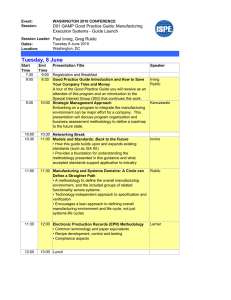

DemeeOeejCe meeceev³e yewþkeÀ kesÀ efueS veesefìme cebieueJeej, cee®e&, , Je[esoje

advertisement

DemeeOeejCe meeceev³e yewþkeÀ kesÀ efueS veesefìme

Notice for Extraordinary General Meeting

cebieueJeej, 27 cee®e&, 2012, Je[esoje

Tuesday, 27th March, 2012, Vadodara

efveJesMekeâ mesJee efJeYeeie

yeÌ[ewoe keâeHeexjsš meWšj, ØeLece leue, meer-26, peer-yuee@keâ, yeebõe kegâuee& keâe@cHeueskeäme, yeebõe (HetJe&), cegbyeF& - 400 051.

INVESTORS’ SERVICES DEPTT

Baroda Corporate Centre, 1st Floor, C-26, G-Block, Bandra Kurla Complex,

Bandra (East), Mumbai – 400 051. • Email: investorservices@bankofbaroda.com

ãäÌãÓã¾ã

CONTENTS

¶ããñãä›Ôã

NOTICE.........................................................................................................................................

¶ããñ›

NOTES..........................................................................................................................................

¹ãÆãù‡ã‹Ôããè ¹ãŠã½ãÃ

PROXY FORM..............................................................................................................................

„¹ããäÔ©ããä¦ã ¹ãÞããê †Ìãâ ¹ãÆÌãñÎã ¹ã¨ã

ATTENDANCE SLIP CUM ENTRY PASS....................................................................................

¹ãðÓŸ Ôãâ.

Page

No.

1

5

9/10

11/12

¹ãÆ£ãã¶ã ‡ãŠã¾ããÃÊã¾ã – ½ããâ¡Ìããè, ºãü¡ãõªã 390 006

Head Office: Mandvi, Baroda – 390 006

‡ãŠã¹ããóÀñ› ‡ãŠã¾ããÃÊã¾ã : ºãü¡ãõªã ‡ãŠã¹ããóÀñ› Ôãò›À, Ôããè-26,

•ããè ºÊããù‡ãŠ, ºããâ³ã-‡ãìŠÊããà ‡ãŠãù½¹Êãñ‡ã‹Ôã, ºããâ³ã (¹ãîÌãÃ),

½ãìâºãƒÃ – 400 051

Corporate Office: Baroda Corporate Centre, C-26,

G-Block, Bandra Kurla Complex, Bandra (East),

Mumbai – 400 051

veesefìme

NOTICE

SleoÜeje ³en veesefìme efo³ee peelee nw efkeÀ efvecveefueefKele keÀe³eeX

keÀe meb®eeueve keÀjves kesÀ efueS yeQkeÀ Dee@]HeÀ yeæ[ewoe kesÀ Mes³ejOeejkeÀeW

keÀer DemeeOeejCe meeceev³e yewþkeÀ cebieueJeej, 27 cee®e&, 2012

keÀes Òeeleë 10.00 yepes mej me³eepeerjeJe veiej ie=n, Je[esoje

ceneveiej, mesJee meove, yeQkeÀ Dee@HeÀ yeæ[ewoe Meleeyoer Je<e&

(2007-2008), ìer.heer.-1, SHeÀ.heer. 549/1, peerF&yeer

keÀe@ueesveer kesÀ heeme, Deesu[ heeoje jes[, Je[esoje - 390020

ceW mebheVe nesieer:

NOTICE IS HEREBY GIVEN that an Extraordinary

efJeMes<e mebkeÀuhe kesÀ ªhe ceW efvecveefueefKele mebkeÀuhe hej efJe®eej keÀjvee

Deewj ³eefo Gef®ele mecePee peeS lees mebMeesOeve meefnle DeLeJee mebMeesOeve

kesÀ efyevee heeefjle keÀjvee:

To consider and if thought fit, pass with or without

’³en mebkeÀuhe efkeÀ³ee peelee nw efkeÀ jeä^er³eke=Àle yeQkeÀ (he´yebOeve SJeb

efJeefJeOe he´eJeOeeve) ³eespevee, 1970 (FmekesÀ yeeo efpemes '³eespevee'

keÀne ie³ee nw) Deewj yeQkeÀ Dee@]HeÀ yeæ[ewoe meeceev³e (Mes³ej SJeb yewþkeÀ)

efJeefve³eceve, 1998 mece³e mece³e hej ³eLee mebMeesefOele, kesÀ meeLe

heefþle yeQkeÀkeÀejer kebÀheveer (Ghe¬eÀceeW keÀe Depe&ve Deewj DeblejCe)

DeefOeefve³ece, 1970 (FmekesÀ yeeo efpemes `DeefOeefve³ece' keÀne ie³ee

nw) kesÀ he´eJeOeeveeW kesÀ DevegmejCe ceW Deewj Yeejleer³e efj]peJe& yeQkeÀ, Yeejle

mejkeÀej, Yeejleer³e he´efleYetefle Deewj efJeefvece³e yees[& Deewj/³ee Fme yeejs

“RESOLVED THAT pursuant to the provisions of

General Meeting of the shareholders of Bank of

Baroda will be held on Tuesday, 27th March 2012,

at 10.00 a.m. at Sir Sayaji Rao Nagargriha,

Vadodara Mahanagar Seva Sadan, Bank of

Baroda Centenary Year (2007-2008), T. P. – 1,

F. P. 549/1, Near GEB Colony, Old Padra Road,

Vadodara – 390 020 to transact the following

business:

modification, the following resolution as a Special

Resolution:

the Banking Companies (Acquisition and Transfer

of Undertakings) Act, 1970 (herein after referred

to as the ‘Act’) read with the Nationalised Banks

(Management

and

Miscellaneous

Provisions)

Scheme 1970 (herein after referred to as the

‘Scheme’) and Bank of Baroda General (Shares

and Meetings) Regulations, 1998 as amended

from time to time and subject to the approvals,

1

consents, sanctions, if any, of Reserve Bank of

ceW Dehesef#ele Dev³e efkeÀmeer he´eefOekeÀejer kesÀ Devegceesove, menceefle, cebpetjer,

India (RBI), Government of India (GOI), Securities

³eefo keÀesF& nes, kesÀ DeO³eOeerve Deewj Ssmes Devegceesove keÀer cebpetjer ceW

and Exchange Board of India (SEBI), and / or any

GvekesÀ Üeje efveOee&efjle Ssmes efve³eceeW, MeleeX Deewj GmeceW mebMeesOeveeW kesÀ

other authority as may be required in this regard and

subject to such terms, conditions and modifications

DeO³eOeerve Deewj efpeme hej yeQkeÀ kesÀ efveosMekeÀ ceb[ue Üeje menceefle

thereto as may be prescribed by them in granting

nesieer Deewj Yeejleer³e he´efleYetefle Deewj efJeefvece³e yees[& (hetbpeer efveie&ce Deewj

such approvals and which may be agreed to by

he´keÀìerkeÀjCe DeeJeM³ekeÀleeSb) efJeefve³eceve, 2009 DeÐeleve leejerKe

the Board of Directors of the Bank and subject to

lekeÀ ³eLee mebMeesefOele, (mesyeer DeeF&meer[erDeej efJeefve³eceve) Deewj

SEBI (Issue of Capital & Disclosure Requirements)

