall profit" realized by the producer as a result

of the phased decontrol of crude oil prices.

ation are variable,

The rates of tax-

such variation depending on (i)

the category,

or tier into which a given barrle of oil is placed, and (ii)

whether or not the producer (the taxpayer)

is classified as an

independent producer by the Act.

Clearly,

the initial problem confronting the taxpayer is a

determination of the amount of windfall profit on which the tax

must be paid.

That amount is defined in the Act as "the excess

of the removal price of the barrel of crude oil over the sum of

(1)

the adjusted base price of such barrel, and

(2)

the amount

of severance tax adjustment with·respect to such barrel provided

by section 4996(c)."_3

The first hurdle to be dealt with in de-

ciphering that definition is the meaning of the phrase "removal

Price".

In general,

the removal price of a barrel of crude oil

for WPT purposes is the amount for which that barrel is sold. 4

In some circumstances, however, the removal price will be the

constructive sales price for purposes of determining gross income from the property under Internal Revenue Code ("IRC")

§613.

Those circumstances arise in the case of sales between related

Persons

(as defined in IRC §103(b)(6)(C)) 5 , when the oil is re-

moved from the premises

(as definde in IRC §613) prior to sale 6 ,

or when processing of the crude is commenced prior to removal

from the premises.

In the latter situation,

the oil is con-

-4-

strued to be removed on the day the refining process begins.7

The next major determination which must be made in calculating the amount of taxable windfall profit is that of the "adjusted base price" of the barrel.

In stark terms,

the adjusted

base price is the sum of the base price of the barrel plus an

amount equal to such base price multiplied by the inflation adjustment for the calendar quarter in which the barrel is removed

(or constructively removed)

from the premises. 8

The base price of a barrel of crude oil depends on the

tier into wh~i c h the barre 1 fa 11 s .

For tier one,

the base price,;

is the ceiling price of upper tier crude oil under the March,

1979 energy regulations if the oil had been produced and sold

in May, 1979 as upper tieroil,

reduced by twenty-one cents. 9

Tier one oil is defined in the Act by exclusion;

that is,

as

any taxable crude oil other than that in tiers two and three. 10

The base prices of tier two and tier three crude are divided into two time periods:

pre-October, 1980 base price, and

post-September 1980 base price.

before October of 1980,

For a barrel or crude produced

the base price for both tiers was "the

highest posted price for uncontrolled oil of the same grade,

quality and field multiplied by the fraction 15.20/35.00 for

tier two oil and 16.55/35.00 for tier three oil. " 11

For a

barrel produced after September, 1980, base prices are to be

determined " pursuant to the method prescribed by the Secretary

[of the Treasury]

by regulations.

Any method so prescribed

shall be designed so as to yield, with respect to oil of any

&rade, quality and field,

a base price which approximates the

Price at which such oil would have sold in December 1979 if all

6~J6

-5-

domestic crude oil were uncontrolled, and the average removal

price for all domestic crude oil (other than Sadlerochit oil)

were (i)

$15.20 a barrel for purposes of determining base prices

for tier two oil,

and (ii)

$16.55 a barrel for purposes of de-

termining base prices for tier three oil."12

A minimum base

price for tier two and tier three oil is also established by

the Act;

that minimum is

the ceiling price under the March, 1979

energy regulations if the oil had been produced in May of 1979,

plus either $1.00

(tier two)

or $3.00 (tier three). 1 3

/

'

Tier two oil is defined in the Act as oil from "stripper

well operations" as defined in the June, 1979 energy regulations

and oil from an economic interest in a National Petroleum Reserve belonging to the United States.

Tier two is also expres-

sly exclusive of oil included in tier three. 14

oil is oil from a property which,

Stripper well

at the time of certification

as such, must average ten barrels of oil per day or less.

If

the rate increases after the certification date, however,

the

property is not removed from the stripper well category.

Tier three oil falls

discovered oil, heavy oil,

into one of three categories:

15

newly

and incremental tertiary oil.

"Newly discovered oil" is defined in the June,

1979 energy

regulations as production from properties from which commercial

quantities of oil were not produced in 1978.

