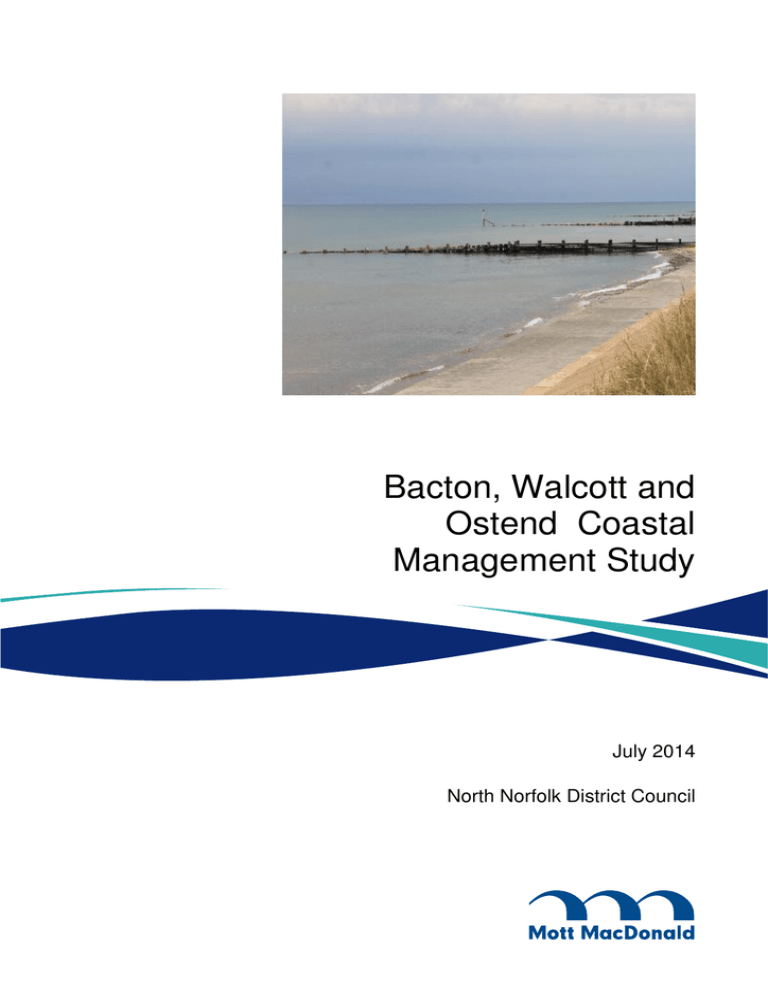

Bacton, Walcott and Ostend Coastal Management Study July 2014

advertisement