Board of Directors Meeting in Public 30 October 2014

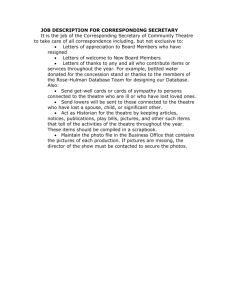

advertisement