PROFIT T RPRISES: orporations, Trusts, and Associations

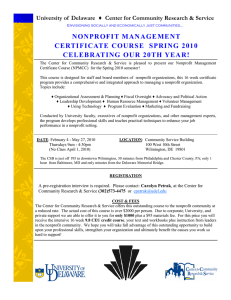

advertisement

JUL 2-3 2001 r'( PROFIT T RPRISES: orporations, Trusts, and Associations By MARILYN E. PHELAN Professor ofLaw Texas Tech University School ofLaw VOLUMEl Cite as: Phelan Nonprofit Enterprises § - WEST GROUP Bancroft-Whitney • Clark Boardman Callaghan Lawyers Cooperative Publishing. WESTLAW®. West Publishing Customer Service: 1-800-328-4880 FAX: 1-800-340-9378 Pub 9/2000 LAW UBRARY TEXAS TECH UNIVERSITY, LUBBOCK, TEXAS 79409 Comprehensive Table of Contents Volume 1 Chapter 1 Nature of Nonprofit Enterprises. § 1:01 § 1:02 § 1:03 § 1:04 § 1:05 § 1:06 § 1:07 § 1:08 § 1:09 § 1:10 § 1:11 § 1:12 § 1:13 § 1:14 § 1:15 § 1:16 § 1:17 § 1:18 § 1:19 § 1:20 § 1:21 § 1:22 § 1:23 § 1:24 § 1:25 § 1:26 § 1:27 § 1:28 § 1:29 § 1:30 § 1:31 § 1:32 Nonprofit Enterprise. Nonprofit Versus Profit Status. Alternatives to Incorporation. - Charitable Trust. - - Creation of Charitable Trust. - - Operation of Charitable Trust. - - Form for Declaration of Trust. - - Alternative Form Executed by. Donor and Trustee. - Association. Incorporation of Nonprofit Organization. Model Nonprofit Corporation Act. Summary of State Acts. - Alabama Nonprofit Corporation Act. - Alaska Nonprofit Corporation Act. - Arizona Nonprofit Corporation Act. - Arkansas Nonprofit Corporation Act. - California Nonprofit Corporation Acts. - Colorado Nonprofit Corporation Act. - Connecticut Nonstock Corporation Act. - Delaware Corporation Act. - District of Columbia Nonprofit Corporation Act. - Florida Nonprofit Corporation Act. - Georgia Nonprofit Corporation Code. - Hawaii Nonprofit Corporation Act. - Idaho Nonprofit Corporation Act. - Illinois General Not-for-Profit Corporation Act. - Indiana Not-for-Profit Corporation Act. - Iowa Nonprofit Corporation Act. - Kansas Corporation Act. - Kentucky Nonprofit Corporation Act. - Louisiana Nonprofit Corporation Law. - Maine Nonprofit Corporation Act. © West Group Pub. 9/2000 (NPE) VII NONPROFIT ENTERPRISES § 1:33 § 1:34 § 1:35 § 1:36 § 1:37 § 1:38 § 1:39 § 1:40 § 1:41 § 1:42 § 1:43 § 1:44 § 1:45 § 1:46 § 1:47 § 1:48 § 1:49 § 1:50 § 1:51 § 1:52 § 1:53 § 1:54 § 1:55 § 1:56 § 1:57 § 1:58 § 1:59 § 1:60 § 1:61 § 1:62 § 1:63 § 1:64 - Maryland Corporations Code. - Massachusetts Corporation Acts. - Michigan Nonprofit Corporation Act. - Minnesota Nonprofit Corporation Act. - Mississippi Nonprofit Corporation Act. - Missouri General Not-for-Profit Act. - Montana Nonprofit Corporation Act. - Nebraska Nonprofit Corporation Act. - Nevada Nonprofit Corporation Acts. - New Hampshire Corporations Act. - New Jersey Nonprofit Corporation Act. - New Mexico Nonprofit Corporation Act. - New York Not-for-Profit Corporation Law. - North Carolina Nonprofit Corporation Act. - North Dakota Nonprofit Corporation Act. - Ohio Nonprofit Corporation Law. - Oklahoma Corporation Acts. - Oregon Nonprofit Corporation Act. - Pennsylvania Corporation Not-for-Profit Code. - Rhode Island Nonprofit Corporation Act. - South Carolina Corporation Act. - South Dakota Nonprofit Act. - Tennessee Nonprofit Corporation Act. - Texas Nonprofit Corporation Act. - Utah Nonprofit Cooperative Association Act. - Vermont Nonprofit Corporation Act. - Virginia N onstock Corporation Act. - Washington Nonprofit Corporation Act. - West Virginia Corporation Act. - Wisconsin Nonstock Corporation Law. - Wyoming Nonprofit Corporation Act. Checklist of Points To Remember. Chapter 2 Creation of a Nonprofit Corporation § 2:01 § 2:02 § 2:03 § 2:04 § 2:05 § 2:06 § 2:07 VIll Organization of Nonprofit Corporation. Articles of Incorporation. - Form for Articles of Incorporation. - Purpose Clause. Corporate Name. - Form for Application for Reservation of Corporate Name. Registered Office and Agent. COMPREHENSIVE TABLE OF CONTENTS § 2:08 § 2:09 § 2:10 § 2:11 § 2:12 § 2:13 § 2:14 § 2:15 § 2:16 § 2:17 § 2:18 § 2:19 § 2:20 § 2:21 § 2:22 § 2:23 § 2:24 § 2:25 § 