We are public school employees. Just like you.

advertisement

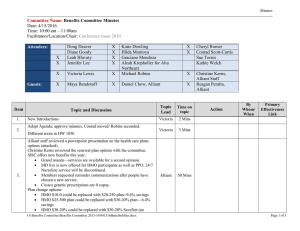

Cabrillo College 2015 - 2016 Health Benefits Renewal We are public school employees. Just like you. Self-insured Schools of California (SISC) was Schools Helping Schools established in 1979. We operate as a public school Joining together with other schools provides Joint powers Authority (JPA) administered by the Kern SISC members with the most stable long- county Superintendent of Schools office. Our staff term insurance solutions available. For over members are certificated and classified public school 35 years, our commitment to controlling employees covered under the same benefit programs costs has been reflected in our mission of as our membership. This gives us a unique and personal perspective into how best to serve our members. providing affordable rates and continued access to quality health care. Unlike some pools, SISC is subject to the Brown Act. We are a transparent operation. All of our board meetings are open to the public and our financial statements are a matter of public record. Representatives from district unions attend our board meetings on a regular basis. SISC is run in the best interests of our membership. We do not receive sales commissions. Our focus is on the value we provide to our members—not politics or a profit margin. “Our SISC account manager is very personable and a great listener. She has always been there for me.” — Member, California School Employees Association SISC IS THE LARGEST PUBLIC ENTITY RISK SHARING POOL IN THE UNITED STATES. WE SERVICE OVER 400 SCHOOL DISTRICTS AND 300,000 MEMBERS. WE RECOGNIZE AND SUPPORT THE NEEDS OF OUR MEMBER DISTRICTS We know our member districts need time to make decisions prior to school getting out for the summer. We support our districts by providing: • Health renewals in the early spring • Resources for informed decision making • Experienced Account Management teams WE OFFER VARIETY WHICH PROVIDES FLEXIBILITY We have a wide range of health benefit plans and options that allow for coverage to every corner of the state. This gives our members the flexibility to assemble health benefit packages that meet employee needs while fitting within budget parameters. Our offerings include: Medical • Anthem Blue Cross (PPO & HMO) Dental • Delta Dental • Blue Shield (PPO & HMO) Vision • Vision Service Plan (VSP) • Kaiser Permanente HMO Prescription Drug • Navitus Health Solutions • Medical Eye Services (MES) Life • Mutual of Omaha WE INCLUDE VALUE-ADDED FEATURES AT NO ADDITIONAL COST Benefits and Services • COBRA administration Wellness: Health Smarts • Onsite flu shots • Direct bill program for self-paid retirees • Onsite biometric testing • Employee Assistance Program (EAP) included on all PPO, HMO and Kaiser Plans • Member participation awards • Condition management • MDLive 24/7 physician line (Anthem and Blue Shield PPO and Anthem HMO) • $0 generic drugs at Costco (PPO and HMO) Questions? Please visit http://SISC.kern.org or contact your SISC Account Management Team at (661) 636-4410. 1 2014-2015 Plan Year Review SISC Health Smarts Program • Flu Shot Clinics For the fourth consecutive year SISC provided districts with the opportunity to hold onsite flu shot clinics. These voluntary events are offered at no cost to the employee or district and provide employees with convenient access to the flu vaccine. Over 21,000 flu shots were administered at 339 locations. • Health Screening Events The popular onsite health screening events are being offered again this year. These voluntary events are offered at no charge to the employee or district. This is a “know your numbers” campaign providing employees with quick and easy access to important health statistics. Participants walk away with test results for cholesterol, glucose, blood pressure, body mass index, and other information. Members can earn up to $30 just for scheduling an appointment and participating. It’s not too late for those districts that have not yet participated. Please contact your SISC Account Management Team for information about holding an event at your district. There is a minimum participation requirement. SISC Dependent Eligibility Audit The SISC Dependent Eligibility Audit commenced in December 2013 and reached completion in October 2014. SISC requested documentation from dependents to verify their eligibility on the plan. The audit was a challenging process. The number of dependents removed due to ineligibility, along with the corresponding projection of significant savings proved that the audit was necessary. The final results and the estimated savings are as follows. Ineligible Dependents Disenrolled: Estimated Annual Savings: 3,349 $5,881,460 2015-2016 Medical Renewals The cost of delivering medical care is unique to various areas throughout the state. SISC provides regional rating to adjust for those differences. When your district’s renewal rates are available, appropriate district staff will receive a notification of the availability of your district’s 2015-2016 Rates-At-A-Glance on the SISC Secure web portal. Medical plan rate grid options are provided with renewal, and may be requested through your Account Management Team. 2015-2016 Plan Year Changes/Updates SISC PPO Plans Two New PPO Plans Will be Introduced • 100-G $30 ($500/$1,000 deductibles, $1,000/$3,000 out of pocket maximum) • 90-G $20 ($500/$1,000 deductibles, $1,000/$3,000 out of pocket maximum) Health Savings Account (HSA) Plan Changes • HSA-Plan A – Deductibles will be increasing to $1,500/$3,000 and out of pocket maximums will decrease to $4,000/$8,000. • HSA-Plan B – Deductibles will be increased to $3,000/$5,000 and the out of pocket maximum will remain $5,000/$10,000. It is the district’s responsibility to notify affected employees and retirees of the change. 