Yeejleer³e efj]peJe& yeQkeÀ leLee Dev³e meYeer mebye× he´eefOekeÀeefj³eeW

Regulations, 2009 as amended up to date (SEBI

ICDR Regulations) and regulations prescribed by

Üeje mece³e-mece³e hej efveOee&efjle efJeefve³eceeW kesÀ DeO³eOeerve

RBI and all other relevant authorities from time

Deewj mìe@keÀ SkeÌme®eWpeeW, peneb yeQkeÀ kesÀ Mes³ej met®eerye× nQ, kesÀ meeLe

to time and subject to the Listing Agreements

efkeÀS ieS met®eerkeÀjCe keÀjej kesÀ DeO³eOeerve yeQkeÀ kesÀ Mes³ejOeejkeÀeW

entered into with the Stock Exchanges where the

equity shares of the Bank are listed, consent of the

keÀer menceefle nw Deewj SleoÜeje yeQkeÀ kesÀ efveosMekeÀ ceb[ue (Fmes ³eneb

shareholders of the Bank be and is hereby accorded

FmekesÀ he½eeled yees[& keÀne ie³ee nw efpemeceW SkeÀ meefceefle keÀe meceeJesMe

to the Board of Directors of the Bank (hereinafter

nesiee efpemes yees[& Üeje Fme mebkeÀuhe kesÀ lenle he´oÊe MeefÊeÀ³eeW meefnle

called “the Board”

which shall be deemed to

include a Committee which the Board may have

Deheveer MeefÊeÀ³eeW keÀes he´³egÊeÀ keÀjves kesÀ efueS ieefþle efkeÀ³ee peeSiee Deewj

constituted/may constitute, to exercise its powers

/³ee ieefþle keÀj mekesÀiee) keÀes mesyeer DeeF&meer[erDeej efJeefve³eceeW kesÀ

including the powers conferred by this Resolution)

Devegmeej Yeejleer³e peerJeve yeercee efveiece leLee / ³ee Yeejleer³e peerJeve

to create, offer, issue and allot up to 1,95,77,304

yeercee efveiece (SueDee³emeer) keÀer efJeefYeVe ³eespeveeDeeW / c³et®egDeue HebÀ[eW

(One crore ninety five lac seventy seven thousand

three hundred and four) equity shares of Rs. 10/-

keÀes DeefOeceeveer DeeOeej hej efveOee&efjle he´erefce³ece hej ©.10/-he´efle

each (Rupees Ten only) for cash at a premium

(ome ©heS kesÀJeue) vekeÀo cetu³e kesÀ 1,95,77,304 (SkeÀ keÀjesæ[

to be determined in accordance with SEBI ICDR

efhe®eeveJes ueeKe melenÊej npeej leerve meew ®eej) lekeÀ FeqkeÌJeìer Mes³ejeW

Regulations on preferential basis to Life Insurance

Corporation of India and/or various Schemes of

keÀe me=peve keÀjves, Dee@]HeÀj keÀjves, peejer keÀjves leLee Deeyebefìle keÀjves

Life Insurance Corporation of India (LIC)/ Mutual

keÀer cebpetjer oer peeleer nw.“

Funds.”

’³en Yeer mebkeÀuhe efkeÀ³ee peelee nw efkeÀ efveie&ce cetu³e kesÀ efveOee&jCe nsleg

mebye× leejerKe 24 HeÀjJejer, 2012 nw.’

“RESOLVED FURTHER THAT the Relevant

Date for determination of the Issue Price is

24th February 2012.”

2

“³en Yeer mebkeÀuhe efkeÀ³ee peelee nw efkeÀ efveosMekeÀ ceb[ue kesÀ heeme

Yeejle mejkeÀej/Yeejleer³e efj]peJe& yeQkeÀ/Yeejleer³e he´efleYetefle SJeb

efJeefvece³e yees[& /mìe@keÀ SkeÌme®eWpeeW, peneb yeQkeÀ kesÀ Mes³ej met®eerye× nQ

DeLeJee Ssmes Dev³e Gef®ele he´eefOekeÀeefj³eeW mes Mes³ejeW kesÀ efveie&ce, Deeyebìve

SJeb GvekeÀes met®eerye× keÀjves nsleg GvekesÀ Devegceesove, menceefle, Devegceefle

SJeb cebpetjer he´oeve keÀjves /cebpetjer kesÀ mece³e GÊeÀ he´mleeJe ceW ³eLee

Dehesef#ele DeLeJee ueeiet efkeÀS ieS efkeÀmeer Yeer he´keÀej kesÀ DeeMeesOeve

keÀes efveosMekeÀ ceb[ue keÀer menceefle kesÀ Devegªhe mJeerkeÀej keÀjves keÀe

he´eefOekeÀej SJeb MeefÊeÀ nesieer.’

"RESOLVED FURTHER THAT the Board shall

“³en Yeer mebkeÀuhe efkeÀ³ee peelee nw efkeÀ peejer efkeÀS peeves Jeeues GÊeÀ

"RESOLVED FURTHER THAT the said equity

FeqkeÌJeìer Mes³ej yeQkeÀ kesÀ ceewpetoe FeqkeÌJeìer Mes³ejeW kesÀ mecelegu³e ceeves

shares to be issued shall rank pari passu with the

have authority and power to accept any modification

in the proposal as may be required or imposed by

the Government of India / Reserve Bank of India

/ Securities and Exchange Board of India/ Stock

Exchanges where the shares of the Bank are listed

or such other appropriate authorities at the time

of according / granting their approvals, consents,

permissions and sanctions to issue, allotment and

listing thereof and as agreed to by the Board."

existing equity shares of the Bank and shall be

peeSbieW Deewj ³eefo keÀesF& ueeYeebMe Ieesef<ele efkeÀ³ee peelee nw lees Ssmeer

entitled to dividend declared, if any, in accordance

Iees<eCee kesÀ mece³e he´Je=Êe meebefJeefOekeÀ efoMee-efveoxMeeW kesÀ Devegmeej GmekesÀ

with the statutory guidelines that are in force at the

nkeÀoej neWies.’

time of such declaration."