2:26 § 2:27 § 2:28 § 2:29 - Form for Statement of Change of Registered Office, Registered Agent or Both. Incorporators. Organizational Meeting. Bylaws. - Form for Bylaws. Corporate Minutes. - Form for Corporate Minutes. Powers of Nonprofit Corporation. Defense of Ultra Vires. Procedures To Amend Articles of Incorporation. - Articles of Amendment. - Form for Articles of Amendment. Authorization To Do Business in Another State. - Certificate of Authority. - Form for Application for Certificate of Authority. Books and Records. Benefits to Members. Licenses and Permits. - Permits for Charitable Solicitations. Obtaining Tax-Exempt Status. Summary of Procedures To Create a Nonprofit Corporation. Checklist of Points To Remember. Chapter 3 Members and Directors of a Nonprofit Corporation § 3:01 § 3:02 § 3:03 § 3:04 § 3:05 § 3:06 § 3:07 § 3:08 § 3:09 § 3:10 § 3:11 § 3:12 § 3:13 § 3:14 § 3:15 § 3:16 § 3:17 Members. -Meetings. - Notice of Members' Meetings. --Form of Notice of Meeting of Members. - - Form of Notice of Special Meeting. - Right To Vote. - Voting by Proxy. --Form of Proxy. - Right of Members To Inspect Books and Records. - Derivative Actions of Members. - Removal of Members. Directors. - Election of Directors. - Meetings of Directors. - Management of Affairs of a Nonprofit Corporation. - Action ofthe Board of Directors. - Removal of Director. © West Group Pub. 9/2000 (NPE) IX NONPROFIT ENTERPRISES § 3:18 Checklist of Points To Remember. Chapter 4 Liability of Members and Directors § 4:01 § 4:02 § 4:03 § 4:04 § 4:05 § 4:06 § 4:07 § 4:08 § 4:09 § 4:10 § 4:11 § 4:12 § 4:13 § 4:14 § 4:15 § 4:16 § 4:17 § 4:18 § 4:19 § 4:20 § 4:21 §4:22 Liability of Members. Legal Standards Determining Liability of Directors. General Duties of Trustees. General Duties of Corporate Directors. - Duty of Loyalty. - - Corporate Opportunity. - - Use of Inside Information. -Duty of Care. Standards Applicable to Nonprofit Enterprises. Dissolution of Nonprofit Organization. Statutory Law Relating to Liability of Directors. - Investment of Institutional Funds. - Indemnification of Officers and Directors. - Immunity from Liability. - Uniform Prudent Investor Act. Standing To Sue. Federal Standard of Care. - Self-Dealing-8ection 4941. - Excess Benefit Transactions-8ection 4958. Reporting Requirements. Basic Requirements To Avoid Liability. Checklist of Points To Remember. Chapter 5 Officers and Employees § 5:01 § 5:02 § 5:03 § 5:04 § 5:05 § 5:06 § 5:07 § 5:08 § 5:09 § 5:10 § 5:11 § 5:12 § 5:13 § 5:14 x Selection of Officers. Duties of Officers. Authority of Officers. Officers as Employees. Liability of Officers. Removal of Officers. Employees. Occupational Safety and Health Act. Workers's Compensation. Discrimination in Employment-Title VII. - Equal Pay Act. --Age Discrimination in Employment Act. Americans with Disabilities Act (ADA). Vocational Rehabilitation Act. COMPREHENSIVE TABLE OF CONTENTS § 5:15 § 5:16 § 5:17 § 5:18 § 5:19 § 5:20 § 5:21 § 5:22 § 5:23 § 5:24 § 5:25 § 5:26 § 5:27 § 5:28 - Vietnam Era Veterans's Readjustment Assistance Act. Retirement Plans for Employees of Nonprofit Enterprises. - Qualified Plans. - - Participation and Vesting Requirements. - - Funding of Qualified Plans. - Limitations on Contributions. - Integration with Social Security. - - Reporting Requirements for Qualified Plans. - - Plan Termination. - - Taxation of Benefits. - Individual Retirement Accounts. - Simplified Employee Pension. - Tax-Sheltered Annuities for Employees of Section 501(c)(3) Organizations. Checklist of Points To Remember. Chapter 6 Accounting for Nonprofit Enterprises § 6:01 § 6:02 § 6:03 § 6:04 § 6:05 § 6:06 § 6:07 § 6:08 § 6:09 § 6:10 § 6:11 § 6:12 Reporting Practices of Nonprofit Enterprises. Objectives of Financial Reporting for Nonprofit Enterprises. Fund Accounting. Characteristics of Financial Statements for Nonprofit Enterprises. - Form for Financial Statements of a Nonprofit Organization. - Chart