2 Discontinued Plans Due to having very low enrollment, six non-marketed PPO plans are being discontinued effective October 1st, 2015. Each of the plans had less than 1% of the SISC enrollment. In each case, the discontinued plan will automatically be replaced with a plan nearest in benefits to the discontinued plan. Districts affected by this change will receive notification soon. The designated replacement plans will be reflected on the 2015-2016 Rates-At-A-Glance. It is the district’s responsibility to notify affected employees and retirees of the change. If your district would like to choose a different plan as a replacement, you need to notify your SISC Account Management Team by August 1, 2015. Out of Pocket (OOP) Maximum Changes As SISC continues to comply with the ACA, there will be some changes to medical out-of-pocket maximums on some PPO plans. The OOP maximums are identified in the 2015-2016 SISC Medical Plan pages. The medical plan rate grids also include the OOP maximum information. It will be the district’s responsibility to verify changes to your district’s plan offerings and notify employees and retirees accordingly. 100% PPO Plans: All plans will have an OOP of $1,000 individual / $3,000 family 90% PPO Plans: All plans have an OOP $1,000 individual / $3,000 family 80% PPO Plans: OOP will vary by plan Please reference the 2015-2016 SISC Health Benefit Manual Medical Plan pages for further detail. Hip, Knee and Spine Inpatient Surgical Benefit Change Effective October 1, 2015, the Blue Distinction Specialty Care program will be implemented for inpatient Hip and Knee replacement procedures and inpatient Spine procedures. There will be no out-of-network benefit for these inpatient procedures. Members considering these types of procedures must contact member services at the phone number on their ID card to obtain information regarding in-network facilities for the procedure requested. Blue Distinction Specialty Care Program designated facilities must meet quality criteria. For example, the number of times the procedure has been performed at the facility and the facility’s track-record for procedure results. A travel benefit will be available for members who do not have access to a covered facility in their area. Member services can provide assistance to members with questions. X-Ray & Lab, Durable Medical Equipment, and Physical Medicine – Out of Network Benefit Change X-Ray, Lab, Durable Medical Equipment and Physical Medicine provided by non-participating providers will no longer be covered. Physical Medicine includes chiropractic, physical and occupational therapy. This change does not apply to emergencies. Removing fraud, waste and abuse (FW&A) from the system is a challenge all health plans face. Over the last few years, the FW&A keeps popping up in the same categories - X-Ray & Lab, Physical Medicine and Durable Medical Equipment. As a result, a decision was made to eliminate out of network coverage for these services. Our PPO carriers have performed an extensive review of the network coverage in these categories and determined that there are ample in-network providers. In rare instances where a member may not have access to a contracting provider in one of these categories, the PPO carrier can assist the member with an authorized referral to a non-participating provider prior to services being rendered. Medical Plan Claims Process Change for Members Covered by Other Plans Effective July 1, 2015, there will be a procedural change on claims processing for members who have/may have coverage through another medical plan. Members who have medical coverage under more than one plan need to provide their medical plan member services with updated information on secondary coverage. When letters are sent requesting information on secondary 3 coverage, a response is required. Failure to respond can cause a delay or denial in claims processing and payment. This procedure change ensures that claims are being processed in the proper order of benefit. Unnecessary plan costs can be avoided when another plan should be primary. HMO Plans Chiropractic/Acupuncture Rider Included SISC is pleased to include a combined Chiropractic and Acupuncture Rider on all HMO plans (except Kaiser H.S.A. Plans). This includes Anthem Blue Cross, Blue Shield of California and Kaiser Permanente. The benefit will allow for 30 combined acupuncture or chiropractic visits per calendar year with a $10 co-pay. Members may access chiropractic care or acupuncture benefits without a referral from their primary care physician. Members must use the designated American Specialty Health (ASH) network and services must continue to be medically necessary. Kaiser Permanente Health Savings Account (HSA) Plans Added SISC will be introducing two new Kaiser HSA plans to our portfolio of plan offerings. Please reference the 2015-2016 SISC Medical Plan pages for further detail. SISC Pharmacy Plans Out of Pocket (OOP) Maximums The out-of-pocket maximums on the SISC pharmacy plans have been updated for ACA compliance. The OOP maximum will vary on the five plans offered. See the 2015-2016 Prescription Drug page for details. Diabetic Test Strips As of October 1, 2015, SISC will have preferred test strips from Abbott (Freestyle) and Lifescan (One Touch) available at the generic co-pay. All other test strips will be covered at the brand co- pay. Members affected by this change will be notified by Navitus 90-days and again 30-days prior to October 1. If a physician prescribes a preferred test strip, a new meter will be provided at no cost. Mutual of Omaha Life Rates will NOT be changing on Basic or Voluntary Life. For those districts offering the Voluntary Life, please note that the Guarantee Issue amounts will be changing to $150K per employee and $25K per spouse. This change will only affect new enrollees. See the Life pages of the 2015-2016 Health Benefits Manual for additional details. Zurich AD&D Life SISC will discontinue the Zurich AD&D life policy that was included on the Medical plan enrollments. 