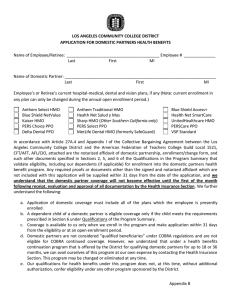

10/1/2011 Renewal Meeting May 26, 2011

advertisement

10/1/2011 Renewal Meeting May 26, 2011 Table of Contents Section 1: Renewal Summary Section 2: Financial Summary – Medical Only Section 3: SISC Blue Shield HMO Medical Renewal HMO High Plan Options HMO Low Plan Options Section 4: SISC Blue Shield PPO Medical Renewal PPO High Plan Options PPO Medium Plan Options Section 5: CompanionCare/Kaiser Permanente (Individual Retiree Plan) Section 6: Contributions with Options Section 7: Next Steps 2 Cabrillo College - 5/26/2011 Copyright © 2011 Alliant Insurance Services, Inc. Confidential; not for distribution Section 1: Renewal Summary Blue Shield HMO HMO High Plan - 5.6% increase HMO Low Plan – 5.4% increase Current Blue Shield Rx will be replaced with Medco 3 tier (generic/brand/’non-formulary) to 2 tier (generic/brand) co-pays Blue Shield PPO PPO High Plan - 4.9% increase PPO Medium Plan – 4.8% increase PPO Low HDHP Plan – 7.0% increase $0 generic copay at Costco CompanionCare (Medicare Supplement Plan) Rate decrease effective October 1, 2011 Rx plan change effective January 1, 2012 Costco Generic Prescriptions Take your prescription for a generic medication to a Costco Pharmacy Present the pharmacist with your insurance card Get your generic medication with a $0 co-payment (excluding some narcotic pain medications and some cough medications) 3 Cabrillo College - 5/26/2011 Copyright © 2011 Alliant Insurance Services, Inc. Confidential; not for distribution Section 2: Financial Summary FINANCIAL SUMMARY Effective October 1, 2011 10/1/2010 10/1/2011 $∆ %∆ 153 214 96 30 25 518 $215,530 $230,785 $114,563 $37,871 $18,200 $616,949 $227,588 $243,339 $120,128 $39,690 $19,467 $650,212 $12,058 $12,554 $5,565 $1,819 $1,267 $33,263 5.6% 5.4% 4.9% 4.8% 7.0% 5.4% 10 6 39 2 1 58 $12,368 $6,190 $42,451 $1,476 $962 $63,447 $13,064 $6,528 $44,504 $1,548 $1,030 $66,674 $696 $338 $2,053 $72 $68 $3,227 5.6% 5.5% 4.8% 4.9% 7.1% 5.1% CompanionCare CompanionCare 9 $4,807 $4,697 ($110) -2.3% KAISER PERMANENTE (IND. RETIREE PLAN) KP (Ind. Retiree Plan) 1 $324 $324 $0 0% 6 4 49 2 0 61 647 $3,000 $2,712 $27,060 $976 $0 $33,748 $719,275 $8,631,300 $3,132 $2,900 $28,600 $1,032 $0 $35,664 $757,571 $9,090,852 $132 $188 $1,540 $56 $0 $1,916 $38,296 $459,552 4.4% 6.9% 5.7% 5.7% 0.0% 5.7% 5.3% 5.3% Line of Coverage ACTIVE EMPLOYEES HMO High ($10 copay) HMO Low ($25 copay) PPO High ($300 ded) PPO Med ($500 ded) PPO Low ($2,500 ded) RETIREE UNDER AGE 65 HMO High ($10 copay) HMO Low ($25 copay) PPO High ($300 ded) PPO Med ($500 ded) PPO Low ($2,500 ded) RETIREE OVER AGE 65 HMO High ($10 copay) HMO Low ($25 copay) PPO High ($300 ded) PPO Med ($500 ded) PPO Low ($2,500 ded) MONTHLY TOTAL ANNUAL TOTAL Medical Headcounts as of 5-11-11 4 Cabrillo College - 5/26/2011 Copyright © 2011 Alliant Insurance Services, Inc. Confidential; not for distribution Section 3: High HMO Plan Renewal High HMO (Access HMO $10-0) Plans Current None Renewal None $1,000 / $2,000 $1,000 / $2,000 $10 $10/$30** $0 No charge $10 $10/$30** $0 No charge No charge No charge No charge No charge $100 $100 (waived if admitted) 20%** $10 in your service area; $50 outside your service area $100 $100 (waived if admitted) 20%** $10 in your service area; $50 outside your service area Chiropractic Services (see separate rider) $10 (up to 30 visits per cal year)** $10 (up to 30 visits per cal year)** Skilled Nursing (up to 100/days/cal year Home Health Care No charge $10 (up to 100 visits p/cal yr)** No charge $10 (up to 100 visits p/cal yr)** No charge No charge Calendar Year Deductible Calendar Year Copayment Maximum Individual / Family MAJOR MEDICAL Physician Office Visit Specialist Visit Preventive Care Lab & X-Ray Outpatient Surgery Hospitalization Inpatient Ambulance Emergency Room Durable Medical Equipment Urgent Care Mental Health Care Inpatient hospital facility Outpatient Physician Visit Substance Abuse - (see separate rider) Inpatient Detox Inpatient hospital facility Outpatient Physician Visit Outpatient Prescription Drugs (At participating Pharmacies only) Retail - 30 day supply Mail order - 90 day supply No annual deductible $10** $10** No charge No charge $10** Blue Shield Generic/Brand/Non-Formulary** $5 / $10 / $25 $10 / $20 / $50 20% for home self injectables; max of $100 per prescription $10** Medco Generic/Brand** $5/$10 $10/$20 Self Injectables; Covered at generic or brand copay * Access + Specialist (self-referred office visits within your medical group are available for higher copay) ** These member payments do not apply to the member calendar year Copayment Maximum ACTIVES Employee Only Employee + 1 Family TOTAL MONTHLY PREMIUM TOTAL ANNUAL PREMIUM $ ∆ to Current % ∆ to Current RETIREE UNDER AGE 65 Retiree Retiree plus 1 dependent Retiree plus family TOTAL MONTHLY PREMIUM TOTAL ANNUAL PREMIUM $ ∆ to Current % ∆ to Current RETIREE OVER AGE 65 Employee Only Employee + 1 TOTAL MONTHLY PREMIUM TOTAL ANNUAL PREMIUM $ ∆ to Current % ∆ to Current 61 30 62 153 Current $738.00 $1,476.00 $2,036.00 $215,530 $2,586,360 Renewal $780.00 $1,559.00 $2,149.00 $227,588 $2,731,056 $144,696 5.6% 4 5 1 10 Current $738.00 $1,476.00 $2,036.00 $12,368 $148,416 Renewal $780.00 $1,559.00 $2,149.00 $13,064 $156,768 $8,352 5.6% 6 0 6 Current $500.00 $1,000.00 $3,000 $36,000 Renewal $522.00 $1,044.00 $3,132 $37,584 $1,584 4.4% 5 Cabrillo College - 5/26/2011 Copyright © 2011 Alliant Insurance Services, Inc. Confidential; not for distribution Section 3: Low HMO Plan Renewal Low HMO (Access HMO $25-500 Admit) Current Renewal None None Plans Calendar Year Deductible Calendar Year Copayment Maximum Individual / Family MAJOR MEDICAL Physician Office Visit Specialist Visit Preventive Care Lab & X-Ray $2,000 / $4,000 $2,000 / $4,000 $25 $25/$30** $0 No charge $150 at an Ambulatory Surgery Center; $300 at a Hospital $25 $25/$30** $0 No charge $150 at an Ambulatory Surgery Center; $300 at a Hospital $500 / Admit $500 / Admit $100 $100 (waived if admitted) 20%** $25 in your service area; $50 outside your