of Accounts for Nonprofit Organization. -AICPA Illustrative Financial Statement for Nonprofit Organization. Accounting Methods. Tax Accounting. - Tax Accounting Methods. -Tax Year. Checklist of Points To Remember. Chapter 7 Federal Tax-Exempt Status § 7:01 § 7:02 § 7:03 § 7:04 § 7:05 § 7:06 § 7:07 Tax-Exempt Status-In General. - Public Inspection of Annual Returns. - Application for Tax-Exempt Status. - Group Exemption Letter. Charitable Organizations. - Public Charities. - Private Foundations. © West Group Pub. 9/2000 (NPE) xi NONPROFIT ENTERPRISES § 7:08 § 7:09 § 7:10 § 7:11 § 7:12 § 7:13 § 7:14 § 7:15 § 7:16 § 7:17 § 7:18 § 7:19 § 7:20 § 7:21 § 7:22 § 7:23 § 7:24 § 7:25 § 7:26 § 7:27 § 7:28 § 7:29 § 7:30 § 7:31 § 7:32 § 7:33 § 7:34 § 7:35 § 7:36 § 7:37 § 7:38 § 7:39 § 7:40 § 7:41 § 7:42 § 7:43 § 7:44 § 7:45 § 7:46 § 7:47 xii - Private Operating Foundations. - Charitable Trusts. - Split-Interest Trusts. - Application for Exemption. -Advance Ruling as to Tax-Exempt Status. - - Completed Form 1023 for Application for Advance Ruling. Other Tax-Exempt Organizations. - Social Welfare Organizations. - Penalty Tax on "Excess Benefit Transactions." - - Completed Form 1024 for Welfare Organization. - Labor, Agricultural, and Horticultural Organizations. - Business Leagues and Development Corporations. - Social Clubs and Country Clubs. - - Completed Form 1024 for Country Club. - Fraternal Societies. - Voluntary Employees' Beneficiary Associations. - Benevolent Life Insurance Associations, Mutual Irrigation, and Cooperative Telephone Companies. - Cemetery Companies. - - Completed Form 1024 for Cemetery Company. - War Veterans' Organizations. - - Completed Form 1024 for War Veterans' Post. - Farmers' Cooperative Associations. - - Completed Form 1028 for Farmers' Cooperative Association. - Political Organizations. - - Completed Form 1120-POL for Political Organizations. - Homeowners' Associations. - - Completed Form 1120-H for Homeowners' Association. - Prepaid Tuition Programs. - Cooperative Service Organizations. - Other Nonprofit Organizations. - - Form of Application for Exempt Status for Credit Union. Summary Chart of Tax-Exempt Organizations. Loss of Exempt Status. - Feeder Organization. - Prohibited Transactions. Appeal Procedures. - Appeal to Courts. - Declaratory Judgments. Disclosure Requirements for Fund-Raising Activities. Checklist of Points To Remember. COMPREHENSIVE TABLE OF CONTENTS Chapter 8 Charitable Organizations and the Charitable Contribution Deduction § 8:01 § 8:02 § 8:03 § 8:04 § 8:05 § 8:06 § 8:07 § 8:08 § 8:09 § 8:10 § 8:11 § 8:12 § 8:13 § 8:14 § 8:15 § 8:16 § 8:17 § 8:18 § 8:19 § 8:20 § 8:21 § 8:22 § 8:23 § 8:24 § 8:25 § 8:26 § 8:27 Charitable Organizations--In General. - Organizational Test. - - Sample Articles of Incorporation Meeting Organizational Test. - Operational Test. - Charitable Purpose. - Educational Purpose. - Scientific Purpose. Lobbying Activities. - Form for Election and/or Revoking Election To Engage in Lobbying. Charitable Contributions Deduction. - Form for Claiming Deduction for Noncash Gifts. - Form for Donee Reporting of Disposition of Donated Property. - Public Charities. - Private Foundations. - Private Operating Foundations. - Private Nonoperating Foundations Distributing All Their Contributions. - Private Foundation Maintaining a Common Fund. - Gifts of Less Than an Entire Interest. - - Remainder Interest in Farm or Personal Residence or Gifts for Conservational Purposes. - - Charitable Lead Trust. - - Pooled Income Fund. - - - Form of Declaration for Pooled Income Fund. - - - Form of Instrument of Transfer to Pooled Income Fund. - - Charitable Remainder Trusts: Annuity Trusts and Unitrusts. - - Form for Annuity Trust. - - - Form for Unitrust. Checklist of Points To Remember. Chapter 9 Public Charities § 9:01 § 9:02 § 9:03 Definition of Public Charity. Penalty Tax on "Excess Benefit Transactions." Section 509(a)(1) Organizations. © West