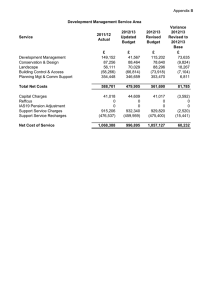

Appendix B

advertisement

Appendix B Environment Service Area Commercial Services Rural Sewerage Schemes Travellers Licensing Street Naming Pest Control Environmental Protection Dog Control Env Health - Service Mgmt * Parks & Open Spaces Sports Centres Leisure Complexes Other Sports Recreation Grounds Arts & Entertainments Museums Pier Pavilion Foreshore (Water Safety, Lifeguards etc) Woodlands Management Cromer Pier Public Conveniences Waste Collection And Disposal Cleansing Leisure* Environmental Strategy Civil Contingencies 2009/10 Actual £ 350,596 305,671 30,398 (70,613) 20,513 32,928 352,515 61,447 285,151 336,120 313,478 283,514 55,536 11,164 99,182 47,644 95,217 138,168 48,072 4,707 470,735 1,739,683 534,531 211,451 24,467 107,933 2010/11 Updated Base Budget £ 368,288 326,790 0 (67,296) 27,553 35,007 402,292 73,734 273,162 341,103 282,092 287,514 54,368 10,780 89,470 47,500 96,377 311,120 58,176 22,829 470,879 1,806,803 512,974 213,936 169,056 125,897 2011/12 Base Budget £ 350,900 339,922 0 (55,299) 27,140 24,032 417,533 57,554 257,630 391,358 246,566 299,129 55,921 10,349 127,800 48,513 96,377 412,284 76,769 22,829 408,829 1,036,136 725,927 144,970 101,734 94,032 Variance 2011/12 Base to 2009/10 Base £ (17,388) 13,132 0 11,997 (413) (10,975) 15,241 (16,180) (15,532) 50,255 (35,526) 11,615 1,553 (431) 38,330 1,013 0 101,164 18,593 0 (62,050) (770,667) 212,953 (68,966) (67,322) (31,865) Total Net Costs 5,890,208 6,340,404 5,718,935 (621,469) Capital Charges Support Service Charges 470,353 1,431,924 345,794 1,462,470 666,661 1,185,230 320,867 (277,240) Net Costs 7,792,485 8,148,668 7,570,826 (577,842) Service * These budgets represent the Service Management & Support Service costs for the Council. These costs are recharged in full to the final services, based on an appropriate method of allocation, for example, percentage of time spent. The summary above includes movements on all costs chargeable to the service including notional charges, for example, FRS 17, capital charges and support services for which variances will not impact on the bottom line. Appendix B 2010/11 Updated Budget 2011/12 Base Budget £ £ Explanation for Major Variances Variance £ ENVIRONMENT SERVICE AREA Commercial Services Gross Direct Costs 385,440 375,334 Gross Direct Income Support Service Charges Net Expenditure (17,152) 280,170 648,458 (24,434) 230,380 581,280 Rural Sewerage Schemes Gross Direct Costs 326,790 339,922 7,590 800 334,380 340,722 50,000 40,000 0 97,800 (50,000) (40,000) 0 97,800 104,166 124,884 (171,462) 150,920 (180,183) 154,770 Net Expenditure 83,624 99,471 15,847 Street Naming Gross Direct Costs Capital Charges 27,553 9,960 27,140 3,330 Gross Direct Income Support Service Charges Net Expenditure 0 3,100 40,613 0 4,940 35,410 (413) No major variances (6,630) (£6,630) - Lower than anticipated capital expenditure in 2009/10 resulted in lower depreciation charges. 0 1,840 No major variances (5,203) Pest Control Gross Direct Costs Gross Direct Income Support Service Charges Net Expenditure 39,507 (4,500) 30,750 65,757 28,532 (4,500) 20,250 44,282 417,995 431,763 4,290 0 Gross Direct Income Support Service Charges (15,703) 249,080 (14,230) 218,260 Net Expenditure 655,662 635,793 Support Service Charges Net Expenditure Travellers Gross Direct Costs Capital Charges Gross Direct Income Net Expenditure Licensing Gross Direct Costs Gross Direct Income Support Service Charges Environmental Protection Gross Direct Costs Capital Charges (10,106) (£19,853) Saving identified as part of the budget process partly offset by incremental increases on salaries and on costs. (7,282) New fee structure for Private Water Sampling (49,790) (£48,210) - Environmental Health recharges. (67,178) 13,132 Inflation on Internal Drainage Board (IDB) Rates and Levies. (6,790) (£3,770) - reduction in Central Costs recharge and other minor adjustments. 6,342 (10,000) Running costs for travellers sites at Cromer and Fakenham lower than anticipated. 97,800 £97,800 - Depreciation relates to significant capital expenditure incurred on Temporary Travellers sites in 2009/10. 10,000 Facility charges for travellers sites at Cromer and Fakenham lower to offset the running costs. 