service area $100 $100 (waived if admitted) 20%** $25 in your service area; $50 outside your service area Chiropractic Services (see separate rider) $10 (up to 30 visits per cal year)** $10 (up to 30 visits per cal year)** Skilled Nursing (up to 100/days/cal year Home Health Care $100 per day $25 (up to 100 visits p/cal yr) $100 per day $25 (up to 100 visits p/cal yr) Outpatient Surgery Hospitalization Inpatient Ambulance Emergency Room Durable Medical Equipment Urgent Care Mental Health Care Inpatient hospital facility Outpatient Physician Visit Substance Abuse - (see separate rider) Inpatient Detox Inpatient hospital facility Outpatient Physician Visit Outpatient Prescription Drugs (At participating Pharmacies only) Retail - 30 day supply Mail order - 90 day supply No annual deductible $500 / Admit $500 / Admit $25 per visit** $25 per visit** $500 / Admit $500 / Admit $25** Blue Shield Generic/Brand/Non-Formulary** $10 / $20 / $35 $20 / $40 / $70 20% for home self injectables; max of $100 per prescription $25** Medco Generic/Brand** $5/$20 $10/$50 Self Injectables; Covered at generic or brand copay * Access + Specialist (self-referred office visits within your medical group are available for higher copay) ** These member payments do not apply to the member calendar year Copayment Maximum ACTIVES Employee Only Employee + 1 Family TOTAL MONTHLY PREMIUM TOTAL ANNUAL PREMIUM $ ∆ to Current % ∆ to Current RETIREE UNDER AGE 65 Retiree Retiree plus 1 dependent Retiree plus family TOTAL MONTHLY PREMIUM TOTAL ANNUAL PREMIUM $ ∆ to Current % ∆ to Current RETIREE OVER AGE 65 Employee Only Employee + 1 TOTAL MONTHLY PREMIUM TOTAL ANNUAL PREMIUM $ ∆ to Current % ∆ to Current 103 48 63 214 2 4 0 6 Current $619.00 $1,238.00 $1,708.00 $230,785 $2,769,420 Renewal $654.00 $1,305.00 $1,799.00 $243,339 $2,920,068 $150,648 5.4% $619.00 $1,238.00 $1,708.00 $6,190 $74,280 $654.00 $1,305.00 $1,799.00 $6,528 $78,336 $4,056 5.5% 2 2 4 Current $452.00 $904.00 $2,712 $32,544 Renewal $483.00 $967.00 $2,900 $34,800 $2,256 6.9% 6 Cabrillo College - 5/26/2011 Copyright © 2011 Alliant Insurance Services, Inc. Confidential; not for distribution Section 3: High HMO Plan - Options Alternative 1 Alternative 2 Current None Renewal None 10-0 w/Chiro $5/$20 Rx None 20-250 w/Chiro $5/$10 None $1,000 / $2,000 $1,000 / $2,000 $1,000 / $2,000 $1,500/$3,000 $10 $10/$30** No charge No charge No charge $10 $10/$30** No charge No charge No charge $10 $10/$30** No charge No charge No charge $20 $20/$30** No charge No charge $100 performed in an ASC; $150 in a hospital No charge No charge No charge $250 / admission $100 $100 (waived if admitted) $100 $100 (waived if admitted) $100 $100 (waived if admitted) $100 $100 (waived if admitted) High HMO (Access HMO $10-0) Plans Calendar Year Deductible Calendar Year Copayment Maximum Individual / Family MAJOR MEDICAL Physician Office Visit Specialist Visit Preventive Care Lab & X-Ray Outpatient Surgery Hospitalization Inpatient Ambulance Emergency Room Durable Medical Equipment 20%** 20%** 20%** 20%** Urgent Care $10 in your service area; $50 outside your service area $10 in your service area; $50 outside your service area $10 in your service area; $50 outside your service area Chiropractic Services (see separate rider) $10 (up to 30 visits per cal year)** $10 (up to 30 visits per cal year)** $10 (up to 30 visits per cal year)** $20 in your service area; $50 outside your service area $10 (up to 30 visits per cal year)** Skilled Nursing (up to 100/days/cal year Home Health Care No charge $10 (up to 100 visits p/cal yr) No charge $10 (up to 100 visits p/cal yr) No charge $10 (up to 100 visits p/cal yr) $100/day $25 (up to 100 visits p/cal yr) No charge No charge No charge $250 / admission $10** $10 $10 $20 No charge No charge No charge $250 / admission $10 Medco Generic/Brand** $5/$10 $10/$20 Self Injectables; Covered at generic or brand copay $10 Medco Generic/Brand** $5/$20 $10/$50 Self Injectables; Covered at generic or brand copay $20 Medco Generic/Brand** $5/$10 $10/$20 Self Injectables; Covered at generic or brand copay Renewal $780.00 $1,559.00 $2,149.00 $227,588 $2,731,056 $144,696 5.6% $769.00 $1,539.00 $2,125.00 $224,829 $2,697,948 $111,588 4.3% $719.00 $1,435.00 $1,977.00 $209,483 $2,513,796 -$72,564 -2.8% Mental Health Care Inpatient hospital facility Outpatient Physician Visit Substance Abuse - (see separate rider) Inpatient Detox Inpatient hospital facility Outpatient Physician Visit Outpatient Prescription Drugs (At participating Pharmacies only) Retail - 30 day supply Mail order - 90 day supply $10 Blue Shield Generic/Brand/Non-Formulary** $5 / $10 / $25 $10 / $20 / $50 20% for home self injectables; No annual deductible max of $100 per prescription * Access + Specialist (self-referred office visits within your medical group are available for higher copay) ** These member payments do not apply to the member calendar year Copayment Maximum Active Current Employee Only 61 $738.00 Employee + 1 30 $1,476.00 Family 62 $2,036.00 TOTAL MONTHLY PREMIUM 153 $215,530 TOTAL ANNUAL PREMIUM $2,586,360 $ ∆ from Current % ∆ from Current RETIREE UNDER AGE 65 Retiree Retiree plus 1 dependent Retiree plus family TOTAL MONTHLY PREMIUM TOTAL ANNUAL PREMIUM $ ∆ to Current % ∆ to Current RETIREE OVER AGE 65 Retiree Retiree plus 1 TOTAL MONTHLY PREMIUM TOTAL ANNUAL PREMIUM $ ∆ to Current % ∆ to Current 4 5 1 10 Current $738.00 $1,476.00 $2,036.00 $12,368 $148,416 Renewal $780.00 $1,559.00 $2,149.00 $13,064 $156,768 $8,352 5.6% $769.00 $1,539.00 $2,125.00 $12,896 $154,752 $6,336 4.3% $719.00 $1,435.00 $1,977.00 $12,028 $144,336 -$4,080 -2.7% 6 0 6 Current $500.00 $1,000.00 $3,000 $36,000 Renewal $522.00 $1,044.00 $3,132 $37,584 $1,584 4.4% TBD TBD $0 $0 TBD TBD TBD TBD $0 $0 TBD TBD 7 Cabrillo College - 5/26/2011 Copyright © 2011 Alliant Insurance Services, Inc. Confidential; not for distribution Section 3: Low HMO Plan - Options Plans Low HMO (Access HMO $25-500 Admit w/Chiro) Current Renewal None None Calendar Year Deductible Calendar Year Copayment Maximum Individual / Family MAJOR MEDICAL Physician Office Visit Specialist Visit Preventive Care Lab & X-Ray Outpatient Surgery Hospitalization Inpatient Ambulance Emergency Room Durable Medical Equipment Alternative 1 Alternative 2 $25-500 w/Chiro $9/$35 Rx None 30-20% Zero Facility $5/$10 Rx None $2,000 / $4,000 $2,000 / $4,000 $2,000 / $4,000 $1,500 p/member $25 $25/$30** $0 No charge $150 at an Ambulatory Surgery Center; $300 at a Hospital $25 $25/$30** $0 No charge $150 at an Ambulatory Surgery Center; $300 at a Hospital $25 $25/$30** $0 No charge $150 at an Ambulatory Surgery Center; $300 at a Hospital $30 $30/$45** $0 No charge $500 / Admit $500 / Admit $500 / Admit 20% $100 $100 (waived if admitted) $100 $100 (waived if admitted) $100 $100 (waived if admitted) $100 $150 (waived if admitted) No charge 20%** 20%** 20%** 50%** Urgent Care $25 in your service area; $50 outside your service area $25 in your service area; $50 outside your service area $25 in your service area; $50 outside your service area Chiropractic Services (see separate rider) $10 (up to 30 visits per cal year)** $10 (up to 30 visits per cal year)** $10 (up to 30 visits per cal year)** $30 in your service area; $50 outside your service area $10 (up to 30 visits per cal year)** Skilled Nursing (up to 100/days/cal year Home Health Care $100 per day $25 (up to 100 visits p/cal yr) $100 per day $25 (up to 100 visits p/cal yr) $100 per day $25 (up to 100 visits p/cal yr) 20% $20 (up to 100 visits p/cal yr) $500 / Admit $500 / Admit $500 / Admit 20% $30 per visit Mental Health Care Inpatient hospital facility Outpatient Physician Visit Substance Abuse - (see separate rider) Inpatient Detox Inpatient hospital facility Outpatient Physician Visit Outpatient Prescription Drugs (At participating Pharmacies only) Retail - 30 day supply Mail order - 90 day supply $25 per visit $25 per visit $25 per visit $500 / Admit $500 / Admit $500 / Admit 20% $25 Medco Generic/Brand** $5/$20 $10/$50 Self Injectables; Covered at generic or brand copay $25 Medco Generic/Brand** $9/$35 $18/$90 Self Injectables; Covered at generic or brand copay $30 Medco Generic/Brand** $5/$10 $10/$20 Self Injectables; Covered at generic or brand copay Renewal $654 $1,305 $1,799 $243,339 $2,920,068 $150,648 5.4% $644 $1,288 $1,777 $240,107 $2,881,284 $111,864 4.0% $615 $1,222 $1,681 $227,904 $2,734,848 -$34,572 -1.2% $25 Blue Shield Generic/Brand/Non-Formulary** $10 / $20 / $35 $20 / $40 / $70 20% for home self injectables; No annual deductible max of $100 per prescription * Access + Specialist (self-referred office visits within your medical group are available for higher copay) ** These member payments do not apply to the member calendar year Copayment Maximum Current Active Employee Only 103 $619 Employee + 1 48 $1,238 Family 63 $1,708 TOTAL MONTHLY PREMIUM 214 $230,785 TOTAL ANNUAL PREMIUM $2,769,420 $ ∆ from Current % ∆ from Current RETIREE UNDER AGE 65 Retiree Retiree plus 1 dependent Retiree plus family TOTAL MONTHLY PREMIUM TOTAL ANNUAL PREMIUM $ ∆ to Current % ∆ to Current RETIREE OVER AGE 65 Retiree Retiree plus 1 dependent TOTAL MONTHLY PREMIUM TOTAL ANNUAL PREMIUM 2 4 0 6 Current $619 $1,238 $1,708 $6,190 $74,280 Renewal $654 $1,305 $1,799 $6,528 $78,336 $4,056 5.5% $644 $1,288 $1,777 $6,440 $77,280 $3,000 4.0% $615 $1,222 $1,681 $6,118 $73,416 -$864 -1.2% 2 2 4 Current $452.00 $904.00 $2,712 $32,544 Renewal $483.00 $967.00 $2,900 $34,800 $2,256 6.9% TBD TBD TBD TBD TBD TBD TBD TBD TBD TBD TBD TBD 8 Cabrillo College - 5/26/2011 Copyright © 2011 Alliant Insurance Services, Inc. Confidential; not for distribution Section 4: PPO Renewal High PPO (90-E $10, Rx 5-20 w $100 brand deductible) Current Renewal $300 p/ind; $600 p/fam $300 p/ind; $600 p/fam $600 p/ind; $1,800 per fam $600 p/ind; $1,800 per fam Plans Calendar Year Deductible(s) Maximum *Co-Insurance Co-insurance is the member's responsibility to pay when the plan is paying less than 100% ( i.e. plan pays 80%, member pays the other 20%) Services Office Visits Inpatient Hospital Room, Board & Support Services (prior authorization required) Ambulatory Surgery Center Emergency Room (non-emergency) Facility Expenses: Professional Expenses: Surgeon & Anesthetist Accident Care (Professional) (initial care) Preventive Care Routine Exam Diagnostic X-Ray & Lab Once the memb er's 10% co-insurance totals $600 per individual, the plan will pay 100% of the allowab le amount for the remainder of the calendar year. Once the memb er's 20% co-insurance totals $1,000 per individual, the plan will pay 100% of the allowab le amount for the remainder of the calendar year. Once the memb er's 20% co-insurance totals $1,000 per individual, the plan will pay 100% of the allowab le amount for the remainder of the calendar year. In Network $10; (does not apply to deductible or coinsurance max.) Out of Network In Network $10; (does not apply to deductible or coinsurance max.) Out of Network In Network $10; does not apply to ded or max Out of Network In Network $10; does not apply to ded or max Out of Network In Network Out of Network In Network Out of Network 50% 90% 50% 90% 50% 90% $600 p/day 90% $600 p/day 80% $600 p/day 80% $600 p/day 90% 90% 90% 50% $350 p/day $100 copay 90% of eligible expenses 50% 50% 90% Chiropractic Low PPO (HDHP -B w/HSA Compatibility) Current Renewal $2,500 p/ind; $5,000 p/fam $2,500 p/ind; $5,000 p/fam $5,000 p/ind or $10,000 per fam $5,000 p/ind or $10,000 per fam Once the memb er's 10% co-insurance totals $600 per individual, the plan will pay 100% of the allowab le amount for the remainder of the calendar year. 90% Physical Medicine PT, OT Speech Therapy Acupuncture 12 visits per year Durable Medical Equipment Hearing Aid ($700 maximum every 24 months) Hospice Ambulance Home Health Care 100 visits/yr (prior authorization required) Psychiatric Inpatient Outpatient Visits For Severe Conditions Outpatient Visits For Non-Severe Conditions Substance Abuse Inpatient For Acute Detox Outpatient Visits Outpatient Prescription Drugs Medium PPO (80-G $10, Rx 5-20 w $100 brand deductible) Current Renewal $500 p/ind; $1,000 p/fam $500 p/ind; $1,000 p/fam $1,000 p/ind; $3,000 per fam $1,000 p/ind; $3,000 per fam 90% 90% 90% 90% 90% 50% $350 p/day $100 copay 90% of eligible expenses 50% 50% 80% 80% 80% 80% 90% 90% 50% $350 p/day $100 copay 90% of eligible expenses 50% 50% 80% 80% 80% 80% 80% 80% NOTE: This plan has an Annual Out-of-Pocket Maximum that includes the deductib le, copays and co-insurance. 