I u LINCOLN ~.

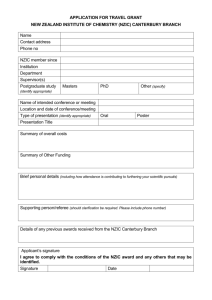

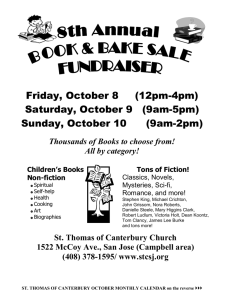

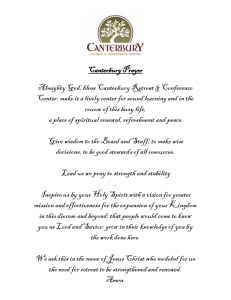

advertisement