R C V IP

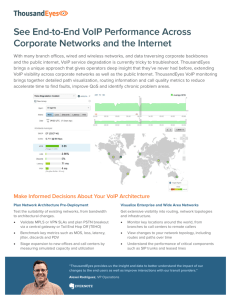

advertisement