Gift & Endowment Income Report – Job Aid MYR-203e

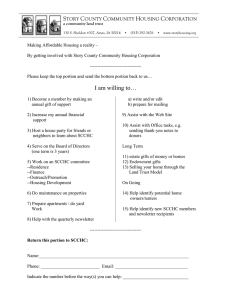

advertisement

Gift & Endowment Income Report – Job Aid What is the Gift and Endowment Income Report? The report allows you to view Restricted Gifts, Unrestricted Gifts, and Endowment income across Business Units. The report displays transfer activity between the Foundation and the Regents by leveraging Pair logic. Pair Logic identifies when the same Project is used in recording activity across all Business Units (BU). MYR-203e The Account and Fund fields are not available for selection in the Chartstring Filter page to ensure all applicable rows of data are retrieved in the report. What can I learn from the Gift and Endowment Income Report? The report allows you to view the beginning and ending net position by Project and clearly identifies transactions related to transfers between the Foundation and the Regents Business Units.. (Refer to the Net Position Report job aid MYR203c for more detailed information on the calculation of net position). Select from MyFavorites and Save as MyFavorite are available. Transfer amounts are displayed under the Transfer from Foundation Revenue or Expense column headings. Report Specific Filters Transfer from the Foundation BU is recorded as Expense Transfer received by Regents BUs is recorded as Revenue The report can only be run for Restricted and Unrestricted Gifts and Endowment Income which are identified by the following Funds: 7000 - Private Restricted Gifts 7100 - Private unrestricted Gifts 7700 - Endowment Income, Foundation 7710 - Endowment income, Regents The Fund Selection defaults to specific Funds for Gifts and Endowments to include in the report. Fund codes can be deselected individually as needed. The Show All selection is defaulted to display both positive and deficit net position in the report. The report can also be run to display Positive Project net position or deficit Project net position only. Report Filters The Report Date Range for this report can be changed – either by Month and Year, or by Quarter. If you select Quarter, the Report Date Range will be automatically updated to reflect the quarter, or quarters, selected. All BUs (Business Units) are selected by default. You may unselect a BU that you do not wish to include in the report; however this will limit visibility of projects shared by a BU not selected. MYR-203e 06/25/2014 Tips & Tricks Provides drill-through capability on Transfer from Foundation, Revenues, Expenses and Other Changes to display transaction detail for further analysis. Transfers not related to Gifts and Endowments are totaled under the Other Changes column of the report i.e. transfers within the Campus. Uses Pair Logic (Same Project on both sides of the transaction) to view transfer activity between the Foundation SFFDN and Regent BUs. Page 1 of 3 Gift & Endowment Income Report – Job Aid Transfers between the Foundation SFFDN and Regents BUs are shown as an Expense to the Foundation and Revenue to the Regents. The amounts shown in the Foundation Transfer columns can be clicked on to drill-through to view the transaction detail behind the amount. MYR-203e Run the report by Parent/Award ID and select the Award sort option to see any roll-up relationships between the parent project and sub-projects. Run the report by Project Manager/PI and select the Project Manager sort option to see any roll-up relationships between the Project Manager and Projects Sort options are available to further modify the report view. Use of the Sort 1 option to group by Project Award or Project Manager. The data is then sorted and subtotaled by Project. MYR-203e 06/25/2014 Page 2 of 3 Gift & Endowment Income Report – Job Aid MYR-203e By selecting the “Show Liens” checkbox, and then clicking the Update button, additional columns are added to the report: the Liens column and the Projected Total with Liens column. The Liens column displays any outstanding lien amounts for the chartstring. The Projected Total with Liens column subtracts the lien amount from the Net Position End of Period amount to calculate a new projected total. You can click on the Lien amount to drill through to the transaction detail. MYR-203e 06/25/2014 Page 3 of 3