’³en Yeer mebkeÀuhe efkeÀ³ee peelee nw efkeÀ Fme mebkeÀuhe keÀes ueeiet keÀjves

kesÀ he´³eespeve nsleg yees[& hetCe&le: Deheves efJeJeskeÀevegmeej DeeJeM³ekeÀ, Gef®ele

leLee Jeebíveer³e he´leerle nesves Jeeues Ssmes meYeer keÀe³eeX, efJeuesKeeW, ceeceueeW

leLee ke=Àl³eeW keÀes keÀjves kesÀ efueS he´eefOeke=Àle nw Deewj SleoÜeje he´eefOeke=Àle

efkeÀ³ee peelee nw Deewj FeqkeÌJeìer Mes³ejeW kesÀ efveie&ce kesÀ mebyebOe ceW Gþves

Jeeues efkeÀmeer Yeer he´Mve, mecem³ee ³ee mebosn keÀe efveheìeve keÀjves Deewj

Ssmes meYeer keÀe³eeX, efJeuesKeeW, ceeceueeW Deewj ke=Àl³eeW keÀes keÀjves, Deheves

hetCe&le: efJeJeskeÀevegmeej Mes³ejOeejkeÀeW keÀer Deeies keÀesF& Deewj menceefle

³ee Devegceesove efueS efyevee DeeJeM³ekeÀ, Jeebíveer³e ³ee peªjer meYeer

omleeJespeeW Deewj efueKeleeW keÀes Debeflece ªhe osves Deewj GvnW efve<heeefole

keÀjves kesÀ efueS he´eefOeke=Àle nw DeLeJee Mes³ejOeejkeÀeW keÀer Deesj mes keÀjves

Deewj GvekeÀer Deesj mes DeefYehe´sle keÀes keÀjves kesÀ efueS DeefOeke=Àle keÀjves nsleg

Fme mebkeÀuhe kesÀ he´eefOekeÀej Üeje DeefYeJ³eÊeÀ efkeÀS ieS Devegmeej GvekeÀe

Devegceesove ceevee peeSiee.’

"RESOLVED FURTHER THAT for the purpose of

giving effect to this Resolution, the Board be and is

hereby authorised to do all such acts, deeds, matters

and things as it may in its absolute discretion deem

necessary, proper and desirable and to settle any

question, difficulty or doubt that may arise in regard

to the issue of the equity shares and further to do

all such acts, deeds, matters and things, finalise

and execute all documents and writings as may

be necessary, desirable or expedient as it may in

its absolute discretion deem fit, proper or desirable

without being required to seek any further consent

or approval of the shareholders or authorise to

the end and intent that the shareholders shall

be deemed to have given their approval thereto

expressly by the authority of this resolution.”

3

“³en Yeer mebkeÀuhe efkeÀ³ee peelee nw efkeÀ efveosMekeÀ ceb[ue he´eefOeke=Àle nw

Deewj SleoÜeje Gmes DeO³e#e SJeb he´yebOe efveosMekeÀ DeLeJee keÀe³e&keÀejer

efveosMekeÀeW DeLeJee yeQkeÀ kesÀ efkeÀmeer Ssmes Dev³e DeefOekeÀejer keÀes, efpemes

Jen Gef®ele mecePes, GhejesÊeÀ mebkeÀuhe ueeiet keÀjves nsleg, FmeceW ³eneb

he´oÊe meYeer DeLeJee efkeÀmeer Yeer MeefÊeÀ keÀes he´l³ee³eesefpele keÀjves kesÀ efueS

he´eefOeke=Àle efkeÀ³ee peelee nw.’

"RESOLVED FURTHER THAT the Board be and

efveosMekeÀ ceb[ue kesÀ DeeosMeevegmeej

By order of the Board of Directors

(Sce.[er.ceu³ee)

DeO³e#e SJeb he´yebOe efveosMekeÀ

(M. D. Mallya)

is hereby authorised to delegate all or any of the

powers herein conferred on it, to the Chairman and

Managing Director or Executive Director/s or such

other officer of the Bank as it may deem fit to give

effect to the aforesaid Resolution."

Chairman & Managing Director

mLeeve : cegbyeF&

efoveebkeÀ : 28 HeÀjJejer, 2012

Place: Mumbai

Date : 28th February 2012

4

veesì

NOTES

1.J³eeK³eelcekeÀ efJeJejCe

keÀe³e&met®eer keÀer ceo mes mebyebefOele J³eeK³eevelcekeÀ efJeJejCe FmekesÀ

meeLe mebueive nw.

2.he´e@keÌmeer keÀer efve³egefÊeÀ

yewþkeÀ ceW Yeeie uesves Deewj cele osves kesÀ efueS hee$e

Mes³ejOeejkeÀ mJe³eb kesÀ mLeeve hej yewþkeÀ ceW Yeeie uesves

Deewj cele osves kesÀ efueS he´e@keÌmeer efve³egÊeÀ keÀjves kesÀ efueS

hee$e nesiee / nesieer Deewj Ssmes he´e@keÌmeer keÀe yeQkeÀ keÀe

Mes³ejOeejkeÀ nesvee peªjer veneR nQ. leLeeefhe, Ssmes efve³egÊeÀ

he´e@keÌmeer keÀes yewþkeÀ ceW yeesueves keÀe DeefOekeÀej veneR nesiee. he´e@

keÌmeer HeÀece& keÀes he´YeeJeer keÀjves kesÀ efueS ³en DeefveJee³e& nw efkeÀ

Jen yeQkeÀ kesÀ he´Oeeve keÀe³ee&ue³e kesÀ SSceSue efJeYeeie, yeQkeÀ Dee@]

HeÀ yeæ[ewoe, 8 Jeeb leue, metjpe hueepee - I, me³eepeeriebpe,

Jeæ[esoje - 390 005 keÀes yewþkeÀ keÀer leejerKe mes ®eej efove

henues DeLee&led ye=nmheefleJeej, efoveebkeÀ 22 cee®e& 2012 keÀes

mee³eb 5.00 yepes lekeÀ DeLeJee Fmemes hetJe& efceue peevee ®eeefnS. ke=Àhe³ee veesì keÀjW efkeÀ yeQkeÀ keÀe keÀesF& keÀce&®eejer DeLeJee DeefOekeÀejer

yeQkeÀ Dee@]HeÀ yeæ[ewoe (Mes³ej leLee ceereEìie) meeceev³e efJeefve³ece

1998, mece³e mece³e hej ³eLeemebMeesefOele kesÀ he´eJeOeeveeW kesÀ

Devegmeej he´e@keÌmeer kesÀ ªhe ceW efve³egÊeÀ veneR efkeÀ³ee pee mekeÀlee.

