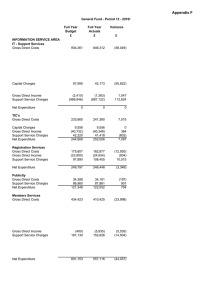

Appendix F

advertisement

Appendix F General Fund - Period 12 - 2010/11 Full Year Budget £ RESOURCES SERVICE AREA Car Parking Gross Direct Costs 590,243 Full Year Actuals £ Variance £ 586,697 (3,546) 16,320 (1,867,283) 13,843 (1,790,363) (2,477) 76,920 114,995 107,785 (7,210) (1,145,725) (1,082,038) 63,687 97,419 (71,150) 95,789 (72,291) (1,630) (1,141) Support Service Charges 28,140 26,389 (1,751) Net Expenditure 54,409 49,887 (4,522) Industrial Estates Gross Direct Costs 38,264 38,123 (142) 18,686 (93,860) 118,112 (99,865) 99,426 (6,005) 40,950 39,581 (1,369) 4,040 95,950 91,910 (50) (50) (50) (50) 0 0 85,605 86,478 873 (117,238) 57,800 26,167 (117,185) 55,867 25,160 53 (1,933) (1,007) Capital Charges Gross Direct Income Support Service Charges Net Expenditure Markets Gross Direct Costs Gross Direct Income Capital Charges Gross Direct Income Support Service Charges Net Expenditure Surveyors Allotments Gross Direct Income Net Expenditure Handyman Gross Direct Costs Gross Direct Income Support Service Charges Net Expenditure Appendix F General Fund - Period 12 - 2010/11 Full Year Budget £ RESOURCES SERVICE AREA Parklands Gross Direct Costs 28,360 Full Year Actuals £ Variance £ 16,646 (11,714) 5,050 (49,962) 5,050 (46,723) 0 3,239 22,600 6,048 21,738 (3,289) (862) (9,337) 549,364 565,999 16,635 15,000 19,593 4,593 (374,544) (388,893) (14,349) Support Service Charges 519,560 477,664 (41,896) Net Expenditure 709,380 674,363 (35,017) 33,600,954 33,754,054 153,100 24,945 (33,424,398) 24,945 (33,789,672) 0 (365,274) Support Service Charges 596,450 552,592 (43,858) Net Expenditure 797,951 541,919 (256,032) 52,390 52,390 55,074 55,074 2,684 2,684 Capital Charges Gross Direct Income Support Service Charges Net Expenditure Local Taxation Gross Direct Costs Capital Charges Gross Direct Income Benefits Gross Direct Costs Capital Charges Gross Direct Income Treasury Management Support Service Charges Net Expenditure Appendix F General Fund - Period 12 - 2010/11 Full Year Budget £ RESOURCES SERVICE AREA Discretionary Rate Relief Gross Direct Costs 68,018 Net Expenditure Non Distributed Costs Gross Direct Costs Net Expenditure Full Year Actuals £ Variance £ 56,783 (11,235) 68,018 56,783 (11,235) 0 0 (6,712,000) (6,712,000) (6,712,000) (6,712,000) Note A: This budget reflects notional charges in relation to IAS 19, pension cos Settlements and Curtailments which represents the cost of the early payment o Also included is (£6,733,000) for Past Service Costs which arise as a result of a retire early on unreduced benefits on the grounds of efficiency. This represents linked to the Consumer Prices Index (CPI) and not the Retail Prices Index (RPI the account to ensure there is no impact on the bottom line. Benefits & Revenues Management Gross Direct Costs 147,089 Gross Direct Income 0 Support Service Charges (147,089) Net Expenditure 0 150,016 (5) (150,011) 0 2,927 (5) (2,922) 0 Personnel & Payroll Support Services Gross Direct Costs 413,722 349,213 (64,509) (10,000) (403,722) (10,075) (339,138) (75) 64,584 0 0 0 Gross Direct Income Support Service Charges Net Expenditure Appendix F General Fund - Period 12 - 2010/11 Full Year Budget £ RESOURCES SERVICE AREA Administrative Buildings Gross Direct Costs Capital Charges Gross Direct Income Support Service Charges Net Expenditure Full Year Actuals £ Variance £ 523,346 118,113 (99,617) 550,126 118,113 (108,199) 26,780 0 (8,582) (489,178) 52,664 (494,364) 65,676 (5,186) 13,012 Note A - £29,369 Costs associated with clearance of Blowlands Depot and sub £3,791 Increased expenditure on premises repairs and maintenance. £10,273 A Cromer and Fakenham Connect Offices. £2,655 Additional refuse collection co £2,576 Additional costs incurred at Fakenham Connect as a result of moving te (£7,180) Reduced expenditure on equipment repairs and maintenance and con equipment rental and hire. (£3,500) Underspend on upholstery of council chairs Underspend on office structural survey being funded from the Asset Manageme legionella surveys. (£2,555) Reduction in telephone expenditure. £3,196 Additio additional income. Property Services Gross Direct Costs 444,210 466,225 22,015 Gross Direct Income (10,000) (35,000) (25,000) Support Service Charges Net Expenditure (434,210) 0 (431,225) 0 2,985 0 Corporate Finance Gross Direct Costs Capital Charges Gross Direct Income Support Service Charges 592,088 2,170 (410) (589,848) 601,004 2,170 0 (603,174) 8,916 0 410 (13,326) 4,000 0 (4,000) 287,048 (22,650) 