Summer School 2016 HEC Paris June & July

advertisement

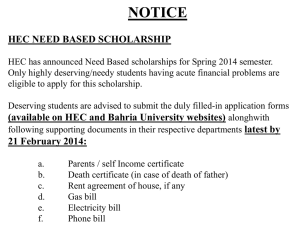

HEC Paris June & July 2016 Summer School What we offer Why spend your summer at HEC Established in 1881, HEC Paris is worldrenowned for the quality of its degrees, faculty and research. #5 Business School Worldwide Ranked by the number of Fortune-Global500-CEOs trained at HEC Paris Times Higher Education, THE Alma Mater Index: Global Executives 2013 Top 100 Ranking #1 Master in Finance Worldwide Pre-experience Global Masters in Finance Ranked #1 for 5th straight year The Financial Times 2015 #2 Master in Management Worldwide The Financial Times 2015 Unparalleled Access to Leading Professors › Intensive courses (42 contact hours) taught entirely by HEC professors and leading professionals › Practical, hands-on approach as well as theoretical knowledge › Exposure to real business cases and interaction with leading guests Our Campus Advantage › situated 20 km Southwest of Paris and neighboring Versailles › campus infrastructure offers vibrant student life and well-priced student residences (housing included in full program fees) › extensive sports facilities and student venues on campus › language lab and library with access to vast internal and external databases HEC Paris Summer School Programs are two-week, intensive programs offered in English and in French. The Summer School is geared toward university-level students or recent graduates with a business orientation, entrepreneurial mindset and passion for discovery. Summer School Programs at HEC Paris are thoughtprovoking and demanding. Summer school students at HEC Paris will: › Develop an international outlook as part of a highly diverse class › Establish a strong academic foundation with worldclass HEC professors › Interact with leading experts › Earn international course credit and a certificate of successful program completion All courses take place on the 300-acre HEC Paris campus. Students reside in on-campus dormitories, a step away from classes. Learning Methods › Team projects and case studies provide opportunities to build critical thinking, analytical and decision-making skills. Session 1 Session 2 June 13 - 24, 2016 International Finance Inclusive and Social Business Investment Banking and International Corporate Finance Energy and Finance Fashion Management Business & Geopolitics Luxury management Luxury management › On-campus seminars with leading speakers offer students the chance to interact with outstanding leaders. › A final exam or team presentation defended in front of a jury of experts evaluates participants’ performance. June 27 – July 8, 2016 Objectif Création d’Entreprise* * taught in French SESSION 1 June 13 - 24, 2016 International Finance INCLUSIVE AND SOCIAL BUSINESS Summer Program Overview Summer Program Overview As we enter the third millennium, information technology - by crushing the cost of communications - is accelerating the globalization of manufacturing, commerce and especially finance. News travelling at the speed of light through the internet reaches an estimated 250,000 computer terminals in trading rooms around the world, morphing national financial markets into one huge efficient global marketplace for capital. And yet diehard sovereigns are holding firm onto their prerogatives of having a national currency, a national regulatory framework and a national tax code of their own and much more. International business’ vastly expanded global reach is redefining the risks and opportunities faced by financial executives whether they are at the helm of international trading firms, old fashioned brick-and-mortar multinational corporations à la IBM, Nestlé or Toyota or “virtual” multinational enterprises à la Google or Facebook. Poverty remains a strong reality in the developing world, even in countries which experience high growth rates. It is also on the rise in many – if not all – developed countries. To fight poverty, philanthropic action, public authorities and international institutions have shown their limits. In this intensive 2-week summer program, students discover how forward-looking firms develop creative market-based solutions to alleviate poverty, at times in partnership with civil society and public authorities. Students are exposed to social enterprises with innovative business models, as well as established firms who have realized it is in their interest to develop inclusive business models. Students will work in teams in coordination with executives from a multinational corporation in the formulation of an inclusive business model to be presented to a Final Jury at the session close. This introductory course is about key decisions made by treasurers or chief financial officers of exporting firms, multinational corporations and financial institutions. It does not require prior finance training. Specifically, it addresses the funding/financing and investment questions within a multi-currency setting. Special attention is devoted to Risk Management (including valuation of hedging instruments such as forwards, futures, swaps and options) as it permeates international funding and investment decisions. The Inclusive and Social Business Summer School Program is launched by The Social Business / Enterprise and Poverty Chair, co-presided by Professor Muhammad Yunus (Founder of the Grameen Bank and Nobel Prize Winner 2006) and Martin Hirsch (former French High Commissioner on Active Solidarity against Poverty). The Social Business / Enterprise and Poverty Chair is sponsored by Danone, Renault and Schneider