Document 12926178

advertisement

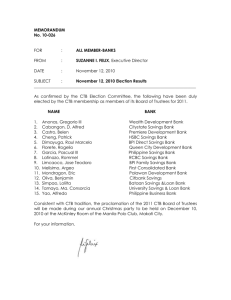

Please Contact: Emma Denny Please email: emma.denny@north-norfolk.gov.uk Please Direct Dial on: 01263 516010 14 January 2013 A special meeting of the North Norfolk District Council will be held in the Council Chamber at the Council Offices, Holt Road, Cromer on Wednesday 23 January 2013 at 6.00 p.m. Sheila Oxtoby Chief Executive To: All Members of the Council Members of the Management Team, appropriate Officers, Press and Public. If you have any special requirements in order to attend this meeting, please let us know in advance If you would like any document in large print, audio, Braille, alternative format or in a different language please contact us Chief Executive: Sheila Oxtoby Corporate Directors: Nick Baker and Steve Blatch Tel 01263 513811 Fax 01263 515042 Minicom 01263 516005 Email districtcouncil@north-norfolk.gov.uk Web site northnorfolk.org AGENDA 1. PRAYER Led by Reverend Derek Earis, St Nicholas Parish Church, North Walsham. 2. TO RECEIVE DECLARATIONS OF INTERESTS FROM MEMBERS Members are asked at this stage to declare any interests that they may have in any of the following items on the agenda. The Code of Conduct for Members requires that declarations include the nature of the interest and whether it is a disclosable pecuniary interest. 3. APOLOGIES FOR ABSENCE To receive apologies for absence, if any. 4. PUBLIC QUESTIONS To consider any questions received from members of the public. 5. COUNCIL TAX SUPPORT SCHEME 2013/14 (page 1) (Appendix A – p.7) (Appendix B –electronic only) (Appendix C – p.8) (Appendix C2 – p.16) Please note that Appendix B is very large – printed copies are available on request from Democratic Services and will be provided at the meeting Summary: On the 1st November the Local Government Finance Bill received Royal Assent. The Act includes a requirement for each billing authority in England to develop its own Local Council Tax Support Scheme which must be agreed by full Council before 31st January 2013 for implementation on 1 April 2013. Conclusions: That the Council adopt a Local Council Tax Support Scheme that meets the criteria for the transitional funding that was announced in October 2012.The scheme would enable a maximum award of 91.5% of a person’s council tax liability for those people currently in receipt of 100% Council Tax Benefit. Recommendations: Cabinet recommend to Full Council the Local Council Tax Support as set out in this report (option 3). Reasons for Recommendations: Legislation requires a Council Tax Support Scheme to be agreed by full Council by the 31 January 2013 prior to implementation of the scheme on 1 April 2013. LIST OF BACKGROUND PAPERS AS REQUIRED BY LAW (Papers relied on to write the report, which do not contain exempt information and which are not published elsewhere) Localising Support for Council Tax – Transitional grant scheme https://www.gov.uk/government/publications/localising-support-for-council-taxtransitional-grant-scheme Cabinet Member(s) Wards affected: Contact Officer, Telephone no & email: Cllr W Northam All Louise Wolsey 01263 516081, louise.wolsey@north-norfolk.gov.uk 6. DETERMINATION OF COUNCIL TAX DISCOUNTS AND LEVEL OF CHARGES FOR 2013/14 (Cabinet Agenda - 7 January 2013) (Cabinet Agenda - p. 31) Summary: The Local Government Finance Act 2012 includes a number of reforms in relation to council tax exemptions, discounts and the introduction of the empty property premium. The reforms give councils new flexibilities to vary council tax on second homes and empty dwellings which offer the opportunity to raise additional revenue as well as encouraging empty properties to be brought back into use. This report recommends changes to discount levels and the adoption of an empty property premium to take advantage of the new areas of discretion and recommends all discounts Options considered: that will apply for 2013/14. The determinations and decisions set out in this paper come into effect on 1 April 2013 for the financial year 1 April 2013 to 31 March 2014. They are made by the Council under sections 11, 11A, 11B, and of the Local Government Finance Act 1992 and other enabling powers. References to the Local Government Finance Act 1992 include references to Regulations made under that Act. Conclusions: The Council Tax reforms as included within the Local Government Finance Act 2012 provide greater flexibility for Local Authorities to set levels of discounts on second homes and empty dwellings to generate both revenue streams and incentives to bring empty properties back into use. The Council has to approve its determinations for each financial year. The calculation of the tax base for 2013/14 will be made on the assumption that the determinations recommended below will apply. Recommendations: 1 That Cabinet recommend that Council Resolve that under section 11A of the Local Government Finance Act 1992, and in accordance with the provisions of the Local Government Finance Act 2012 and other enabling powers that: (i) the council tax discount for dwellings defined as being within Class ‘A’ remains at 50% for the year 2013/14 (report para.3.4); (ii) the council tax discount for dwellings defined as being within Class ‘B’ be reduced to 5% for the year 2013/14 with the exceptions of (report para. 3.4): (a) those dwellings that are specifically identified under regulation 6 of the Council Tax (Prescribed Classes of Dwellings)(England) Regulations 2003, which will retain the 50% discount; and (b) those dwellings described or geographically defined at Appendix D which in the reasonable opinion of the Head of Finance are judged not to be structurally capable of occupation all year round and were built before the restrictions of seasonal usage were introduced by the Town and Country Planning Act 1947, will retain the 50% discount. (iii) The council tax discount for dwellings defined as being within Class ‘C’ to be set at 100% for three months for the year 2013/14 (report para. 3.3) (iv) The council tax discount for Class D properties to act as an incentive to bring them back into use is recommended to be a discount of 50% for a maximum of 12 months (report para.3.2) 2 That Cabinet recommend that Council Resolve that under section 11B(2) of the Local Government Finance Act 1992, and in accordance with the provisions of the Local Government Finance Act 2012 and other enabling powers that: (i) A premium is charged for properties which have been empty and substantially unfurnished for two years or more of 50% of the council tax payable in relation to that home. 3 Reasons for Recommendations: In accordance with the relevant legislation these determinations shall be published in at least one newspaper circulating in North Norfolk before the end of the period of 21 days beginning with the date of the determinations. To recommend for approval the Council Tax discount and premium determinations to come into effect from 1 April 2013. To raise additional council tax revenue and to encourage properties to be brought back into use. Cllr W Northam All Karen Sly 01263 516243 Karen.sly@north-norfolk.gov.uk Cabinet Member(s) Wards affected: Contact Officer, Telephone no & email: 7. DETERMINATION OF THE COUNCIL TAX BASE FOR 2013/14 AND THE TREATMENT OF SPECIAL EXPENSES (page 17) Summary: The purpose of this report is to determine the Council’s 2013/14 tax base and the 2013/14 tax base for each parish in accordance with the legal requirements. Options considered: N/A Conclusions: The determination of the tax base for a financial year has to be undertaken in accordance with legislative requirements between 1 December and 31 January of the preceding financial year. Recommendations: a) That the calculations set out in this report used to produce the Council’s tax base be approved, and the tax base for 2013/14 be determined as 36,411; b) That the tax base for each parish area for the financial year 2013/14 be as set out at paragraph 2.1. Reasons for Recommendations: To determine the 2013/14 Council Tax Base in accordance with legislative requirements and to inform the 2013/14 budget setting process. Cabinet Member(s) Wards affected: Contact Officer, Telephone no & email: 8. Cllr W Northam All Karen Sly 01263 516243 Karen.sly@north-norfolk.gov.uk NATIONAL NON-DOMESTIC RATES – NNDR1 RETURN (page 23) (Appendix D – p.26) Summary: The purpose of this report is to seek delegated authority for approval of the final National