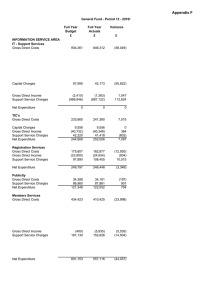

Appendix B Full Year Budget Actuals

advertisement

Appendix B SERVICE AREA SUMMARIES P12 2011-12 ENVIRONMENT SERVICE AREA Full Year Budget Full Year Actuals Variance £ £ £ Service R111A R114 R115 R117 R117B R118 R119A R120 R151 R300 R303 R304 R305 R306 R307 R308 R309 R310 R312 R314 R315 R3160 R316 R397 R412 R420 Commercial Services Rural Sewerage Schemes Travellers Licensing Street Signs Pest Control Environmental Protection Dog Control Env Health - Service Mgmt * Parks and Open Spaces Sports Centres Leisure Complexes Other Sports Recreation Grounds Arts & Entertainments Museums Pier Pavillion Foreshore (Community) Woodlands Management Cromer Pier Public Conveniences Cleansing Waste Collection And Disposal Leisure * Environmental Strategy Civil Contingencies Total Environment 559,459 335,441 97,800 118,836 33,875 31,494 626,368 91,073 0 539,161 472,724 588,774 92,125 11,839 173,452 50,509 110,887 408,414 143,445 54,411 550,982 764,493 1,626,443 0 167,193 174,662 531,737 335,441 97,800 108,040 27,633 30,324 591,751 84,667 6 462,463 472,358 593,263 76,407 15,737 170,989 50,347 103,952 410,463 157,824 39,645 567,217 758,203 1,635,515 0 143,322 160,698 (27,722) 0 0 (10,796) (6,242) (1,170) (34,617) (6,406) 6 (76,698) (366) 4,489 (15,718) 3,898 (2,463) (162) (6,935) 2,049 14,379 (14,766) 16,235 (6,290) 9,072 0 (23,871) (13,964) 7,823,860 7,625,802 (198,058) * These budgets represent the Service Management & Support Service costs for the Council. These costs are ultimately recharged in full to the final services, based on an appropriate method of allocation, for example, percentage of time spent Appendix B General Fund - Period 12 - 2011/12 Full Year Budget £ ENVIRONMENT SERVICE AREA Full Year Actuals £ Variance £ Explanation for Major Variances Commercial Services Gross Direct Costs Gross Direct Income Support Service Charges 378,283 (24,434) 205,610 371,480 (23,322) 183,579 (6,803) 1,112 (22,031) Net Expenditure 559,459 531,737 (27,722) Rural Sewerage Schemes Gross Direct Costs Net Expenditure 335,441 335,441 335,441 335,441 0 0 42,236 47,951 5,715 97,800 (42,236) 97,800 (47,951) 0 (5,715) 97,800 97,800 0 116,609 (175,183) 115,049 (172,212) (1,560) 2,971 Support Service Charges 177,410 165,203 (12,207) Net Expenditure 118,836 108,040 (10,796) Street Naming Gross Direct Costs Gross Direct Income Support Service Charges Net Expenditure 27,214 5,691 970 33,875 21,384 5,691 558 27,633 (5,830) 0 (412) (6,242) Savings associated with a current vacant post Pest Control Gross Direct Costs Gross Direct Income Support Service Charges Net Expenditure 28,274 (3,770) 6,990 31,494 27,425 (3,853) 6,752 30,324 (849) (83) (238) (1,170) No major variances No major variances No major variances Environmental Protection Gross Direct Costs 434,228 420,236 (13,992) Capital Charges Gross Direct Income 3,600 (14,230) 3,600 (18,737) 0 (4,507) Support Service Charges 202,770 186,652 (16,118) Net Expenditure 626,368 591,751 (34,617) Travellers Gross Direct Costs Capital Charges Gross Direct Income Net Expenditure Licensing Gross Direct Costs Gross Direct Income (£5,657) IAS Pension costs adjustment. No major variances Lower recharges from IT, Environmental Health and Central costs No variance £9,561 Lease expenditure charged as a Reffcus Capital charge; (£3,846) Savings in a number of supplies and services budgets (£14,515) Reffcus adjustment re Capital grant expenditure; £8,800 Contributions collected lower than budget due to a lower level of occupancy than anticipated No major variances (£4,705) Increase in