Electric. The intensive summer program is designed for students aspiring to careers in finance at large and small corporations with extensive international dealings, banks, pension funds, private equity firms or hedge funds as well as «globally reaching» financial institutions. Learning Outcomes Upon successful completion of the summer program, participants will be able to understand: ›T he international monetary system and how exchange rates are set with special reference to the subprime and the euro crisis › Interest Rate Arbitrage and the “carry trade” or how money managers can compare the yield on short term investments denominated in different currencies such as the US dollar, the Japanese yen, the Swiss franc, the euro, etc. and how corporate treasurers can compare the cost of financing sourced from different currencies ›T he dynamics of global capital markets and how debt or equity financing is no different from any other procurement decision except that when it is international, it only means there are far more financing sources to choose from Learning Outcomes Upon successful completion of the summer program, participants will be able to: › Understand the set of reasons that prompt firms to contribute to poverty alleviation › Describe and analyze the characteristics of inclusive and social business models which firms adopt when fighting poverty › Propose how firms can transform themselves when seeking to become more inclusive & sustainable › Understand innovative ways to finance these initiatives and to market them › Understand the pivotal role of social entrepreneurs and “intrapreneurs” inside large multinationals, both in emerging and developed countries › Develop and formulate an inclusive business model based on consideration of firm resources and societal need › Draw on insights from cutting-edge research on Inclusive and Social Business ›W hat is at risk in international business and how firms develop risk-management frameworks within which currency risk can be hedged with derivatives such as forwards, futures, options and swaps ›H ow to value cross-border mergers & acquisitions or simply foreign direct investment Laurent Jacque Frédéric Dalsace Affiliate Professor, HEC Paris Associate Professor, HEC Paris “Participants aspiring to careers in finance will benefit from an intensive mix of international macroeconomics, international corporate finance and risk management.” “This intensive summer program is an opportunity for students to understand why and how firms and social enterpreneurs can contribute to solving societal problems, such as hunger, bad housing, pollution, etc. As part of the learning experience, participants will develop innovative, inclusive and social business models.” Bénédicte Faivre-Tavignot Affiliate Professor, HEC Paris SESSION 1 SESSION 1 & SESSION 2 June 13 - 24, 2016 June 13 - 24, 2016 June 27 - July 8, 2016 Fashion Management Luxury Management Summer Program Overview Summer Program Overview With Fashion weeks, new designers’ contests, influential fashion blogging, September issues… fashion receives growing interest and encourages careers globally. Yet, behind the glossy images of fashion magazines and the glitter of glamorous events, fashion is a complex and fast-paced business involving risky ventures and investments. The luxury sector is a key asset in France and it requires a specific set of managerial skills and expertise. The HEC Paris Summer Program in Luxury Management is intended for students who demonstrate the following characteristics: • a curiosity to learn and understand the luxury business model • an interest for different ways of doing business • a taste for refined goods and services To succeed in this highly competitive and risky environment, future fashion leaders need to understand fashion business specificities to better address them and foster profit. Unpredictable trends, scarce resources, lack of creativity, rejection from audience or ethical issues all concur to threaten fashion ventures. Fashion brand and product management skills are crucial to overcome these challenges and develop attractive brands, creative and desirable collections and foster collective appraisal. Deeply rooted in Parisian fashion culture and industry, the Fashion Management Summer Program exposes the next generation of fashion leaders to the components and drivers of fashion brand successes. Curriculum particularly covers industry characteristics and challenges; historical roots and prospective paths; trends and cycles; fashion brand management and collection and style development. The objective of the Fashion Management Summer Program is to provide participants with hands-on knowledge from expert practitioners and researchers in the field and also to encourage collective learning and skills co-production through applied group projects and a final wrap-up group presentation. Learning Outcomes Upon successful completion of the summer program, participants will be able to: › Identify key success factors for fashion ventures according to business units and markets › Understand the major differences between fashion business models (i.e. luxury vs. mass fashion; Haute-Couture vs. Ready-to-Wear) and fashion business units (i.e. apparel; accessories; footwear) › Catch fashion trends and adapt value brand propositions for both brands and consumers › Apply fashion brand and product management models › Analyze and bolster fashion brand image ›B uild and develop successful styles and collections according to parent brand and product category specificities › Promote and communicate