Non-Domestic Rates (NNDR1) form to be given to the Section 151 Officer. A provisional form was required to be submitted by 7 January, the deadline for the final version is 31 January 2013. Conclusions: The completion of the NNDR1 allows the Council to calculate the expected income in respect of business rates for the year 2013/14. The Council will retain a proportion of this income from 2013/14 onwards. Recommendations: It is recommended that Members note the provisional NNDR1 form (Appendix D) and that delegated authority for approval of the final form be given to the Section 151 Officer. Reasons for Recommendations: To ensure that the final NNDR1 form can be submitted based on the latest information and guidance. LIST OF BACKGROUND PAPERS AS REQUIRED BY LAW (Papers relied on to write the report, which do not contain exempt information and which are not published elsewhere) NNDR1 papers and supporting data. Cabinet Member(s) Wards affected: Contact Officer, Telephone no & email: 9. Cllr W Northam All Karen Sly 01263 516243 Karen.sly@north-norfolk.gov.uk COUNCIL TAX SETTING COMMITTEE 2013/14 (page 28) Summary: The deadlines for setting the combined council tax for 2013/14 conflict with the dates for Full Council. In these conditions there is a statutory facility to enable the combined council tax to be set by a Committee established for the purpose. Options considered: Arranging a special full council meeting for a time and date after the final major preceptor has set their budget. This option is not really feasible due to the time. Conclusions: The use of the legislative provision of the 1992 Local Government Finance Act will allow the Full Council to discharge its obligations in setting the Council Tax for 2013/14. The committee identified to be established will meet for a single purpose and then be disbanded. Recommendations: It is recommended that: a) A Combined Council Tax Setting Committee be established with five Members to set the combined council tax for 2013/14; b) Delegation be given to the Chief Executive to appoint named members and named substitutes in consultation with the Group Leaders to the Committee; b) Full Council delegates to this committee the setting of the Combined Council Tax for 2013/14 for the County Council, the Police, North Norfolk District Council and the Parish and Town Councils of the billing authority area. Reasons for Recommendations: Cabinet Member(s) Wards affected: Contact Officer, Telephone no & email: To enable the setting of the combined Council Tax for 2013/14 on a timely basis once the final precept has been set. Cllr W Northam All Karen Sly 01263 516243 Karen.sly@north-norfolk.gov.uk 10. EXCLUSION OF PRESS AND PUBLIC To pass the following resolution – if necessary: “That under Section 100A(4) of the Local Government Act 1972 the press and public be excluded from the meeting for the following item(s) of business on the grounds that they involve the likely disclosure of exempt information as defined in paragraph(s) _ of Part 1 of Schedule 12A (as amended) to the Act.” 11. PRIVATE BUSINESS Circulation: All Members of the Council. Members of the Management Team and other appropriate Officers. Press and Public Agenda Item No______5_____ Local Council Tax Support Scheme 2013/14 Summary: On the 1st November the Local Government Finance Bill received Royal Assent. The Act includes a requirement for each billing authority in England to develop its own Local Council Tax Support Scheme which must be agreed by full Council before 31st January 2013 for implementation on 1 April 2013. Conclusions: That the Council adopt a Local Council Tax Support Scheme that meets the criteria for the transitional funding that was announced in October 2012.The scheme would enable a maximum award of 91.5% of a person’s council tax liability for those people currently in receipt of 100% Council Tax Benefit. Recommendations: Cabinet recommend to Full Council the Local Council Tax Support as set out in this report (option 3). Reasons for Recommendations: Legislation requires a Council Tax Support Scheme to be agreed by full Council by the 31 January 2013 prior to implementation of the scheme on 1 April 2013. LIST OF BACKGROUND PAPERS AS REQUIRED BY LAW (Papers relied on to write the report, which do not contain exempt information and which are not published elsewhere) Cabinet Report 16 July 2012 Local Government Finance Act Localising Support for Council Tax – Transitional grant scheme https://www.gov.uk/government/publications/localising-support-for-council-taxtransitional-grant-scheme Cabinet Member(s) Ward(s) affected Cllr W Northam Contact Officer, telephone number and email: 1 1. Introduction 1.1 Government legislation has abolished Council Tax Benefit (CTB) from the 1 April 2013. All Councils are required to implement new arrangements to replace CTB with the expectation that government support for the new scheme would reduce by 10%. The new scheme is called the Council Tax Support Scheme (CTS). This change is part of a wider set of welfare reforms currently being implemented. The scheme is intended to work closely within the framework of the national welfare reform. 1.2 Cabinet received a report at its meeting on the 16 July 2012 detailing the changes being introduced to the Council Tax Benefits (CTB) system and how the scheme would be funded in future, essentially moving from a scheme funded 100% from Department for Work and Pensions Subsidy to a scheme funded by government grant (base funding) and local discounts. Indicative base funding grants were announced earlier in 2012, the provisional figures for 2013/14 are expected in late December as part of the provisional finance settlement announcements. 1.3 The Government determined that pensioners should be protected from the impacts of these reforms and has developed prescribed scheme to ensure that pensioners are not adversely affected by these reforms. 1.4 The Government has provided a default scheme that will be applied to all Councils where the Council has not implemented its own CTS Scheme by the 31 January 2013. The provisions of the default scheme are that it broadly reflects the requirements of the existing CTB scheme and would deliver similar outcomes for recipients of CTB as they receive now. Whilst this would minimise the impacts of the changes it would mean that the Council and precepting bodies would have a loss of income equal to the cut in the Government grant in excess of 10% of prior CTB expenditure. 2. Background 2.1 A politically balanced working party was set up in July 2012 to consider options for a local scheme for North Norfolk District Council. It was initially proposed that Norfolk wide scheme be developed. The Norfolk Authorities and other precepting bodies have agreed that given the authorities different demographics and financial positions that it will not be possible to have one scheme for Norfolk. It was agreed that the local schemes would be selffinancing. 2.2 A draft scheme was proposed and a comprehensive consultation process with local residents took place during September and early October 2012 through a wide range of methods. These included a mail shot to over 4,000 people who currently receive CTB, drop in session, electronic and paper surveys, press and web publicity and consultation with organisations in the district that support the most vulnerable. 2.3 The draft scheme proposed that claimants, other than pensioners, would have seen their council tax support reduced by 30%. 2.4 In October 2012 the Department for Communities and Local Governments published a transitional grant scheme for Localising Support for Council Tax1 to help fund part of the cost of a local CTS scheme for 2013/14. The Government has set aside £100m which may be applied for by billing 1 https://www.gov.uk/government/publications/localising-support-for-council-tax-transitional-grantscheme 2 authorities (on behalf of the billing authorities and major precepting authorities) after 31 January 2013. Payment of grant monies will be made in a single instalment in March 2103. The breakdown of the grant is as below for North Norfolk. 