Included in this

category is production from properties which yielded production in 1978 as a result of test wells; as long as such production was not inciderl.t to continuous commercial production,

Property can qualify as a source of newly discovered oil.l6

6(17

"''

the

-6-

Heavy oil is oil produced from a property which,

either the last month before July,

during

1979 in which crude oil was

produced or during the taxable quarter,

"had a weighted aver-

age gravity of 16degrees A.P.I.[American Petroleum Institute]

or less

(corrected to 60 degrees Farenheit)."l7

Incremental tertiary oil is defined as the excess of the

amount of production on or after the date of beginning of a

qualified tertiary recovery project, while such a project is

in effect on the property,

the month -·cons i de red • 18

over the property's base level for

The b as e 1 eve 1 ref e r red to above is /

an amount equal to the average monthly production from the property during the six month period ended March 31, 1979 (determined in accordance with the June, 1979 energy regulations),

reduced by one percent for each month between December 31, 1978

and the project beginning date,

and two-and-one-half percent

for each month after the project beginning date (or after December 31, 1978, whichever is earlier) and before the month for

which the base level is being calculated. 1 9

Additionally,

a

minimum amount of tertiary oil from a qualifying property is

established by the Act. 20

Generally,

a "qualified tertiary recovery project" is one

which has been certified as such by the DOE under the June, 1979

regulations,

Act.

or which meets alternative requirements under the

The thrust of the requirements for certification is that

(i) the project will "result in more than an insignificant in-

crease in the amount of crude oil which will ultimately be re-

-7-

covere d , u21 and ( ii )

that certain procedural requirements,

such

as the starting date of the project and certification of the

project as a qualifying tertiary recovery project, be met.22

Once the b3se price for the barrel is determined,

it is

necessary to calculate the inflation adjustment for the calendar quarter in which the barrel is removed,

referred to above.

That adjustment is established by the Act as "the percentage

by which

(A)

the implicit price deflator for

ional product for

the gross nat-

the second preceding calendar quarter,

(B) such de f~l at or for the c a 1 end a r

exceeds

quarter ending June 3 0 ,

19 7 9 . " 2 3

.i

Thus, the base price is adjusted for inflation, with the price

deflator indexed to the middle of 1979.

is added for tier three oil:

An additional twist

the adjustment is made by multi-

plying the deflator for the second preceding calendar quarter

I

(A above)

by- 1.005 to the nth power, n being the number of

quarters after September, 1979 and before the quarter in which

the barrel is removed.24

The result of the latter method is

to adjust the base price for inflation plus two percent annually, compounded quarterly. 25

The determination of adjusted base price is best demonstrated by illustration.

Where base prices are $13 for tier

one, $15 for tier two and $16 for tier three

per barrel prices),

(all prices are

and inflation rates for 1979 are three per-

cent in the third quarter,

four percent in the fourth quarter,

and five percent each in the first and second quarters of 1980,

adjusted base prices for tiers one and two are as follows:

-8-

First quarter (base X 1.03)

Tier 1

13.39

Tier 2

15.45

Second quarter(base X 1. 0 7)

13.91

16.05

Third quarter (base X 1.15)

14.95

17.25

Fourth quarter(base X 1.20)

15.60

18.00

Tier three adjusted base price is calculated in this way:

First quarter

16.00 X 1.03 X 1.005

Second quarter

16.00 X 1.07 X 1.010025 = 17.29

Third quarter

16.00 X 1.15 X 1.015075 = 18.68

Fourth quarter

16.00 X 1.20 X 1.020151 = 19.5926

=

16.56

/

Section 499l(b) specifically exempts certain categories

of oil from inclusion in the calculation of windfall profit.

Those exempted are . "(1) cr u de o1"l fr o m a q ua l1"f"1e d g overnmen t al interest or a qualified charitable interest,

Indian oil,

(3) any exempt Alasltan oil, and

front-end oil. "27

(2) any exempt

(4) any exempt

i:

Each of the exemptions is treated individ-

ually in the Act.

A "qualified governmental interest" is one which is held

by a State "or a political subdivision thereof"

or by any agency,

etc., of such State ot political subdivision, and frwm whichi

all oitthe,net income is dedicated forpublic use. 28

The Act

expressly includes the use of a permanent fund for public use

as a qualifying method of handling the net income from an exempt

governmental interest.

The exemption for qualified charitable interests is tied

to IRC §170,

the section which discusses qualified charitable

organizations for Federal income tax deduction purposes.

700

The

-9-

interest must be "(i) held by an organization described in

clause (ii),

(iii),

or (iv) of section 170 (b) (1) (A) which is

also described in section 170(c)(2), or (ii) held (I) by an

organization described in clause

(i)

of section 170(b)(l)(A)

which is also described in section 170(c)(2), and (II)

for

the benefit of an organization described in clause (i)

of this

subparagraph .

•

." and held from January 21, 1980 to the last

day of the taxable period considered. 2 9

Such organizations

generally are those which are "organized and operated exclusively for .religious,

charitable, scientific,

literary or educ-·

ational purposes, or th foster national or international amateur sports competition .

., or for the prevention of cruelty

to children or animals "3° which are creatures of United States

law or the law of any State or possession, "no part of the

earnings of~which inures to the benefit of any private shareholder or individual." 31

As this is an area of tax law which

is peculiarly susceptible of IRS scrutiny (and of taxpayer abuse), it is possible that.-putative qualified charitbble interests will be a continuing source of controversy as applied to

the Act.