90% $350 p/day $100 copay 90% of eligible expenses 50% 50% 80% 90% 90% 90% 90% 80% $600 p/day $350 p/day $100 copay 90% of eligible expenses 50% 50% 90% 90% NOTE: This plan has an Annual Out-of-Pocket Maximum that includes the deductib le, copays and co-insurance. 90% 90% 90% 90% 90% $600 p/day $350 p/day $100 copay 90% of eligible expenses 50% 50% 90% 90% Ded waived; 100% 50% Ded waived; 100% Not Covered 90% 50% 20 Visits per year 90% 50% 90% 50% 90% 50% Ded waived; 100% 50% Ded waived; 100% Not Covered 90% 50% 20 Visits per year 90% 50% 90% 50% 90% 50% Ded waived; 100% 50% Ded waived; 100% Not Covered 80% 50% 20 Visits per year 80% 50% 80% 50% 80% 50% Ded waived; 100% 50% Ded waived; 100% Not Covered 80% 50% 20 Visits per year 80% 50% 80% 50% 80% 50% Ded waived; 100% 50% Ded waived; 100% Not Covered 90% 50% 12 Visits per year 90% up to $25 p/visit 50% up to $25 p/visit 90% 50% 90% 50% Ded waived; 100% 50% Ded waived; 100% Not Covered 90% 50% 12 Visits per year 90% up to $25 p/visit 50% up to $25 p/visit 90% 50% 90% 50% 90% up to $50 p/visit 50% up to $25 p/visit 90% up to $50 p/visit 50% up to $25 p/visit 80% up to $50 p/visit 50% up to $25 p/visit 80% up to $50 p/visit 50% up to $25 p/visit 90% up to $30 p/visit 50% up to $30 p/visit 90% up to $30 p/visit 50% up to $30 p/visit 90% 90% 90% 90% 50% 90% Not cov. unless pre auth 90% Not covered unless pre auth 90% 90% 90% 90% 50% 90% Not cov. unless pre auth 90% Not covered unless pre auth 80% 80% 80% 80% 50% 80% Not cov. unless pre auth 80% Not covered unless pre auth 80% 80% 80% 80% 50% 80% Not cov. unless pre auth 80% Not covered unless pre auth 90% 90% 90% 90% 50% 90% Not cov. unless pre auth 90% Not covered unless pre auth 90% 90% 90% 90% 50% 90% Not cov. unless pre auth 90% Not covered unless pre auth 90% $600 p/day 90% $600 p/day 80% $600 p/day 80% $600 p/day 90% $600 p/day 90% $10 copay 50% $10 copay 50% $10 copay 50% $10 copay 50% 90% 50% 90% 50% 90% $600 p/day 90% $600 p/day 80% $600 p/day 80% $600 p/day 90% $600 p/day 90% $600 p/day 90% 90% 80% 80% 90% 90% $600 p/day Supply Generic Drugs Single Source Brand Name Drugs Multi Source Brand Name Drugs $10 copay 50% Medco Rx plan $5-20 w/$100 brand ded Retail Mail 30 days 90 days $5 $10 $20 $50 $5 + cost diff $10 + cost diff $10 copay 50% Medco Rx plan $5-20 w/$100 brand ded Retail Mail 30 days 90 days $5 $10 $20 $50 $5 + cost diff $10 + cost diff $10 copay 50% Medco Rx plan $5-20 w/$100 brand ded Retail Mail 30 days 90 days $5 $10 $20 $50 $5 + cost diff $10 + cost diff $10 copay 50% Medco Rx plan $5-20 w/$100 brand ded Retail Mail 30 days 90 days $5 $10 $20 $50 $5 + cost diff $10 + cost diff 90% 50% Rx w/ Blue Shield Contracted Provider Retail Mail 30 days 90 days $7 $14 $25 $14 $25 $60 90% 50% Rx w/ Blue Shield Contracted Provider Retail Mail 30 days 90 days $7 $14 $25 $14 $25 $60 Brand Name Calendar Year Deductible $100 per individual up to $300 per family $100 per individual up to $300 per family $100 per individual up to $300 per family $100 per individual up to $300 per family $2,500 medical deductible must be met before co-pays apply $2,500 medical deductible must be met before co-pays apply 11 12 7 30 $738 $1,311 $2,003 $37,871 $454,452 $774 $1,373 $2,100 $39,690 $476,280 $21,828 4.8% 19 2 4 25 $540 $962 $1,504 $18,200 $218,400 $577 $1,030 $1,611 $19,467 $233,604 $15,204 7.0% 2 0 0 $738 $1,311 $2,003 $1,476 $774 $1,373 $2,100 $1,548 0 1 0 $540 $962 $1,504 $962 $577 $1,030 $1,611 $1,030 $17,712 $18,576 $11,544 $12,360 * This is only a brief summary of benefits. For details, limitations and exclusions, please refer to the summary plan descriptions. Active Employee Only Employee + 1 Family TOTAL MONTHLY PREMIUM TOTAL ANNUAL PREMIUM $ ∆ from Current % ∆ from Current RETIREE UNDER AGE 65 Retiree Retiree plus 1 dependent Retiree plus family TOTAL MONTHLY PREMIUM TOTAL ANNUAL PREMIUM $ ∆ to Current % ∆ to Current RETIREE OVER AGE 65 Retiree Retiree plus 1 dependent Retiree plus family TOTAL MONTHLY PREMIUM TOTAL ANNUAL PREMIUM 54 29 13 96 22 17 0 39 43 6 0 49 Current $813 $1,445 $2,212 $114,563 $1,374,756 Renewal $853 $1,514 $2,320 $120,128 $1,441,536 $66,780 4.9% Current Renewal $813 $1,445 $2,212 $42,451 $853 $1,514 $2,320 $44,504 $509,412 $534,048 2 1 $24,636 $864 $816 4.8% 4.9% 7.1% Current Renewal $492 $984 $1,266 $27,060 $520 $1,040 $1,350 $28,600 $324,720 $343,200 $18,480 5.7% 2 0 0 2 $488 $976 $1,254 $976 $516 $1,032 $1,388 $1,032 $11,712 $12,384 $672 5.7% 0 0 0 0 $506 $1,012 $1,518 $0 $497 $994 $1,342 $0 $0 $0 $0 0% 9 Cabrillo College - 5/26/2011 Copyright © 2011 Alliant Insurance Services, Inc. Confidential; not for distribution Section 4: High PPO Plan Options Current $300 p/ind; $600 p/fam $600 p/ind; $1,800 per fam Calendar Year Deductible(s) Maximum *Co-Insurance Co-insurance is the member's responsibility to pay when the plan is paying less than 100% ( i.e. plan pays 80%, member pays the other 20%) Services Office Visits Inpatient Hospital Room, Board & Support Services (prior authorization required) Ambulatory Surgery Center Emergency Room (non-emergency) Facility Expenses: Professional Expenses: Surgeon & Anesthetist Accident Care (Professional) (initial care) Preventive Care Routine Exam Diagnostic X-Ray & Lab Renewal $300 p/ind; $600 p/fam $600 p/ind; $1,800 per fam 80%-D $20 Rx $5/$20 $200 p/ind; $500 p/fam $300 p/ind; $900 per fam $200 p/ind; $500 p/fam $1,000 p/ind; $3,000 per fam Once the member's 10% co-insurance totals $600 per Once the member's 10% co-insurance totals $300 per Once the member's 20% co-insurance totals $1,000 per individual, the plan will pay 100% of the allowable individual, the plan