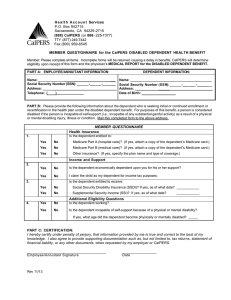

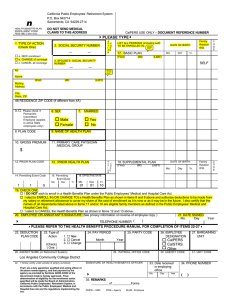

Service Retirement Election Application A Guide to Completing Your CalPERS

advertisement