284,856 (16,997) (2,192) 5,653 (264,398) (267,859) (3,461) 0 0 0 Net Expenditure Insurance & Risk Management Gross Direct Costs Gross Direct Income Support Service Charges Net Expenditure Appendix F General Fund - Period 12 - 2010/11 Full Year Budget £ RESOURCES SERVICE AREA Internal Audit Gross Direct Costs 131,467 Support Service Charges (131,467) Net Expenditure 0 Full Year Actuals £ Variance £ 132,154 (132,154) 0 687 (687) 0 54,300 (54,300) 0 50,728 (50,728) 0 (3,572) 3,572 0 Foreshore Gross Direct Costs 81,877 78,672 (3,205) Capital Charges Gross Direct Income Support Service Charges 7,996 (329) 67,120 7,996 (329) 63,761 0 0 (3,359) 156,664 150,100 (6,564) 9,519 11,931 2,412 Gross Direct Income Support Service Charges (2,000) 29,260 (2,000) 28,217 0 (1,043) Net Expenditure 36,779 38,148 1,369 108,963 113,540 4,577 2,900 (201,663) 2,900 (209,672) 0 (8,009) 109,010 104,915 (4,095) 19,210 11,683 (7,527) Performance Management Gross Direct Costs Support Service Charges Net Expenditure Net Expenditure Community Centres Gross Direct Costs Investment Properties Gross Direct Costs Capital Charges Gross Direct Income Support Service Charges Net Expenditure Appendix F General Fund - Period 12 - 2010/11 Full Year Budget £ RESOURCES SERVICE AREA Central Costs Gross Direct Costs 226,083 Full Year Actuals £ Variance £ 47,116 (178,967) (226,083) (47,116) 178,967 0 0 0 Corporate & Democratic Core Gross Direct Costs 376,414 365,075 (11,339) Support Service Charges 865,450 857,872 (7,578) 1,241,864 1,222,947 (18,917) 742,841 754,264 11,423 (300) (742,541) (431) (753,833) (131) (11,292) 0 0 0 2,083,809 (4,809,687) (6,893,496) Support Service Charges Net Expenditure Net Expenditure Corporate Leadership Team Gross Direct Costs Gross Direct Income Support Service Charges Net Expenditure Appendix F Explanation for Major Variances £4,229 Additional rents due on leased car parks. £1,224 Increased electricity costs. (£6,605) Reduced contract management costs. (£2,186) Reduced NNDR costs (£2,477) Reduced depreciation charges £58,868 Reduced income from pay and display car park charges. £13,277 Reduced income from excess charges. £5,902 Reduced income from season tickets. (£1,406) Additional income following increase in licence rents due on car parks. (£3,648) Reduced charge from Estates and Valuation following reduction in service costs. (£1,655) Lower recharge for legal disbursements. (£3,276) Reduced contract services costs (£1,141) Increased income from market rentals. (£1,751) Reduced charges from Estates and Valuation and Internal Audit. No major variances Reffcus - Wymans Way (£5,788) Additional income following rent reviews, extended periods of occupation and introduction of service charges on lease renegotiations. (£1,362) Reduced charges from Estates and Valuation. No major variances £1,011 Additional costs associated with overtime and standby payments. £1,010 IAS 19 pension adjustment. (£3,178) Reduction in consumable materials used. No major variances No major variances Appendix F Explanation for Major Variances (£10,765) Reduced electricity costs following invoicing on meter readings rather than estimates. (£2,458) Lower expenditure on repairs and maintenance £4,285 Reduction in electricity recharges following on from reduced expenditure on electricity. No major variances £5,987 IAS19 pension adjustment. £6,500 Additional Business Rates Software costs covered by new burdens grant. £6,722 Additional Postage costs. £4,593 Interest on NNDR Refunds greater than budgeted. (£13,485) New burdens Grant for Business Rates. £4,918 Court costs recovered lower than antcipated. (£4,593) Additional Interest payments credited through collection fund. The main explanation for this variance is reduced recharges from (£7,715) Postal and Scanning, (£9,475) Computer applications team and (£9,907) Central Costs. The balance is made up of smaller variances. £8,553 IAS19 pension adjustment. £129,678 Provison for bad and doubtful debts including bad debt write offs. £16,834 Increase in benefits payments made. (£57,499) Prior year subsidy adjustments. £11,790 Income based on draft final subsidy claim. A provision has been made against this as system reconciliations and important year end software patches had not been implemented when the draft claim was produced. (£314,751) relating to recovery of Overpaid benefits, (£27,174) of this relates to movement on the system debtor provision. Reduced recharges from Central Costs (£18,078), Fakenham Connect (£13,520) , Computer