Private equity in Southeast Asia Global private equity investors

advertisement

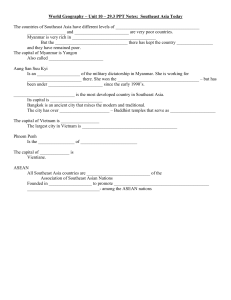

Private equity in Southeast Asia Global private equity investors just 23 during the recent downturn, 2009 was still are stepping up their presence the fourth-best year for transactions in the past decade (see Figure 1). The value of those deals, meanwhile, and increasing their capital soared six-fold, to $12.3 billion in 2007. Deal value commitments to the region dropped by nearly half, in 2009, to $6.3 billion; but even at that depressed level, the total value of PE Private equity’s expanding global scope and influence— particularly in the big emerging markets of China and India—has been one of the leading financial stories of the past decade. Less visible, although no less significant, has been private equity’s increasing role in speeding the growth of companies across the transactions last year was nearly eight times higher than in 2001, when the region began to pull out of the last recession. From 2006 through the end of last year, buyouts comprised less than one-third of all deals, but they accounted for between one-half and three-fourths of total deal value. dynamic economies of Southeast Asia—from Singapore, Malaysia and the Philippines to Indonesia, Thailand and Vietnam. With the return of strong GDP growth across the region since the second half of 2009, PE in Southeast Asia looks poised to resume its ascent (see Figure 2). The PE industry has sunk deep roots in the region. From peak to peak across the business cycle, the number of deals financed by PE investors rose from 40 in 2000 to 60 in 2007, a 50 percent increase. Even though the deal count in the region dropped to Deal flow has continued to increase into 2010, along with average deal size. A wide array of large-cap, midcap, sovereign wealth funds and Asia-focused funds wielding sizable amounts of “dry powder”—capital targeted for investment but not yet allocated—are Figure 1: Following years of strong growth, PE dealmaking in Southeast Asia slumped in 2009 but is now rebounding Deal value by type of investment Number of deals by type of investment Southeast Asia Southeast Asia $15B 75 12.3 60 60 51 10 45 8.3 6.8 5 40 30 27 4.1 0.8 1.0 00 15 2.4 2.0 0 6.3 43 01 02 11 1.5 03 04 Buyouts 05 06 07 0 08 09 Mezzanine/pre IPO/expansion PIPE 00 01 Startup/early stage/concept 15 17 02 03 23 21 04 05 06 07 08 09 Turnaround/ restructuring Notes: Investments with announced deal value only; excludes deals of value <$10M; does not include bridge loans, franchise funding and seed/R&D deals; excludes infrastructure project finance deals, real estate, real estate investment trust and hotels & lodging property deals; Southeast Asia includes Indonesia, Malaysia, Philippines, Thailand, Vietnam and Singapore Sources: AVCJ; Bain analysis Figure 2: Many factors point to growth of PE as an asset class in Southeast Asia Number of funds will most likely increase or remain the same Percentage of survey respondents who expect the number of PE funds focusing on Southeast Asia to... 100% 80 Decrease New funds will mostly be regionally focused Percentage of potential new PE funds are expected to be... 100% Remain the same 80 60 60 40 40 20 0 Increase Expectation Single country funds Sector focused funds Generalist funds Percentage of PE funds who believe, with regards to allocation to PE/VC as an asset class, LPs will... 100% Regional funds Increase allocation 40 20 New fund type Decrease allocation 80 60 20 0 LP asset allocation to PE/VC will remain stable or increase 0 Remain the same Asset allocation Sources: Bain Southeast Asia PE Survey; Bain analysis scouting the region for opportunities. Credit markets expertise to the region. Nearly two-thirds of the re- have stabilized, laying a foundation for a cautious spondents expect that new funds will be regional return of both buyouts and growth capital. specialists, and another 13 percent will specialize by industry sector. Overwhelmingly, PE general partners This constellation of favorable conditions makes now expect limited partners’ interest in investing in the a good time to take stock of how the industry will region to remain high, with nearly nine out of 10 evolve over the balance of 2010 and beyond. To find looking for them to maintain or increase their asset out, Bain & Company, with the cooperation of the allocations to PE and venture capital. Singapore Venture Capital & Private Equity Association (SVCA), surveyed general partners at many of PE firms are increasing their physical and the leading PE and venture capital funds in the region. financial commitment The picture that emerges is of a dynamic young industry ready to move into a phase that will require Among funds already active in Southeast Asia, just PE firms active in the region to acquire new skills. 