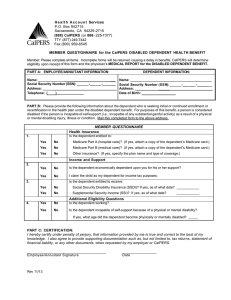

State Miscellaneous & Industrial Benefits

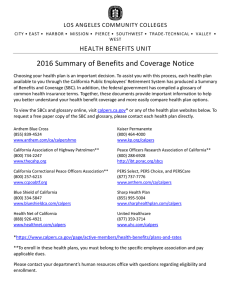

advertisement