Front-end tertiary oil is defined as "any domestic crude

oil (A) which is removed from the premises before October

1, 1981, and

(B) which is treated as front-end oil by reason

of a frint-end tertiary project on one or more properties

2

. h 1s

.

each o f wh 1c

a qua l"f"

1 1e d proper t y. .. 3

"Front-end oil" is

domestic crude for which no first sale ceiling price is imposed

by June, 1979 energy regulations §212.78. 33

701

A qualified pro-

-10-

perty is one the mineral interests of which are at least 50%

held by persons who were independent producers

(as defined by

IRC §4992(b); see infra) in the fourth quarter of 1979 as of

January 1, 1980. 34

A front-end tertiary project is one which

would qualify as such under §212.78 of the energy regulations.35

Basically,

then,

oil which is deregulated as front-end ter-

tiary oil by the DOE is exempt, save for

(i) oil which could

have been deregulated under any other DOE regulation, and (ii)

oil deregulated to finance prepaid expenses.36

"Exemp"t Indian oil" is crude produced by an Indian tribe,

a tribal member or a tribal organization over which the United

States government exercises trust responsibilities, proceeds

of production paid to the United States to the credit of tribal trust funds,

and oil produced before 1992 by an Alaskan

Native Corporation pursuant to the Alaskan Native Claims Settlement Act.37

It is to be noted that only production from

economic interests held by or for one of the above described

groups will qualify for exemption from the tax; production from

an entire property,

fractional interests of which might be

held by non-qualifying entities or individuals, will not be

automatically exempt.

Finally, "exempt Alaskan oil" is crude which is

(i) pro-

from a commercially exploited well located North of the Arctic

Circle, and (ii) produced from a well North of the divide of

the Alaska-Aleutian Range and 75 miles from the nearest point

of the Trans-Alaske pipeline.38

The purpose of the exemption

-11-

for the Alaskan oil named was elucidated in the Conference Report; it "reflects the concern of the conferees that taxation

of this production would discourage exploration and development of reservoirs in areas of extreme climatic conditions."39

The Alaskan oil exemption does not, however,

include oil from

the Sadlerochit reservoir at Prudhoe Bay, Alaska (Sadlerochit

oil), for which special tax provisions are made.40

At this point in the calculation of the tax, it is known

whether the oil produced by the taxpayer is exempt or taxable,

the tier irito which the oil is placed if taxable, and the am-;

ount of wirldfall profit upon which the tax is assessed for

each barrel produced.

The next step in determining the amount

of windfall profit tax liability is the application of the appropriate tax rate to the windfall profit.

As indicated above,

.:_ ....

that tax rate is dependent upon the characterization of the

taxpayer as an "independent producer" or as one outside that

category.

If a taxpayer qualifies as an independent producer,

such taxpayer is entitled to a reduced rate for oil in tiers

one and two to the extent that his production doesn't exceed

his quarterly independent producer amount as explained below.

Tier three oil is taxed at the same rate regardless of the taxpayer's characterization (or not) as an independent producer.

An independent producer is defined in the Act as any producer for whom percentage depletion is ont denied by the operation of IRC §613A(d) (2) or (c) (4). 41

Section 613A(d) (2)

pro-

hibits a percentage depletion deduction for producers or royalty owners who sells, either directly or through a related

7fJ3

-12-

person, oil or naturla gas or derivative products through a

retail outlet operated by the taxpayer or a related person,

or to any person who is obligated to the taxpayer or a related

person to sell the products under the taxpayer's trade name

in marketing or distributing the products.

The limitation on

percentage depletion is applicable when the combined gross receipts of all the retail outlets considered for this purpose

exceeds $5,000,000.

For WPT purposes,

is divided into quarterly amounts

collection. of the tax.

the $5 million limit

to reflect the quarterly

A related person is one who holds five.

/

percent of the outstanding stock of a corporation, five percent of the interests of a partnership, or five percent of the

beneficial interests of an estate or trust.42

The "independent producer amount" to which the reduction

of the t a·x r a t e a p p 1 i e s

is de f in e d in the A c t

of (A) 1,000 barrels, multiplied by

(B)

as " the p r o duct

the number of days in

[the taxable] quarter (31 in the case of the first quarter of

1980) ."43

In other words,

the independent producer amount is

In the event that

average daily production of 1,000 barrels.

the taxpayer's qualified production exceeds that limit,

the

1,000 barrel limit will be allocated between tiers one and

two in the ratio of the taxpayer's production of tier one and

tier two crudes in the taxable quarter. 44

v

ithin each tier,

the independent producer amount must be allocated on "the basis of the removal price for such person's domestic crude oil

in such tier removed during such quarter, beginning with the

highest of such prices. n45

The allocation supplied by these

-13-

provisions allows

the taxpayer to have the production with

the greatest taxable windfall profit placed into the independent producer amount category,

thus

taxable at the lower rate.