Group Pub. 9/2000 (NPE) XlIl NONPROFIT ENTERPRISES § 9:04 § 9:05 § 9:06 § 9:07 § 9:08 § 9:09 § 9:10 § 9:11 § 9:12 § 9:13 § 9:14 § 9:15 § 9:16 § 9:17 § 9:18 § 9:19 § 9:20 § 9:21 § 9:22 § 9:23 § 9:24 § 9:25 § 9:26 § 9:27 § 9:28 § 9,:29 § 9:30 § 9:31 § 9:32 § 9:33 § 9:34 § 9:35 § 9:36 -Churches. - Educational Organizations. - Hospitals and Medical Research Organizations. - Organizations for the Benefit of State and Municipal Colleges and Universities. - Governmental Units. - Publicly Supported Organizations. - - One-Third Support Test. - - Facts and Circumstances Test. Disqualified Persons. Exclusion for Unusual Grants. Section 509(a)(2) Organizations. - One-Third Support Test. - Not More than One-Third Gross Investment Income Test. Section 509(a)(3) Organizations. - Organizational Test. - Operational Test. - Relationship with Publicly Supported Charities. - - Operated, Supervised, or Controlled by. - - Supervised or Controlled in Connection With. - - Operated in Connection With. - Control by Disqualified Persons. - Organizations Operated in Conjunction with Section 501(c)(4H6) Organizations. Section 509(a)(4) Organizations. Procedures To Obtain Public Charity Status. - Completed Form 1023 for Section 50l(c)(3) Organization Seeking Public Charity Status Under Sections 170(b)(1)(A)(vi) and 509(a)(1). - Completed Part III of Form 1023 for Organization Seeking Public Charity Status Under Section 509(a)(2). - Completed Schedule D of Form 1023 for Organization Seeking Public Charity Status Under Section 509(a)(3). Rulings as to Public Charity Status. - Grantors and Contributors. Annual Returns. - Completed Form 990 and Schedule A for Public Charity. - Completed Form 990EZ for Public Charity. Checklist of Points To Remember. Chapter 10 Private Foundations § 10:01 XIV In General. COMPREHENSIVE TABLE OF CONTENTS § 10:02 § 10:03 § 10:04 § 10:05 § 10:06 § 10:07 § 10:08 § 10:09 § 10:10 § 10:11 § 10:12 § 10:13 § 10:14 § 10:15 § 10:16 § 10:17 § 10:18 § 10:19 § 10:20 § 10:21 § 10:22 § 10:23 § 10:24 § 10:25 § 10:26 § 10:27 § 10:28 § 10:29 § 10:30 § 10:31 § 10:32 § 10:33 § 10:34 § 10:35 § 10:36 § 10:37 § 10:38 § 10:39 § 10:40 § 10:41 § 10:42 § 10:43 Governing Instrument. Tax on Net Investment Income. Self-Dealing. - Correction of Self-Dealing. - Specific Acts of Self-Dealing. - Exceptions to Self-Dealing. Failure To Distribute Income. - Minimum Investment Return. - Qualifying Distributions. - Timing of Qualifying Distributions. Excess Business Holdings. - Business Holdings Held on May 26, 1969. Investments which Jeopardize Charitable Purposes. Taxable Expenditures. - Payments To Influence Legislation or an Election. - Grants to Individuals. - - Form for Request of Grant Procedure Approval. - Grants to Organizations. - Grants to Public Charities and Governmental Agencies. - Grants to Employees. - Expenditures for Noncharitable Purposes. Private Operating Foundations. - Qualifying Distributions for Operating Foundations. - Assets Test. - Endowment Test. - Support Test. - Procedure To Obtain Private Operating Foundation Status. - Form for Application for Exempt Status for Private Operating Foundation. Nonexempt Trusts. - Charitable Trusts. - Split-Interest Trusts. - - Completed Form 5227 for Split-Interest Trust. Annual Returns for Private Foundations. - Completed Form 990-PF for a Private Foundation. Termination of Private Foundation Status. - Voluntary Termination. - - Transfer of Assets to a Public Charity. - - Operation as a Public Charity. - Form for Notice of Termination of Private Foundation Status. - Transferee Foundation. Abatement of Tax Upon Termination. Checklist of Points To Remember. © West Group Pub. 9/2000 (NPE) xv NONPROFIT ENTERPRISES Chapter 11 Unrelated Business Taxable Income § 11:01 § 11:02 § 11:03 § 11:04 § 11:05 § 11:06 § 11:07 § 11:08 § 11:09 § 11:10 § 11:11 § 11:12 § 11:13 § 11:14 § 11:15 § 11:16 § 11:17 § 11:18 § 11:19 § 11:20 § 11:21 § 11:22 § 11:23 § 11:24 § 11:25 § 11:26 § 11:27 § 11:28 § 11:29 § 11:30 § 11:31 § 11:32 § 11:33 xvi In General. Income from Unrelated Trade or Business. - Regularly Carried On. - Not Substantially Related to Organization's Exempt Purpose. - Specific Exclusions from Unrelated Trade or Business Designation. - Income from Advertising. - Income from Trade Shows and Public Entertainment Activities. - Income from Bingo Games and Games of Chance. - Unrelated Trade or Business ofa Hospital. - Unrelated Trade or Business of a College or University. - Corporate Sponsorships. - Income from Museum Shops. - Travel Tours. - Income from Sale of Books and Other Publications. Income from Investments. - Rental Income. - Royalty Income. - Income from Security Loans. Income from Controlled Organizations. Income from Unrelated Debt-Financed Property. - Unrelated Debt-Financed Property. - Average Acquisition Indebtedness. - Average Adjusted Basis. Unrelated Business Taxable Income of Social Clubs and Employees' Associations. - Gross Income from Members. - Set-Aside Income. - Sales of Property by Social Clubs and Employees' Associations. Summary Chart of Unrelated Business Taxable Income. Reporting of Unrelated Business Taxable Income. - Hypothetical. - Completed Form 990-T. College and University Examination Guidelines. Checklist of Points To Remember. COMPREHENSIVE TABLE OF CONTENTS Chapter 12 Specialized Tax Problems of Nonprofit Organizations § 12:01 § 12:02 § 12:03 § 12:04 § 12:05 § 12:06 § 12:07 § 12:08 § 12:09 § 12:10 § 12:11 § 12:12 § 12:13 § 12:14 § 12:15 § 12:16 §12:17 § 12:18 § 12:19 § 12:20 § 12:21 § 12:22 Loss of Tax-Exempt Status. - Inurement. Executive Compensation. - Feeder Organization. - - Commercial Activities of Nonprofit Organizations. - - Involvement in Partnership. - - Shareholder in For-Profit Corporation. - Public Policy Limitation. - Lobbying Activities of Nonprofit Organization. - - Lobbying Disclosure Act. - - Section 501(c)(3) Organizations. - - Other Nonprofit Organizations. --Definition of Lobbying. Grass Roots Lobbying. - Communications With Members. - - Allocation of Expenditures To Lobbying. - - Mfiliation Rules. - - Exceptions To Lobbying. - - Political Campaigns. - - Penalty Taxes. Tax-Exempt Bond Financing for Section 501(c)(3) Organizations. Checklist of Points To Remember. Volume 2' Chapter 13 Fund Raising § 13:01 § 13:02 § 13:03 § 13:04 § 13:05 § 13:06 § 13:07 § 13:08 § 13:09 § 13:10 § 13:11 Procedures. Charitable Contribution Deduction for Donors. Deferred Giving. Valuation. Disclosure Requirements. - Required Statement for Fundraising Solicitations. - Telephone, Television, and Radio Solicitation. - Membership Dues Solicitation. Permits. Pooled Income Fund. Charitable Trust. © West Group Pub. 9/2000 (NPE) XVII NONPROFIT ENTERPRISES § 13:12 § 13:13 Family Foundation. Charitable Foundation Operated as a Public Charity. Chapter 14 Legal Problems of Nonprofit Enterprises § 14:01 § 14:02 § 14:03 § 14:04 § 14:05 § 14:06 § 14:07 § 14:08 § 14:09 § 14:10 § 14:11 § 14:12 § 14:13 § 14:14 § 14:15 § 14:16 § 14:17 § 14:18 § 14:19 § 14:20 § 14:21 § 14:22 § 14:23 § 14:24 § 14:25 § 14:26 § 14:27 § 14:28 § 14:29 § 14:30 § 14:31 § 14:32 § 14:33 xviii Legal Action Involving Nonprofit Enterprises. Right ofAssociation. -Discriminatory Practices of Private Associations. - Judicial Intervention in Religious Associations. - Standing of Association To Seek Judicial Relief. - Standing To Challenge Actions of Nonprofit Enterprises. Tort Liability of Nonprofit Enterprises. - Charitable Immunity. Application of Copyright Act to Nonprofit Enterprises. - Originality Requirement for Works Including Digital Images. - Sources of Copyright Ownership. - Copyright Protection. - - Application of Copyright Laws to the Electronic Age --Computers as Copyrightable Works - - Protection of Artist's Moral Right from Internet Downloading - Public Performances of Copyrighted Music by Nonprofit Enterprises. - - Copyright Infringement Action - - Liability of Bulletin Board Operators and Internet Access Providers - - Forum and Choice of Law for Infringement Claim - Fair Use of Copyrighted Works. - - Internet Downloading of Digital Images as Fair Use - - Liability Outside Copyright Law&-Rights of Privacy and Publicity - - Unfair Competition by Misappropriation - - Licensing of Digital Images. Securities Laws. - Exemptions for Securities Issued by Nonprofit Enterprises. Sale of Securities Donated to Nonprofit Organization. - Compliance with State Securities Laws. Application of Antitrust Laws to Nonprofit Enterprises. Unfair Competition. Labor Laws. - Selection of Labor Representative. - Duty To Bargain in Good Faith. COMPREHENSIVE TABLE OF CONTENTS § 14:34 § 14:35 § 14:36 § 14:37 § 14:38 - Subject Matter of Bargaining. - Unfair Labor Practices. -Strikes. - Right To Work Laws. Checklist of Points To Remember. Chapter 15 Merger, Consolidation, and Dissolution § 15:01 § 15:02 § 15:03 § 15:04 § 15:05 § 15:06 § 15:07 § 15:08 § 15:09 § 15:10 § 15:11 § 15:12 § 15:13 § 15:14 § 15:15 § 15:16 § 15:17 Procedure for Merger or Consolidation. Effect of Merger or Consolidation. Articles of Merger or Consolidation. - Form of Articles of Merger. - Form of Articles of Consolidation. - Form of Articles of Merger or Consolidation of Domestic and Foreign Corporation. Withdrawal of a Foreign Corporation. Sale of Assets. Voluntary Dissolution of a Nonprofit Corporation. Distribution of Assets. - Cy Pres Doctrine. - Articles of Dissolution. - Form for Articles of Dissolution. Involuntary Dissolution. Procedures After Dissolution. Bankruptcy. Checklist of Points To Remember. Chapter 16 Churches § 16:01 § 16:02 § 16:03 § 16:04 § 16:05 § 16:06 § 16:07 § 16:08 § 16:09 § 16:10 § 16:11 § 16:12 § 16:13 § 16:14 What Is a Church? State Intervention in Religious Organizations. - Establishment Clause Versus Free Exercise. - Property Disputes. - Membership. - Employment. - Educational Programs. - Solicitation. -Zoning. Association Status. - Liability of Members. - Property Ownership. Incorporation of Religious Association. -Alabama. © West Group Pub. 9/2000 (NPE) xix NONPROFIT ENTERPRISES § 16:15 § 16:16 § 16:17 § 16:18 § 16:19 § 16:20 § 16:21 § 16:22 § 16:23 § 16:24 § 16:25 § 16:26 § 16:27 § 16:28 § 16:29 § 16:30 § 16:31 § 16:32 -Alaska. - California. -Delaware. - Illinois. -Kansas. - New Jersey. -New York. - Pennsylvania. -Texas. -Utah. - Virginia. Taxation Issues. - Tax-Exempt Status. - Audit of Churches. - Unrelated Business Taxable Income. - Social Security Taxes for Employees. - Tax Sheltered Retirement Plans for Employees. Checklist of Points To Remember. Chapter 17 Homeowner Associations and Condominium Associations § 17:01 § 17:02 § 17:03 § 17:04 § 17:05 § 17:06 § 17:07 § 17:08 § 17:09 Nature of Homeowner and Condominium Associations. - Condominium.Associations. - Cooperative Associations. - Planned Unit Developments. - Uniform Common Interest Ownership Act. Powers of Homeowners' Associations. Rights and Liabilities of Members. Taxation Issues. Checklist of Foints To Remember. Chapter 18 Museums § 18:01 § 18:02 § 18:03 § 18:04 § 18:05 § 18:06 § 18:07 § 18:08 xx Organizational Structure of Museums.. Federal Funding for Museums. Tax Considerations of Museums. Laws Relating to Museum Acquisitions. - Application of State's Commercial Code. - Statutes Relating to Acquisition of Artifacts. - - Archaeological Resources Protection Act. - - American Indian Religious Freedom Act. COMPREHENSIVE TABLE OF CONTENTS § 18.09 § 18:10 § 18:11 § 18:12 § 18:13 § 18:14 § 18:15 § 18:16 § 18:17 § 18:18 § 18:19 § 18:20 § 18:21 § 18:22 § 18:23 § 18:24 § 18:25 § 18:26 § 18:27 § 18:28 § 18:29 § 18:30 § 18:31 § 18:32 § 18:33 § 18:34 § 18:35 § 18:36 - - Native American Graves Protection and Repatriation Act. - - Pre-Columbian Art Act. - - Convention on Cultural Property Implementation Act. -Gifts. - - Form for Gift of Personalty. - - Cy Pres Doctrine. - - Charitable Contribution