1. EXPLANATORY STATEMENT

3. he´eefOeke=Àle he´efleefveefOe keÀer efve³egefÊeÀ

keÀesF& Yeer J³eefÊeÀ efkeÀmeer kebÀheveer kesÀ ³eLeeefJeefOe he´eefOeke=Àle

he´efleefveefOe kesÀ ªhe ceW yewþkeÀ ceW Yeeie uesves kesÀ efueS DeLeJee Jeesì

osves kesÀ efueS leye lekeÀ hee$e veneR nesiee peye lekeÀ efkeÀ Gmes ³eLee

efJeefOe he´eefOeke=Àle he´efleefveefOe kesÀ ªhe ceW efve³egÊeÀ keÀjves mebyebOeer

mebkeÀuhe keÀer SkeÀ he´efle, efpemes Gmes yewþkeÀ kesÀ DeO³e#e, efpemeceW

³en heeefjle efkeÀ³ee ie³ee Lee, Üeje SkeÀ mel³e he´efleefueefhe kesÀ ªhe

ceW DeefOehe´ceeefCele efkeÀ³ee ie³ee nes, yewþkeÀ keÀer leejerKe mes 4

efove hetJe& DeLee&le ye=nmheefleJeej, efoveebkeÀ 22 cee®e&, 2012 keÀes

yeQkeÀ keÀe keÀe³e& meceehle nesves DeLee&led mee³eb 5.00 yepes lekeÀ ³ee

Fmemes henues SSceSue efJeYeeie, yeQkeÀ Dee@]HeÀ yeæ[ewoe, 8 Jeeb

leue, metjpe hueepee - I, me³eepeeriebpe, Jeæ[esoje - 390

005 ceW eqmLele yeQkeÀ kesÀ he´Oeeve keÀe³ee&ue³e kesÀ heeme pecee ve keÀj

efo³ee ie³ee nes. ke=Àhe³ee veesì keÀjW efkeÀ yeQkeÀ keÀe keÀesF& keÀce&®eejer

DeLeJee DeefOekeÀejer yeQkeÀ Dee@]HeÀ yeæ[ewoe (Mes³ej leLee ceereEìie)

meeceev³e efJeefve³ece 1998, mece³e mece³e hej ³eLeemebMeesefOele kesÀ

he´eJeOeeveeW kesÀ Devegmeej he´e@keÌmeer kesÀ ªhe ceW efve³egÊeÀ veneR efkeÀ³ee

pee mekeÀlee.

3. APPOINTMENT

OF

REPRESENTATIVE

The Explanatory Statement concerning the

agenda item is annexed hereto.

2. APPOINTMENT OF PROXY

A SHAREHOLDER ENTITLED TO ATTEND

AND VOTE AT THE MEETING, IS ALSO

ENTITLED TO APPOINT A PROXY TO

ATTEND AND VOTE INSTEAD OF HIMSELF

/ HERSELF, AND SUCH A PROXY NEED

NOT BE A SHAREHOLDER OF THE BANK.

However the Proxy so appointed will not have any

right to speak at the meeting. The proxy form in

order to be effective must be received at the Head

Office situated at Bank of Baroda, AML Dept.,

8th floor, Suraj Plaza I, Sayajiganj, Vadodara –

390 005, not later than FOUR DAYS before the

date of the Extraordinary General Meeting i.e., on

or before the closing hours of the Bank at 5.00

pm on Thursday, 22nd March, 2012. Please

note that any employee or officer of the Bank

cannot be appointed as proxy as per provision of

Bank of Baroda General (Share and Meetings)

Regulations, 1998 as amended from time to time.

5

AUTHORISED

o person shall be entitled to attend or vote at

N

the meeting as a duly authorised representative

of a Company or any body corporate which

is a shareholder of the Bank, unless a copy

of the resolution appointing him/her as a duly

authorized representative certified to be a true

copy by the Chairman of the meeting at which

it was passed, shall have been deposited at

the Head Office situated at Bank of Baroda,

AML Dept., 8th floor, Suraj Plaza I, Sayajiganj,

Vadodara – 390 005, not later than FOUR

DAYS before the date of the Extraordinary

General Meeting, i.e., on or before the closing

hours of the Bank at 5.00 pm on Thursday, 22nd

March, 2012. Please note that an employee

or officer of the Bank cannot be appointed as

authorized representative as per provisions of

Bank of Baroda General (Shares and Meetings)

Regulation 1998, as amended from time to time.

4. GheeqmLeefle he®eea-men-he´JesMe he$e

Mes³ejOeejkeÀeW keÀer megefJeOee kesÀ efueS, Fme veesefìme kesÀ meeLe

GheeqmLeefle he®eea men he´JesMe-he$e mebueive nw. Mes³ejOeejkeÀeW /

he´e@keÌmeer OeejkeÀeW / he´eefOeke=Àle he´efleefveefOe³eeW mes DevegjesOe nw efkeÀ

GmeceW efveOee&efjle mLeeve hej Deheves nmlee#ej keÀjW Deewj Gmes

yewþkeÀ kesÀ mLeeve hej meghego& keÀj oW. he´e@keÌmeer / Mes³ejOeejkeÀeW kesÀ

he´eefOeke=Àle he´efleefveefOe, GheeqmLeefle he®eea men he´JesMe he$e ceW pewmee

ceeceuee nes, mheä keÀjW efkeÀ Jen 'he´e@keÌmeer' nw ³ee 'he´eefOeke=Àle

he´efleefveefOe' nw.

4. ATTENDANCE SLIP-CUM-ENTRY PASS

5.celeeefOekeÀej

DeefOeefve³ece keÀer Oeeje 3 keÀer GheOeeje (2F&) kesÀ he´eJeOeeveeW kesÀ

Devegmeej keWÀêer³e mejkeÀej mes efYeVe leovegªheer ve³es yeQkeÀ keÀe

keÀesF& Yeer Mes³ejOeejkeÀ yeQkeÀ kesÀ meYeer Mes³ejOeejkeÀeW kesÀ kegÀue

celeeefOekeÀej kesÀ 1 he´efleMele mes DeefOekeÀ Oeeefjle Mes³ejeW kesÀ yeejs

ceW celeeefOekeÀej he´³egÊeÀ keÀjves keÀe hee$e veneR nesiee.

5. VOTING RIGHTS

For the convenience of the shareholders,

Attendance slip-cum-Entry Pass is annexed

to this Notice. Shareholders/Proxy holders /

Authorised Representative are requested to fill in

and affix their signatures at the space provided

therein and surrender the same at the venue of

the meeting. Proxy/Authorised Representative

of shareholders should state in their Attendance

Slip-cum-Entry Pass as “Proxy” or “Authorised

Representative” as the case may be.

In terms of the provisions of Section 3 (2E) of

the Act, no shareholder of the corresponding

new bank, other than the Central Government,

shall be entitled to exercise voting rights in

respect of any shares held by him/her in excess

of one percent of the total voting rights of all the

shareholders of the corresponding new bank.

Mes³ejOeejkeÀeW mes veesefìme keÀer Deheveer he´efle³eeb yewþkeÀ ceW

ueeves keÀe DevegjesOe nw.

SHAREHOLDERS ARE REQUESTED TO

BRING THEIR COPIES OF THE NOTICE TO

THE MEETING.