4 Retiree 65+ Rates and Plans Retiree PPO and HMO plans will have the same benefit changes as the active plans noted above. The average rate of increase will be 3.3%. Kaiser Permanente Senior Advantage Plan 2015-2016 single rates will be $330 for Northern California; $193 for Southern California. SISC is pleased to include a combined Chiropractic and Acupuncture Rider on our Senior Advantage Plan. The benefit will allow for 30 combined acupuncture or chiropractic visits per calendar year with a $10 co-pay. Members may access chiropractic care or acupuncture benefits without a referral from their primary care physician. Members must use the designated American Specialty Health (ASH) network and services must continue to be medically necessary. Blue Shield 65 Plus HMO Advantage Plan will have no change in benefits. 2015-2016 single rates will be $428 for Northern California; $223 for Southern California. Companion Care will have no change in benefits. The single rate will be $385 for Northern and Southern California. 2015-2016 SISC Health Benefits Manual The annual SISC Health Benefits Manual is the administrative resource for guidelines and procedures. This Manual is updated each year. It is the district’s responsibility to review the SISC Health Benefits Manual each year and administer the benefits accordingly. The medical and prescription drug pages have been reformatted. The 2015-2016 Health Benefits Manual will be made available electronically to authorized district staff on March 31, 2015. Highlights of changes (not all inclusive): • Board Members - Per Centers for Medicare Services (CMS), board members who are retired from a school district or private employer and do not receive compensation in the form of salary subject to FICA taxes for their board service must be enrolled in a retiree group number and subject to retiree participation rules. • New Mid-Year Qualifying Event Table included – changes, additions and terminations require a qualifying event. Please review table. Program Features MDLive provides members with on-demand access to board-certified physicians by phone, online video or secure e-mail for a $5.00 co-pay. This feature is currently available only to SISC PPO members. • Effective October 1, 2015 MD Live will replace the 24/7 NurseLine on Anthem HMO Plans. Employee Assistance Program (EAP) is included on all medical plans offered. EAP resources include workshops on wellness and other topics, management resources, and in-person counseling for employee and household members at no charge to member or district. Costco $0 co-pay for generics – 30 and 90-day supplies of most generics are available for a $0 co-pay at Costco Pharmacies and through Costco Mail Order. This feature is not available on the following plans: HSA, Kaiser, Minimum Value, Two-Tier Anchor Bronze, and Individual Retiree Plans. 5 Important Reminders SISC Retroactivity Guideline – It is the district’s responsibility to reconcile the monthly billing statements and report changes to SISC within the retroactivity guideline. Deadline Dates • August 1 – Request for benefit modifications are due for an October 1 effective date. Changes must be submitted on a Notification of Plan Change Form available on the SISC website. All requests for changes received after August 1st will be delayed to a later date. SISC allows plan modifications for an employee group once per contract year. Effective dates other than October 1 will require a 75-day advance notice for districts to be in compliance with notification requirements of the Affordable Care Act (ACA). • September 1 – Open Enrollment Activity is due to SISC. It is recommended that the school districts hold their open enrollment period prior to the end of the school year or in August to meet the activity submission deadline. Otherwise, enrollment changes may not be updated in the carrier systems when benefits become effective. The SISC Health Benefits Manual outlines the number of medical plans a school district/employee group may offer depending on the size of the group. Number of Plan Options Per Employee Group • School districts/employee groups with less than 50 insured employees may offer any combination of PPO plans and HMO plans with a maximum of three plans. • School districts/employee groups with 51 to 99 insured employees may offer any combination of PPO plans and HMO plans with a maximum of four plans. • School districts/employee groups with 100 or more insured employees may offer any combination of PPO plans and HMO plans with a maximum of six plans. Plan Documents Plan documents such as Summary of Benefits and Coverage (SBC), Benefit Summaries from the carriers and Plan Documents/EOCs will be posted electronically as the documents become available. An email will be sent from SISCHealth that will provide the link where the documents will be available. Affordable Care Act (ACA) All SISC plans are in compliance with the requirements of the Affordable Care Act. ACA Reinsurance Fees and PCORI Fees are paid by SISC. Districts with 50 or more Full-Time Employees might consider offering the SISC 2-Tiered Anchor Bronze plan to provide access to minimum value coverage and avoid Penalty A. 6