2.5 Authority Transitional Grant Amount North Norfolk District Council 22,740 Norfolk County Council 147,893 Norfolk Police Authority 25,434 Total 2.6 £196,067 To apply for the grant, billing authorities must adopt schemes which ensure that; • Those who would be entitled to 100% support under the current CTB arrangements pay between zero and no more than 8.5% of their net council tax liability; • The taper rate does not increase above 25%; • There is no sharp reduction in support for those entering work 2.7 The funding is described as transitional funding and therefore has to be assumed it is a one off payment for 2013/14 only. The scheme would need to be amended in the second year or funding identified elsewhere, to fill the gap in future years. 3. Council Tax Support Scheme Options 3.1 The Government’s ‘transitional scheme’ would prevent the Council implementing some CTS options being considered in the first year, such as changes to savings limits, removal of second adult rebates allowances, and a 70% ceiling for CTS. This is because these options would result in Council Tax increases for some individuals in excess of the Government’s 8.5% scheme limit. 3.2 There are three main options for the Council to consider; 1) Adopt the Governments default scheme and subsequent loss of revenue for all precepting bodies of at least 10%. 2) To develop a local scheme without recourse to the transitional grant and the conditions attached to the grant. The Council would be free to include the CTS options outlined in 3.1. The scheme would be selffinancing. 3) To develop a CTS scheme eligible for government transitional funding but which limits the Council Tax increase to no more than 8.5% for those currently receiving 100% CTB. 3.3 Under separate legislative changes to Council Tax exemptions and discounts Councils have discretion to change the level of discount awarded to Empty 3 Homes and Second Homes. The details of proposed changes and financial implications are included as a separate item on this agenda. The additional revenue from these changes could be used to support the loss of funding supporting a CTS scheme. 3.4 The table attached at Appendix A sets out the overall impacts of the three options including revenues from changes to discounts and exemptions and the Government Grant. 3.5 In relation to the town and parish councils NNDC will receive the base funding grant and the transitional grant which are intended to be passed to the town and parish councils. Initially the Government proposed that the local preceptors (parishes) would not have their tax base reduced by local CTS, ie two tax base calculations would be required, which would provide certainty of funding for the parishes. This proposal was changed in late November when the Government announced their response to this consultation which states that only one tax base calculation would be required, i.e. a reduced tax base for all2. 3.6 The council tax base for parishes will now reflect the changes for the CTS scheme and the respective grant for the parishes will be allocated accordingly. It is estimated that the shortfall for the parishes will be approximately £26,000 and due to the transitional arrangements for the scheme these costs will be funded by the district. 4 Scheme Administration 4.1 Administration of the scheme is set out in S13a and Schedule 1a of the Local Government Finance Act 1992 and a copy of the Local scheme for NNDC is attached at Appendix B (Council Tax Reduction Scheme. S13a and Schedule 1a of the Local Government Finance Act 1992). 4.2 The Council may administer Housing Benefit and other welfare payments and discretionary payments alongside the administration and management of Local Council Tax Support. 4.3 Personal data obtained by the Council for the purposes of processing or managing Local Council Tax Support may be shared in relation to Housing Benefit, Discretionary Housing Payments or any other fund administered undersection13A of the Local Government Finance Act 1992. 4.4 Personal data obtained by the Council for the purposes of processing or managing Local Council Tax Support may be shared with any other body where: 4.5 2 • The data subject (or their representative) provides formal consent; • It is in the beneficial interest of the data subject to do so; • To prevent fraud; • The law permits sharing of data, (for example to prevent or detect a crime). Persons in receipt of Local council Tax support shall be deemed to be in receipt of a means tested entitlement for the purposes of any council policy https://www.gov.uk/government/consultations/localising-support-for-council-tax-council-tax-base 4 where entitlement under the that policy was linked to the receipt of Council Tax Benefit. 5 Conclusion 5.1 It is recommended that Option 3 be adopted. This takes into consideration the feedback that was received when the scheme as outlined in 3.1 was consulted on. Feedback from the consultation supported the view that we should protect those on lowest incomes and this is reflected in the proposed option. This scheme would ensure compliance with the Governments wider aims including protecting vulnerable people, making work pay and integrating the new CTS scheme with the introduction of Universal Credit. 6. Financial Implications and Risks 6.1 The financial implications are detailed within section 3 and Appendix A to the report. The risk of funding shortfalls is shared across the major preceptors in proportion to their share of the Council tax bill. After taking account of the transitional grant and indicative base funding and potential additional revenue from the proposed reforms to council tax discounts, the costs to the major preceptors is estimated to be: Major Preceptor £000 NNDC 18 Norfolk County Council 120 Norfolk Police Authority 21 Total 158 6.2 The decision as to how to fund the gap is an individual one for each precepting body to consider. 6.3 The Council consulted on a scheme that differs from the scheme now being recommended in that the scheme now being proposed is a more generous scheme to individuals. By recommending a scheme that is eligible for the transitional grant, this reduces the minimum a customer would be expected to pay from the consulted scheme of 30%,to 8.5%. With a significantly lower percentage that is more favorable to customers, it is considered that the risk associated any challenge to the scheme is low. Feedback from the consultation supported the view that we should protect those on lowest incomes and this is reflected in the proposed option. 6.4 If the Council reduces the level of benefit in payment it will have additional income to collect from some of the most vulnerable households in the District, with a risk that this money will not be recoverable. The proposed option reduces this risk from that of the original scheme consulted on. The Council will also have additional income to collect from customers who previously had an exemption or a higher level of discount, with the potential risk of failing to collect this money. 6.5 The estimates relating to the changes in discounts and exemptions on empty properties are based on historical data. Trends can change with a 5 subsequent positive or negative impact on the Tax Base. Estimates for the CTS Scheme have been based on current caseload, with some provision for growth. Regulations regarding the changes and other welfare reforms changes may affect the CTS Scheme e.g. Universal Credit, have yet to be passed. 6.6 The annual billing processes may be adversely affected if the key scheme principles are not prescribed before January 2013 as this will limit time for testing and development of software and narrow the time for training of staff. It will also restrict available time to provide relevant information to members of the public who will be affected by these reforms. 6.7 One of the main changes required to enable the new scheme to operate is to update the current software on the revenues and benefits system. One-off new burdens grants have been made available and it is anticipated that these will more than cover the associated software costs. 