Yeejleer³e he´efleYetefle SJeb efJeefvece³e yees[& (hetbpeer efveie&ce

leLee he´keÀìerkeÀjCe DeeJeM³ekeÀleeSb) efJeefve³eceve, 2009

DeÐeleve ³eLee mebMeesefOele kesÀ Devegmeej efkeÀ³es peeves kesÀ efueS

Dehesef#ele he´keÀìerkeÀjCe

(keÀ)DeefOeceeveer efveie&ce keÀe GÎsM³e :

Deeeqmle³eeW ceW eqmLej Je=ef× neefmeue keÀjves Deewj meg¢æ{

meerDeejSDeej nsleg hetbpeer yeæ{eves keÀer DeeJeM³ekeÀlee cenmetme

keÀer ieF& ke̳eeWefkeÀ kesÀJeue ueeYe keÀes hegve: efveJesefMele keÀjves

mes Deeeqmle³eeW ceW Jeebefíle Je=ef× nsleg DeefYekeÀefuele hetbpeer

DeeJeM³ekeÀleeDeeW keÀer hete|le veneR nes mekeÀleer.

Yeejleer³e peerJeve yeercee efveiece ves mJe³eb leLee / DeLeJee

FmekeÀer efJeefYeVe ³eespeveeDeeW kesÀ ceeO³ece mes ³en F®íe

J³eÊeÀ keÀer Deewj yeQkeÀ keÀer efveie&ce hetJe& hetbpeer keÀe 5…

lekeÀ DeLee&led 1,95,77,304 (SkeÀ keÀjesæ[ efhe®eeveJes

ueeKe melenÊej npeej leerve meew ®eej) FeqkeÌJeìer Mes³ej

DeefOeceeveer DeeOeej hej Dee|pele keÀjves keÀer mew×ebeflekeÀ

mJeerke=Àefle he´oeve keÀer nw. Fme he´keÀej pegìeF& ieF& hetbpeer mes

hetbpeer he³ee&hlelee ceW megOeej nesiee Deewj yeQkeÀ keÀer meeceev³e

J³eeJemeeef³ekeÀ peªjleeW keÀes efveefOe³eeb he´ehle nesieer.

Explanatory Statement and Disclosure as

required to be made in terms of Securities

& Exchange Board of India (Issue of Capital

and Disclosure Requirements) Regulations,

2009, as amended up to date.

a) Objects of the Preferential Issue

In order to achieve a sustainable growth

in its assets and maintaining robust CRAR,

need is felt for augmenting capital as the

plough back of profits alone would not be

adequate enough to meet the required capital

to support the envisaged asset growth.

LIC through itself and / or its various

schemes has expressed its intention and

has given its principle approval to acquire

equity shares upto 5% of the pre-issue

capital of the Bank on a preferential basis

i.e. upto 1,95,77,304 (One crore ninety five

lac seventy seven thousand three hundred

and four) equity shares. The capital raised

would be utilized to improve the Capital

Adequacy and to fund general business

needs of the Bank.

6

(Ke)®eteb kf eÀ he´mleeefJele efveie&ce, Yeejleer³e peerJeve yeercee efveiece

keÀes he´mleeefJele nw, Dele: efve³eb$eCe ceW keÀesF& heefjJele&ve

veneR nesiee. efveie&ce keÀe cetu³e mesyeer DeeF&meer[erDeej kesÀ

efJeefve³ece 76 (4), DeÐeleve leejerKe lekeÀ ³eLee mebMeeseOf ele

kesÀ Devegmeej efveOee&ejf le efkeÀ³ee peeSiee.

b) A

s the issue is proposed to LIC, there

would not be any change in control.

The Issue Price shall be determined in

accordance with Regulation 76(4) of

SEBI ICDR Regulations, as amended

up to date.

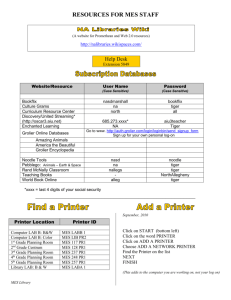

(ie) efveie&ce - hetJe& SJeb Ghejeble Mes³ejOeeefjlee keÀe mJeªhe

c)Shareholding Pattern before and after

the Issue

ke´À.

meb.

ÞesCeer

efveie&cehetJe&

efveie&ce Ghejeble

(24.2.2012 keÀs Devegmeej)

Oeeefjle Mes³ejeW keÀer Mes³ej- Oeeefjle Mes³ejeW keÀer Mes³ejmebK³ee

Oeeefjlee

mebK³ee

Oeeefjlee

he´efleMele

he´efleMele

keÀ he´Je&lekeÀ keÀer

Oeeefjlee

(Yeejle

mejkeÀej)

Ke iewj he´Jele&keÀ

Oeeefjlee

168266500 42.97 187843804 45.69

kegÀue

391546079 100.00 411123383 100.00

Sl. Category

No.

A

223279579 57.03 223279579 54.31

B

Mes³ejeW keÀer

mebK³ee

hetbpeer keÀe

he´efleMele

efveie&ce hetJe& (24 HeÀjJejer

2012 kesÀ Devegmeej)

30183225

7.71

efveie&ce Ghejeble

49760529

12.10

Promoter’s

Holding

(Govern223279579

ment of

India)

Non –

Promoter 168266500

Holding

Total

(Ie)mesyeer DeeFmeer[erDeej efJeefve³eceeW ceW efJeefvee|oä mece³e meercee

kesÀ Deboj yeQkeÀ efveie&ce he´e¬f eÀ³ee keÀes hetje keÀjves keÀe he´³eeme keÀj

jne nw.

(*)DeeF&meer[erDeej efJeefve³eceeW keÀer MeleeX kesÀ Devegmeej peerJeve

yeercee efveiece keÀer hetJe& DeefOeceeveer Oeeefjlee keÀes ueekeÀ-Fve

keÀjvee peªjer veneR nw.

(®e)Yeejleer³e peerJeve yeercee efveiece keÀer Mes³ejOeeefjlee efveie&ce

hetJe& SJeb efveie&ce Ghejeble efvecveevegmeej nesieer.

No. of

shares

held

Percentage of

shareholding

57.03 223279579

54.31

42.97 187843804

45.69

391546079 100.00 411123383 100.00

d.The Bank endeavours to complete the issue

process within the prescribed time lines as

indicated in SEBI ICDR Regulations.

e.In terms of ICDR Regulations, prepreferential holding of LIC is not required

to be locked-in.

f.The Pre and Post issue shareholding of

Life Insurance Corporation of India would

be as under:

7

After the issue

Pre- issue

(As on 24th

February

2012)

Post -issue

(í)yeQkeÀ keÀe FeqkeÌJeìer Mes³ej í: cenerves mes DeefOekeÀ mes

met®eerye× nw Deewj Fme keÀejCe mesyeer DeeFmeer[erDeej

efJeefve³ece kesÀ efJeefve³ece 76 (3) SJeb 78 (5) Deewj mesyeer

Before the Issue

(As on 24.2.2012)

No. of

Pershares

centheld

age of

shareholding

Number of

Shares

30183225

Percentage to

Capital

7.71

49760529

12.10

g.The equity shares of the Bank have

been listed for more than six months and

accordingly, provisions of Regulation 76

(DeeF&meer[erDeej) efJeefve³eceve 2009 kesÀ efJeefve³ece 73

(1) (SHeÀ) leLee (peer) kesÀ Debleie&le he´keÀìerkeÀjCe mebyebOeer

he´eJeOeeve ueeiet veneR nesles nQ.

