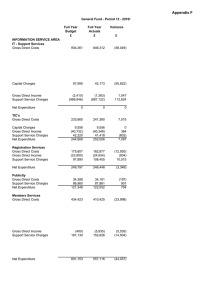

Appendix B RESOURCES SERVICE AREA Full Year Budget

advertisement

Appendix B GENERAL FUND - PERIOD 12 - 2011/12 RESOURCES SERVICE AREA Full Year Budget £ Service R112A R200 R200A R201 R202 R203 R204 R210 R211 R213 R214 R219 R251 R260 R262 R262A R263 R263B R263C R263D R301 R302 R318 R340 R341 R410 R411 R413 R414 R450 R450A R460A R472 Health Car Parking Markets Industrial Estates Surveyors Allotments Handy Man Parklands Local Taxation Benefits Treasury Management Discretionary Rate Relief Non Distributed Costs Benefits & Revenues Management * Personnel & Payroll Support Services * Administrative Buildings Property Services Corporate Finance * Insurance & Risk Management * Internal Audit * Performance Management * Foreshore Community Centres Investment Properties Coast Protection Pathfinder Coast & Community Partnership Transport Community Safety Cctv Central Costs * Corporate & Democratic Core Corporate Leadership Team * Coastal Management * Total Resources Full Year Actuals £ Variance £ 8,720 (1,106,307) 98,106 21,926 3,370 31,036 2,143 636,717 842,981 54,210 68,018 0 0 0 99,126 0 0 0 0 0 169,370 7,947 1,077 1,027,093 751,183 309,724 71,315 78,960 265,588 0 1,214,025 0 0 8,725 (1,155,849) 79,611 (21,831) 3,271 18,828 (8,478) 600,226 388,260 51,712 62,952 212,000 0 0 87,446 0 0 0 0 0 143,035 8,481 (2,912) 842,317 319,807 262,062 50,203 65,787 241,689 0 1,195,608 0 0 5 (49,542) (18,495) (43,757) (99) (12,208) (10,621) (36,491) (454,721) (2,498) (5,066) 212,000 0 0 (11,680) 0 0 0 0 0 (26,335) 534 (3,989) (184,776) (431,376) (47,662) (21,112) (13,173) (23,899) 0 (18,417) 0 0 4,656,328 3,452,950 (1,203,378) * These budgets represent the Service Management & Support Service costs for the Council. These costs are ultimately recharged in full to the final services, based on an appropriate method of allocation, for example, percentage of time spent Appendix B General Fund - Period 12 - 2011/12 Full Year Budget £ RESOURCES SERVICE AREA Health Gross Direct Costs 0 Gross Direct Income 0 Support Service Charges 8,720 Net Expenditure 8,720 Full Year Actuals £ Variance Explanation for Major Variances £ 3,004 (3,563) 9,284 8,725 3,004 (3,563) 564 5 No major variances No major variances 654,081 677,748 23,667 £20,541 - Additional reactive repairs and maintenance costs. £17,132 - Additional rental payable partly due to move from calendar to financial year rental calculations. (£1,095) Reduced external printing costs. (£1,985) Reduced advertising costs. £1,713 - Bad debts written off. (£12,140) - Net reduction in car parks contract management fee as a result of (£28,635) basic contract cost, £14,975 additional Penalty Charge Notice administration charge and £1,519 additional Penalty Charge Notice Levy. 14,205 (1,894,215) 14,205 (1,960,778) 0 (66,563) 119,622 112,976 (6,646) (1,106,307) (1,155,849) (49,542) Markets Gross Direct Costs 118,721 104,744 (13,977) Gross Direct Income Support Service Charges (76,785) 56,170 (79,982) 54,849 (3,197) (1,321) Net Expenditure 98,106 79,611 (18,495) Industrial Estates Gross Direct Costs 37,343 (4,433) (41,776) 40,441 (101,528) 40,441 (102,815) 0 (1,287) Support Service Charges 45,670 44,976 (694) Net Expenditure 21,926 (21,831) (43,757) (50) 3,420 3,370 (50) 3,321 3,271 0 (99) (99) Car Parking Gross Direct Costs Capital Charges Gross Direct Income Support Service Charges Net Expenditure Capital Charges Gross Direct Income Surveyors Allotments Gross Direct Income Support Service Charges Net Expenditure (£21,570) - Additional car park fee income. (£43,442) - Additional Penalty Charge Notice income, offset in part by 40% admin charge within contract management fee. (£3,000) - Insurance claim reimbursement. (£1,964) - Additional recharge to markets based on additional market rent income. £4,682 - Lower recharges due from Property Services. (£1,140) - Reduced overtime payments. (£1,340) Reduced repairs and