B P R ?

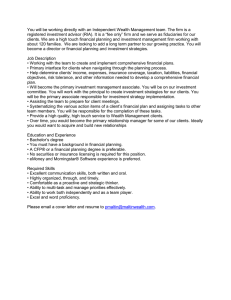

advertisement