(3) and 78 (5) of SEBI ICDR Regulations

and the disclosures under Regulation 73

(1) (f) & (g) of SEBI (ICDR) Regulations,

2009 are not applicable.

(pe)peerJeve yeercee efveiece keÀes peejer leLee Deeyebefìle Mes³ej,

Deeyebìve keÀer leejerKe mes 1 Je<e& kesÀ efueS ueekeÀ-Fve jnWies.

h.The shares to be issued and allotted to

LIC shall be locked in for a period of one

year from the date of Allotment.

(Pe)meebefJeefOekeÀ uesKeehejer#ekeÀ (keÀeW) Üeje peejer efkeÀ³ee

ie³ee Fme DeeMe³e keÀe he´ceeCe-he$e efkeÀ ³en efveie&ce Fve

efJeefve³eceveeW keÀer Dehes#eeDeeW kesÀ Devegªhe efkeÀ³ee pee jne

nw, DemeeOeejCe meeceev³e yewþkeÀ ceW he´mlegle efkeÀ³ee peeSiee.

i.The Certificate issued by the Statutory

Auditor(s) certifying that the issue is being

made in accordance with the requirements

of these regulations will be tabled at the

Extraordinary General Meeting.

(_e)Yeejleer³e peerJeve yeercee efveiece Üeje Oeeefjle meYeer Mes³ej

DeYeeweflekeÀªhe ceW nQ leLee yeQkeÀ, mìe@keÀ SkeÌme®eWpeeW,

peneb yeQkeÀ kesÀ FeqkeÌJeìer Mes³ej met®eerye× nQ, kesÀ meeLe efkeÀ³es

ie³es met®eerkeÀjCe keÀjej ceW efJeefvee|oä FeqkeÌJeìer Mes³ejeW keÀer

DeveJejle met®eerye×lee keÀer MeleeX keÀe Devegheeueve keÀj jne nw.

j.All the shares held by Life Insurance

Corporation of India are in dematerialized

mode and the Bank is in compliance with

the conditions of continuous listing of equity

shares as specified in the Listing Agreement

with the Stock Exchanges where the equity

shares of the Bank are listed.

(ì) peerJeve yeercee efveiece, yeercee kebÀheveer nesves kesÀ keÀejCe mesyeer

DeeF&meer[erDeej efJeefve³eceeW kesÀ efJeefve³ece 72 (2) kesÀ

he´eJeOeeveeW kesÀ Debleie&le mebyebeOf ele leejerKe mes 6 ceen hetJe&

FeqkeÌJeìer Mes³ej ve yes®eves kesÀ mebyebOe ceW ítì he´ehle nw.

k.LIC being an Insurance Company is

exempt from the provisions of Regulation

72 (2) of the SEBI ICDR Regulations

relating to non selling of equity shares

during the six months preceding the

Relevant Date.

(") DeehekesÀ efveosMekeÀeW ves efJeMes<e mebkeÀuhe heeefjle keÀjves keÀer

efmeHeÀeefjMe keÀer nw.

l.Your Directors recommend passing of the

Special Resolution.

yeQkeÀ keÀe keÀesF& Yeer efveosMekeÀ Fme mebkeÀuhe mes mebyebefOele DeLeJee FmeceW

GvekeÀe efnle keÀesF& efveefnle veneR nw.

efveosMekeÀ ceb[ue kesÀ DeeosMe Üeje

None of the Directors of the Bank are concerned or

interested in the resolution.

(Sce.[er.ceu³ee)

DeO³e#e SJeb he´yebOe efveosMekeÀ

(M. D. Mallya)

By order of the Board of Directors

Chairman & Managing Director

Place: Mumbai

mLeeve : cegbyeF&

efoveebkeÀ: 28 HeÀjJejer, 2012

Date : 28th February 2012

8

yeQkeÀ Dee@]HeÀ yeæ[ewoe

he´Oeeve keÀe³ee&ue³e : ceeb[Jeer, yeæ[ewoe - 390 006

HeÀe@ce& yeer

he´e@keÌmeer HeÀece&

(Mes³ejOeejkeÀ Üeje Yeje SJeb nmlee#eefjle efkeÀ³ee peeS)

hebpeerke=Àle HeÀesefue³ees vebyej

(³eefo DeYeeweflekeÀ ªhe ceW ve nes)

[erheerDeeF&[erveb.

(³eefo DeYeeweflekeÀ ªhe ceW nes)

Mes³ejeW keÀer mebK³ee

ceQ/ nce

efveJeemeer

efpeuee

yeQkeÀ Dee@]HeÀ yeæ[ewoe keÀe / kesÀ Mes³ejOeejkeÀ nesves kesÀ veeles SleoÜeje

efveJeemeer

jep³e

Þeer/Þeerceleer

efpeuee

jep³e

keÀes cebieueJeej, 27 cee®e& 2012

keÀes he´ele: 10:00 yepes mej me³eepeer jeJe veiej ie=n, Je[esoje ceneveiej mesJee meove, yeQkeÀ Dee@]HeÀ yeæ[ewoe Meleeyoer Je<e& (2007-2008), ìer.

heer- 1, SHeÀ. heer. 549/1, peerF&yeer keÀe@ueesveerskesÀ heeme, Deesu[ heeoje jes[, Je[esoje- 390020 ceW ³ee FmekeÀer efkeÀmeer mLeefiele leejerKe keÀes yeQkeÀ

Dee@]HeÀ yeæ[ewoe kesÀ Mes³ejOeejkeÀeW keÀer nesvesJeeueer DemeeOeejCe meeceev³e yewþkeÀ ceW cesjer / nceejer Deesj mes Jeesì osves kesÀ efueS he´e@keÌmeer efve³egÊeÀ keÀjlee ntb / keÀjleer

ntb / keÀjles nQ.

efoveebkeÀ

ceen

2012

ÀÔããèªãè

keÀes nmlee#eefjle

ã䛇㊛

he´e@keÌmeer kesÀ nmlee#ej

veece :

helee :

he´Lece Mes³ejOeejkeÀ / SkeÀcee$e Mes³ejOeejkeÀ kesÀ nmlee#ej

he´e@keÌmeer HeÀe@ce& hej nmlee#ej keÀjves Deewj Fmes pecee keÀjves mebyebOeer DevegosMe

1.he´e@keÌmeer keÀe keÀesF& efueKele leYeer JewOe ceevee peeSiee peye efkeÀ,

keÀ)³en SkeÀue Mes³ejOeejkeÀ J³eefÊeÀ kesÀ ceeceues ceW, Mes³ejOeejkeÀ Üeje ³ee GmekesÀ Üeje efueefKele

ªhe ceW efJeefOeJeled he´eefOeke=Àle GmekesÀ Deìveea Üeje nmlee#eefjle nes.