"Qualified production" for purposes of the Act is defined as "the number of barrels of crude oil

[taxpayer]

is

the producer,

taxable] quarter,

which is

(A) of which the

(B) which is removed during

(C) whuch is tier 1 or tiler 2 oil,

attributable to

[the

and

(D)

the independent producer's working

interest in a property. " 46

A significant departure from characterization of a pro/

ducer as an independent producer is found in the Act's treatment of production from transferred property is certain situa t ions.

Essentially, production will not qualify as indepen-

dent producer oil if an interest in the relevant property was

transferred by a disqualified transferor on or after January

1, 1980.

A disqualified transferor is one whose production

exceeded the independent producer amount for the taxable quarter, and who was not an independent producer for that quarter.47

Holdings of partnerships and trusts or estates are

deemed to be owned proportionately by the partners and benefic. .

.

1 y,

1ar1.es,

respect1ve

of

48

. .

sue h ent1tles.

Again,

the test

here is related to IRC §613A in that disqualification of the

transferee from claiming percentage deplation under that section would similarly disqualify him from claiming independent

producer status.

However,

there are some differences between

the percentage depletion and the WPT prov is ions.

First,

trans-

fers between related persons who must share one 1,000 barrel

7fJ5

-14-

amount won"t.,~,disqualify a property which would otherwise qualify; secondly,

,.a more flexible rule applies to transfers bet-

ween small independent producers." 49

Also exempted from the transfer rule are transfers at

death, a qualifying change of beneficiaries, and,

above,

amount.

as mentioned

transfers who are required to share one 1,000 barrel

Expressly included in the transfer rule are subleases

of properties after 1979.50

As alluded to in the foregoing discussion,

tains a

cl~use

the Act con-

which requires the allocation of the 1,000 bar-/

rel independent producer amount among persons who belong to

the same related group at any point in time during the taxable

quarter.5 1

Related groups include the following:

controlled corporate group,

a family,

a

a group of entities under common

control, or a trust or estate, at least 50% of which is owned

by the same family.

Additionally, an interest in relevant

property shall be deemed to be held both by the entity directly and by its shareholders, partners or beneficiaries proportionately for purposes of a group of entities at least 50% of

which is family owned.52

Wiile these provisions will make it

more difficult for the affected persons to qualify production

as independent producer oil,

they are exempt from transfer

rule disqualifications.

Two final adjustments or limitations must be applied before the ultimate taxable windfall profit can be determined.

First,

the state severance tax adjustment previously referred

to must be determined and incorporated. 53

7f'6

The adjustment is

-15-

calculated by determining

11

the amount by which

ance tax imposed with respect

to

(A)

any sever-

[the oil being taxed],

ex-

ceeds hhe severance tax would have been imposed if the barrel

ha d b e en v a 1 u e d a t

i ts

a d j us t e d b as e p r i c e .

11

54

A s eve r an c e

tax is one which is levied on the value of a barrel of oil for

the act of extraction of such barrel.

era n c e tax

X: a,!: e

s

in~~

In no case will a sev-

a X cess of f if t e en percent be taken into a c-

count for purposes of this adjustment.55

of the amount of such a

Nor will any excess

tax over that imposed on March 31, 1979

be taken intu account unless attributable to a

rate increase

,/

applicable to all portions of the value of the taxable oil,

i.e. not solely attributable to the increase in value resulting

from decontrol.56

The second limitation is a ceiling on the amount of taxThat amount cannot exceed 90% of the

able windfall profit.

net income attributable to the barrel of crude taxed.57

amount is determined by

d~viding

property for the taxable year,

Such

the taxable income from the

not including a dedcution for

the WPT, by the number of barrels produced during that year. 58

Having determined all of the foregoing,

liability is

the amount of WPT

calculated as per the following illustration:

WINDFALL PROFIT

less:

NET INCOME ADJUSTMENT

times:

APPLICABLE TAX RATE

(a)

Tier one oil -

70% General rate

50% Independent Producer rate

(b)

Tier two oil -

60% General rate

~·i'

{~;

Y'i

(

-16-

(b) Tier two oil -

30% Independent Producer Rate

(c) Tier three oil equals:

30% on all taxable oil

WINDFALL PROFIT TAX LIABILITY59

The responsibility for collection and payment of the tax

is spread among the producer,

chaser of the oil.60

the operator, and the first pur-

Generally,

the responsibility for pay-

ment of the tax is on the owner of the interest, whether the

owner is a producer or a royalty owner.

The responsibility for

collection of the amount of tax liability, however, falls on

..