Deduction for Gifts. - - Valuation of Gift Property. -Loans. - - Form for Bailment Contract. - - International Loans of Artistic Treasures. Deaccessioning. Historical Preservation Laws. - State Preservation Laws. - Tax Incentives for Historic Preservation. Systematic Collections. -Lacey Act. - Endangered Species Act. - Marine Mammal Protection Act. - Other Acts Relating to Protection of Wildlife. Rights of Artists in Their Works. - Moral Right. - Property Rights. - Freedom of Expression. Use of Volunteers. Use of Guards. Duties of Museum Directors and Employees. Checklist of Points To Remember. Chapter 19 Schools § 19:01 § 19:02 § 19:03 § 19:04 § 19:05 § 19:06 § 19:07 § 19:08 § 19:09 § 19:10 § 19:11 Requirement of Public Education. State Board of Education. School Districts. Meetings of School Boards. Role of Private Schools. Tax Audits of Private Schools. Liability of Schools and School Administrators. - Governmental Immunity. - Eleventh Amendment Immunity. - Liability of Private Schools Under Federal Civil Rights Acts. - Educational Malpractice or Student Consumerism. © West Group Pub. 9/2000 (NPE) xxi NONPROFIT ENTERPRISES § 19:12 § 19:13 § 19:14 § 19:15 § 19:16 § 19:17 § 19:18 § 19:19 § 19:20 § 19:21 § 19:22 § 19:23 § 19:24 § 19:25 § 19:26 § 19:27 § 19:28 § 19:29 § 19:30 § 19:31 § 19:32 - Admission Policies. - Ability Grouping and Special Educational Programs. - Disciplinary Actions. Student Related Searches and Seizures. -Academic Dismissal of Students. - Student Privacy. - Student Expression. - Curriculum. - Teacher Certification. Contractual Relations With Teachers. - Property Interest in Employment. - Liberty Interest. - First Amendment and Academic Freedom. - Procedural Due Process. - Financial Exigency. - Mfirmative Action Requirements. - Tort Liability. Religion and Schools. Race Relationships and Schools. Federal Tax Reporting Requirements of Schools. Checklist of Points To Remember. Chapter 20 Political Organizations § 20:01 § 20:02 § 20:03 § 20:04 § 20:05 § 20:06 § 20:07 § 20:08 § 20:09 § 20:10 § 20:11 § 20:12 § 20:13 § 20:14 xxii Political Organization&-In General. Registration of Political Organizations. Regulation of Contributions and Expenditures of Political Committees. Reports by Political Committees. Political Contributions by Corporations and Labor Organizations. Independent Political Expenditures by Unincorporated Associations. Taxation of Political Parties and Committees. - Exempt Function of a Political Organization. - Organizational and Operational Test. Newsletter Fund. Taxable Income of a Political Organization. Political Expenditures of Section 501(c) Organizations. - Directly Related Exempt Function Expenditures. - Indirect Political Expenditures. COMPREHENSIVE TABLE OF CONTENTS § 20:15 § 20:16 - Filing Requirements of a Section 501(c) Organization Expending Funds To Support or Defeat Candidates for Public Office. Checklist of Points To Remember. Chapter 21 Hospitals § 21:01 § 21:02 § 21:03 § 21:04 § 21:05 § 21:06 § 21:07 § 21:08 § 21:09 § 21:10 § 21:11 § 21:12 § 21:13 § 21:14 § 21:15 § 21:16 §21:17 § 21:18 § 21:19 § 21:20 § 21:21 § 21:22 § 21:23 § 21:24 § 21:25 § 21:26 § 21:27 § 21:28 § 21:29 § 21:30 § 21:31 § 21:32 § 21:33 § 21:34 § 21:35 § 21:36 § 21:37 Organizational Structure. Governmental Regulation of Hospitals. - Licensure. Accreditation. - Medicare Act. -Medicaid. - Fraud Provisions under Medicare and Medicaid Programs. - Controlled Substances Act. -National Health Planning. - Alcohol and Drug Abuse Treatment. - Treatment of Mentally Ill. Application of Antitrust Laws to Nonprofit Hospitals. Nonprofit Hospitals. Unrelated Business Taxable Income of Nonprofit Hospitals. Reorganizations of Nonprofit Hospitals. - Conversion to For-Profit Status. - Exemption from Property Taxes. Health Care Provider Systems. Medical Staff. - Admission to and Membership on Medical Staff. Liability of Professional Review Committees. Tort Liability of Hospitals. - Blood