taxi licensing income due to additional driver and vehicle applications; £9,382 Reduction in general licensing income due to a decline in the number of licenced premises operating Lower recharges from IT, Environmental Health and Central costs No major variances Savings in a number of demand led supplies and services budgets E.g. Air quality management, assisted burials, contaminated land and rechargeable works Reimbursement of costs associated with works in default Lower recharges from IT, Environmental Health and Central costs Appendix B General Fund - Period 12 - 2011/12 Full Year Budget £ ENVIRONMENT SERVICE AREA Dog Control Gross Direct Costs Gross Direct Income Support Service Charges Net Expenditure Full Year Actuals £ Variance £ Explanation for Major Variances 57,973 (500) 33,600 91,073 55,473 (1,666) 30,860 84,667 (2,500) (1,166) (2,740) (6,406) Env Health - Service Management Gross Direct Costs 256,486 238,376 (18,110) 12,482 (850) (268,118) 12,482 (473) (250,379) 0 377 17,739 0 6 6 Parks & Open Spaces Gross Direct Costs 484,038 462,619 (21,419) Capital Charges Gross Direct Income 27,668 (66,965) 27,668 (118,969) 0 (52,004) Capital Charges Gross Direct Income Support Service Charges Net Expenditure Support Service Charges 94,420 91,145 (3,275) Net Expenditure 539,161 462,463 (76,698) Sports Centres Gross Direct Costs 439,921 442,244 2,323 Equipment purchases not made No major variances No major variances (£2,868) IAS Pension costs adjustment; (£15,621) Savings in a number of supplies and services budgets including equipment, furniture, computer hardware and software, contributions and the out of hours service. No major variances Reduced recharges reflecting lower direct costs Annual non-contract repair and maintenance not required for playgrounds (£11,747) and grounds maintenance (£10,684). £8,440 - Income from rents and other recoverable charges. £2,088 - Grassed area deposits interest. (£32,500) - Commuted sum, Aylsham Rd North Walsham, will be transferred to grassed area deposits. (£43,900) - Norfolk Homes, will be transferred to grassed area deposits. £13,871 Expenditure relating to the Adventurous Fun and Open Spaces funded from Arts & Community Projects earmarked reserve. (£2,397) - Recharges from Leisure services lower than expected (£3,362) - Staff travel costs lower than expected. £8,937 - Condition survey at Fakenham dual use centre, partly offset by external contribution. Capital Charges Gross Direct Income 34,725 (150,622) 34,725 (137,767) 0 12,855 Support Service Charges 148,700 133,156 (15,544) Net Expenditure 472,724 472,358 (366) Leisure Complexes Gross Direct Costs 298,629 310,373 11,744 Capital Charges Gross Direct Income Support Service Charges Net Expenditure 270,835 0 19,310 588,774 270,835 (6,731) 18,786 593,263 0 (6,731) (524) 4,489 £15,993 - Sports Hall income. (£2,237) Contribution towards condition survey. Lower charges from Central Costs and Computer Services. £9,977 - Condition survey, North Walsham, partly offset by external contribution. (£6,731) - Contribution towards condition survey. No Major Variances. Appendix B General Fund - Period 12 - 2011/12 Full Year Budget £ ENVIRONMENT SERVICE AREA Full Year Actuals £ Variance £ Other Sports Gross Direct Costs 123,819 116,869 (6,950) Gross Direct Income (67,184) (71,740) (4,556) Support Service Charges 35,490 31,278 (4,212) Net Expenditure 92,125 76,407 (15,718) 9,149 12,309 3,160 520 (1,000) 3,170 11,839 520 (201) 3,109 15,737 0 799 (61) 3,898 129,502 151,017 21,515 480 (1,460) 480 (20,721) 0 (19,261) Support Service Charges Net