-

the first purchaser of the crudeoil.61

According to the with~

holding and depositary provisions of the Act,

the first produ-

cer "shall withhold a tax equal to the amount of the tax imposed

by section 4986 with respect

by such purchaser

to such oil from amounts payable

to the producer of such oil •

"62

If an

(~

election is properly made,

the producer and the operator of the

property may substitute such operator for the first purchaser

for collection purposes. 63

The depositary requirements regarding the

freq~ency

and

amount of withholding and payment of tax vary depending on the

nature of the producer.

If such producer is an integrated oil

company, "deposit of the estimated amount of (A) withholding

under subsection (a) by such company, and (B)

such company's

liability for the tax imposed by section 4986 with respect to

oil for which withholding is not required,

a month. n64

shall be made twice

For persons other than integrated oil companies,

deposits are to be made within 45 days after the month in which

the oil was produced. 65

708

-17-

There are a number of practical steps which may be taken

by working interest and

royalty owners which will facilitate

compliance with the provisions of the Act.

Main Hurdman and

cranstoun, certified public accountants, has listed certain

recordkeeping guidelines for the vast majority of situations

covered by the Act as they arise with respect to small, private interests.

For working interest owners,

it is recommended

initially that check skirts from checks received from first

purchasers be retained,

and that the following information be

---

~

captured therefrom on a property-by-property basis:

(1)

the

gross value of any oil sold prior to deduction for any taxes;

(2) the WPT withheld;

withheld; and

(4)

( 3)

the severance or gross production tax

the amount of production in barrels.

For

purposes of calculating the 90% of net income limitation,

it

is recommended that certain historical data are collected, viz:

original lease cost of a given property;

costs incurred on such property;

intangible drilling

cumulative production from the

inception of the working interest through December 31, 1979;

and the estimated reserves attributable to the interest at the

beginning of 1980.

Royalty owners are also advised to retain check skirts received from first purchasers,

capturing the following informa-

tion on a property-by-property basis:

the oil sold;

( 2)

the WPT withheld;

gross production tax withheld.

Where possible,

( 1)

and

the gross value of

( 3)

the severance or

It is also advisable to check,

the computations made by the first purchaser

7f}9

-18-

as reflected on IRS Form 6248,

the annual recap of relevant

data such as the total quantity of crude removed,

liability for

the year,

the amount of WPT withheld,

price of oil in each tier.

dix hereto,

total WPT

and removal

Form 6248 is attached as an appen-

along with various other WPT forms.

One of the more controversial aspects of the Act, aside

from the industry's general dislike for it,

its constitutionality.

is the matter of

The tax is expressly identified in the

text of the Act and in the Conference Report as an excise tax,

·--

which is usually defined as a tax on a privilege,

or selling property.66

such as using

An excise tax has as its only constitu-

tiona! requirement to be applied with geographical uniformity.

I t is argued by some that, by virtue of the exemption from

tax of certain Indian and Alaskan production,

"-

graphical uniformity doesn't exist.

the requisite geo-

It is further argued that

the tax is not an excise tax at all, but a direct tax on property.

"If a tax is imposed by Congress after a privilege is

exercised,

such a tax appears to be a demand against the pro-

perty resulting from exercise of the privilege and hence a direct tax."67

As such,

the tax is required to be apportioned

based on population,

or must qualify as an income tax under the

Sixteenth Amendment.

As the Act appears to meet neither test,

the proponents of the argument maintain that the tax is without

the ambit of the Congress'

power to tax,

and is in fact a con-

fiscation of public property without compensation, and thus

Violative of the Fifth Amendment.

7~10

-19-

There is,

in fact,

a suit pending in the Federal Dist-

rict Court for the District of Wyoming challenging the constitutionality of the Act,

sociation of America

filed by the Independent Petroleum As-

(IPAA)

and thirty national,

state and re-

gional associations of oil and gas producers and royalty owners.

Joining them are several producers and royalty owners who

are themselves directly subject to the tax.

filed on October 14, 1980,

The action was

joining another challenge to the

Act which was filed in Oklahoma.

·-

Both Oklahoma and Wyoming

are located in the Tenth Judicial Circuit, which was part of

the strategy of the Wyoming filing.

to be decided,

While the cases have yet

it is hoped by the plaintiffs that the absence

of a backlog of cases in Wyoming's District Court will facili tate a speedy resolution of the Constitutional attacks on

the Act.

Whether P.L.

from taxpayers,

96-223 will weather the tide of criticism

the judicial attacks referred to above, and the

weakening of its political underpinnings by virtue of the election of a politically conservative and aggressive administration and a Rpeublican-held Senate remains to be seen.

The Act

itself provides for a phaseout of the tax beginning on the

earlier of

(1) December, 1987, or (2)

the month which the Sec-

retary of the Treasury estimates will see the realization of

the target net revenue figure of $227.3 billion.

The phaseout

is to be accomplished by reducing the tax's effect by three

percent for each month following

the target month referred to

711

-20-

above, resulting in the total phaseout no later than September

of 1990.

