I u LINCOLN ~.

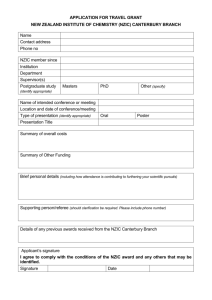

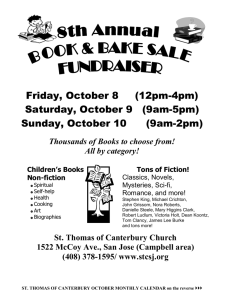

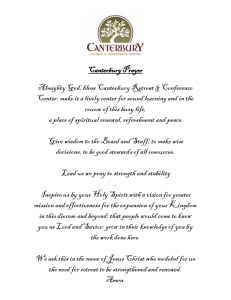

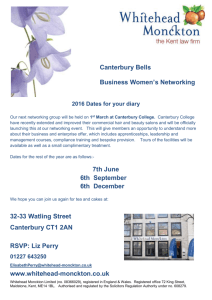

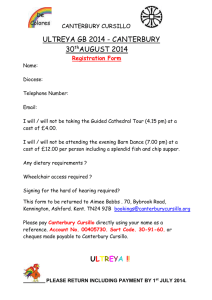

advertisement