maintenance expenditure. (£10,383) - Reduction in contract costs following internalisation of function. (£3,197) - Additional markets rental income. (£893) - Lower recharges due from Property Services (£37,846) - Reduced rental payments previously due to EEDA. These have been transferred to an earmarked reserve to fund relevant regeneration projects. (£2,952) - Reduced repairs and maintenance expenditure. (£1,228) - Additional rental and service charge income following lease renegotiations (£648) - Lower recharges due from Property Services. No major variances Appendix B General Fund - Period 12 - 2011/12 Full Year Budget £ RESOURCES SERVICE AREA Handyman Gross Direct Costs 87,224 Full Year Actuals £ Variance Explanation for Major Variances £ 82,639 (4,585) (£1,038) - Reduced salary and overtime costs. (£1,208) - IAS pension costs adjustment. (£3,163) Reduction in consumable materials purchases. (117,238) (119,052) (1,814) (£1,814) - Additional recharges to external organisations and insurance claim reimbursement. Support Service Charges 61,050 55,241 (5,809) (£5,809) - Lower than anticipated recharges for Computers, Central Costs, Admin Buildings and Property Services. Net Expenditure 31,036 18,828 (12,208) Parklands Gross Direct Costs 35,860 15,229 (20,631) 585 (58,322) 585 (47,800) 0 10,522 24,020 2,143 23,508 (8,478) (512) (10,621) 534,230 548,231 14,001 15,000 6,876 (8,124) (382,863) (380,186) 2,677 Support Service Charges 470,350 425,305 (45,045) Net Expenditure 636,717 600,226 (36,491) Gross Direct Income Capital Charges Gross Direct Income Support Service Charges Net Expenditure Local Taxation Gross Direct Costs Capital Charges Gross Direct Income (£4,122) - Reduction in repairs and maintenance expenditure. (£16,162) - Reduced electricity costs offset by under recovery of electricity costs from tenants. £10,523 - Under recovery of electricity costs, offset by reduced electricity expenditure. No major variances £9,108 Increase in the provision for bad and doubtful debts not budgeted for at service level. £7,385 Increased postages costs. Reduction in interest paid on NNDR overpayments. This is offset by a reduction in income transferred from the collection fund. £8,124 reduction in income transferred from collection fund to cover interest on overpayments. (£6,465) Grant to fund NNDR legislative changes. The main variances relate to (£9,222) Central Costs, (£13,506) ICT (£3,585) Postal and Scanning and (£3,676) Customer Services. The balance is made up of a number of smaller variances below £2,000. Appendix B General Fund - Period 12 - 2011/12 Full Year Budget £ RESOURCES SERVICE AREA Benefits Gross Direct Costs 35,363,078 Full Year Actuals £ Variance Explanation for Major Variances 35,458,629 95,551 Capital Charges Gross Direct Income 23,358 (35,196,565) 23,358 (35,684,599) 0 (488,034) Support Service Charges 653,110 590,872 (62,238) Net Expenditure 842,981 388,260 (454,721) Treasury Management Support Service Charges Net Expenditure 54,210 54,210 51,712 51,712 (2,498) (2,498) No Major Variances. Discretionary Rate Relief Gross Direct Costs Net Expenditure 68,018 68,018 62,952 62,952 (5,066) (5,066) Lower level of rate relief given. Non Distributed Costs Gross Direct Costs 0 212,000 212,000 Net Expenditure 0 212,000 212,000 Benefits & Revenues Management Gross Direct Costs 72,744 Support Service Charges (72,744) Net Expenditure 0 71,900 (71,900) 0 (844) 844 0 £ £61,948 movement in the provision for bad and doubtful debts not budgeted for at service level. £37,451 Net increase in benefits payments made this is off set by Department of Works and Pensions (DWP) subsidy. (£52,485) Budgeted software costs transfered to capital, these costs were funded by grant income which was alos transfered to capital. £36,819 Partnership project expenditure offset by grant funding. (£232,855) Balance of Shared Services Partnership funding earmarked for spend in 2012/13. £52,485 