68

In the meantime, producers and royalty owners and oper-

ators and first purchasers, as large as Exxon Corp. and as

small as the undivided one-half interest in the south 160,

will have to live with the Windfall Profits Tax Act of 1980 •

-

..

7~12

FOOTNOTES

1.

Moffett, The Crude Oil Windfall Profit Tax Act of 1980

and the Proposed Regulations, 58 Taxes 417(1980).

2.

Attermeier, The Crude Oil Windfall Profit Tax of 1980:

How It Will Affect Oil Companies, The Journal of Taxation, May, 1980 at 258.

3.

I.R.C. §4988(a).

4.

I.R.C.

§4988(c) (1).

5.

I.R.C.

§4988(c)(2).

6.

I.R.C.

§4988(c)(3) .

...-

7.

I.R.C. §4988(c)(4).

8.

I.R.C. §4989(a).

9.

I.R.C.

§4989(c).

10.

I.R.C. §499l(c).

11.

Research Institute of America, The RIA Complete Analysis

of the '80 Windfall Profit Tax Act

12.

I.R.C. §4989(d)(l).

13.

I.R.C.

§4989(d)(3).

14.

I.R.C.

§499l(d).

15.

Moffett, supra note 1, at 417.

16.

I.R.C. §499l(c)(2).

17

I.R.C.

§499l(c)(3).

18.

I.R.C.

§4993( a).

19.

I.R.C. §4993(b)(l).

20.

I.R.C.

§4993(b)(2).

21.

I.R.C.

§4993(c) (2) (A).

22.

I.R.C.

§499:X c).

23.

I.R.C.

§4989(b)(l).

7:13

~605

(1980).

24.

I.R.C.

§4989(b)(2).

25 •

Re s e a r c h

26.

Id.

27.

I.R.C.

§499l(b).

28.

I.R.C.

§4994(a).

29.

I.R.C.

§4994(b)(l).

30.

I.R.C.

§170(c)(2)(B).

31.

I.R.C.

§170 (c) (2) (C).

32.

I.R.C.

§4994 (c) (1).

33.

I . R: .• C.

§4994 (c) (4) (B).

34.

I.R.C.

§4994(c)(4).

35.

I.R.C.

§4994 (c) (4) (D).

36.

Main,

I ns t i t ut e of

Am e r i c a ,

s up r a no t e 11 ,

at

,I 6 0 5 .

Hurdman & Cranstoun, A Complete Analysis of the

Crude Oil Windfall Profit Tax (1980).

37•

I • R ~- C •

§ 49 94 ( d ) •

38.

I.R.C.

§4994(e).

39.

H.R.

Rept.

40.

Id.;

cf.

41.

I.R.C.

§4992(b)(l).

42.

I.R.C.

§613(d);

No.

96-817,

I.R.C.

Two Years Later,

.,_

Taxation 581

96th Cong.,

1st Sess.

103 (1980).

§4994(e).

cf.

Burke,

Tax Reduction Act of 1975-

28 Annual Institute on Oil and Gas

(1977).

43.

I.R.C.

§4992(c)(l).

44.

I.R.C.

§4992(c)(2).

45.

I.R.C.

§4992(c)(2)(B).

46.

I.R.C.

§4992(d)(l).

47.

I.R.C.

§4992(d)(3)(B)(ii).

~714

48.

I.R.C.

49.

H.R.

SO.

I.R.C.

§4992(d)(3)(C).

51.

I.R.C.

§4992(e)(l).

52.

I.R.C.

§4992(e).

53.

I.R.C.

§4988(a)(2).

54.

I.R.C.

§4996(c)(l).

55.

I.R.C.

§4996(c)(3)(A).

56.

I.R.C.

§4996(c)(3)(B).

57.

I.R.C.

§4988(b)(l).

58.

I.R.G .•

§4988(b)(2).

59.

Moffett,

60.

I d. ,

61.

I.R.C.

§4995(a)(l).

62.

I.R.C.

§4995(a)(l)(A).

63.

I.R.C.

§4995(a)(7).

64.

I.R.C.

§4995(b)(l).

65.

l.R.C.

§4995(b)(2).

66.

Burke,

The Windfall Profit Tax -

§4992(d)(3)(B)(iv).

Rept.

No.

96-817,

supra note 39,

supra note 1, at 421.

at 41 7;

cf .

I. R. C.

§ 4 9 9 5.

or the Taking of Property?,

Reporter, March,

67.

Id.

68.

I.R.C.

at 109.

The Power of Taxation

The American Oil and Gas

1980.

§4990.

715

BIBLIOGRAPHY

Crude Oil Windfall Profit Tax Act of 1980, Pub. L. No.

(codified at 26 U.S.C.