6.8 The Council does hold earmarked and a general reserve which can be used as a one-off to mitigate the impact on the Council’s budget of any shortfall resulting from the scheme in the short term. 7. Sustainability No significant impact 8. Equality and Diversity 8.1 Consultation was undertaken to assist with the proposals for the new scheme. The Equality Impact Assessment for the scheme now being recommended is attached at Appendix C 9. Section 17 Crime and Disorder considerations No significant impact 6 Local Council Tax Support - Options Appendix A Financial Implications - Local Council Tax Support Scheme £000 Estimated shortfall from introduction of Local Council Tax Support Scheme (based on indicative grant amounts) 1,094 Cost of Option 1,094 Option 1 - No Change, retain current scheme Cost allocated across Major Preceptors (Based on current Council Tax) NNDC 11.6% County 75.4% Police 13.0% Total 100.0% 127 825 142 1,094 Option 2 - Fully funded scheme from reductions in support (consulted scheme) - This options assumes a fully funded scheme and therefore the estimated impact would be nil as a direct impact, although there would implications in terms of funding hardship/writing off and this would have an impact on the collection fund for all the major preceptors. Option 3 - Scheme that meets the Government criteria for transiational grant funding Estimated Cost Transitional Grant (share of £100m): 1,094 NNDC County Police (23) (148) (25) (196) Scheme Reductions (as per Governments criteria) ie Council Tax generated Shortfall Cost allocated across Major Preceptors: NNDC County Police Total 593 11.6% 75.4% 13.0% 100.0% Council Tax Reforms - Gross Additional Income (Estimate): Second Homes (retaining 5% discount) * Empty Properties undergoing major repairs Vacant Dwellings - 100% discount for 3 months then zero Empty Homes Premium (150% of full charge after 2 years) Total Revised Shortfall after application of Council Tax Reforms Cost allocated across Major Preceptors: NNDC County Police Total (304) 11.6% 75.4% 13.0% 100.0% 7 69 448 77 593 (262) (55) (32) (86) (435) 158.46 18 120 21 158 EQUALITY IMPACT ASSESSMENT FORM Appendix C What are you completing this impact assessment for? Introduction of the Localisation of Council Tax Support At what stage are you completing the impact assessment? Localisation of Council Tax Support The Government intends to introduce legislation to reduce the Council Tax Benefit (CTB) grant to local authorities (LA) by 10%. LAs will be required to design a local scheme or use the default scheme based on council tax benefit. Using the default scheme would give a shortfall in funding in real terms of £1.094m. This shortfall cannot in totality be funded by Norfolk County Council, the Police Authority and North Norfolk District council (NNDC). In 2011/12 The cost of CTB for NNDC was £8,200,981, of which 100% was funded by central government. The costs will also be fully funded for 2012/13. The new scheme will be funded locally and the costs have taken into account the indicative grant from government (reduction of 11.4%) and estimated growth. The EIA assesses the proposed local Council Tax Support (CTS) scheme for NNDC. A politically balanced working party was set up in July 2012 to consider options for a local scheme for NNDC. A draft scheme was proposed. A comprehensive consultation process with local residents took place during September and early October 2012 through a wide range of methods. The draft scheme proposed that claimants, other than pensioners, would have seen their council tax support reduced by 30%. In October 2012 the Government announced ‘transitional funding’ for 2013/14 to help fund part of the cost of a local CTS scheme. A scheme has been developed which meets the Governments criteria to enable NNDC to apply for the transitional funding limiting the Council Tax increase to no more than 8.5% This option is being recommended to NNDC Cabinet on Monday 7th January 2013. Section 1 – Aims & Objectives. Aims The national Council Tax Benefit (CTB) scheme comes to an end on 1st April 2013 and is to be replaced by a locally determined system of CTS. The funding available for the new scheme will be cash limited. The aim of the new support scheme is to provide financial assistance to council taxpayers who have low incomes. Persons who are of state pension age (a minimum 60 years or greater) are protected under the scheme in that the calculation of the support they are to receive has been set by Central Government. For working age applicants however the support they receive is to be determined by the local authority. Version 1 – February 2011 8 EQUALITY IMPACT ASSESSMENT FORM Appendix C Number of Council Tax Benefit Recipients as at October 2012 No of CTB Claims % Pension Age CTB Working Age CTB Total 5925 4553 10478* 57% 43% 100% No in receipt of full CTB 5362 3152 8514 90.5% 69.0% 81.3% • This fig represents those people receiving or having received CTB in 2012. • National statistics January 2011 11.38% pension age and 62% working age. Objectives of the Scheme The objective of the new scheme is to successfully implement a scheme of support for low‐ income council taxpayers which will successfully replace the existing CTB scheme. The scheme recommended to Cabinet on the 7th January 2013 is to adopt a scheme that limits a Council Tax increase to no more than 8.5% for those currently receiving 100% CTB. In accordance with Government guidance. Administration of the scheme is set out in Sec13a and Shedule1a of the Local Government Finance Act 1992 and a copy of the scheme is attached as Appendix B to the Cabinet report) It is anticipated that the level of support given to pension age claimants will continue at the same level or more. The schemes will be means tested and as far as possible replicate the current Council Tax Benefit scheme. The desired outcomes are as follows; Pension Age Claimants • That existing pensioner claimants for Council Tax Benefit (up until 31st March 2013) are successfully transferred to the new Council Tax Support scheme; • That all pensioners receive the level of support required by regulations set by Central Government (Council Tax Reduction Scheme (Prescribed Requirements) Regulations 2012); • That all new pensioner claimants or existing working age claimants who rise to pension age are able to receive Council Tax Version 1 – February 2011 9 EQUALITY IMPACT ASSESSMENT FORM Appendix C • support in line with the regulations; and That all pensioner claimants continue to receive the correct level of support at all times. Working Age Claimants Working Age Claimants • That the working age claimants who currently claim CCTB (up until 31st March 2013) are successfully transferred to the new CTS scheme; • That all new working age claimants are able to receive CTS in line with Council policy; and • That they continue to receive the correct level of support at all times. There are a number of factors which will contribute to the outcomes of the new process namely; • That the new CTS scheme broadly replicates the existing CTB scheme for pension age. • That management and staff are experienced in delivering means tested support / benefit schemes; and • That there is a comprehensive project plan, which ensures that delivery of the new scheme, will be on time and in line with legislative requirements. The factors / forces that could detract from these outcomes are as follows; • The failure of Central Government to approve the necessary legislation on time; • The tight timescales for implementation of the new scheme; • The failure of the Council’s software suppliers to deliver the necessary changes to existing software systems to enable the correct processing of the new support; and • The failure to deliver these significant changes to the welfare benefit system on time and within budget. Version 1 – February 2011 10 EQUALITY IMPACT ASSESSMENT FORM Appendix C Section 2A – Groups that may be affected by the proposed changes to CTB The main group affected by the changes will be existing working age claimants who will see a reduction in support from 1st April 2013 Working Age – Family Type Family Type No of Claims % No in % of no of receipt of claims full CTB Single Households 1712 37.6% 1217 71% Couples 414 30.4% 281 68% Families 1044 23.0% 672 64% Lone Parents 1383 9.0% 982 71% Total 4553 100% 3152 69% Approximately 69% of those people receiving CTB are not/were not paying council tax. Section 2B – what is the potential impact on the different groups disability, gender, race, age, faith and belief and sexual orientation) Under the proposed scheme, everyone of working age applying for CTS must pay 8.5% of their council tax. This represents a new or increased bill payable by working age people on low incomes and/or receiving state benefits. The impact for all groups could potentially be additional pressure on household incomes, at a time when other welfare benefits are being reduced – i.e. size restriction, benefit cap, personal independence payments. This could lead to an increase in indebtness, unpaid council tax, rents which could lead to an increase in