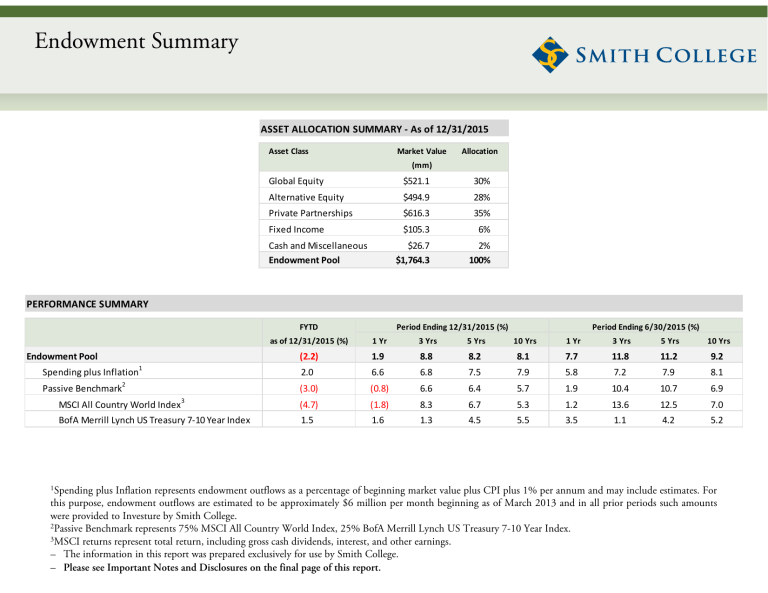

Endowment Summary ASSET ALLOCATION SUMMARY ‐ As of 12/31/2015

Endowment Summary

ASSET ALLOCATION SUMMARY ‐ As of 12/31/2015

Asset Class

Global Equity

Alternative Equity

Private Partnerships

Fixed Income

Cash and Miscellaneous

Endowment Pool

Market Value Allocation

(mm)

$521.1

$494.9

$616.3

$105.3

$26.7

$1,764.3

30%

28%

35%

6%

2%

100%

PERFORMANCE SUMMARY

Endowment Pool

Spending plus Inflation

1

Passive Benchmark

2

MSCI All Country World Index

3

BofA Merrill Lynch US Treasury 7 ‐ 10 Year Index

FYTD as of 12/31/2015 (%)

(2.2)

2.0

(3.0)

(4.7)

1.5

1 Yr

1.9

6.6

(0.8)

(1.8)

1.6

Period Ending 12/31/2015 (%)

3 Yrs 5 Yrs 10 Yrs

8.8

8.2

8.1

6.8

6.6

8.3

1.3

7.5

6.4

6.7

4.5

7.9

5.7

5.3

5.5

1 Yr

7.7

5.8

1.9

1.2

3.5

Period Ending 6/30/2015 (%)

3 Yrs 5 Yrs

11.8

11.2

7.2

10.4

13.6

1.1

7.9

10.7

12.5

4.2

10 Yrs

9.2

8.1

6.9

7.0

5.2

1 Spending plus Inflation represents endowment outflows as a percentage of beginning market value plus CPI plus 1% per annum and may include estimates. For this purpose, endowment outflows are estimated to be approximately $6 million per month beginning as of March 2013 and in all prior periods such amounts were provided to Investure by Smith College.

2 Passive Benchmark represents 75% MSCI All Country World Index, 25% BofA Merrill Lynch US Treasury 7-10 Year Index.

3 MSCI returns represent total return, including gross cash dividends, interest, and other earnings.

– The information in this report was prepared exclusively for use by Smith College.

– Please see Important Notes and Disclosures on the final page of this report.

Important Notes and Disclosures

FYE = June 30. Past performance is not necessarily indicative of future results, and any investment described herein involves the risk of loss. Where there is an opportunity for gain, there is a risk of loss. Clients should compare this report to statements prepared by custodians and fund administrators.

Market values may include estimates, are unaudited, and may be subject to change. Such data are believed to be reliable, Investure, LLC (“Investure”) provides no assurance as to its accuracy or completeness, and Investure is under no obligation to update the estimated information included herein. Totals may not sum due to rounding.

Except as otherwise specified, all return information contained herein includes reinvestments of interest, dividends, and other earnings and is net of underlying manager fees and expenses. In addition, Endowment Pool returns are net of Investure management fees, expenses, and accrued incentive fees, if any, for the current calendar year.

Returns through 1/31/2004 were provided by Russell Mellon and have not been confirmed by Investure. Returns for periods less than 12 months are not annualized.

Time-weighted returns for private partnerships are not necessarily indicative of investment performance in drawdown funds.

Any index or benchmark returns mentioned herein are for discussion purposes only. Investure fund holdings and your portfolio's holdings may not resemble the composition, volatility, or risk of any such index or benchmark. There is no guarantee that any Investure fund or your portfolio as a whole will meet or exceed the index or benchmark or that any such index or benchmark is available for investment.

The MSCI ACWI Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI ACWI consists of 45 country indices comprising 24 developed and 21 emerging market country indices. The developed market country indices included are: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan,

Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom and the United States. The emerging market country indices included are: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Morocco, Peru, Philippines,

Poland, Russia, South Africa, Taiwan, Thailand, and Turkey.

The BofA Merrill Lynch US Treasury 7-10 Year Index is a subset of The BofA Merrill Lynch US Treasury Index including all securities with a remaining term to final maturity greater than or equal to 7 years and less than 10 years.