Malfeasance and the Foundations for Global Trade: The Structure of... Indies, 1601–1833

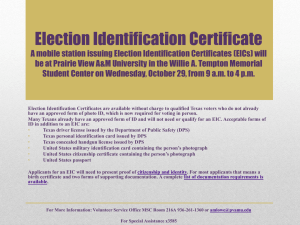

advertisement