Ke)meb³egÊeÀ OeejkeÀeW kesÀ ceeceues ceW, ³en jefpemìj ceW ope& he´Lece Mes³ejOeejkeÀ Üeje ³ee GmekesÀ

Üeje efueefKele ªhe ceW efJeefOeJeled he´eefOeke=Àle GmekesÀ Deìveea Üeje nmlee#eefjle nes.

ie)efvekeÀe³e keÀeheexjsì kesÀ ceeceues ceW, efueefKele ªhe ceW efJeefOeJeled he´eefOeke=Àle FmekesÀ

DeefOekeÀejer DeLeJee Deìveea Üeje nmlee#eefjle nes.

Ie) HeÀece& yeer ceW nes Deewj efJeefOeJeled ©He mes mìeefcHele nes.

2.he´ek@ eÌmeer-efueKele efkeÀmeer Mes³ejOeejkeÀ Üeje he³ee&hle ªhe mes nmlee#eefjle nesvee ®eeefnS, eEkeÀleg

³eefo efkeÀmeer keÀejCeJeMe Mes³ejOeejkeÀ Dehevee veece efueKeves ceW DemeceLe& nw Deewj GmekesÀ Debietþs

keÀe efveMeeve Jeneb ueiee nw, lees v³ee³eeOeerMe, ceefpemì^ìs , jefpemì^ej ³ee Ghe jefpemì^ej Dee@H] eÀ

SM³eesjvs me ³ee efkeÀmeer Dev³e mejkeÀejer jepeheef$ele DeefOekeÀejer ³ee yeQkeÀ Dee@]HeÀ yeæ[ewoe kesÀ efkeÀmeer

DeefOekeÀejer Üeje mee#³eebefkeÀle nesvee ®eeefnS.

3. he´eskeÌmeer kesÀ meeLe

keÀ.cegKleejveecee DeLeJee Dev³e he´eefOekeÀej(³eefo keÀesF& nes) efpemekesÀ lenle nmlee#ej efkeÀS

ieS nw DeLeJee

Ke.cegKleejveeces DeLeJee he´eefOekeÀej keÀer he´efle pees efkeÀ efkeÀmeer veesìjer heeqyuekeÀ DeLeJee

ceefpemì^sì Üeje he´ceeefCele keÀer ieF& yeQkeÀ kesÀ he´Oeeve keÀe³ee&ue³e ceW mene³ekeÀ

cenehe´yebOekeÀ(SSceSue), yeQkeÀ Dee@HeÀ yeæ[ewoe, 8Jeeb leue, metjpe hueepee-I,

me³eepeeriebpe, Jeæ[esoje - 390005 kesÀ heeme DemeeOeejCe meeceev³e yewþkeÀ keÀer

leejerKe mes ®eej efove henues DeLee&led ye=nmHeefleJeej 22 cee®e& 2012 keÀes keÀe³e&meceeeqhle

mes hetJe& oeshenj oes yepes mes henues pecee efkeÀ³ee peevee ®eeefnS .

4.³eefo mebyeb× cegKleejveecee yeQkeÀ Dee@]HeÀ yeæ[ewoe kesÀ heeme DeLeJee DemekesÀ Mes³ej DeblejCe Spebsì

kesÀ heeme henues mes hebpeerke=Àle nw lees cegKleejveeces keÀe hebpeerkeÀjCe ¬eÀceebkeÀ leLee Fmehe´keÀej kesÀ

hebpeerkeÀjCe keÀer leejerKe keÀe GuuesKe efkeÀ³ee peevee ®eeefnS.

5. yeQkeÀ kesÀ heeme pecee keÀer ieF& he´e@keÌmeer efueKele DeheefjJele&veer³e Deewj Debeflece nesieer

6.efJekeÀuhe kesÀ leewj hej oes ieejbefì³eeW kesÀ he#e ceW oer ieF& he´e@keÌmeer-efueKele kesÀ ceeceues ceW, SkeÀ mes

DeefOekeÀ HeÀece& efve<heeefole veneR efkeÀ³ee peeSiee.

7.ÒeekeÌmeer keÀe efueKele efve<heeefole keÀjvesJeeuee MesDejOeejkeÀ Gme yewþkeÀ ceW J³eeqkeÌleiele ©He mes

celeoeve vener keÀjsiee efpeme yewþkeÀ kesÀ mebyebOe ceW efueKele nw~

8.yeQkeÀ Dee@]HeÀ yeæ[ewoe Üeje yeQkeÀ kesÀ efkeÀmeer keÀce&®eejer ³ee DeefOekeÀejer keÀes efJeefOeJeled ÒeeefOeke=Àle

ÒeefleefveefOe DeLeJee he´eskeÌmeer efve³egÊeÀ veneR efkeÀ³ee peeSiee.

9.he´ek@ eÌmeer HeÀece& ceW efkeÀS ieS meYeer HesÀjyeoue hej efJeefOeJele ªhe mes DeeÐe#ej efkeÀS peeves ®eeefnS.

9

Bank of Baroda

Head Office: Mandvi, Baroda – 390 006

FORM ‘B’

FORM OF PROXY

(To be filled in and signed by the shareholder)

Regd. Folio No.

(If not Dematerialised)

DPID No.

Client ID No.

(If Dematerialised)

No of shares.

I/We,

Resident of

in the

in the State of

district of

being a shareholder/s of BANK OF BARODA, hereby appoint Shri/Smt.

resident of

in the State of

or

in the district of

resident of

failing him/her, Shri/Smt.

in the district of

in the

as my/our proxy to vote for me/us and on my/our behalf

State of

at the Extraordinary General Meeting of the shareholders of the Bank to be held on Tuesday, 27th March

2012, at 10.00 a.m., at Sir Sayaji Rao Nagargriha, Vadodara Mahanagar Seva Sadan, Bank of Baroda

Centenary Year (2007-2008), T. P. – 1, F. P. 549/1, Near GEB Colony, Old Padra Road, Vadodara

– 390 020 and at any adjournment thereof.

Signed this

day of

2012.

Revenue

stamp

Signature of the Proxy

Name :

Address:

Signature of first /sole holder

INSTRUCTIONS FOR SIGNING AND DEPOSITING THE PROXY FORM

1. The instrument of proxy to be valid,

a.in case of an individual shareholder, shall be signed by him/her or by his/her

attorney duly authorised in writing ,

b. in the case of joint holders, shall be signed by the shareholder first named

in the Register of Shareholders or by his/her attorney duly authorised in

writing,

c. in the case of a body corporate, shall be signed by its officer and executed

under its Common Seal, if any, or otherwise signed by its attorney duly

authorised in writing, and

d. shall be in the Form B and duly stamped.