20 percent are local specialists, and nearly half of Let’s look at the specifics: those concentrate on Singapore. The remainder are about evenly split between funds that invest broadly PE is now a major asset class in across Asia and global funds that have established Southeast Asia a local presence. Continuing to target mainly small and mid-cap companies, the survey respondents Many factors point to a deepening of PE investor anticipate that 50 percent of funds’ annual invest- commitment to the region. Half of all respondents ments in the region over the coming two to three years look for the number of funds active in Southeast will be more than $100 million (see Figure 3). They Asia to increase over the next two to three years. The expect that only about one-quarter will invest more funds will also be bringing a new focus and deeper than $200 million a year. Figure 3: Half of PE funds will deploy less than US$100 million annually to deals in Southeast Asia Figure 4: In spite of increasing competition, about 40% of all deals were solely sourced In Southeast Asia, most deals are proprietary or involve limited competition Percentage of PE funds that will invest on an annual basis for the next 2–3years Deals in Southeast Asia in the last 2–3 years that... 100% 100% > US$200M 80 80 US$150–200M 60 US$100–150M 60 40 US$50–100M 40 20 20 < US$50M 0 Had three or more other competitive bidders Had 1–2 competitive bidders Had no other competitive bidders 0 Annual investment Competition Sources: Bain Southeast Asia PE Survey; Bain analysis Sources: Bain Southeast Asia PE Survey; Bain analysis Competition will heat up New skills required The influx of new funds wielding large amounts of As competition to identify attractive deals and to win dry powder to invest will bring a new intensity to the the best ones ramps up, PE firms will need to sharpen competition for deals across Southeast Asia. But their capabilities along each phase of the investment survey respondents report that incumbent funds that life cycle, from deal sourcing to exit (see Figure 5). have an established presence in the region’s fragmented markets have distinct deal-sourcing advan- • In deal sourcing, for example, the leading firms tages. About half of all deals completed over the past are strengthening their skills as geographic and two to three years were sourced, in about equal pro- industry sector specialists, enabling them to portion, through networks of industry relationships differentiate themselves from their peers as the and advisers or by direct approaches to the target preferred partner to owners of the companies companies themselves. Brokers and other interme- they target. Greater specialization will be an diaries were the sources for the balance of deal in- increasing source of competitive advantage for troductions. Those early leads have kept a lid on sustaining a strong deal flow. competition. Nearly 40 percent of deals completed across the region since 2007 and 2008 were pro- • Leading firms are honing their due-diligence prietary (see Figure 4). In another 30 percent, win- disciplines, skills that are especially important ning bidders faced just one or two bidding rivals. in Southeast Asia, where a high proportion of potential target companies are small, private and lacking in transparency. Figure 5: Differentiated investment capabilities will be critical Sector specialization Sourcing Due diligence Ownership Exit Efficient markets Ability to drive differentiated returns — — Necessary to be Significant share of Enhanced due More critical threshold competitive deals are proprietary, diligence and in future in mature markets; especially in less investment benefits all value mature markets committee process chain steps • PE firms increasingly recognize that they need Strong regional growth, dynamic entrepreneurs and to work actively with owners to identify high- increasingly knowledgeable and seasoned investors priority initiatives that create value. They moni- add up to a promising period ahead for private equity tor performance by tracking a few key metrics investment in Southeast Asia. that provide an early warning system to alert management to take fast corrective action if the program begins to drift off course. • Finally, PE leaders begin weighing how they will exit from each investment well before the time comes to sell by continuously evaluating market conditions for initial public offerings (IPOs) and identifying potential strategic acquirers. Key contacts in Bain’s Private Equity practice in Southeast Asia: Singapore: Suvir Varma (suvir.varma@bain.com) Sharad Apte (sharad.apte@bain.com) Till Vestring (till.vestring@bain.com) For additional information, please visit www.bain.com