96-223

§§4986-4998, 6076, 6050C, and 7241(1980))

Main, Hurdman & Cranstoun, An Analysis of the Crude Oil

Windfall Profit Tax (1980)

Price Waterhouse and Co., The Crude Oil Windfall Profit Tax (1980)

F. Burke arrd R.

Bowhay, Crude Oil Windfall Profit Tax Act

of 1980; Prentice-Hall, Booklet No. 19498-5 (1980)

Attermeier, The Crude Oil Windfall Profit Tax Act of 1980: How

it Will Affect Oil Companies, The Journal of Taxation, May

0,.

19 8 0 , a t

2 5 "8 •

Moffett, The Crude Oil Windfall Profit Tax of 1980 and the

Proposed Regulations,

58 Taxes 417

(1980)

Research Institute of America, The RIA Complete Analysis of

the '80 Windfall Profit Tax Act

(1980)

Main, Hurdman & Cranstoun, Recordkeeping Under the Windfall

Profit Tax Act

(July 22, 1980) (unpublished letter to clients)

Reese, Temporary Windfall Profit Tax Regulations: Much Ado

!bout Nothing?,

29 Oil and Gas Tax Quarterly 1

7~16

(1980)

', .....

'.

i,:_,.,

·...._.

(or~

_.)._

/.

.

.

6047

iRrv Juiy 1980l

Prpartmr,t of the Tru~u~y

llllrrnll J(evenue Stnuce

...·.

-.

~

.

:r.;

·..

·.-

••

..

~

~;.

.

..

--;

Windfall Profit Tax

...

'

..:. .

....--~):

l

.

..... I .....

~.

'

~ See separate Instructions.

-~--~·/.· . ~.·~~f.~. ,~o_f~~m 720.

.~

Nan1e

·;;·~··.. :,- .-:·~_,;\ ·

ForTa)(ablePenod Ending

--------------

, 19

c·,..~,

.·.. .:..

---

::

0

A Type of person filing rorm 604?, (Check all appl1cable boxes):: ..; ·

0

D

..; ·~

- - - . --------------------- - - - - Electing operator

[l Proc~ucer

,.

Fir:st pu~chaset:.·..

[J

45 day dep~~.it rul~s

60 day deposit rules~- · · 0 Se.m·i·.f!!or1thly deposit rules

c Number of Known Producers ~ --------------------~"------:: ________ Other Entities (see.tn$t;uctlons) .,.. ___ ........................ _

B Oepos1t Rules

-Tier

0 Number of bJrrels of exempt oil

(1) Qualified govemmental interests

(2) Qualified charitable interests

(3) Exempt Indian oil .

(4) Exempt Alaskan oil

. . . .

. .

one

~ ":

.

r

.

-

New1y

-

- - - - -Tru

- -thre~

-

disc:ove.red·

,..

.~.

·-----

··-lncr•·•••.·r,• .11

----~rtt:OH:I

•.

·

..

:!·•·

..

'•

--- --·

...

- - - - - - - -----

------

-

Number of

barrels of oil

Acgregate

rernov31 value

(a)

(b)

AeP,rt>P,;')tc

t:ase

value

.

2 Tier one, Sadlerochit oil:

---

~t

60%

4 Tier two oil taxed at 30%

-·

. .

--

----

--

~

. .

. . .

. . . .

.

(e)

~/

A Subject to 70% tax rate •

B Subject to 50% tax rate •

3 Tiei two oil taxed

··-Tax

(d)

(c)

.

~

AgP,rc>gat(' state

!>•''J<:rance t'lx

adjustment

adju~t.!d

1 Tier one, other th.J.n Sadlerochit oil:

A Subject to 70% t.Jx rate .

B .Subject to 50% tax rate •

Heavy

-

-

Windfall Profit Tax L::. Jility

--

. :~~..~~·:·.~~·.: •.·.:. t .

.. :···.---:

-

(6) Totals

'· .=

...

.

(5) Exempt front·cnd oil .

Tiet two

-

.

..

--

·- ------

.

--

. .

--

. .

6 Tier three,

tertiary oil • .

7 Tier three, heavy oil • . • . .

--·-----·--- - - - - - - - - ----·----

---

5 Tier three, newly discovered oil

-

incr~mental

8 Total (add lines 1 through 7. Enter this amount on page one, Form 720) •

. .

. . .

....

. . . . .

.

•

• •

• •

. . . . . . .I

9 Adjustments to prev1ously reported tax

~Adj11.;tr1:ents requ1red to be made to previously reported t<lx liability (also enter on line 2, Form 720) .

---

Schedule of Deposits Under Semi-monthly

Deposit Rules

Period

-------First

Manth

---Secnnd

Mo~th

Amount of liability

~t-1 '):h

day

~6!h-last

day

Date of deposit

/

.

1Cth-last day

TMal for month

Third

Month

~~

. .

. .