about the brand and new collections Gachoucha Kretz Affiliate Professor, HEC Paris “This summer program is a unique combination: at HEC Paris, we mix an authentic passion for fashion with a critical business orientation for long-term success.” The intensive summer program introduces participants to key concepts and principles of luxury management. The curriculum starts out with an in-depth understanding of luxury, its role in society and the key principles defining it. There is a particular focus on luxury brand management as well as the strategic perspectives and challenges for luxury brands in today’s world. A variety of teaching methods include cases, workshops and an independent experience in downtown Paris, which adds an action-oriented perspective to the program. Participants are encouraged to not only learn new business principles but also to apply them in a real business setting. At the close of the two-week program, students present their team proposals to the concerned brand managers in a Final Jury. Although the program is intended for participants who have limited experience in luxury, the material and teaching methods are designed in a way that will provide a challenging experience for those who already have some knowledge or experience in the luxury industry. Learning Outcomes Upon successful completion of the summer program, participants will be able to: › Achieve familiarity with the luxury sector, its products and services › Understand the key specificities of the luxury business in terms of managerial practices › Apply the key management principles in the luxury industry to make appropriate business decisions › Describe and analyze the characteristics of a luxury brand and get a sense of the prerequisites needed to build one over time › Develop and formulate a luxury strategy based on the offering’s characteristics and market opportunities › Understand the implications of a luxury strategy from a financial perspective Session 1 Patrick ALBALADEJO Affiliate Professor, HEC Paris Session 2 Anne MICHAUT Affiliate Professor, HEC Paris “The Luxury Management Summer Program offers an engaging and comprehensive approach to the specific business model of luxury; future managers will gain essential tools needed to manage luxury businesses. You will learn invaluable tools that you’ll use for the rest of your business life, whatever your choice of career path, even if outside the luxury domain.” SESSION 2 SESSION 2 June 27 - July 8, 2016 June 27 - July 8, 2016 Investment Banking and International Corporate Finance Energy and Finance Summer Program Overview Summer Program Overview The purpose of this intensive summer program is to provide participants with the necessary skills to analyze a company’s financial situation, determine its value and understand how it raises funds. Taught exclusively by senior Investment Banking professionals, the program is designed for participants seeking an insider view on how Chief Financial Officers utilize financial theories (market equilibrium, agency theory, signal theory, behavioral finance) to make financial decisions and create shareholder value. Recent case studies and real-life scenarios will be utilized throughout the two-week program. The world is changing. Every year, the BRICS countries’ appetite for all sources of primary energy pushes energy demand and CO2 emissions to a new high. The latest climate assessment by the Inter-Governmental Panel on Climate Change in March 2014 is discouraging: if we do not change direction soon, global temperatures will go up by approximately 3 degrees Celsius by the middle of the century. If we are serious about maintaining the global temperature increase to 2° Celsius this century (“the 2°C challenge”), we cannot emit more than an extra 1000 giga-tonnes of carbon emissions globally, and this “Carbon Budget” will be completely exhausted by 2040 at today’s carbon emission rate. In other words, no more than one-third of the currently proven reserves of oil, gas and coal globally can be consumed over this century. At the same time, the number of people without access to electricity remains unacceptably high at 1.3 billion, around 20% of the world’s population. Against this unpromising background, events such as the Fukushima nuclear disaster and escalating tensions at the very borders of Europe or in the Middle East today, cast doubts on the security of the global energy supply. Participants seeking an internship or a future career in Investment Banking will benefit from the professors’ insight on how to navigate the Investment Banking application process. To complement classroom discussions, participants will be invited to an evening networking event with Investment Banking professionals. Although the program is accessible to finance and non-finance students alike, those admitted without an accounting or corporate finance background may be selected for a compulsory, online accounting course before the Summer School start, in addition to a two-hour review on Day 1 of the program. Learning Outcomes Upon successful completion of the summer program, participants will be able to: ›U nderstand how to successfully apply Investment Banking tools ›U nderstand key accounting principles and links among the 3 main financial statements ›A nalyze a company’s financial performance Learning Outcomes ›U nderstand company decisions on capital structure ›A scertain how company stakeholders work together despite diverging interests › I dentify the ways companies raise funds (debt and equity) as well as the associated costs ›U nderstand the