Transfusions. - Consents for Treatment. - Informed Consent. Incompetents. Minors. Patients'Rights. - Duty To Treat. - Emergencies. - Refusal of Treatment and Right To Die. - Abortions. - Sterilization. - Right To Procreate. - Artificial Insemination and Surrogate Parenting. - Wrongful Pregnancy, Wrongful Birth, and Wrongful Life. Discharge of Patients. © West Group Pub. 9/2000 (NPE) xxiii NONPROFIT ENTERPRISES § 21:38 § 21:39 § 21:40 § 21:41 § 21:42 § 21:43 Death and Dead Bodies. Medical Records. Reporting Requirements. - Child Abuse. Reportable Diseases. Checklist of Points To Remember. Chapter 22 Cooperatives § 22:01 § 22:02 § 22:03 § 22:04 § 22:05 § 22:06 § 22:07 § 22:08 § 22:09 § 22:10 § 22:11 § 22:12 § 22:13 § 22:14 § 22:15 § 22:16 § 22:17 § 22:18 Nature of Cooperatives. Formation of a Cooperative. Members of Cooperatives. - Membership Agreements. - Members' Ownership Rights. - Stock Ownership. - Patronage Dividends. Directors. Officers. Application of Securities Laws. Antitrust Provisions. Taxation of Cooperatives. - Taxable Income of a Cooperative. - Tax-Exempt Farmers' Cooperatives. - Taxable Income of Patron. Merger or Consolidation of Two or More Cooperatives. Dissolution. Checklist of Points To Remember. Chapter 23 Social Clubs, Fraternities, and Sororities § 23:01 § 23:02 § 23:03 § 23:04 § 23:05 § 23:06 § 23:07 § 23:08 § 23:09 § 23:10 § 23:11 § 23:12 § 23:13 xxiv Nature of Social Clubs. Right of Association. Expulsion of Members. Taxation of Social Clubs. Tax-Exempt Social Clubs. -Business Use ofa Club. - Transactions With the Public. - Transactions With Members. - Member-Guest Relationships. - Discriminatory Practices. Fraternities and Sororities. - Use of Alcoholic Beverages. -Hazing. COMPREHENSIVE TABLE OF CONTENTS § 23:14 § 23:15 - Tax Deduction for Contributions. Checklist of Points To Remember. Chapter 24 Family Foundations § 24:01 § 24:02 § 24:03 § 24:04 § 24:05 § 24:06 § 24:07 § 24:08 § 24:09 § 24:10 § 24:11 Nature and Form of a Family Foundation. Charitable Trust. - Declaration of Trust. - Testamentary Trust. Nonprofit Corporation. - Articles of Incorporation. Private Foundation. Public Charity. Gifts of Partial Interests to Charity. Community Foundations. Checklist of Points To Remember. Chapter 25 Labor Organizations § 25:01 § 25:02 § 25:03 § 25:04 § 25:05 § 25:06 § 25:07 § 25:08 § 25:09 § 25:10 § 25:11 § 25:12 Definition of Labor Organization. Reporting Requirements for Labor Organization. Officers. - Standard of Conduct. -Removal. Reports of Officers and Employees. Members. Tort Liability for Labor Activity. Trusteeships. Political Activities of Labor Organizations. Tax-Exempt Status. Checklist of Points To Remember. Chapter 26 Trade and Professional Organizations § 26:01 § 26:02 § 26:03 § 26:04 § 26:05 § 26:06 § 26:07 § 26:08 Trade Association Status. Requirements for Tax-Exempt Status. Agricultural and Horticultural Associations. Business Leagues and Boards of Trade. Business Activities. Trade Shows. Political Activities. Antitrust Regulation. © West Group Pub. 9/2000 (NPE) xxv NONPROFIT ENTERPRISES § 26:09 § 26:10 § 26:11 Unfair Competition. Membership in Trade Association. Checklist of Points To Remember. Chapter 27 Cemetery Associations § 27:01 § 27:02 § 27:03 § 27:04 § 27:05 § 27:06 § 27:07 § 27:08 § 27:09 § 27:10 § 27:11 Organizational Structure. -Dedication of Property. -Location. Power and Duties of Cemetery Association. Tax-Exempt Status. Tax Deductions for Contributions. Perpetual Care Fund. Use of Grounds and Income. Sale of Lots. Rights of Members. Checklist of Points To Remember. Volume 3 Appendix A AppendixB Appendix C AppendixD AppendixE AppendixF TAX FORMS COPYRIGHT FORMS U.S. CODE SECTIONS RELATING TO NONPROFIT CORPORATIONS (26 USC §§ 501-530) MODEL NONPROFIT CORPORATION ACT REVISED MODEL NONPROFIT CORPORATION ACT UNIFORM UNINCORPORATED NONPROFIT ASSOCIATION ACT Table of Statutes, Rules and Regulations Table of Cases Index xxvi