16th-last day

Tota! for month

-f..,,_/~:.;·

... .-.,~~;,y,///c

.. _., :.;(.>;,;:,:>- '0~-~~;~f;'f<~~X[f/ .}$~ o/$fJ:

~~eposit Made For Taxable Period. . .

~·

...... ,.

~.

---. -..:.~-"~--- ~-;: .,,·.. ·.-.

'

-'i.~',../..-

Date of

depo~it

Amount of deposit

/:Z

"/.r

'//,

_Total deoosits (include in line 4(e), Form 720)

Amount of li1bility

Date of deposit

Amount of deposit

1

2

3

'--~ ~/~~~~-

'• .·.-/;'/ .·. "''·"

Amount of liability

1

2

3

W~ff%~,%'%@Y~i%~?~{~&JJ:fff$$~

;.;:~g~

GO day

')/,

% %·.~

1st-15th day

1st-15th day

. .

Schedule of Deposits Under 45 Day and 60 Day

Deposit Rules

Month

45 day

~'~%}

~/"/)

.

Total for month

Amount of deposit

%/%/;.

':~·,;:;:p~

/.~ •... "'/~-//;::

'/.%0

. . .

. . .

. . . .

. . . . . .

tfU.S. GOVERNMENT PRINTING OFFICE: 1980-0-313-274 • 58-040.1110

;I"

Form

6047

(Rev. 7-80)

..

.·•:'"

717

page 7 48.989

10!80

~ 6248

Annual Information Return of

Windfall Profit Tax-1980

rtJ!Ient ol the Treasury

~al Revenue Service

Copy ATo Be Filed

With the IRS

Filer

;ducer or Other Recipient

; , address, and ZIP code

Name, address, and ZIP code

I

;ioYer identification number

Employer identification number

Social security number, if any

-

the in~ormation on this return is _base~. on. a Form 6248 received from another person, check this box (see instructions)

nd provrde the name and employer 1dentrf1catron number of the person who furnished you Form 6248:

0

Employer identification number

llrnt

Producer Or Other Recipient

fype of Pro ducer

0

O

Individual

O Partnership

Resr.d en t of U.S. Possessrons

.

Producer Status (check _ 0

all applicable boxes) ·· 0

Ufilll

O

0

O

0

Independent producer

Integrated oil company

Corporation

Foreign entity

0

0

Estate 0 Trust

Other ....

Member of "related group"

Operator

U.S. citizen or resident

O

Producer with no

withholding

Royalty owner

Working interest

0

Tier three

Exempt Oil

Number of barrels of exempt oil

1 Qualified governmental interests

2 Qualified charitable interests •

: 3 Exempt Indian oil :

4 Exempt Alaskan oil

5 Exempt front-end oil •

. .

.

0

0

.

0

0

0

0

0

Tier one

(a)

Tier two

(b)

Newly

discovered

(c)

Incremental

tertiary

(d)

Heavy

(e)

Number of

barrels of oil

Aggregate

removal value

Aggregate

adjusted base

value

Aggregate state

severance tax

adjustment

Tax liability

(b)

(c)

(d)

(e)

. .

. .

. .

0

. . .

. . . . . . .

0

0

0

l>,.

1$1111 Information on Taxable Oil

Removed During 1980

1 Tier one, other than Sadlerochit oil:

A Subject to 70% tax rate

•

B Subject to 50% tax rate.

2 Tier one, Sadlerochit oil:

I A Subject to 70% tax rate •

B Subject to 50% tax rate •

3 Tier two oil taxed at 60%

4 Tier two oil taxed at 30%

. .

. . ..

. . . . .

. . ..

. . ..

. . . .

. . . .

5 Tier three, newly discovered oil • . . .

. . .

6 Tier three, incremental tertiary oil

tTier three, heavy oil . . . . . . .

o

;

8 Total (add lines 1 through 7)

,_- · ·

D

0

.

.

.

.

.

.

.

. .

.

(a)

0

. .

-~-~,~-

Windfall Profit Tax Liability for Oil Removed During 1980

,'I Amount of windfall profit tax liability for oil removed during 1980 (from Part Ill, line 8, column (e)) .

. . . . .

t2 Amount of windfall profit tax withheld with respect to oil removed during 1980.

. .

. .

. . .

rl If line 1is greater than line 2, subtract line 2 from line 1. This is amount of underwithheld windfall profit tax·

.~line 2 is greater than line 1, subtract line 1 from line 2. This is the amount of overwithheld

Qa!JI Amount of Windfall Profit Tax Withheld from Payments Made in 1980

.

windfall profit tax ·

r--

_I Amount of windfall profit tax withheld from payments made in 1980 (regardless of

......_profit tax arose)

t

. . . . . . . . .

. . .

'

. .

'~'18

.. '-

wh~n hat>.!.~

fct •·lf'ldfat

l

-