will pay 100% of the allowable amount individual, the plan will pay 100% of the allowable amount for the remainder of the calendar year. for the remainder of the calendar year. amount for the remainder of the calendar year. In Network $10; (does not apply to deductible or coinsurance max.) In Network $10; (does not apply to deductible or coinsurance max.) Out of Network 50% Out of Network 50% 22 17 0 39 Out of Network 50% In Network $20; (does not apply to deductible or coinsurance max) Out of Network 50% 90% $600 p/day 90% $600 p/day 90% $600 p/day 80% $600 p/day $350 p/day 90% $350 p/day 90% $350 p/day 80% $350 p/day $100 copay 90% of eligible expenses 50% 50% 90% 90% 90% 90% $100 copay 90% of eligible expenses 50% 50% 90% 90% 90% 90% 90% $100 copay 90% of eligible expenses 50% 50% 90% 90% 80% 80% 80% $100 copay 90% of eligible expenses 50% 50% 80% 80% Ded waived; 100% 50% Ded waived; 100% Not Covered 90% 50% 20 Visits per year 90% 50% 90% 50% 90% 50% Ded waived; 100% 50% Ded waived; 100% Not Covered 90% 50% 20 Visits per year 90% 50% 90% 50% 90% 50% Ded waived; 100% 50% Ded waived; 100% Not Covered 90% 50% 20 Visits per year 90% 50% 90% 50% 90% 50% Ded waived; 100% 50% Ded waived; 100% Not Covered 80% 50% 20 Visits per year 80% 50% 80% 50% 80% 50% 90% up to $50 p/visit 50% up to $25 p/visit 90% up to $50 p/visit 50% up to $25 p/visit 90% up to $50 p/visit 50% up to $25 p/visit 80% up to $50 p/visit 50% up to $25 p/visit 90% 90% 90% 90% 50% 90% Not cov. unless pre auth 90% 90% 90% 90% 90% 50% 90% Not cov. unless pre auth 90% 90% 90% 90% 90% 50% 90% Not cov. unless pre auth 90% 80% 80% 80% 80% 50% 80% Not cov. unless pre auth 80% 90% Not covered unless pre auth 90% Not covered unless pre auth 90% Not covered unless pre auth 80% Not covered unless pre auth 90% $600 p/day 90% $600 p/day 90% $600 p/day 80% $600 p/day $10 copay 50% $10 copay 50% $30 copay 50% $20 copay 50% 90% $600 p/day 90% $600 p/day 90% $600 p/day 80% $600 p/day $10 copay 50% $10 copay 50% Medco Rx plan $5-20 w/$100 brand ded Medco Rx plan $5-20 w/$100 brand ded Retail Mail Retail Mail Supply 30 days 90 days 30 days 90 days Generic Drugs $5 $10 $5 $10 Single Source Brand Name Drugs $20 $50 $20 $50 Multi Source Brand Name Drugs $5 + cost diff $10 + cost diff $5 + cost diff $10 + cost diff $100 per individual up to $300 per family $100 per individual up to $300 per family Brand Name Calendar Year Deductible * This is only a brief summary of benefits. For details, limitations and exclusions, please refer to the summary plan descriptions. 54 29 13 96 In Network $30; (does not apply to deductible or coinsurance max.) 90% 90% Chiropractic RETIREE UNDER AGE 65 Retiree Retiree plus 1 dependent Retiree plus family TOTAL MONTHLY PREMIUM TOTAL ANNUAL PREMIUM $ ∆ to Current % ∆ to Current Alternative 2 90-C $30 Rx $7/$25 Once the member's 10% co-insurance totals $600 per individual, the plan will pay 100% of the allowable amount for the remainder of the calendar year. 90% 90% 90% Physical Medicine PT, OT Speech Therapy Acupuncture 12 visits per year Durable Medical Equipment Hearing Aid ($700 maximum every 24 months) Hospice Ambulance Home Health Care 100 visits/yr (prior authorization required) Psychiatric Inpatient Outpatient Visits For Severe Conditions Outpatient Visits For Non-Severe Conditions Substance Abuse Inpatient For Acute Detox Outpatient Visits Outpatient Prescription Drugs Active Employee Only Employee + 1 Family TOTAL MONTHLY PREMIUM TOTAL ANNUAL PREMIUM $ ∆ from Current % ∆ from Current Alternative 1 High PPO (90-E $10, Rx 5-20 w $100 brand deductible) Plans Current $813 $1,445 $2,212 $114,563 $1,374,756 $30 copay 50% Medco Rx plan $7/$25 Retail Mail 30 days 90 days $7 $14 $25 $60 $7 + cost diff $14 + cost diff None $10 copay 50% Medco Rx plan $5/$20 Retail Mail 30 days 90 days $5 $10 $20 $50 $5 + cost diff $10 + cost diff None $841 $1,494 $2,288 $118,484 $1,421,808 $47,052 3.4% $829 $1,471 $2,246 $116,623 $1,399,476 $24,720 1.80% $853 $1,514 $2,320 $120,128 $1,441,536 $66,780 4.9% Current Renewal $813 $1,445 $2,212 $42,451 $853 $1,514 $2,320 $44,504 $841 $1,494 $2,288 $43,900 $829 $1,471 $2,246 $43,245 $509,412 $534,048 $526,800 $518,940 $24,636 $17,388 $9,528 4.8% 3.4% 1.87% \ RETIREE OVER AGE 65 Retiree Retiree plus 1 dependent Retiree plus family TOTAL MONTHLY PREMIUM TOTAL ANNUAL PREMIUM $ ∆ to Current % ∆ to Current 43 6 0 49 Current Renewal $492 $984 $1,266 $27,060 $520 $1,040 $1,350 $28,600 TBD TBD TBD TBD TBD TBD TBD TBD $324,720 $343,200 TBD TBD $18,480 TBD TBD 5.7% TBD TBD 10 Cabrillo College - 5/26/2011 Copyright © 2011 Alliant Insurance Services, Inc. Confidential; not for distribution Section 4: Medium PPO Plan Options Alternative 1 Alternative 2 80%-E $30 Rx $9/$35 80%-G $30 Rx $5/$20 80%-G $20 Rx $5/$20 Medium PPO (80-G $10, Rx 5-20 w $100 brand deductible) Plans Calendar Year Deductible(s) Maximum *Co-Insurance Co-insurance is the member's responsibility to pay when the plan is paying less than 100% ( i.e. plan pays 80%, member pays the other 20%) Services Office Visits Inpatient Hospital Room, Board & Support Services (prior authorization required) Ambulatory Surgery Center Emergency Room (non-emergency) Facility Expenses: Professional Expenses: Surgeon & Anesthetist Accident Care (Professional) (initial care) Preventative Care Routine Exam Diagnostic X-Ray & Lab Current $500 p/ind; $1,000 p/fam $1,000 p/ind; $3,000 per fam Renewal $500 p/ind; $1,000 p/fam $1,000 p/ind; $3,000 per fam $300 p/ind; $600 p/fam $1,000 p/ind; $3,000 per fam $500 p/ind; $1,000 p/fam $1,000 p/ind; $3,000 per fam $500 p/ind; $1,000 p/fam $1,000 p/ind; $3,000 per fam Once the member's 20% co-insurance totals $1,000 per individual, the plan will pay 100% of the allowable amount for the remainder of the calendar year. Once the member's 20% co-insurance totals $1,000 per individual, the plan will pay 100% of the allowable amount for the remainder of the calendar year. Once the member's 10% co-insurance totals $1,000 per individual, the plan will pay 100% of the allowable amount for the