homelessness. Average Band D property – Annual Charge 8.5% Band Full Council Tax Bill Version 1 – February 2011 11 EQUALITY IMPACT ASSESSMENT FORM Appendix C D 1,518.06 129.04 Race ‐ There is no differential impact due to race Gender ‐ There is no differential impact due to gender Transgender / Transsexual ‐ There is no differential impact due to a person being transgender or transsexual Disability ‐ This policy change to Council Tax Support should not affect the overall level of support to pension age claimants – however for working age claimants where there is a disability, this could potentially reduce the level of support given as a result of the proposed maximum award of 91.5% of a person’s council tax liability for those people currently receiving 100% CTB. Disabled premiums /allowances and disregarded income rules under CTB will be applied in the same way in CTS. Sexual Orientation ‐ There is no differential impact due to sexual orientation Age ‐ This policy change to Council Tax Support should not affect the overall level of support to pension age claimants – however there is a differential impact due to age; for working age applicants however the support they receive would be reduced. Religious belief ‐ There is no differential impact due to religious belief Gypsies & Travellers ‐ The change to Council Tax Support should not affect the overall level of support to pension age claimants and there is no differential impact due gypsies or travellers Persons with dependants and caring responsibilities ‐ The change to Council Tax Support should not affect the overall level of support to pension age claimants. Carers premium rules under CTB will be applied to CTS. Persons with an offending past ‐ there is no differential impact due having an offending past Impact on children and vulnerable adults ‐ The change to Council Tax Support should not affect the overall level of support to pension age claimants and where there are children or vulnerable adults, all protections built into the Council Tax Benefit scheme that has been Version 1 – February 2011 12 EQUALITY IMPACT ASSESSMENT FORM Appendix C in place since 1993 remain under the new scheme. This includes the income disregard of Child Benefit. Across equality strands ‐ there is no differential impact identified that cut across equality strands The proposed scheme retains several types of ‘premiums’ which allow appropriate levels of support to be awarded for disabled people, carers and those with disable children. The premiums reflect the additional living costs incurred by disabled people and do not specially mitigate the impact of having to pay additional Council Tax. The LA is aware of its responsibilities in relation to: • The child poverty act 2012 which imposes a duty to have regard to and address child poverty. • The disabled persons (services, consultation and representation )Act 1986 and Chronically sick and disabled person Act 1971, which include duties relating to the welfare needs of disabled people • The housing act 1996,which gives LA’s a duty to prevent homelessness with special regard to vulnerable groups Appendix 2 – Illustrative scenarios Section 3 – Evidence and data used for assessment DCLG have already completed and impact assessment for the implementation of CTS www.communities.gov.uk/localgovernment/localgovernementfinance/counciltax/counciltaxsupport All major precepting authorities have been consulted on the implementation of the new Council Tax Support scheme. A full consultation with the public was carried out on a draft scheme which was self‐financing, proposed prior to the Government’s announcement about the transitional funding. This scheme saw the removal of second adult rebate allowances, changes to savings limits increased non‐dependent charges and a ceiling of 70% for CTS support. Whilst pension age claimants are protected, the authority was still, as part of the consultation process, looking to pension age claimants and pensioners generally to respond to the consultation itself. In respect of working age claimants, it was essential to consult with the group as, being of working age, they are directly affected by any changes decided by the Council. Version 1 – February 2011 13 EQUALITY IMPACT ASSESSMENT FORM Appendix C The consultation process was comprehensive and encouraged a full response to the new support scheme itself (notwithstanding the fact that the authority is obliged to implement the scheme determined by Central Government for pension age claimants). Interest groups were also be directly consulted as part of the process. Public consultation took place during the period 27/08/2012 until 14/10/2012 Consultation Process • Mail shot over 4,000 working age claimants currently in receipt of CTB • Drop in sessions at the two main NNDC offices – advertised on the web /leaflets and posters • Electronic and paper surveys • Press and web publicity • Consultation in the district with organisations in the district that support the most vulnerable All the figures in the document are indicative only. They have been extracted from data held for the purposes of administering Council Tax Benefit and do not necessarily give a complete profile of people affected by the proposed scheme. The case load and its profile change as new claims and changes are received daily. Section 4 – Conclusions drawn from the consultation process The majority of the respondents disagreed or strongly disagreed with the initial scheme that was proposed. Comments received indicated that the 70% maximum support allowable would cause financial hardship to many of the respondents. Section 5 – List any comments, criticisms or alternative approaches regarding the impact of the introduction of the proposed CTS scheme With the late announcement of transitional funding officers were asked to consider a scheme that would meet the Governments Version 1 – February 2011 14 EQUALITY IMPACT ASSESSMENT FORM Appendix C criteria to enable access to the funding, mitigating some of the effects of the initial scheme proposal . A review of the budgetary implications of the precepting bodies funding any funding shortfall through the use of the additional revenue receipts from the technical reforms to council tax discounts and exemptions was to be considered. The Debt Management policy will be reviewed to ensure it reflects the changes to the CTB scheme. Section 6 – How will the assessment, consultation and outcomes be published and communicated? The EIA will be available on the web. Completed 18/12/12 by/date: Signed off Louise Wolsey by/date: Version 1 – February 2011 15 Appendix C2 Appendix 2 – EIA Maximum Benefit restricted to 91.5% of CT liability (8.5% restriction) Household: Single Person over 25 Income: Income Support . The Council Tax liability is £770.14. The household currently receives £770.14 CTB per annum . They currently pay no council tax Under the proposed scheme the would pay £65.46 (8.5%) Household: Couple over 25 Weekly income Total £350.92 (current disregard £131.50 DLA care and mobility) The Council Tax liability is £1850. The household currently receives £1737.38 CTB per annum They currently pay £112.62 ((*taper applies @ 2.16 week = £112.62 (2.16 ÷7 x 365) Under the proposed scheme they would pay £269.87 to pay (CTS annual liability £1692.75 8.5% = £157.25 CTS Annual entitlement £1692.75 ‐ £112.62 taper = £1580.13 £157.25 + 112.62 = £269.87 to pay) Household: Couple over 25 with 2 dependent children Weekly income £320.60 The Council Tax liability is £1198. The household currently receive £1198 CTB per annum They currently pay no benefit. Under the proposed scheme they would pay £101.83 (8.5%) 16 Agenda Item No_____7_______ DETERMINATION OF THE COUNCIL TAX BASE FOR 2013/14 AND THE TREATMENT OF SPECIAL EXPENSES Summary: The purpose of this report is to determine the Council’s 2013/14 tax base and the 2013/14 tax base for each parish in accordance with the legal requirements. Options considered: N/A Conclusions: The determination of the tax base for a financial year has to be undertaken in accordance with legislative requirements between 1 December and 31 January of the preceding financial year. Recommendations: a) That the calculations set out in this report used to produce the Council’s tax base be approved, and the tax base for 2013/14 be determined as 36,411; b) That the tax base for each parish area for the financial year 2013/14 be as set out at paragraph 2.1. Reasons for Recommendations: To determine the 2013/14 Council Tax Base in accordance with legislative requirements and to inform the 2013/14 budget setting process. Cabinet Member(s) Ward(s) affected All All Contact Officer, telephone number and email:Karen Sly, 01263 516243, Karen.sly@northnorfolk.gov.uk 1. Council Tax Base 1.1 The council tax base is the measure of the relative taxable resources of an area and represents the estimated full year equivalent number of chargeable dwellings expressed as the equivalent number of Band ‘D’ dwellings. 