97,800 20,718 £11,215 Additional costs for taxi testing. £8,463 Staff restructure costs. (8,721) Additional taxi licensing charges 3,850 Decrease in recharges (£27,260) - Environmental Health, (£3,700) Sundry Debtors. Increased recharges from £29,410 Customer Services, £3,980 Corporate Leadership Team and £4,020 Media & Communications. (10,975) Staff savings following restructure of the service. 0 (10,500) (£7,760) - Environmental Health recharges. (21,475) 13,768 £3,344 Salary increments and regrading. £10,424 Increased charges apportioned for litter picker by new Kier cleansing contract. (4,290) (£4,290) - Air Monitoring Equipment has now been fully depreciated. 1,473 No major variances (30,820) Decrease in recharges (£39,440) - Environmental Health, (£5,850) - Admin Buildings. Increase in recharges of £14,660 to Customer Services, £5,020 to Media & Communications. (19,869) Appendix B 2010/11 Updated Budget 2011/12 Base Budget £ £ Explanation for Major Variances Variance £ ENVIRONMENT SERVICE AREA Dog Control Gross Direct Costs Gross Direct Income Support Service Charges 74,234 (500) 49,880 58,054 (500) 39,540 Net Expenditure 123,614 97,094 Env Health - Service Mgmt Gross Direct Costs Capital Charges 275,225 13,720 258,480 9,347 (2,063) (288,664) (1,782) (850) (266,977) 0 432,063 442,312 10,249 £10,000 - 2010/11 updated budget included a one-off transfer of budget to cover the cost of emergency tree works within Woodlands Management. (£36,450) - Big Lottery project completed during 2010/11, no expenditure in 2011/12 £36,699 - New cleansing and grounds maintenance contract. 18,320 28,059 9,739 £8,645 - Greater than anticipated capital expenditure on playground equipment - Playbuilder funded by capital grant. (90,960) (50,954) 40,006 £36.450 - Big Lottery project completed during 2010/11, no grant in 2011/12. £3,556 - Parish and Town Councils no longer recharged for amenity cutting. 58,660 120,720 Net Expenditure 418,083 540,137 62,060 More accurate reflection of time spent by Leisure services staff on Parks services 122,054 Sports Centres Gross Direct Costs 422,542 430,404 7,862 £4,648 - Pay award and effect of holiday pay entitlement. (£10,115) - Savings identified as part of budget process. (£4,000) - One-off cost in 2010/11 of new food preparation area at North Walsham Sports Hall. £2,969 - New cleansing and grounds maintenance contract. £9,500 Increased sports hall hire costs to bring in line with 2009/10 actual. This is mainly due to increased utility and NNDR costs. £3,000 - Additional coaching costs, funded by additional income. £3,346 - Inflation on sports hall management fee for Fakenham sports hall. 6,080 34,725 (140,450) (183,838) 28,645 (£5,887) - Lower than anticipated capital expenditure on sports centres, £35,752 - Removal of previous credit in relation to Govt Grants Deferred, due to changes under IFRS. (43,388) (£5,000) - Additional income from outreach coaching. (£37,718) - Various income generation opportunities identified as part of the budget process, including the effect of a marketing campaign, income from the new Multi Use Games Area and the introduction of a membership scheme. 74,310 112,560 38,250 £14,730 - More accurate reflection of time spent by Leisure services staff on Sports Halls. £19,090 - Recharges now allocated on a per head basis including Administrative Buildings, employee related insurances and Central Costs. £4,550 - Recharge from Property Services 362,482 393,851 31,369 Gross Direct Income Support Service Charges Net Expenditure Parks & Open Spaces Gross Direct Costs Capital Charges Gross Direct Income Support Service Charges Capital Charges Gross Direct Income Support Service Charges Net Expenditure (16,180) Staff savings following restructure of the service. 0 (10,340) Decrease in recharges (£6,690) - Environmental Health, (£3,280) Admin Buildings. (26,520) (16,745) Restructure of Environmental Health Management (4,373) (£7,739) - Lower than anticipated capital expenditure in 09/10 resulted in lower depreciation charges. £3,366 Removal of previous credit in relation to Government Grants Deferred, due to changes under International Financial Reporting Standards (IFRS). 1,213 No major variances 21,687 Reflection of lower direct costs. 