Grant income transferred to capital to fund expenditure. (£4,732) costs awarded. (£22,522) Overpayments collected through sundry income and not through ongoing benefit. (£125,852) Subsidy and Discrecionary housing grant income. The main variances relate to (£19,404) Central Costs, (£15,975) ICT (£7,328) Postal and Scanning,(£5,125) Customer Services, (£5,153) Common training and (£6,352) Admin Buildings. This budget reflects notional charges in relation to IAS 19, pension costs. The variance consists of £18,000 for Settlements and Curtailments which represents the cost of the early payment of pension benefits as a result of redundancies. Also included is £194,000 for Past Service Costs which arise as a result of awarding added years or allowing employees to retire early on unreduced benefits on the grounds of efficiency. The impact of these costs are reversed out of the account to ensure there is no impact on the bottom line. No Major Variances Appendix B General Fund - Period 12 - 2011/12 Full Year Budget £ RESOURCES SERVICE AREA Personnel & Payroll Support Services Gross Direct Costs 360,203 Full Year Actuals £ Variance Explanation for Major Variances £ 320,910 (39,293) (360,203) (320,910) 39,293 0 0 0 Administrative Buildings Gross Direct Costs 528,267 460,910 (67,357) Capital Charges Gross Direct Income 81,528 (81,702) 81,528 (86,717) 0 (5,015) (428,967) (368,275) 60,692 99,126 87,446 (11,680) 414,841 410,750 (4,091) (400) (414,441) (4,532) (406,218) (4,132) 8,223 0 0 0 601,812 577,424 (24,388) (£21,680) Saving on Maternity cover and backfilling of Procurement post. (£3,806) Savings in bank charges. £15,000 has been carried forward to fund ongoing project work in relation to a number of key changes introduced by the finance bill. 2,435 16,333 13,898 Adjustment to reflect capital charges relating to the councils financial system. 0 (604,247) (628) (593,129) (628) 11,118 0 0 0 Support Service Charges Net Expenditure Support Service Charges Net Expenditure Property Services Gross Direct Costs Gross Direct Income Support Service Charges Net Expenditure Corporate Finance Gross Direct Costs Capital Charges Gross Direct Income Support Service Charges Net Expenditure (£29,426) - Underspend on common training budget,of which £15,000 has been transferred to the common training reserve to fund potential staff survey costs in 2012/13. (£4,184) - Periodicals and external printing. The balance consists of minor variances under £2,000. Reduced recharges to reflect lower costs in the year. £2,150 - Additional overtime expenditure. £1,731 Agency cost increases. (£3,156) - Utility costs. (£1,007) - Reduced travel expenditure. (£6,900) Reduced equipment rental hire. (£41,000) Creditor provision is no longer required for payments due for Stalham depot under the old NCS partnership agreement. (£12,374) - Reduced repairs and maintenance expenditure. (1,266) NNDR refund for Fakenham Connect offices. (£2,485) - Lower than anticipated telephone rental and call costs. (£1,213) - Additional rental income for Cromer Offices. (£2,957) - Additional income from sales and internal recharges, offset by additional material purchases. £66,900 - Reduction in management unit recharge income as a result of reduced direct expenditure. (£1,102) - Lower than anticipated Central Cost management unit recharges. £2,013 - Additional superannuation costs. (£5,721) IAS pension costs adjustment. (£3,187) - Additional recoverable charges. (£7,230) - Lower than anticipated recharges for Central Costs and Legal services. £16,971 Reduction in management unit recharge income as a result of reduced direct expenditure. Reduction in direct costs redistributed to services supported. Appendix B General Fund - Period 12 - 2011/12 Full Year Budget £ RESOURCES SERVICE AREA Insurance & Risk Management Gross Direct Costs 279,150 Gross Direct Income (650) Support Service Charges (278,500) Full Year Actuals £ Variance Explanation