1.2 The council tax base for a billing authority’s area, or any part of its area (e.g. parish) must be calculated by the billing authority in accordance with the Local Authorities (Calculation of Tax Base) Regulations 1992 as amended. It is calculated as the aggregate of the “relevant amounts”, calculated for each valuation band, multiplied by the authority’s estimated “collection rate”. The “relevant amount” represents the estimated full year equivalent number of Band D dwellings after taking into account the number of discounts and disabled reductions which apply to those dwellings. 1.3 The Local Authorities (Calculation of Tax Base) (England) Regulations 2012 introduced a reduction to the tax base in respect of the Council’s Local Council Tax Support Scheme. From 1 April 2013 Council Tax Benefit will be replaced with a Local Council Tax Support Scheme, and the reductions granted under the scheme will reduce the tax base in a similar way to discounts. 17 1.4 The “collection rate” reflects an assessment of how much council tax may not ultimately be collected due to dwellings leaving the valuation list, successful appeals against valuation bandings, increased numbers of exemptions and discounts, and bad debts. The council tax base for tax setting purposes for a financial year has to be determined between 01 December and 31 January of the preceding financial year. 1.5 The calculations below assume that the determination of council tax discounts and level of charges considered by Cabinet on the 7th January 2013, and recommended to this meeting elsewhere on the agenda, are approved for 2013/14. Under these new technical reforms to council tax, the Council has new flexibilities to vary the discount on second homes, vacant and uninhabitable dwellings, and to introduce an empty property premium. Items in the table at 1.6 below in italics have been introduced or varied under the new flexibilities. 1.6 Firstly, the number of chargeable dwellings in North Norfolk for 2013/14 is calculated in the table below: Equivalents Number of dwellings on the council tax data base as at 15 November 2012 LESS No of exempt dwellings 52,835.00 -2,099.00 Number of chargeable dwellings at 15 November 2012 LESS LESS LESS LESS 50,736.00 Equivalent reduction for dwellings subject to a 5% discount (second homes not entitled to a 50% discount) (-3,720.00 x 0.05) (A 10% discount applied in 2012/13) Equivalent reduction for dwellings subject to a 25% discount (including single occupancy) (-15,738.00 x 0.25) Equivalent reduction for dwellings subject to a 50% discount (including tied accommodation, some care homes, and some second homes) (-466.00 x 0.5) Equivalent reduction for the Local Council Tax Support Scheme Total equivalent number of discounts -186.00 -3,934.50 -233.00 -6,768.52 -11,122.02 Number of chargeable dwellings after discounts at 15 November 2012 ADD ADD Dwellings coming on list sometime before 31 March 2014 Properties with seasonal prohibitions ADD Vacant Dwellings 53.00 ADD Uninhabitable Dwellings 38.00 ADD Empty Homes Premium Dwellings expected to fall out of list sometime before 31 March 2014 64.05 LESS Total additional chargeable properties 18 176.00 510.74 -19.00 822.79 39,613.98 LESS LESS LESS Additional equivalent reduction for dwellings coming on list before 31 March 2014 expected to receive a 5% discount (second homes not entitled to a 50% discount) (14.66 x 0.05) Additional equivalent reduction for dwellings coming on list before 31 March 2014 expected to receive 25% discounts (including single occupancy) (61.25 x 0.25) Additional equivalent reduction for dwellings coming on list before 31 March 2014 and properties with seasonal prohibitions expected to receive a 50% discount (511.25 x 0.5) Net reduction in equivalent number of dwellings for discounts -0.73 -15.31 -255.63 -271.67 Total additional chargeable dwellings 551.12 Number of chargeable dwellings for 2013/14 after discounts 1.7 The calculation of the aggregate of the ‘relevant amounts’ for the North Norfolk area for the financial year 2013/14 is shown below: BAND A, subject to reduction for disabilities A B C D E F G H TOTAL 1.8 40,165.10 Total No of chargeable dwellings adjusted for discounts (i) Relevant Proportion Relevant Amount (ii) (i) x (ii) 24.75 5/9 6/9 7/9 8/9 9/9 11/9 13/9 15/9 18/9 6,660.39 9,998.51 9,093.62 7,358.64 4,106.35 1,947.39 903.45 72.00 40,165.10 13.75 4,440.26 7,776.62 8,083.22 7,358.64 5,018.87 2,812.90 1,505.75 144.00 37,154.01 The Council’s Council Tax Base is then calculated by multiplying the total of the relevant amounts for the year for each of the valuation bands by the Authority’s estimate of its collection rate for that year. A collection rate of 0.98 is suggested, which allows for 2.00% for non-collection factors that apply each year. The non-collection allowance in the current year is 1.5% but is anticipated to deteriorate on the introduction of the Local Council Tax Support Scheme, the technical reforms to council tax and the difficult economic climate. The Council Tax Base for tax setting purposes is calculated as follows: 37,154.01 x 0.98 = 36,411.00 19 1.9 The Local Government Finance Act 1992 also requires that a Council Tax Base is determined for each individual parish area within the District. These are detailed in paragraph 2.1 below. 2. Tax Base per Parish 2.1 The amounts calculated in accordance with the relevant regulations as the Council Tax Base for each parish area for the financial year 2013/14 are as follows:- 20 PARISH Council Tax Base Alby With Thwaite 93.05 Aldborough and Thurgarton 208.51 Antingham 115.08 Ashmanhaugh 65.32 Aylmerton 186.10 Baconsthorpe 76.30 Bacton 455.98 Barsham 93.91 Barton Turf 237.01 Beckham East/West 108.64 Beeston Regis 356.83 Binham 165.01 Blakeney 505.35 Bodham 146.65 Briningham 61.01 Brinton 117.06 Briston 778.76 Brumstead 25.50 Catfield 295.78 Cley 303.94 Colby 177.50 Corpusty & Saxthorpe 252.43 Cromer 2,652.62 Dilham 130.60 Dunton 50.83 East Ruston 175.20 Edgefield 167.65 Erpingham 226.77 Fakenham 2,280.37 Felbrigg 65.01 Felmingham 176.88 Field Dalling 133.08 Fulmodestone 166.28 Gimingham 137.45 Great Snoring 76.39 Gresham 161.29 Gunthorpe 138.53 Hanworth 96.40 Happisburgh 286.91 Helhoughton 115.70 Council Tax Base PARISH Hempstead Hempton Hickling High Kelling Hindolveston Hindringham Holkham Holt Honing Horning Horsey Hoveton Ingham Ingworth Itteringham Kelling Kettlestone Knapton Langham Lessingham Letheringsett with Glandford Little Barningham Little Snoring Ludham Matlaske Melton Constable Morston Mundesley Neatishead North Walsham Northrepps Overstrand Paston Plumstead Potter Heigham Pudding Norton Raynham Roughton Runton Ryburgh 21 70.90 175.29 383.36 262.01 189.65 227.25 84.78 1,473.54 116.74 575.07 27.67 703.68 143.10 39.94 57.41 80.82 86.76 140.32 188.74 215.06 120.94 37.24 203.36 467.30 60.42 172.58 57.88 1,032.89 224.87 3,543.15 301.95 402.95 75.63 48.21 383.11 69.12 123.07 311.39 679.64 210.85 PARISH Salthouse Scottow Sculthorpe Sea Palling Sheringham Sidestrand Skeyton Sloley Smallburgh Southrepps Stalham Stibbard Stiffkey Stody Suffield Sustead Sutton Swafield Swanton Abbott Swanton Novers Tattersett Thornage Thorpe Market Thurning Thursford Trimingham Trunch Tunstead Upper Sheringham Walcott Walsingham Warham Wells-Next-The-Sea Westwick Weybourne Wickmere Wighton Witton Wiveton Wood Norton Worstead Council Tax Base 110.07 267.12 265.23 194.44 2,924.32 44.05 83.56 81.73 169.34 301.30 928.23 128.37 123.98 88.79 49.65 82.58 359.70 105.53 140.35 78.56 260.63 88.87 103.14 29.11 101.73 127.14 325.06 243.36 90.84 198.36 327.79 73.02 995.12 27.93 306.88 56.19 102.78 116.63 82.91 96.77 297.52 3. Special Items 3.1 These are items taken into account by a District Council, County Council or Police Authority, which relate to a part only of its area. Special items include parish precepts and special expenses. No requirement has been identified for any special expenses in 2013/14 and so it is only necessary to calculate tax bases for each parish. 