2.An instrument of proxy, in which the thumb impression of the shareholder is

affixed, will be valid provided it is attested by a Judge, Magistrate, Sub-Registrar

of Assurances or any other Government Gazetted Officer or an officer of Bank of

Baroda.

3. The proxy together with

a.the power of attorney or other authority (if any) under which it is signed or

b. a copy of that power of attorney or authority, certified by a Notary Public or

10

a Magistrate, should be deposited at the Head Office with Assistant General

Manager (AML), Bank of Baroda, 8th floor, Suraj Plaza-1, Sayajiganj,

Vadodara – 390 005, not later than FOUR DAYS before the date of the

Extraordinary General Meeting, i.e. on or before closing hours i.e. 5.00

p.m. of Thursday, the 22nd March, 2012.

4. In case the relevant power of attorney is already registered with Bank of Baroda

or its Share Transfer Agent, the registration number of the power of attorney and

the date of such registration may be mentioned.

5. An instrument of proxy deposited with the Bank shall be irrevocable and final.

6.In the case of an instrument of proxy granted in favour of two grantees in the

alternative, not more than one form shall be executed.

7.The shareholder who has executed an instrument of proxy shall not be entitled to

vote in person at the meeting to which such instrument relates.

8. No person shall be appointed as duly authorised representative or a proxy who is

an officer or an employee of BANK OF BARODA.

9. All alteration in the Proxy Form should be duly initialled by executant.

yeQkeÀ Dee@]HeÀ yeæ[ewoe

he´Oeeve keÀe³ee&ue³e : ceeb[Jeer, yeæ[ewoe - 390 006

GheeqmLeefle he®eea

(he´JesMe kesÀ mece³e meghego& keÀjveer nw)

efoveebkeÀ

mece³e

mLeeve

27 cee®e& 2012

he´ele: 10.00 yepes

mej me³eepeerjeJe veiej ie=n, Je[esoje ceneveiej, mesJee meove, yeQkeÀ Dee@HeÀ yeæ[ewoe Meleeyoer Je<e& (2007-2008), ìer.heer.-1,

SHeÀ.heer. 549/1, peerFy& eer keÀe@ueesveer kesÀ heeme, Deesu[ heeoje jes[, Je[esoje - 390020

Mes³ejOeejkeÀ / he´eskeÌmeer / he´eefOeke=Àle he´efleefveefOe kesÀ nmlee#ej

jefpemì[& HeÀesefue³ees (³eefo DeYeeweflekeÀ veneR nw)/ [erheerDeeF&[er veb SJeb

ie´enkeÀ DeeF&[er veb (³eefo DeYeeweflekeÀ nw)/

Mes³ej OeejkeÀ keÀe veece

Mes³ej keÀer mebK³ee

yeQkeÀ Dee@]HeÀ yeæ[ewoe

he´Oeeve keÀe³ee&ue³e : ceeb[Jeer, yeæ[ewoe - 390 006

he´JesMe he$e

(yewþkeÀ kesÀ oewjeve Deheves heeme jKeW)

Mes³ejOeejkeÀ / he´eskeÌmeer / he´eefOeke=Àle he´efleefveefOe kesÀ nmlee#ej

jefpemì[& HeÀesefue³ees (³eefo DeYeeweflekeÀ veneR nw)/ [erheerDeeF&[er veb

SJeb ie´enkeÀ DeeF&[er veb (³eefo DeYeeweflekeÀ nw)/

Mes³ej OeejkeÀ keÀe veece

Mes³ej keÀer mebK³ee

Mes³ejOeejkeÀ / he´eskeÌmeer / Mes³ejOeejkeÀ kesÀ he´eefOeke=Àle he´efleefveefOe mes DevegjesOe nw efkeÀ Jes yewþkeÀ ceW he´JesMe kesÀ efueS, yeQkeÀ ceW jefpemìj efkeÀS ieS vecetvee

nmlee#ej kesÀ Devegªhe ³eLeeefJeefOe nmlee#eefjle GhejesÊeÀ GhemLeefle he®eea Deewj he´JesMe he$e SkeÀ meeLe he´mlegle keÀjW. leLeeefhe he´JesMe mel³eeheve/peeb®e pewmee

DeeJeM³ekeÀ mecePee peeSiee, keÀer Mele& kesÀ DeOeerve nesiee. efkeÀmeer Yeer heefjeqmLeefle ceW yewþkeÀ kesÀ he´JesMe Üej hej keÀesF& [geqhuekesÀì GheeqmLeefle he®eea peejer veneR

keÀer peeSieer.

11

Bank of Baroda

Head Office: Mandvi, Baroda – 390 006

ATTENDANCE SLIP

(To be surrendered at the time of entry)

Date

27th March 2012

Time

10.00 A.M.

Place

Sir Sayaji Rao Nagargriha, Vadodara Mahanagar Seva Sadan, Bank of Baroda Centenary

Year (2007-2008), T. P. – 1, F. P. 549/1, Near GEB Colony, Old Padra Road, Vadodara –

390 020

Signature of the Shareholder/ Proxy/

Representative present

Regd. Folio No. (if not dematerialized)

/ D.P. ID & Client ID(if dematerialized)

Name of the Shareholder

No. of Shares

Bank of Baroda

Head Office: Mandvi, Baroda – 390 006

ENTRY PASS

(To be retained throughout the meeting)

Signature of the Shareholder/

Proxy/Representative present

Regd. Folio No. (if not

dematerialized) / D.P. ID &

Client ID(if dematerialized)

Name of the Shareholder

No. of Shares

Shareholders/proxy or authorized representative of shareholders are requested to produce the above

attendance slip, duly signed in accordance with their specimen signatures registered with the Bank, alongwith

the entry pass, for admission to the venue. The admission will, however, be subject to verification/checks,

as may be deemed necessary. Under no circumstances, any duplicate attendance slip will be issued at the

entrance to the meeting hall.

12

ºãì‡ãŠ ¹ããñÔ›

Book-Post

iewj megHego&ieer keâer efmLeefle ceW veerÛes efoS ieS Heles Hej ueewšeÙeW :

cewmeme& keâeJeea keâbHÙetšjMesÙej HeÇeFJesš efueefcešs[

(Ùetefveš: yeQkeâ Dee@]Heâ yeÌ[ewoe)

Huee@š veb 17 mes 24, Fcespe ne@efmhešue kesâ Heeme

efJeªuejeJe veiej, ceeOeeHegj, nwojeyeeo-500081

Heâesve veb : 040-2342 0815 mes 820

Heâwkeäme veb : 040-2342 0814

F&-cesue : einward.ris@karvy.com

If undelivered, please return to:

M/s Karvy Computershare Private Ltd

(Unit : Bank of Baroda)

Plot No.17 to 24, Near Image Hospital

Vittalrao Nagar, Madhapur

Hyderabad - 500 081

Phone No. 040 – 2342 0815 to 820,

Fax No. 040 – 2342 0814

e-mail : einward.ris@karvy.com