remainder of the calendar year. Once the member's 20% co-insurance totals $1,000 per individual, the plan will pay 100% of the allowable amount for the remainder of the calendar year. Once the member's 20% co-insurance totals $1,000 per individual, the plan will pay 100% of the allowable amount for the remainder of the calendar year. In Network $10; does not apply to ded or max Out of Network In Network $10; does not apply to ded or max Out of Network In Network $30; (does not apply to deductible or coinsurance max) Out of Network In Network $30; (does not apply to deductible or coinsurance max) Out of Network In Network $20; (does not apply to deductible or coinsurance max) Out of Network 80% $600 p/day 80% $600 p/day 80% $600 p/day 80% $600 p/day 80% $600 p/day 80% $350 p/day 80% $350 p/day 80% $350 p/day 80% $350 p/day 80% 80% 80% 80% 50% $100 copay 90% of eligible expenses 50% 50% 80% Chiropractic Physical Medicine PT, OT Speech Therapy Acupuncture 12 visits per year Durable Medical Equipment Hearing Aid ($700 maximum every 24 months) Hospice Ambulance Home Health Care 100 visits/yr (prior authorization required) Psychiatric Inpatient Outpatient Visits For Severe Conditions Outpatient Visits For Non-Severe Conditions Substance Abuse Inpatient For Acute Detox Outpatient Visits Outpatient Prescription Drugs Alternative 3 80% 80% 80% 80% 50% $100 copay 90% of eligible expenses 50% 50% 80% 80% 80% 80% 80% 50% $100 copay 90% of eligible expenses 50% 50% 80% 80% 80% 80% 80% 50% $100 copay 90% of eligible expenses 50% 50% 80% 80% 80% 80% 80% 50% $350 p/day $100 copay 90% of eligible expenses 50% 50% 80% 80% Ded waived; 100% 50% Ded waived; 100% Not Covered 80% 50% 20 Visits per year 80% 50% 80% 50% 80% 50% Ded waived; 100% 50% Ded waived; 100% Not Covered 80% 50% 20 Visits per year 80% 50% 80% 50% 80% 50% Ded waived; 100% 50% Ded waived; 100% Not Covered 80% 50% 20 Visits per year 80% 50% 80% 50% 80% 50% Ded waived; 100% 50% Ded waived; 100% Not Covered 80% 50% 20 Visits per year 80% 50% 80% 50% 80% 50% Ded waived; 100% 50% Ded waived; 100% Not Covered 80% 50% 20 Visits per year 80% 50% 80% 50% 80% 50% 80% up to $50 p/visit 50% up to $25 p/visit 80% up to $50 p/visit 50% up to $25 p/visit 80% up to $50 p/visit 50% up to $25 p/visit 80% up to $50 p/visit 50% up to $25 p/visit 80% up to $50 p/visit 50% up to $25 p/visit 80% 80% 80% 80% 50% 80% Not cov. unless pre auth 80% 80% 80% 80% 80% 50% 80% Not cov. unless pre auth 80% 80% 80% 80% 80% 80% 80% 80% 80% Not covered unless pre auth 80% Not covered unless pre auth 80% 50% 80% Not cov. unless pre auth 80% Not covered unless pre auth 80% 80% 80% 80% 80% 50% 80% Not cov. unless pre auth 80% Not covered unless pre auth 50% 80% Not cov. unless pre auth 80% Not covered unless pre auth 80% $600 p/day 80% $600 p/day 80% $600 p/day 80% $600 p/day 80% $10 copay 50% $10 copay 50% $30 copay 50% $30 copay 50% $20 copay 50% 80% $600 p/day 80% $600 p/day 80% $600 p/day 80% $600 p/day 80% $600 p/day 80% 80% $600 p/day Supply Generic Drugs Single Source Brand Name Drugs Multi Source Brand Name Drugs $10 copay 50% Medco Rx plan $5-20 w/$100 brand ded Retail Mail 30 days 90 days $5 $10 $20 $50 $5 + cost diff $10 + cost diff $10 copay 50% Medco Rx plan $5-20 w/$100 brand ded Retail Mail 30 days 90 days $5 $10 $20 $50 $5 + cost diff $10 + cost diff $30 copay 50% Medco Rx plan $9/$35 Retail Mail 30 days 90 days $9 $18 $35 $90 $9 + cost diff $18 + cost diff $30 copay 50% Medco Rx plan $5/$20 Retail Mail 30 days 90 days $5 $10 $20 $50 $5 + cost diff $10 + cost diff $20 copay 50% Medco Rx plan $5/$20 Retail Mail 30 days 90 days $5 $10 $20 $50 $5 + cost diff $10 + cost diff Brand Name Calendar Year Deductible $100 per individual up to $300 per family $100 per individual up to $300 per family None None None $769 $1,365 $2,094 $39,497 $473,964 $19,512 4.3% $755 $1,340 $2,040 $38,665 $463,980 $9,528 2.1% $770 $1,366 $2,081 $39,429 $473,148 $18,696 4.1% * This is only a brief summary of benefits. For details, limitations and exclusions, please refer to the summary plan descriptions. Current Active Employee Only Employee + 1 Family TOTAL MONTHLY PREMIUM TOTAL ANNUAL PREMIUM $ ∆ from Current % ∆ from Current RETIREE UNDER AGE 65 Retiree Retiree plus 1 dependent Retiree plus family TOTAL MONTHLY PREMIUM TOTAL ANNUAL PREMIUM $ ∆ to Current % ∆ to Current RETIREE OVER AGE 65 Retiree Retiree plus 1 dependent Retiree plus family TOTAL MONTHLY PREMIUM TOTAL ANNUAL PREMIUM $ ∆ to Current % ∆ to Current 11 12 7 30 2 0 0 2 2 0 0 2 Renewal $738 $1,311 $2,003 $37,871 $454,452 $774 $1,373 $2,100 $39,690 $476,280 $21,828 4.8% Current Renewal $738 $1,311 $2,003 $1,476 $774 $1,373 $2,100 $1,548 $769 $1,365 $2,094 $1,538 $755 $1,340 $2,040 $1,510 $770 $1,366 $2,081 $1,540 $17,712 $18,576 $18,456 $18,120 $18,480 $864 $744 $408 $768 4.9% 4.2% 2.3% 4.3% Current Renewal $488 $976 $1,254 $976 $516 $1,032 $1,388 $1,032 TBD TBD TBD TBD TBD TBD TBD TBD TBD TBD TBD TBD $11,712 $12,384 TBD TBD TBD $672 TBD TBD TBD 5.7% TBD TBD TBD 11 Cabrillo College - 5/26/2011 Copyright © 2011 Alliant Insurance Services, Inc. Confidential; not for distribution Section 5: CompanionCare/Kaiser Permanente CompanionCare Current MEDICARE SERVICES 2010 Benefits Pays all but first $1100 for 1st 60 days Pays all but first $275 a day for the 61st to 90th day Inpatient Hospital (Part A) Skilled Nursing Facilites (Must be approved by Medicare) Deductible (Part B) Blood (Part B) EE 7 2 0 9 Pays $283 a day Pays 100% for 151st day to 515th day Pays nothing Pays $137.50 a day for 21st to 100th day Pays nothing after 100th day Pays nothing after Lifetime Reserve is used Pays 100% for 1st 20 days Pays all but $141.50 a day for 21st to 100th day Pays nothing after 100th day Pays 100% for 151st day to 515th day Pays nothing Pays $141.50 a day for 21st to 100th day Pays nothing after 100th day Pays $155 $162 Part B deductible per year Pays $162 80% Medicare Approved (MA) charges after Part B deductible 20% MA charges including 100% of Medicare Part B deductible 80% MA charges 20% MA charges 100% of