for Major Variances £ 276,769 (383) (276,386) (2,381) 267 2,114 0 0 0 111,467 (111,467) 99,822 (99,822) (11,645) 11,645 0 0 0 Policy & Performance Management Gross Direct Costs 161,015 138,614 (22,401) 0 (7,433) (7,433) (161,015) (131,181) 29,834 0 0 0 118,876 96,234 (22,642) 7,354 43,140 7,354 39,447 0 (3,693) 169,370 143,035 (26,335) 6,190 7,543 1,353 27 (2,000) 3,730 7,947 27 (2,732) 3,643 8,481 0 (732) (87) 534 113,707 119,570 5,863 24,569 (204,749) 24,569 (212,620) 0 (7,871) 67,550 1,077 65,569 (2,912) (1,981) (3,989) Net Expenditure Internal Audit Gross Direct Costs Support Service Charges Net Expenditure Gross Direct Income Support Service Charges Net Expenditure Foreshore Gross Direct Costs Capital Charges Support Service Charges Net Expenditure Community Centres Gross Direct Costs Capital Charges Gross Direct Income Support Service Charges Net Expenditure Investment Properties Gross Direct Costs Capital Charges Gross Direct Income Support Service Charges Net Expenditure No Major Variances No Major Variances Reduced recharges to reflect lower costs in the year. Fewer than anticipated number of audit days. Reduced recharges to reflect lower costs in the year. (£4,635) - Staff training & travel expenses lower than budget. (£9,248) - Expenditure not incurred in relation to North Norfolk Youth Voice. (£5,742) Phone calls & Computer purchases. (£5,439) - North Norfolk Racial Equality Council repaid grant. (£1,994) - BIG Lottery project management costs Reduced recharges to reflect lower costs in the year. (£18,061) - Reduction in repairs and maintenance expenditure. Part of this underspend is to be used to finance an RCCO for capital funding of additional works for the old Red Lion Toilets project. (£1,229) - Lower than anticipated electricity costs. (£1,630) - Reduced consumable materials purchases. (£1,631) - Reduction in management unit recharges from Coastal and Central Costs. £1,080 - Additional expenditure on repairs and maintenance. No major variances. No major variances. £4,079 - Additional repairs and maintenance expenditure. (£2,000) - Reduced expenditure on professional fees. £1,300 - Additional costs associated with beach hut storage over the winter period. £2,125 - Reduced rental income from lettings. (£2,704) - Additional recoverable service and utility charges and insurance claim reimbursement. (£6,713) - Additional rental from chalets. No major variances. Appendix B General Fund - Period 12 - 2011/12 Full Year Budget £ RESOURCES SERVICE AREA Coast Protection Gross Direct Costs 429,583 Full Year Actuals £ Variance £ 248,592 (180,991) 466,135 (8,525) 139,900 466,135 (8,550) 136,140 0 (25) (3,760) 1,027,093 842,317 (184,776) Pathfinder Gross Direct Costs 575,153 509,275 (65,878) Gross Direct Income Support Service Charges 0 176,030 (338,184) 148,716 (338,184) (27,314) Net Expenditure 751,183 319,807 (431,376) Coast & Community Partnership Gross Direct Costs 300,282 300,145 (137) (117,568) (155,713) (38,145) Support Service Charges 127,010 117,630 (9,380) Net Expenditure 309,724 262,062 (47,662) 49,955 33,978 (15,977) (27,600) 48,960 (30,172) 46,397 (2,572) (2,563) Net Expenditure 71,315 50,203 (21,112) Community Safety Gross Direct Costs 81,936 57,818 (24,118) (10,346) 0 10,346 7,370 78,960 7,969 65,787 599 (13,173) Capital Charges Gross Direct Income Support Service Charges Net Expenditure Gross Direct Income Transport Gross Direct Costs Gross Direct Income Support Service Charges Gross Direct Income Support Service Charges Net Expenditure Explanation for Major Variances (£174,986) Delays in undertaking programmed sea defence works due to capacity issues as the Assistant Coastal Engineer post remains unfilled. (£3,727) Reduced expenditure on external consulting engineers as a result of more competitive pricing and reduced level of sea defence works expenditure. These underspends will be transferred to an earmarked reserve to be spent in 