network and PCs (£9,013). No major variances. Appendix F Explanation for Major Variances The amount of relief given was less than budgeted. See Note A sts. The variance consists of £21,000 for of pension benefits as a result of redundancies. awarding added years or allowing employees to s the effect of future pension increases being I). The impact of these costs are reversed out of No major variances. No major variances. £3,698 - IAS 19 adjustment for pension costs. (£10,854) - No relocation or interview expenses have been incurred. (£48,703) - Underspend on common training budget Of this £27,000 has been carried forward and is split as follows: £12,000 on Members training to fund the cost of new Member induction and subsequent training following the District elections held in May 2011, £5,000 for the Learning Pool and £10,000 for Health & Safety Reduced recharges to reflect lower costs in the year. Appendix F Explanation for Major Variances See Note A (£6,323) Insurance claim reimbusement. (£3,384) Additional canteen income offset by expenditure on consumable purchases. £2,750 Reduction in recoverable charges from external organisations. No major variances bsequent depot issues, not eligible for capitalising. Additional utilities expenditure in relation to the osts. (£2,497) Reduced contract cleaning costs. enants from Fakenham Community Centre. nsumable materials. (£6,876) Reduction in s - requested for carry forward to 2011/12. (£8,125) ent Reserve. £3,541 Additional expenditure on onal canteen consumables purchases offset by £4,765 IAS 19 pension adjustment. £4,940 Additional costs mainly due to turnover savings not achieved. (£1,500) Reduced training costs. (£1,398) Reduced travelling expenses. £2,252 Surveyors / Agents fees for Bridge Street Fakenham. £8,508 Additional costs relating to Leadership of Place, offset by grant income. (£25,000) Additional grant income in relation to Leadership of Place. The balance of this is fully committed and has therefore been carried forward in 2011/12 in an earmarked reserve. No major variances £6,334 IAS 19 pension adjustment. Increase in direct costs recharged on to final services. (£4,229) - Saving in salaries and oncosts £5,654 - Work undertaken for Great Yarmouth Borough Council ceased before the end of the financial year. Higher recharges to reflect higher costs in the year. Appendix F Explanation for Major Variances No Major Variances No Major Variances No Major Variances No Major Variances £5,202 Additional repairs and maintenance expenditure. (£3,613) Reduction in grounds maintenance charges. (£1,630) Reduced expenditure on materials consumables. (£1,714) Reduced expenditure on water and sewerage. No major variances No major variances (£1,643) Reduced recharge from Estates and Valuation £3,024 Essential repairs and maintenance and professional fees expenditure in relation to Fakenham Community Centre (£1,053) Reduced recharge from Estates and Valuation £2,167 Additional repairs and maintenance expenditure incurred in year. £3,661 Professional fees incurred, partially offset by increase in recoverable charges. (£10,405) Additional recoverable income following the introduction of service charges for common parts at the Rocket House. (£2,830) Professional fee expenditure recoverable from contractor. £4,552 Reduction in standard recovery of utilities expenditure as a result of over provision in previous years. £1,973 Reduction in rental income following lease changes, together with additional licences being issued. (£3,504) Reduced recharge from Estates and Valuation Appendix F Explanation for Major Variances (£90,000) - One off implications of pay and grading funded from Organisational Development Reserve (previously carried forward from 2009/10). (£90,000) - Pay and grading implications, budget previously assumed implementation costs in 2010/11, not yet implemented and therefore still requirement of this pending finalisation of model. Reduced recharges to reflect lower costs in the year. (£6,219) - External audit fees. The balance consists of minor variances under £2,000 £3,941 - Higher Treasury Management costs reflecting higher bank charges. (£4,517) - Lower recharges from Customer Services. £6,058 Higher Internal Audit recharges. (£10,941) - Lower recharges from Legal Services. £9,379 IAS 19 pension adjustment. £4,501 Turnover savings not made. This is offset by a number of minor variances under supplies and services. No major variances. Increased expenditure recharged out to services.