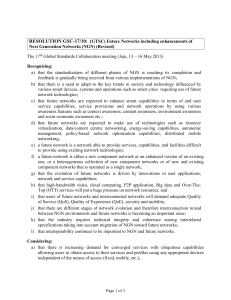

I NGN E

advertisement