4. Implications and Risks 4.1 The determination of the tax base is an essential pre-requisite for the setting of the council tax which will be carried out at Full Council scheduled for 27 February 2013. 4.2 Without the determination of the tax base it will not be possible for the council tax for 2013/14 to be calculated and set, thus preventing the timely billing of council tax. 5. Sustainability – None as a direct consequence of this report. 6. Equality and Diversity – None as a direct consequence of this report. 7. Section 17 Crime and Disorder considerations – None as a direct consequence of this report. 22 Agenda Item No_____8_______ NATIONAL NON-DOMESTIC RATES – NNDR1 RETURN Summary: The purpose of this report is to seek delegated authority for approval of the final National Non-Domestic Rates (NNDR1) form to be given to the Section 151 Officer. A provisional form was required to be submitted by 7 January, the deadline for the final version is 31 January 2013. Options considered: Conclusions: N/A. Recommendations: It is recommended that Members note the provisional NNDR1 form (Appendix D) and that delegated authority for approval of the final form be given to the Section 151 Officer. Reasons for Recommendations: To ensure that the final NNDR1 form can be submitted based on the latest information and guidance. The completion of the NNDR1 allows the Council to calculate the expected income in respect of business rates for the year 2013/14. The Council will retain a proportion of this income from 2013/14 onwards. LIST OF BACKGROUND PAPERS AS REQUIRED BY LAW (Papers relied on to write the report, which do not contain exempt information and which are not published elsewhere) NNDR1 papers and supporting data. Cabinet Member(s) Ward(s) affected Contact Officer, telephone number and email: Karen Sly, 01263 516243, karen.sly@north-norfolk.gov.uk 1. INTRODUCTION 1.1. From 1 April 2013 the business rates retention scheme comes into effect. The scheme of business rates retention is a key component of the new funding system for Local Government introduced by the Local Government Finance Act 2012. Under the new arrangement local authorities are required to split the rates income between the government (50%), the billing authority (40%) and major preceptors (10%). 1.2. Each billing authority is required to compute an estimate of the non-domestic rating income for the forthcoming year within a statutory return referred to as the 23 NNDR1. The calculations are made in accordance with the Local Government Finance Act 1988 and the Localism Act 2011 as amended by regulation. 1.3. Under the current arrangements this form is completed by officers and submitted to the Department for Communities and Local Government (DCLG) before the start of each financial year. The form provides the local tax base for business properties in the area for the forthcoming year. The form has previously been used by the DCLG to set a schedule of payments to be made to the national pool.In its revised form the NNDR1 is used to report the estimated gross yield from business rates to reflect local conditions about likely increases, or decreases in the business rates that can be collected for the year. 2. NNDR 1 – FUTURE ARRANGEMENTS 2.1. As a result of the new arrangements the approval of the NNDR1 should be similar to that of the Council Tax Base, although guidance confirms that there is no direct instruction for this responsibility to sit with Full Council and that it could be delegated. A provisional return must be submitted to the DCLG by 7 January 2013 and the final approved version by 31 January 2013. The provisional return is attached at Appendix A. The return is largely of a technical/factual nature but does include some forecast element in relation to future growth and appeals. 2.2. When agreed by the DCLG, the NNDR1 submission will become the budget for each year and payments of NNDR to the Government and NCC will be based on the returns, An outturn form (NNDR3) will then be submitted at the end of the year detailing the actuals for the financial year just ended. 2.3. Since completing the provisional return further guidance has been sought from the DCLG in relation to some of the fields and in fact even further guidance is still to come which will mean that some of the data contained in the provisional return will be amended before the final submission is made for which the deadline is 31 January 2013. 2.4. Due to the tight timeline for approval of the final NNDR1 form this report requests that delegation be given to the Section 151 to certify the completion of the final NNDR1 form and that the constitution be updated to reflect this. 3. FINANCIAL IMPLICATIONS AND RISKS 3.1. 2013/14 will be the first year that the Council has retained an element of business rates income and potentially a share of any growth in the business rate base. There will risks that fall to the Council are due to the potential volatility of the new model in that the level of funding in the year will be subject to change. 3.2. The level of bankruptcies and businesses in administration together with the number of empty properties and the collection rate will also influence the position and are risks. For example the level of successful appeals both those which are currently unresolved and those which will emerge in the forward year are unknown. 3.3. The current level of appeals lodged with the valuation Office Agency (VOA) in respect of heriditaments in North Norfolk is in excess of £15 million covering a period from 2005. The cost of any successful appeal is to be met from the monies received and underlines the level of volatility in the actual level of income received by the Council in any one year. 24 3.4. A mechanism of tariffs, top-ups, levies and safety nets has been also been introduced. The tariff is an amount calculated by the DCLG. It is deducted from the Councils share of the net yield and it is payable to the DCLG throughout the year. 3.5. The levy is the proportion by which the Council shares any growth in the net yield with central government and provides an incentive for economic development and regeneration. Any growth in the rate yield during 2013/14 above the baseline will result in a levy and although this will be payable in 2014/15 it will have to be accrued for in the 2013/14 accounts 4. Sustainability – none as a direct consequence of this report. 5. Equality and Diversity – none as a direct consequence of this report. 6. Section 17 Crime and Disorder considerations – none as a direct consequence of this report. 25 Appendix D Appendix A Provisional NNDR1 ## NATIONAL NON-DOMESTIC RATES RETURN 1 NNDR1 2013-14 Please e-mail to : nndr.statistics@communities.gsi.gov.uk Please enter your details after checking that you have selected the correct authority name. Please check the figures shown in the cells with a blue border and enter your own figures if you disagree with those suggested. A provisional version of the form should be returned to the Department for Communities and Local Government by Monday 7 January 2013 The final version of this form, including a signed copy, must also be sent to the Department for Communities and Local Government by Thursday 31 January 2013 Select your local authority's name from this list: Check that this is your authority : Check that this is your E Code : Local authority contact name : Telephone number of local authority contact : Fax number for local authority contact : E-mail address of local authority contact : North Norfolk E2635 Mrs C Dawson 01263 516110 01263 516028 brates@north-norfolk.gov.uk Ver 1.3 6,046 £ 64,179,197 1. Number of hereditaments on the rating list on 30 September 2012 2. Aggregate rateable value on the rating list on 30 September 2012 £ 29,650,789.01 GROSS CALCULATED RATE YIELD 3. Enter line 2 x small business non-domestic rating multiplier (0.462) MANDATORY RELIEFS Small business rate relief £ 4. Additional yield generated to finance the small business rate relief scheme 360,676.24 3,667,898.11 5. Cost of small business rate relief for properties within billing authority area 6. Net cost of the small business rate relief (Line 5 minus Line 4) 3,307,221.87 7. Cost of relief to charities 1,236,171.98 8. Cost of relief to Community Amateur Sports Clubs 54,428.77 9. Cost of relief for rural general stores, post offices, public houses, petrol filling stations