2012/13. Reduction in recharge from Coastal Management reflecting reduced costs. £338,184 REFFCUS (£404,062) Underspend of Pathfinder grant monies. This will be transferred to an earmarked reserve to meet continuing project expenditure. (£338,184) REFFCUS Reduction in recharge from Coastal Management reflecting reduced costs. £4,293 - Expenditure relating to the Leadership of place project. (£3,188) - LSP running costs lower than expected. (£10,000) - Grant towards Leadership of place project. (£28,144) - Residue of Ideas into Action Fund. This will be transferred to an earmarked reserve. Lower charges from Central Costs and Computer Services. £5,298 - Higher number of rail cards issued, partly offset by income. (£3,885) - Unclaimed transport grants. (£17,500) - Payments to bus operators, creditor provision no longer required in relation to previous years concessionary fares scheme. This has been transferred to the general reserve. (£2,572) - Higher number of rail cards sold. Reduced recharge from Customer Services Management Unit because of lower than anticipated expenditure. (£9,803) - Anti-social behaviour co-ordinator contribution is lower because the post was vacant for psrt of the year. (£12,807) - Projects not undertaken during the year because no grant funding awarded. £10,346 - No grant funding awarded during the year, offset by a reduction in spend in the year. No Major Variance Appendix B General Fund - Period 12 - 2011/12 Full Year Budget £ RESOURCES SERVICE AREA Full Year Actuals £ Variance Explanation for Major Variances £ CCTV Gross Direct Costs 206,615 189,041 (17,574) Capital Charges Gross Direct Income Support Service Charges 25,479 (22,696) 56,190 25,479 (20,557) 47,726 0 2,139 (8,464) Net Expenditure 265,588 241,689 (23,899) Central Costs Gross Direct Costs 187,542 44,857 (142,685) (187,542) (44,857) 142,685 0 0 0 Corporate & Democratic Core Gross Direct Costs 353,585 331,478 (22,107) Gross Direct Income Support Service Charges 0 860,440 (90) 864,220 (90) 3,780 1,214,025 1,195,608 (18,417) 748,642 845,857 97,215 0 (748,642) (10) (845,847) (10) (97,205) 0 0 0 187,455 160,188 (27,267) 0 (187,455) (159) (160,029) (159) 27,426 0 0 0 4,656,328 3,452,950 (1,203,378) Support Service Charges Net Expenditure Net Expenditure Corporate Leadership Team Gross Direct Costs Gross Direct Income Support Service Charges Net Expenditure Coastal Management Gross Direct Costs Gross Direct Income Support Service Charges Net Expenditure £3,000 - Rental to place cctv cabinet on land. (£19,128) - Cost of replacing CCTV cameras eligible for capitalisation, funded by a revenue contribution to capital. £2,139 - Fewer contributions from businesses. Lower charges from Fakenham Connect, Central Costs and Computer Services. (£142,000) - Costs not yet incurred in relation to the implementation of the pay and grading review. This has been transferred to the Organisational development reserve to be used in 2012/13 Reduced recharges to reflect lower costs in the year. (£8,514) - External audit fees lower than expected. (£8,925) - Professional fees not incurred in the year. (£3,518) - Staff travel expenses are lower than anticipated. (£2,911) - Reduced recharge from Planning. (£3,175) - Reduced recharge from Environmental Health. (£2,712) - Reduced recharge from Computer Services. (£9,241) - Reduced recharge from Accountancy and Treasury Management. £38,705 - Increased recharge from Corporate Leadership Team. (£14,944) - Reduced recharge from Legal Services. Staff savings offset by one-off restructuring costs which are funded from the restructuring reserve. This reflects the increased costs being recharged to the services supported. (£5,736) Assistant Coastal appointed. (£19,739) Reduced external consultancy fees. These be transferred to an earmarked staff costs in 2012/13. Engineer not requirement for underspends will reserve to meet Reduced recharge to reflect lower costs in the year.