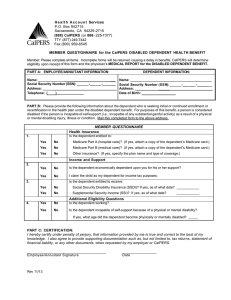

Document 13060029

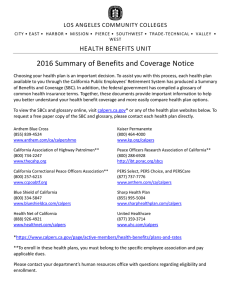

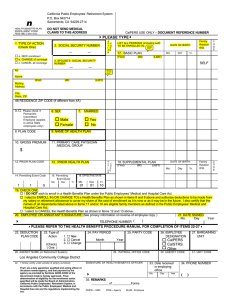

advertisement