1,782 Appendix B 2010/11 Updated Budget 2011/12 Base Budget £ £ Explanation for Major Variances Variance £ ENVIRONMENT SERVICE AREA Leisure Complexes Gross Direct Costs 287,514 299,129 Capital Charges 220,646 268,440 57,420 29,850 Net Expenditure 565,580 597,419 Other Sports Gross Direct Costs 137,753 84,976 Capital Charges Gross Direct Income 0 (83,385) 0 (29,055) Support Service Charges 131,280 20,860 Net Expenditure 185,648 76,781 Recreation Grounds Gross Direct Costs 11,780 11,349 (431) £2,523 - New cleansing and grounds maintenance contract. Gross Direct Income Support Service Charges Net Expenditure (1,000) 1,310 12,090 (1,000) 4,060 14,409 0 2,750 No Major Variances. 2,319 Arts & Entertainments Gross Direct Costs 121,320 129,260 7,940 £36,530 - Transfer of staff costs from Leisure Services, now reflected as a direct cost. (£30,390) - One-off purchase of instruments in 2010/11 funded by a grant from the Department for Culture, Media and Sport. Gross Direct Income (31,850) (1,460) Support Service Charges 106,630 22,670 Net Expenditure 196,100 150,470 30,390 £30,390 - One-off grant in 2010/11 from the Department for Culture, Media and Sport. (83,960) (£75,700) - Staff now charged directly to Final Service instead of Leisure Services Management Unit and more accurate time spent by other Leisure Services staff on arts activities. (45,630) 47,500 74,700 48,513 4,530 122,200 53,043 96,377 43,520 96,377 23,800 139,897 120,177 Support Service Charges Museums Gross Direct Costs Support Service Charges Net Expenditure Pier Pavilion Gross Direct Costs Support Service Charges Net Expenditure 11,615 £11,945 - Inflation on sports hall management fee for Victory and The Splash 47,794 (£4,088) - Lower than anticipated capital expenditure resulting in reduced depreciation charges in year. £51,882 Removal of previous credit in relation to Govt Grants Deferred due to changes under IFRS. (27,570) More accurate reflection of time spent by Leisure services staff on Leisure Complexes 31,839 (52,777) One-off costs in 2010/11 relating to the Tour of Britain (£10,000) and Walking project (£20,000). (£17,005) Cessation of Free Swimming initiative. 0 No Major Variances 54,330 One-off income in 2010/11 relating to the Tour of Britain £10,000 and Walking project £20,000. £17,005 - Cessation of Free Swimming initiative. (110,420) (£115,770) - More accurate reflection of time spent by Leisure services staff on Other Sports. £4,570 - Recharges now allocated on a per head basis including Administrative Buildings, employee related insurances and Central Costs. (108,867) 1,013 No Major Variances (70,170) (£68,870) - More accurate reflection of time spent by Leisure services staff on the Museums service. (69,157) 0 No Major Variances (19,720) (£17,330) - Recharges now allocated on a per head basis including Administrative Buildings, employee related insurances and Central Costs. (19,720) Appendix B 2010/11 Updated Budget 2011/12 Base Budget £ £ Explanation for Major Variances Variance £ ENVIRONMENT SERVICE AREA Foreshore (Water Safety, Lifeguards etc) Gross Direct Costs 325,870 427,034 Gross Direct Income Support Service Charges (14,750) 0 (14,750) 41,690 Net Expenditure 311,120 453,974 Woodlands Management Gross Direct Costs 141,776 95,369 Capital Charges Gross Direct Income Support Service Charges Net Expenditure 1,390 (83,600) 73,580 133,146 1,497 (18,600) 76,920 155,186 Cromer Pier Gross Direct Costs Capital Charges Gross Direct Income Support Service Charges 37,733 5,911 (14,904) 43,300 37,733 5,232 (14,904) 17,550 0 (679) 0 (25,750) 72,040 45,611 (26,429) 470,879 409,649 Capital Charges 73,225 65,460 Gross Direct Income Support Service Charges 0 91,417 (820) 59,867 635,521 534,156 Net Expenditure Public Conveniences Gross Direct Costs Net Expenditure 101,164 £3,019 - Inflation increase on RNLI fee for managing the Lifeguard service. £98,145 - New cleansing and grounds maintenance contract. 0 41,690 £41,690 - Time spent by Leisure services staff on the Foreshore service. 142,854 (46,407) £28,637 - Transfer of staff costs from Leisure Services, now reflected as a direct cost. (£17,000) - 2010/11 updated budget included a one-off transfer of budget to cover the cost of emergency tree works. (£60,000) - Access to Nature project ceasing. 107 No Major Variances 65,000 £60,000 - Access to Nature grant funding ceasing. 