methods CFOs/CEOs and Investment Bankers use to value companies › I dentify key drivers of M&A transactions ›U nderstand the purpose of leveraged buyouts (LBOs), their structure and means of success Affiliate Professor, HEC Paris Upon successful completion of the summer program, participants will have acquired a strong understanding of the following: › The energy industry organization, regulations and market drivers › The geopolitics of resources (oil and gas, coal and mining) › Producers and end-users strategies › Analyze an M&A transaction Ferdinand Petra We must change the way we use energy, and we may also have to change the kind of energy we produce. The 20th century is considered as “the century of hydrocarbons and nuclear”; will the 21st century move away from both? Will the rise of unconventional oil, gas and renewables change the face of the world? Will the long-term fundamentals of energy be completely reviewed due to the shift of Russia’s gas exports toward Asia, or due to the Middle East’s becoming the main destination of its resources? Will long-term importers, such as the U.S., become major exporters? In 20 years, will energy markets become completely deregulated and global, or will they have been re-regulated and decentralized? These are only a few of the important questions that this program will address. Patrick Legland Affiliate Professor, HEC Paris “We look forward to sharing our experience and expertise on valuation, mergers & acquisitions (M&A) and leveraged buyouts (LBOs) in this intensive program on Investment Banking and International Corporate Finance.” › Commodity price formation mechanisms Jean-Michel Gauthier Affiliate Professor, HEC Paris “We all know that you need to have a background in finance to become a decision-maker, irrespective of your business sector. What we have discovered recently is that you also need a background in energy. Why? A successful strategy today hinges upon energy markets and prices. The Summer School Program on Energy and Finance will offer you the energy background that is needed irrespective of your career path.” SESSION 2 SESSION 2 27 juin - 8 juillet 2016 June 27 - July 8, 2016 BUSINESS & GEOPOLITICS Objectif Création d’Entreprise De l’état d’esprit d’entrepreneur au projet personnel Summer Program Overview Pourquoi ce programme ? Recent events in the Middle East, the crisis in the United States and in Europe and growing tensions in the South China Sea have reminded us of how relevant political and geopolitical risks remain for decisionmakers, including those of the private sector. What seemed to be solid assumptions about how the world worked and how stable it was are now continuously challenged by – predictable and unpredictable – events that can unfold very quickly. Perhaps even more crucially, geopolitics is not only a dimension of global risk but also a channel of contagion that can transform a sovereign or a liquidity crisis into a worldwide, systemic failure of the international system. Un nombre croissant de jeunes diplômés considère l’opportunité d’entreprendre. Alors que l’état d’esprit entrepreneurial peut être lié à son milieu familial et sa culture, il est également associé avec la volonté d’innover. Au-delà de ces éléments intrinsèques, l’entrepreneuriat est une synthèse de toutes les disciplines. Ainsi, les entrepreneurs doivent : • Maitriser la plupart des disciplines du management, notamment marketing, stratégie, ressources humaines et finances. • Assimiler les meilleures pratiques proposées par des entrepreneurs expérimentés. The real issue lies in drawing operational implications from geopolitical analysis for businesses and decision-makers. Business executives can become easily obsessed with their inboxes, and be tempted to micromanage, isolate issues and be excessively backward-looking in their analyses as a result. In the Business and Geopolitics Summer School Program, participants will explore how geopolitics can help decision-makers broaden horizons and enrich their strategies by integrating global political and macroeconomic issues. Ce programme intensif est conçu pour les jeunes entrepreneurs qui ont un projet précis en tête, ainsi que pour des participants tentés par l’aventure entrepreneuriale, sans projet précis pour le moment. Learning Outcomes Upon successful completion of the summer program, participants will be able to: › Understand the strategic landscape in which decisions are taken › Assess business risks and opportunities entailed by geopolitical dynamics ›M onitor changes in the international landscape, including the likelihood of low-probability and high-impact events (black swans) › Integrate geopolitical analysis in the firm’s broader international and risk-mitigation strategies › Develop a long-term, consistent strategy and vision, beyond mere day-to-day tactics Jérémy Ghez Affiliate Professor, HEC Paris “The Business and Geopolitics Summer School Program lets participants broaden their horizons and consider how what happens beyond the market can affect their activities.” Grâce à des échanges autour de cas, de partage d’expériences, de travail d’équipe et cours, les participants développeront une meilleure compréhension des conditions essentielles requises pour lancer de nouvelles entreprises. Ce programme estival fournit des concepts critiques et des outils qui sont requis par un large éventail de start-ups : innovations numériques, haute technologie, service, etc. A la fin du programme, les participants seront évalués sur des projets d’entreprise. Objectifs pédagogiques Après avoir suivi le programme, les