Expenditure 44,930 173,452 40,213 170,989 (4,717) (2,463) Museums Gross Direct Costs Support Service Charges Net Expenditure 46,509 4,000 50,509 46,510 3,837 50,347 1 (163) (162) Pier Pavilion Gross Direct Costs 96,377 89,837 (6,540) Support Service Charges Net Expenditure 14,510 110,887 14,115 103,952 (395) (6,935) Foreshore Gross Direct Costs 390,534 382,399 (8,135) Gross Direct Income (14,750) (3,640) 11,110 Support Service Charges Net Expenditure 32,630 408,414 31,704 410,463 (926) 2,049 Recreation Grounds Gross Direct Costs Capital Charges Gross Direct Income Support Service Charges Net Expenditure Arts & Entertainments Gross Direct Costs Capital Charges Gross Direct Income Explanation for Major Variances (£5,571) - Free swimming initiative expenditure not incurred in the year. The balance has been carried forward for a number of projects in 2012/13. (£4,281) - Mobile gym, income from charging for facility usage. Lower charges from Central Costs and Computer Services. £2,520 - Remedial works, Sadler's Wood (works as per survey) & Warren Wood (blown tree over footpath) No Major Variances No Major Variances £3,017 - Festival leaflets. £10,152 - Concerts. £5,990 - Community music east activities contribution. (£10,782) - Contribution to concerts from orchestras live (£1,700) - Contributions towards festival leaflet production. (£6,560) - Concert ticket sales. No Major Variances No Major Variances No Major Variances (£6,050) - Repairs & maintenance costs not required in the year. No Major Variances (£9,713) - No purchase made or maintenance of memorial seats, matched by income not being received. £9,884 - No income in relation to memorial seats. (£2,524) - Government grant towards costs incurred in relation to Water Bathing Quality Regulations, this will be transferred to an earmarked reserve to offset expenditure incurred during 2012/13. £3,750 - Lower contribution towards Lifeguard service at East Runton. No Major Variances Appendix B General Fund - Period 12 - 2011/12 Full Year Budget £ ENVIRONMENT SERVICE AREA Woodlands Management Gross Direct Costs Full Year Actuals £ Variance £ Explanation for Major Variances 96,898 179,730 82,832 1,386 (42,949) 1,386 (105,212) 0 (62,263) 88,110 81,920 (6,190) Net Expenditure 143,445 157,824 14,379 Cromer Pier Gross Direct Costs Capital Charges Gross Direct Income Support Service Charges 38,417 5,232 (15,588) 26,350 26,177 5,232 (15,588) 23,824 (12,240) 0 0 (2,526) 54,411 39,645 (14,766) 428,820 451,240 22,420 70,217 70,217 0 Gross Direct Income Support Service Charges Net Expenditure (1,042) 52,987 550,982 (6,321) 52,081 567,217 (5,279) (906) 16,235 Cleansing Gross Direct Costs 776,913 773,813 (3,100) Gross Direct Income Support Service Charges Net Expenditure (34,000) 21,580 764,493 (35,553) 19,943 758,203 (1,553) (1,637) (6,290) Capital Charges Gross Direct Income Support Service Charges Net Expenditure Public Conveniences Gross Direct Costs Capital Charges £46,487 - Expenditure incurred in relation to the Access to nature project, funded by grant. Additional costs incurred as a result of theft at Holt Country park (HCP) including: £5,398 - Equipment purchases; £3,029 - Cutter & mower; £3,633 Increased security (mesh bulkhead, 2nd padlock etc), partly offset by an insurance claim. £5,317 Costs relating to (HCP) events, offset by additional income. £3,282 - Pond dredging. £3,235 - Concrete for car park extension. £4,320 Tree works at The Warren & The Links, Cromer. (£5,062) - Saving in employee costs to be used as a revenue contribution to capital to cover the additional cost of the