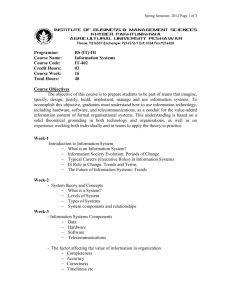

D : R

advertisement