and food shops 97,285.28 617.69 10. Cost of relief for partly occupied premises 298,999.70 11. Cost of relief for empty premises 4,994,725.29 12. Total mandatory reliefs (Sum of lines 6 to 11) DISCRETIONARY RELIEFS 13. Cost of relief to charities 17,868.04 174,981.73 14. Cost of relief to non-profit making bodies 0.00 15. Cost of relief to Community Amateur Sports Clubs 16. Cost of relief for rural general stores, post offices, public houses, petrol filling stations and food shops 14,841.32 17. Cost of relief to other rural businesses 0.00 18. Other Section 47 reliefs (Localism Act discounts) 0.00 207,691.09 19. Total discretionary reliefs (Sum of lines 13 to 18) 24,448,372.63 20. Gross Rate Yield after reliefs (Line 3 minus lines 12 & 19) 21. Estimate of 'losses in collection' 232,595.40 22. Allowance for Cost of Collection 230,177.15 0.00 23. Special Authority Deductions - City of London Offset Page 1 of 2 26 Appendix A Provisional NNDR1 NATIONAL NON-DOMESTIC RATES RETURN 1 2013-14 North Norfolk Ver 1.3 Section 2 Enterprise Zones 24. Estimated level of discount to be awarded in 2013-14 £ 0.00 25. Estimated value of non-domestic rates in the Enterprise Zone area in 2013-14 0.00 26. Enterprise Zone baseline 0.00 0.00 27. Total estimated value of business rates to be retained in 2013-14 (Line 25 minus line 26) New Development Deals 28. Estimated value of non-domestic rates in the New Development Deals area in 2013-14 0.00 29. New Development Deals baseline 0.00 0.00 30. Total estimated value of business rates to be retained in 2013-14 (Line 28 minus line 29) Renewable Energy Schemes 31. Total estimated value of business rates to be retained in 2013-14 18,840.00 23,966,760.08 32. Net Rate Yield excluding transitional arrangements and rate retention (Line 20 minus the sum of lines 21 to 23, 27, 30 & 31) Rate retention adjustments 33. Estimate of the change in rateable value between 1 October 2012 and 30 September 2013 34. Estimate of the change in receipts as a result in the change in rateable value (line 33 times the multiplier) -346,468.00 -160,068.22 % -0.54 This equates to a percentage change of 35. Local authority's estimate of adjustment due to appeals 87,285.37 23,719,406.00 36. Net Rate Yield excluding transitional arrangements but after rate retention adjustments (Line 32 plus lines 34 and minus line 35) Section 3 Transitional arrangements 37. Addition revenue received because reduction in rates have been deferred 14,153.81 340,022.76 38. Revenue foregone because increase in rates have been deferred 325,868.95 39. Net cost of transitional arrangements (Line 38 minus line 37) 40. Net Rate Yield after transitional arrangements and rate retention (Line 36 minus line 39) 23,393,537.00 NNDR Summary for : North Norfolk These figures show the percentage shares of the NNDR you estimate your authority will collect in 2013-14. They are based on line 36. See the Tier Split tab for full information £ 11,859,703.00 Amount of NNDR to be paid to central government Amount to be retained by North Norfolk under the rates retention scheme 9,487,762.00 Amount to be passed to Norfolk 2,371,941.00 15,072.00 Amount to be retained by North Norfolk under the renewable energy scheme 3,768.00 Amount to be passed to Norfolk under the renewable energy scheme Certificate of Chief Financial Officer I certify that the entries in lines 3, 12, 19, 20, 36, 39 and 40 of this form are the best I can make on the information available to me and that the figures given in lines 1 and 2 used in the calculating the amount shown in lines 36 and 40 are, to the best of my knowledge and belief those shown in the rating list for my authority as at 30 September 2012, subject to any order made before 15 January 2013 under the Local Government Act 1972 implementing boundary changes. I also certify that the authority has made proper arrangements for securing efficiency and effectiveness in relation to the collection of non-domestic rates. I also certify to the best of my knowledge and belief that any amount included as legal costs in line 22 and discretionary relief in line 24 meet the conditions set out in the Non-Domestic Rating (Rates Retention) Regulations 2013. Chief Financial Officer : ………………………………………………………………………………………… Date : ……………………………………………………………………………………………………………….. Ver 1.3 Page 2 of 2 27 Agenda Item No_____9_______ COUNCIL TAX SETTING COMMITTEE 2013/14 Summary: The deadlines for setting the combined council tax for 2013/14 conflict with the dates for Full Council. In these conditions there is a statutory facility to enable the combined council tax to be set by a Committee established for the purpose. Options considered: Arranging a special full council meeting for a time and date after the final major preceptor has set their budget. This option is not really feasible due to the time Conclusions: The use of the legislative provision of the 1992 Local Government Finance Act will allow the Full Council to discharge its obligations in setting the Council Tax for 2013/14. The committee identified to be established will meet for a single purpose and then be disbanded. Recommendations: It is recommended that: a) A Combined Council Tax Setting Committee be established with five Members to set the combined council tax for 2013/14; b) Delegation be given to the Chief Executive to appoint named members and named substitutes in consultation with the Group Leaders to the Committee; b) Full Council delegates to this committee the setting of the Combined Council Tax for 2013/14 for the County Council, the Police, North Norfolk District Council and the Parish and Town Councils of the billing authority area. Reasons for Recommendations: To enable the setting of the combined Council Tax for 2013/14 on a timely basis once the final precept has been set. Cabinet Member(s) Ward(s) affected: All Cllr W Northam Contact Officer, telephone number and email: Karen Sly, Karen.sly@northnorfolk.gov.uk 28 COUNCIL TAX SETTING COMMITTEE 2013/14 1. Introduction 1.1. The Council is required by section 30(1) of the Local Government Act 1992 to set an amount of Council Tax for each dwelling in its area. The value of these amounts is the sum of the Council’s own Council Tax and those of the other major precepting authorities (Police and County Council) together with those of the local preceptors (Town and Parish Councils). 2. The approach for 2013/14 2.1. This Council will be in a position to set the Council Tax for 2013/14 for itself, the County Council and the Town and Parish Councils at its meeting on 27 February 2013. 2.2. Unfortunately it appears that the Police will be meeting to make decisions about their precept in the morning of 1 March 2013. 2.3. This Council’s deadline to set the combined council tax is established to allow it to meet all the statutory requirements of preparing the revenues system, printing the bills, collating, despatching and collecting the Council Tax with effect from 1 April 2013. The delay by the Police will impact on these time critical arrangements. 2.4. However, Section 67 (sub section 3) of the Local Government Finance Act 1992 allows that the setting of the Council Tax can be undertaken by a “committee of the authority appointed by it for that purpose” the section also stipulates that “in respect of a committee so appointed the authority shall fix the number of members and their term. Each member of the committee has to be a member of the authority.” 2.5. Further, as the time line for production of the council tax bills is constricted by this delay the committee so appointed will have to meet on the afternoon of Friday 1 March 2013 to allow the use of the weekend to “catch up” on the necessary preparations for the collection of Council Tax in the forward year. 2.6. This report is therefore recommending that a committee is established for this function which should reflect the political make-up of the Full Council and have a maximum of five Members. 3. Financial Implications and Risks - Failure to set the combined Council Tax later than the 1 March 2013 following notification of the Police precept will impact on the billing timetable as outlined within section 2.3 of the report leading to a delay in billing for the 2013/14 Council Tax. 4. Sustainability – None as a direct consequence of this report. 5. Equality and Diversity – None as a direct consequence of this report. 6. Section 17 Crime and Disorder considerations – None as a direct consequence of this report. 29