generator at HCP. The balance consists of minor variances under £2,000. (£41,140) - Access to Nature grant. (£10,685) insurance claim received to partly offset costs. (£4,894) - HCP car park income. (£4,733) - HCP events income. Lower charges from Central Costs and Leisure Services (£12,240) - Repairs & maintenance. No Major Variances Reduced recharge from Coast Protection Management Unit because of lower than anticipated expenditure. (£1,132) - Reduced repairs and maintenance expenditure. (£1,551) - Reduced rental costs. £21,914 - Additional water and sewerage costs based on increased usage and prices. £1,425 Additional electricity costs. £1,009 - Additional vehicle costs. (£4,964) - Refund of costs following removal of Morston Quay from Kier Contract. No major variances Vacant post - retained for contractor costs in respect of minor works on dog and litter bins Recharges for dog and litter bins No major variances Appendix B General Fund - Period 12 - 2011/12 Full Year Budget £ ENVIRONMENT SERVICE AREA Full Year Actuals £ Waste Collection & Disposal Gross Direct Costs 3,728,227 Capital Charges 484,613 Gross Direct Income (2,839,877) Support Service Charges 253,480 Net Expenditure 1,626,443 Variance £ Explanation for Major Variances 3,753,123 484,613 (2,842,257) 240,036 24,896 0 (2,380) (13,444) 1,635,515 9,072 See Note A below See Note B below Lower recharges from IT, Sundry Debtors and Central costs Note A: (£2,771) Repairs to bin compounds on The Broads not spent this year. £14,879 Additional Stock purchases for garden bins. (£5,595) Saving on Kier contract - monthly variations. £20,804 Additional costs to NEWS for the processing of recyclable materials and the contribution towards the plastic sorter. £8,882 Additional costs associated with commercial recycling contamination . (£4,382) Recycling initiatives not spent this year. (£4,531) Reduced employee costs including IAS 19 Pension adjustments. (£4,160) Reduced postage costs. £2,840 Additional advertising costs offset by increased recharges. Note B: (£10,874) Additional fee income from prescribed/commercial customers and clinical waste disposal recharges. £45,818 Lower recycling credits received due to reduced tonnages of garden waste and dry recyclables being processed. (£33,932) Additional NEWS profit share as the prices for the re-sale of the materials have increased. (£2,198) Recharges to neighbouring authorities towards advertising costs Leisure Gross Direct Costs Gross Direct Income Support Service Charges 145,814 (700) (145,114) 141,609 0 (141,609) (4,205) 700 3,505 0 0 0 125,036 113,357 (11,679) 7,717 (5,000) 7,717 (13,540) 0 (8,540) 39,440 167,193 35,788 143,322 (3,652) (23,871) 73,842 70,647 (3,195) Gross Direct Income Support Service Charges 0 100,820 (26) 90,077 (26) (10,743) Net Expenditure 174,662 160,698 (13,964) 7,823,860 7,625,802 (198,058) Net Expenditure Environmental Strategy Gross Direct Costs Capital Charges Gross Direct Income Support Service Charges Net Expenditure Civil Contingencies Gross Direct Costs No Major Variances No Major Variances Reduced recharges to reflect lower costs in the year. (£14,100) Costs of evaporative cooling system to the server charged to Capital - to be funded by a compensating reserve contribution to Capital; £3,844 Staff costs associated with Green Build funded from additional event income. Sponsorship and exhibitor contributions for the Green Build event No major variances Savings in a number of small supplies and services budgets No major variances Lower recharges from IT, Environmental Health and Central costs