participants seront en mesure de : › Comprendre comment étudier un marché innovant › Maîtriser tous les facteurs clés de succès (KSF) de l’esprit d’entreprise, en mettant l’accent sur l’équipe des fondateurs : comment gérer les différents milieux, profils, intérêts et implications › Identifier et obtenir le soutien au projet grâce au réseautage › Calculer vos besoins financiers et trouver un financement : capital-investissement, dettes, subventions... › Identifier et saisir les possibilités optimales pour recueillir des fonds ; anticiper et mettre en œuvre des stratégies de sortie › Convaincre les partenaires (et surtout des investisseurs) en quelques minutes ou secondes › Concevoir et réaliser un business-plan convaincant › Acquérir les connaissances clés sur la création d’entreprise numérique › Comprendre les questions entrepreneuriales liées au développement durable › Maintenir un esprit d’entreprise et éviter la peur de l’échec ; aller de l’avant avec confiance et réussite Etienne Krieger Professeur Affilié, HEC Paris Frédéric Iselin Professeur Affilié, HEC Paris “Notre ambition : faciliter votre compréhension des principaux enjeux stratégiques, techniques, commerciaux, financiers et humains liés à la création et au développement d’une start-up ou d’une entreprise traditionnelle.” In the SUMMER… The HEC Summer experience extends beyond the lecture halls. Summer students will get to know peers both inside and outside of the classroom. Sports Sports are an important dimension of summer programs at HEC Paris. Participants have access to indoor and outdoor sports facilities; sports events foster team-building and leadership development. Culture The HEC Paris campus neighbors Versailles and falls at the back door of Paris, the “cultural capital of the world”. While weekdays will be devoted to academics, weekends are the opportunity to explore Paris. On weekends, buses will leave the HEC Paris campus to take participants directly to the city center. Accommodation and Fees EXPERIENCE THE HEC PARIS SUMMER SCHOOL… Celine Lim, Amherst College, United States “My experience at HEC Paris in one phrase: A program that embodied the very luxury principles it taught—heritage, expertise, and unparalleled excellence.” HEC Summer School Programs are open to undergraduate students and recent graduates from multi-disciplinary backgrounds. Participants select one program per session, and up to 2 programs during the full summer period. Applying is Easy The online application includes short-essay questions, your CV, academic transcripts and a 50 euro application fee. For all programs not taught in your native language, proof of fluency (be it in English or French) is requested. In certain cases, an interview may be required. Consult our website at www.hec.edu/summer-school or contact summerschool@hec.fr for further details. On-Campus Student Accommodation Living on campus allows Summer School students to take full advantage of campus life. All students reside in HEC Paris dormitories, a step away from the classroom. Residential accommodation is included in Summer School program fees. Total Program Fees with Housing* 1 Program 2 Programs 2370 € 4380 € * On-campus accommodation is included in program fees as follows: €320 for 1 session, €580 for 2 sessions. Total program fees include: › Tuition fees, on-campus housing, student card, weekend bus transportation during the program from campus to downtown Paris. Kamil Zielinski, Kozminski University in Warsaw, Poland “The program was as demanding as I expected and the atmosphere was undoubtedly remarkable. I definitely recommend this program to students who are seeking an academic challenge and multi-cultural learning experience.” Christopher Perron, Princeton University, USA “HEC’s Summer School was an extremely rewarding and enlightening experience. The ability to take classes from world renown faculty in an environment composed of students from seemingly innumerable places and cultures was absolutely incredible. HEC’s close proximity to Paris made it a wonderful place to study in addition to a gateway to Europe.” Roberta Pisani, Bocconi University, Italy “The Summer School offered me the opportunity to grow, not only from an academic point of view but also from a personal point of view. Considering the quality of teaching methods, I am now also considering applying to HEC for my Masters.” Claudia Schultz, The University of Queensland, Australia Program fees do not include: “I chose to experience an HEC education during the summer because HEC Paris offers the best and most rigorous academic programs in France with an unwavering connection to the surrounding corporate eco-system. The quality of teaching and guest speakers meant that I had the privilege to be exposed to top influencers and first movers in this business context.” › Travel to and from HEC Paris for program start and close, personal insurance (required), non-refundable 50 € application fee, food, personal expenses and anything not listed as included. “I learned so much about the business side of fashion, including how brands expand into different markets. In particular, I enjoyed learning about premium and luxury brands and how they operate.” Emily Madrigal, Princeton University, United States 23 average age 54 nationalities HEC Paris Summer School Programs 1, rue de la Libération 78350 Jouy-en-Josas France Tél. : +33 1 39 67 70 00 Fax : +33 1 39 67 94 36 Conception : CCI Paris IDF - CICERO - Les Bluets 1204 - © photos : Biais Jean Marc / Ribu Cedric - HEC Paris www.hec.edu/summer-school summerschool@hec.fr