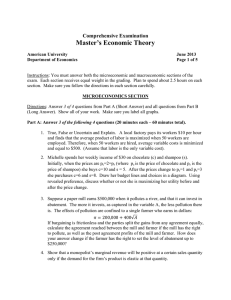

Master’s Economic Theory Comprehensive Examination

Comprehensive Examination

Master’s Economic Theory

American University

Department of Economics

January 2014

Page 1 of 5

Instructions: You must answer both the microeconomic and macroeconomic sections of the exam. Each section receives equal weight in the grading. Plan to spend about 2 hours on each section. Make sure you follow the directions in each section carefully.

MICROECONOMICS SECTION

Directions: Answer 3 of 4 questions from Part A (Short Answer) and all questions from Part B

(Long Answer). Show all of your work. Make sure you label all graphs.

Part A: Answer 3 of the following 4 questions (20 minutes each – 60 minutes total).

1.

Medical research has shown the negative health effects of "secondhand" smoke. Recent social trends point to growing intolerance of smoking in public areas. If you are a smoker and you wish to continue smoking despite tougher anti-smoking laws, compare and contrast the effect of the following legislative proposals on your behavior. As a result of these programs, do you, the individual smoker, benefit? Does society benefit as a whole? i.

A bill is proposed that would lower tar and nicotine levels in all cigarettes. ii.

A tax is levied on each pack of cigarettes produced. iii.

A tax is levied on each pack of cigarettes consumed.

2.

Suppose that Natasha's utility function is given by:

√ where I represents annual income in thousands of dollars. Is Natasha risk loving, risk neutral, or risk averse? Explain.

Suppose that Natasha is currently earning an income of $40,000 (I = 40) and can earn that income next year with certainty. She is offered a chance to take a new job that offers a

0.6 probability of earning $44,000 and a 0.4 probability of earning $33,000. Should she take the new job? Why or why not? Suppose Natasha takes the new job. Would she be willing to buy insurance to protect against the variable income associated with the new job? If so, how much would she be willing to pay for that insurance?

3.

Why does optimal third-degree price discrimination require that marginal revenue for each group of consumers equals marginal cost? Assume that marginal cost increases with output and that there are only two groups of consumers. Use this condition to explain how a firm should change its prices and total output if the demand curve for one

Page 2 of 5 group of consumers shifts outward. Assume that marginal cost increases with output and that there are only two groups of consumers.

4.

Under a welfare plan, poor people are given a lump-sum payment of $L. If they accept this welfare payment, they must pay a high tax, t=⅓, on anything they earn. If they do not accept the welfare payment, they do not have to pay a tax on their earnings. How do the person’s individual taste’s impact whether or not they accept the welfare program?

Illustrate your answer on a well-annotated graph.

Part B: Answer both questions (30 minutes each – 60 minutes total).

1.

Rebecca gets utility from consuming steak and potatoes according to the utility function:

( )

Rebecca has w dollars to spend on the two goods. a.

Find Rebecca's Marshallian (uncompensated) demands for steak and potatoes as a function of her income, the price of steak (p

S

) and the price of potatoes (p t

), and her indirect utility function. What is Rebecca's price elasticity of demand for steak? b.

Calculate Rebecca's Hicksian (compensated) demands for steak and potatoes as a function of the prices of the two goods and her utility level (u), as well as her expenditure function. c.

Now assume that the price of steak and potatoes increases to q

S

and q t

, respectively. How much additional income would Suzy have to be given in order to compensate her for the price change? Illustrate this value on a well-annotated graph.

Continues on next page

Page 3 of 5

2.

The U.S. chocolate industry is dominated by two firms. Mars has a cost function of C m

=

10q m

+ 1, while their largest competitor Hershey has a cost function of $C h

=8q h

. The market demand for U.S. chocolate is defined by the function:

Q d

= 500 - 20p. a.

Assume that Mars and Hershey behave as Cournot competitors, choosing quantities simultaneously. How many units will each firm produce? What will be the market price? Calculate each firm's profits. b.