3,340 No Major Variances 22,040 No Major Variances No Major Variances No Major Variances (£36,540) - Reduced Insurances recharges. £10,380 Increased time recharged by Coastal Management staff. (61,230) (£62,974) - Reduction in contract cleaning costs following the award of the new cleansing contract. £2,228 - Inflation on NNDR costs. (7,765) (£7,099) - Revaluations of public conveniences and reduced capital expenditure resulting in reduced depreciation charges. (820) (£820) - Increase in Radar Key Income (31,550) (£,5,900) - Reduced recharges from Estates and Valuation. (£5,860) - Insurance recharges. (£6,190) - Central Costs recharge. (£2,680) - Accountancy recharge. (£3,160) Creditors recharge. (£2,090) Performance Management recharge. (101,365) Appendix B 2010/11 Updated Budget 2011/12 Base Budget £ £ Explanation for Major Variances Variance £ ENVIRONMENT SERVICE AREA Waste Collection And Disposal Gross Direct Costs Capital Charges Gross Direct Income Support Service Charges Net Expenditure 4,555,479 3,753,874 (801,605) (£681,577) - Contractor costs, (£6,302) - Garden bin issues from stock, (£5,000) - Fixed term contract staff and on costs, (£13,610) - Savings identified as part of the budget process, (£104,500) - One off vonsultancy fees for the contract procurement process, (£5,000) - misc fees and charges, £14,723 - Trade disposal costs. (7,748) 152,771 (2,748,676) (2,717,738) 160,519 £161,964 - Removal of previous credit in relation to Govt Grants Deferred, due to changes under IFRS. 30,938 (£68,079) - Additional fee income, (£120,000) - additional profit share, £25,000 - Contributions from Borough Council of Kings Lynn and West Norfolk (BCKLWN) no longer applicable as part of joint waste procurement, £122,500 Defra grant refunds no longer payable, £2,339 - Reduced recycling credit income, £69,178 - Loss of income from Tipping Away recharges. 337,670 300,860 2,136,725 1,489,767 (36,810) Decrease in recharges (£24,470) - Central costs, (£11,840) Environmental Health, (£6,000) - Corporate Customer Services, (£8,480) - Performance Management, (£18,080) Media and Communications, (£7,020) GIS, (£4,290) Admin Buildings. Increase in recharges of £20,630 to Customer Services, £16,010 to Corporate Leadership Team, £9,200 to Internal Audit. (646,958) Cleansing Gross Direct Costs 541,074 759,927 Gross Direct Income (28,100) (34,000) 22,660 19,380 Net Expenditure 535,634 745,307 209,673 Leisure Gross Direct Costs 214,636 145,670 (700) (218,533) (700) (144,970) (68,966) (£67,193) - Transfer of staff costs to Arts and Entertainment and Woodlands Management, now reflected as a direct cost. 0 No Major Variances 73,563 Reduced unit recharges reflecting the fact that some salaries are now being charged directly to final services. (4,597) 0 Environmental Strategy Gross Direct Costs 196,556 104,234 (92,322) This includes one off use of reserves of (£69,000) of which (£40,000) related to the Carbon Reduction Plan, (£22,500) Area Based Grant - this is to be used for a community project which helps people in their own homes to reduce energy, (£6,500) Green Travel Plan projects. Gross Direct Income Support Service Charges (27,500) 6,580 (2,500) 23,690 Net Expenditure 175,636 125,424 25,000 Area Based Grant 17,110 Increase in recharges from Personnel of £2,730, Admin Buildings of £3,180 and Corporate Leadership Team of £11,260. (50,212) Support Service Charges Gross Direct Income Support Service Charges Net Expenditure 218,853 Implications of new contract costs for cleansing (5,900) Additional income from parish and town councils for recharges from emptying of dog and litter bins (3,280) Decrease in recharges of (£5,480) from Central costs, and an increase in recharges from Accountancy of £3,230 4,597 Appendix B 2010/11 Updated Budget 2011/12 Base Budget £ £ Explanation for Major Variances Variance £ ENVIRONMENT SERVICE AREA Civil Contingencies Gross Direct Costs Gross Direct Income Support Service Charges Net Expenditure Gross Direct Costs FRS 17 Adjustment Capital Charges Gross Direct Income Support Service Charges Net Expenditure 125,897 94,032 (31,865) (£9,247) Workstream savings following restructure. (£2,000) Buildings R&M budget not required, (£21,135) Misc supplies and services to include materials, equipment repair and maintenance, telephone, subscriptions and stationery costs, contributions to the Civil Protection Volunteers and a contingency payment for flooding and any other emergency. 0 75,140 0 49,230 201,037 143,262 0 (25,910) Decrease in recharges of (£11,680) Environmental Health, (£2,790) Personnel, (£4,870) Admin Buildings, (£2,090) Computer Network and application team. (57,775) 9,867,659 0 345,794 (3,527,255) 1,462,470 8,148,668 9,053,951 0 666,661 (3,335,016) 1,185,230 7,570,826 (813,708) 0 320,867 192,239 (277,240) (577,842)