3G M P :

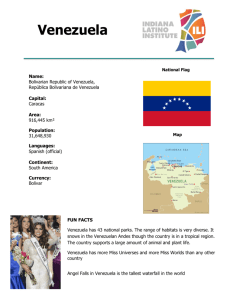

advertisement