Instead assume that Hershey, which revolutionized the chocolate industry prior to the creation of Mars, behaves as a Stackelberg leader. How many units will each firm produce? What will be the market price? Calculate each firm's profits. c.

What will be the market outcome, including market price and quantity, if Mars and

Hershey behave as Bertrand competitors, choosing prices simultaneously? d.

Compare and contrast the total welfare effects of the three forms of market structure.

In other words, rank from lowest to highest the deadweight loss associated with

Cournot, Stackelberg and Bertrand.

P

MACROECONOMICS SECTION

Directions : Answer both parts, A and B; there is some choice in each part. Points will be proportional to the time limits indicated.

Part A – Short Answer Questions (Identifications): Choose three (3) of the following. For each one you choose, you must give a definition and briefly discuss the significance of the concept for macro theory or policy. You may provide examples, but note that these do not substitute for definitions. Time limit: 10 minutes each (30 minutes total) .

1.

Liquidity trap

2.

Uncovered interest parity

3.

Natural rate of unemployment

4.

Seignorage revenue

5.

Real exchange rate

6.

Deflation

7.

Current account balance

8.

Golden rule level of capital

Part B – Long Answer Questions (Problems/Models) Choose two (2) of the following. Time limits: 45 minutes each (90 minutes total)

1.

Many countries will move to monetary contraction over the next many years. Analyze the situation of contractionary monetary policy for all three (3) of the following cases, assuming a short-run analysis. Your analysis can be mainly graphical and must include detailed explanations. You may include equations if you wish. Also, you must show and explain the changes on the central bank balance sheet where relevant. a.

IS-MP model, closed economy, where MP is the “monetary policy” curve assuming the central bank targets the interest rate. b.

Open economy IS-LM model, with free capital mobility (so that the interest parity relation holds) and a flexible exchange rate. Explain in detail the role of the interest parity condition. c.

Open economy IS-LM model, with free capital mobility (so that the interest parity relation holds) and a fixed exchange rate. You must explain in detail the role of the interest parity condition. Could the policy trilemma be relevant in this case?

Explain. d.

Finally, compare the impact on real GDP across the scenarios and explain carefully.

( Part B continues on the next page )

Page 5 of 5

2.

Analyze the short-run and medium-run effects of each of the following on output and the price level, using the IS-LM model and the aggregate-supply/aggregate-demand model

(AS-AD). Be sure to explain how the economy adjusts from the new short-run equilibrium to the new medium-run equilibrium, discuss in detail the role of price expectations, and assess whether the theoretical adjustment process is realistic or not in each case. You may assume that the economy starts in an initial medium-run equilibrium at the “natural” output level

Y n in each situation. a.

An improvement in technology. b.

A reduction in the level of unemployment benefits. c.

A positive shock to aggregate demand, due to a decrease in income taxes.

3.

(a) Derive the Solow Growth model (neoclassical growth model) algebraically.

(b) Explain intuitively the steady-state equilibrium condition in the Solow Growth model.

(c) Use the graph of the Solow model to analyze the effects of each of the following changes (considered separately) on long-run equilibrium:

(i) A rise in the growth rate of the population

(ii) A rise in the saving rate

(iii) A decline in the rate of technical progress

For each case, what is the change in the growth rate of output, output per worker, and output per effective worker? Summarize and explain the reasoning.

(d) Finally, consider whether or not a policy to reduce the saving rate would be a good idea (e.g. is it possible for an economy to have too much capital?).

4.

Many countries are pursuing a policy of fiscal austerity.

(a) Explain fiscal austerity. What has been the rationale for fiscal austerity?

(b) Consider the closed economy IS-LM and AD-AS model and analyze the short run and medium run implications of fiscal austerity for real GDP, interest rates and the price level. Provide a detailed explanation.

(c) What are the implications for your analysis if the economy is in a liquidity trap?

Demonstrate with new graphs and a new explanation.

(d) Use the equation for the government budget constraint to discuss the potential long run consequences for the debt/GDP ratio. Be specific.

(e) Are there any special aspects of the US economy that affect the risks presented by the already accumulated debt? Explain.