MA charges Pays nothing 80% MA charges 20% MA charges including 100% of Medicare Part B deductible 20% MA charges 100% of MA charges Pays nothing 20% MA charges up to the Medicare annual benefit amount. (Physical & Speech Therapy Combined) Pays 1st 3 pints unreplaced blood and 20% MA charges Pays 80% inpatient hospital, surgery, anestetist and in hospital visits for medically Rx drug plan enhanced through Medco Health effective 10/01/2011 thru 12/31/2011 CompanionCare EMPLOYEES Retiree Retiree plus 1 dependent Retiree plus family TOTAL MONTHLY PREMIUM TOTAL ANNUAL PREMIUM $ ∆ to Current % ∆ to Current Pays $1132 Pays nothing after Lifetime Reserve is used Pays 100% for 1st 20 days Pays all but $137.50 a day for 21st to 100th day Pays nothing after 100th day Not covered Outpatient Presrciption Drugs Pays all but first $1132 for 1st 60 days Pays all but first $283 a day for the 61st to 90th day Pays $566 a day 80% MA charges after 3 pints Travel Coverage (when outside the US for less than 6 consecutive months) Based on 2011 Medicare Benefits Pays all but $566 a day Lifetime Reserve for 91st to 150th day 80% MA Charges up to the Medicare annual benefit amount Physical/Speech Therapy (Part B) Pays $275 a day CompanionCare 2011 Benefits Pays $550 a day 80% Medicare Approved (MA) charges after Part B deductible Medical Services (Part B) Doctor, x-ray, appliances, & ambulance Lab Pays $1100 MEDICARE Pays all but $550 a day Lifetime Reserve for 91st to 150th day $155 Part B deductible per year Basis of Payment (Part B) Renewal CompanionCare Based on 2010 Medicare Benefits 20% MA charges up to the Medicare 80% MA Charges up to the annual benefit amount. (Physical & Medicare annual benefit amount Speech Therapy Combined) 80% MA charges after 3 pints Not covered Pays 1st 3 pints unreplaced blood and 20% MA charges Pays 80% inpatient hospital, surgery, anestetist and in hospital visits for medically necessary services for 90 Rx drug plan enhanced through Medco Health effective 1/1/2012 * Generic: $7 co-pay for a 30* Generic: $9 co-pay for a 30-day day supply at a retail pharmacy or $14 co-pay for a 90-day SISC will automatically enroll SISC will automatically enroll supply at a retail pharmacy or $18 CompanionCare members into supply through home delivery CompanionCare members into co-pay for a 90-day supply through home delivery service service Medicare Part D. No additional Medicare Part D. No additional * Brand: $35 co-pay for a 30-day premium required. SISC plans * Brand: $25 co-pay for a 30- premium required. SISC plans are not subject to the are not subject to the supply at a retail pharmacy or $90 day supply at a retail pharmacy 'doughnout hole'. 'doughnout hole'. or $60 co-pay for a 90-day co-pay for a 90-day supply through supply through home delivery home delivery service service Current Renewal $437 $427 $874 $854 $0 $0 $4,807 $4,697 $57,684 $56,364 -$1,320 -2.3% * CompanionCare is a Medicare Supplement plan that pays for medically necessary services and procedures that are considered as a Medicare Approved Expense 12 Cabrillo College - 5/26/2011 Copyright © 2011 Alliant Insurance Services, Inc. Confidential; not for distribution Section 5: : CompanionCare/Kaiser Permanente Kaiser Permanente Individual Retiree Plan SERVICES Current Renewal Hospitalization * Inpatient * Emergency Room $200/Admit $50 co-pay/waived if admitted $200/Admit $50 co-pay/waived if admitted Skilled Nursing Facility Covered in full for 100 days per benefit period Covered in full for 100 days per benefit period $10 co-pay per visit $10 co-pay per visit No charge No charge Physician Services/Basic Health Services * Office visits * Consultation, diagnosis, and treatment by a specialist X-Ray Services * Includes routine annual mammography Laboratory Services Annual Physical Examination * Includes pap smears Outpatient Mental Health/20visits Vision Care * Examination for eyeglasses * Glaucoma testing * Standard frame/lenses every 24 months No charge No charge $10 co-pay per visit $10 co-pay per visit $10 co-pay per visit $10 co-pay per visit; $5 co-pay per group visit $10 per visit $10 per visit $10 co-pay per visit $10 co-pay per visit $150 frame and lens allowance every $150 frame and lens allowance every 24 months 24 months Not covered Not covered $10 co-pay per visit $10 co-pay per visit Dental Care (DeltaCare) Hearing Examination Immunizations * Includes flu injections and all Medicare approved immunizations Ambulance No charge No charge $50/Trip $10 co-pay per visit (subject to medical necessity) $50/Trip $10 co-pay per visit (subject to medical necessity) Prescription Drugs $10 co-pay per generic/$20 co-pay per brand name up to $100 day supply at Kaiser pharmacies $10 co-pay per generic/$20 co-pay per brand name up to $100 day supply at Kaiser pharmacies * Prescription drugs related to sexual dysfunction 50% co-insurance; limited to 27 doses in any 100-day period 50% co-insurance; limited to 27 doses in any 100-day period Current $324 $324 $3,888 Renewal $324 $324 $3,888 $0 Manual Manipulation of the Spine EARLY RETIREES Employee Only TOTAL MONTHLY PREMIUM TOTAL ANNUAL PREMIUM $ ∆ to Current % ∆ to Current 1 1 0% 13 Cabrillo College - 5/26/2011 Copyright © 2011 Alliant Insurance Services, Inc. Confidential; not for distribution Section 6: Contributions with options Employer Stipend Change CURRENT 10/01/2010 Rates Low HMO High PPO Medium PPO (Access HMO $10-0) (Access HMO $25-500 Admit) (90-E $10) (80-G $10) Low PPO (HDHP-B) $10 No charge $100 copay $1,000/$2,000 $25 $500 admit $100 copay $2,000/$4,000 $10 90% $100 copay $300/$600 $10 80% $100 copay $500/$1,000 90% 90% $100 copay $2,500 ind/$5,000 fam $5/$10/$25 $10/$20/$50 Total Premium Employee Cost $738.00 $119.00 $1,476.00 $238.00 $2,036.00 $328.00 $10/$20/$35 $20/$40/$70 Total Premium Employee Cost $619.00 $0.00 $1,238.00 $0.00 $1,708.00 $0.00 $5/$20 $10/$50 Total Premium Employee Cost $813.00 $194.00 $1,445.00 $207.00 $2,212.00 $504.00 $5/$20 $10/$50 Total Premium Employee Cost $738.00 $119.00 $1,311.00 $73.00 $2,003.00 $295.00 $7/$25 $14/$60 Total Premium Employee Cost $540.00 $0.00 $962.00 $0.00 $1,504.00 $0.00 High HMO Office Visit Inpatient Hospital Emergency Room Annual Maximum Prescription Retail Mail Order Stipend $619.00 $1,238.00 $1,708.00 Single 2-party Family Option 1 - with Renewal Rates Option 1 - Stipend = Low Cost HMO 2011/2012 (Current Formula + Renewal Increase on Low HMO) Single 2-party Family 2010/2011 Stipend Stipend Increase 2011/2012 Stipend $619.00 $1,238.00 $1,708.00 $35.00 $67.00 $91.00 $654.00 $1,305.00 $1,799.00 2010/2011 Stipend Stipend Increase (2.7%) 2011/2012 Stipend $619.00 $1,238.00 $1,708.00 $16.71 $33.43 $46.12 $635.71 $1,271.43 $1,754.12 2010/2011 Stipend Stipend Increase 2011/2012 Stipend $619.00 $1,238.00 $1,708.00 $10.00 $30.00 $50.00 $629.00 $1,268.00 $1,758.00 High HMO Low HMO High PPO Medium PPO (Access HMO $10-0) (Access HMO $25-500 Admit) (90-E $10) (80-G $10) Total Premium $780.00 $1,559.00 $2,149.00 Employee Cost $126.00 $254.00 $350.00 Total Premium $654.00 $1,305.00 $1,799.00 Employee Cost $0.00 $0.00 $0.00 Total Premium $853.00 $1,514.00 $2,320.00 Employee Cost $199.00 $209.00 $521.00 Total Premium $774.00 $1,373.00 $2,100.00 Employee Cost $120.00 $68.00 $301.00 Low PPO (HDHP-B) Total Premium $577.00 $1,030.00 $1,611.00 Employee Cost $0.00 $0.00 $0.00 Option 2 - with Renewal Rates Option 2 - 2010/2011 Stipend Capped at CPI (March 2011 CPI at 2.7%) Single 2-party Family High HMO Low HMO High PPO Medium PPO (Access HMO $10-0) (Access HMO $25-500 Admit) (90-E $10) (80-G $10) Total Premium $780.00 $1,559.00 $2,149.00 Employee Cost $144.29 $287.57 $394.88 Total Premium $654.00 $1,305.00 $1,799.00 Employee Cost $18.29 $33.57 $44.88 Total Premium $853.00 $1,514.00 $2,320.00 Employee Cost $217.29 $242.57 $565.88 Total Premium $774.00 $1,373.00 $2,100.00 Employee Cost $138.29 $101.57 $345.88 Low PPO (HDHP-B) Total Premium $577.00 $1,030.00 $1,611.00 Employee Cost $0.00 $0.00 $0.00 Option 3 - with Renewal Rates Option 3 - 2010/2011 Stipend Capped at $10 Single /$30 - 2 Party /$50 - Family Single 2-party Family High HMO Low HMO High PPO Medium PPO (Access HMO $10-0) (Access HMO $25-500 Admit) (90-E $10) (80-G $10) Total Premium $780.00 $1,559.00 $2,149.00 Employee Cost $151.00 $291.00 $391.00 Total Premium $654.00 $1,305.00 $1,799.00 Employee Cost $25.00 $37.00 $41.00 Total Premium $853.00 $1,514.00 $2,320.00 Employee Cost $224.00 $246.00 $562.00 Total Premium $774.00 $1,373.00 $2,100.00 Employee Cost $145.00 $105.00 $342.00 Low PPO (HDHP-B) Total Premium $577.00 $1,030.00 $1,611.00 Employee Cost $0.00 $0.00 $0.00 14 Cabrillo College - 5/26/2011 Copyright © 2011 Alliant Insurance Services, Inc. Confidential; not for distribution Section 6: Contributions with options Employee Contribution Change CURRENT 10/01/2010 Rates Low HMO High PPO (Access HMO $10-0) (Access HMO $25-500 Admit) (90-E $10) (80-G $10) Low PPO (HDHP-B) $10 No charge $100 copay $1,000/$2,000 $25 $500 admit $100 copay $2,000/$4,000 $10 90% $100 copay $300/$600 $10 80% $100 copay $500/$1,000 90% 90% $100 copay $2,500 ind/$5,000 fam $5/$10/$25 $10/$20/$50 Total Premium Employee Cost $738.00 $119.00 $1,476.00 $238.00 $2,036.00 $328.00 $10/$20/$35 $20/$40/$70 Total Premium Employee Cost $619.00 $0.00 $1,238.00 $0.00 $1,708.00 $0.00 $5/$20 $10/$50 Total Premium Employee Cost $813.00 $194.00 $1,445.00 $207.00 $2,212.00 $504.00 $5/$20 $10/$50 Total Premium Employee Cost $738.00 $119.00 $1,311.00 $73.00 $2,003.00 $295.00 $7/$25 $14/$60 Total Premium Employee Cost $540.00 $0.00 $962.00 $0.00 $1,504.00 $0.00 High HMO Office Visit Inpatient Hospital Emergency Room Annual Maximum Prescription Retail Mail Order Single 2-party Family Stipend $619.00 $1,238.00 $1,708.00 Medium PPO Option 4 - with Renewal Rates Option 4 - 2010/2011 Employee Contibution Capped at CPI (March 2011 CPI at 2.7%) 2011/2012 Stipend Single 2-party Family $635.71 $1,271.43 $1,754.12 High HMO Low HMO High PPO Medium PPO (Access HMO $10-0) (Access HMO $25-500 Admit) (90-E $10) (80-G $10) Total Premium $780.00 $1,559.00 $2,149.00 Employee Cost $122.21 $244.43 $336.86 New Stipend $657.79 $1,314.57 $1,812.14 Single 2-party Family Total Premium $654.00 $1,305.00 $1,799.00 Employee Cost $0.00 $0.00 $0.00 New Stipend $654.00 $1,305.00 $1,799.00 Total Premium $853.00 $1,514.00 $2,320.00 Employee Cost $199.24 $212.59 $517.61 New Stipend $653.76 $1,301.41 $1,802.39 Total Premium $774.00 $1,373.00 $2,100.00 Employee Cost $122.21 $74.97 $302.97 New Stipend $651.79 $1,298.03 $1,797.04 Low PPO (HDHP-B) Total Premium $577.00 $1,030.00 $1,611.00 Employee Cost $0.00 $0.00 $0.00 New Stipend $577.00 $1,030.00 $1,611.00 Option 5 - with Renewal Rates Option 5 - 2010/2011 Employee Contribution Capped at $10 Single /$30 - 2 Party /$50 - Family 2011/2012 Stipend Single 2-party Family Single 2-party Family $629.00 $1,268.00 $1,758.00 High HMO Low HMO High PPO Medium PPO (Access HMO $10-0) (Access HMO $25-500 Admit) (90-E $10) (80-G $10) Total Premium $780.00 $1,559.00 $2,149.00 New Stipend $651.00 $1,291.00 $1,771.00 Employee Cost $129.00 $268.00 $378.00 Total Premium $654.00 $1,305.00 $1,799.00 New Stipend $644.00 $1,275.00 $1,749.00 Employee Cost $10.00 $30.00 $50.00 Total Premium $853.00 $1,514.00 $2,320.00 New Stipend $649.00 $1,277.00 $1,766.00 Employee Cost $204.00 $237.00 $554.00 Total Premium $774.00 $1,373.00 $2,100.00 Employee Cost $129.00 $103.00 $345.00 New Stipend $645.00 $1,270.00 $1,755.00 Low PPO (HDHP-B) Total Premium $577.00 $1,030.00 $1,611.00 Employee Cost $10.00 $30.00 $50.00 New Stipend $567.00 $1,000.00 $1,561.00 15 Cabrillo College - 5/26/2011 Copyright © 2011 Alliant Insurance Services, Inc. Confidential; not for distribution Section 7: Next Steps ACSIG Dental – Renewal Expected Mid-June Open Enrollment 16 Cabrillo College - 5/26/2011 Copyright © 2011 Alliant Insurance Services, Inc. Confidential; not for distribution Public Entity Benefits Group 100 Pine Street, 11th Floor San Francisco, CA 94111 Cabrillo College - 5/26/2011 Copyright © 2011 Alliant Insurance Services, Inc. Confidential; not for distribution