UK Motoring Taxes: The Road Ahead Andrew Leicester, IFS

advertisement

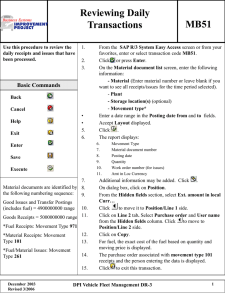

UK Motoring Taxes: The Road Ahead Andrew Leicester, IFS ITS Road User Charging conference, February 23rd 2012 © Institute for Fiscal Studies Motoring is a significant source of tax revenue 2011–12 Revenue (£ bn) Fuel duties 27.0 VAT on duty 5.4 VED 5.9 Total motoring 38.3 % Receipts £ bn Total receipts GDP Source: IFS calculations from OBR Autumn Statement 2011 estimates © Institute for Fiscal Studies % GDP Motoring is a significant source of tax revenue 2011–12 Revenue (£ bn) % Receipts % GDP Fuel duties 27.0 4.7% 1.8% VAT on duty 5.4 0.9% 0.4% VED 5.9 1.0% 0.4% Total motoring 38.3 6.7% 2.5% £ bn Total receipts GDP 575.5 1,521.0 Source: IFS calculations from OBR Autumn Statement 2011 estimates © Institute for Fiscal Studies Real revenues are near historic highs ... Inflation-adjusted receipts of motoring taxes (2010 prices), 1965–2010 Real receipts (£ bn, 2010 prices) 45 40 Car tax 35 30 VED 25 20 15 VAT on duty 10 5 0 1965 1970 1975 1980 1985 1990 1995 2000 2005 2010 Source: IFS calculations from ONS data, deflated using GDP deflator from HM Treasury data © Institute for Fiscal Studies Fuel duties ... but fallen relative to other receipts recently Motoring taxes as a share of total receipts, 1965–2010 12% Share of total receipts 10% Car tax 8% VED 6% 4% 2% 0% 1965 1970 1975 1980 1985 1990 1995 2000 2005 2010 Source: IFS calculations from ONS data © Institute for Fiscal Studies VAT on duty Fuel duties The trend looks set to continue in the short-term Forecast motoring taxes as a share of total receipts 8% Outturn Share of total receipts 7% Forecasts VED 6% 5% 4% VAT on duty 3% 2% Fuel duties 1% 0% 2009 – 2010 – 2011 – 2012 – 2013 – 2014 – 2015 – 2016 – 10 11 12 13 14 15 16 17 6.0%: lowest since 1954 Source: IFS calculations from OBR data © Institute for Fiscal Studies Revenues could continue to erode in long-run Forecast motoring taxes as a share of GDP, 2000–01 to 2029–30 2.5 Share of GDP (%) 2 Fuel duties 1.5 1 VED 0.5 Source: OBR Fiscal Sustainability Report (2011) © Institute for Fiscal Studies 2028-29 2026-27 2024-25 2022-23 2020-21 2018-19 2016-17 2014-15 2012-13 2010-11 2008-09 2006-07 2004-05 2002-03 2000-01 0 Putting the long-term decline into context • Receipts 0.9% of GDP lower by 2029–30 if OBR correct • Equivalent to about £13.2 billion in today’s terms • Approximate tax changes to generate £13 billion include: – 3.4p rise in the basic rate (from 20p) – 2.7ppt rise in the main rate of VAT (from 20%) – 51% rise in main fuel duty rate (from 58p) • Overstating the likely decline? – Assume no change in VED thresholds: 85% of fleet exempt by 2030 • Or understating? – Assume fuel duty inflation-adjusted each year – Unlikely if oil prices remain high – Autumn Statement froze rates © Institute for Fiscal Studies What’s behind the decline? ... and recession-hit road use ... Avg. new car emissions, g CO2/km, 1997–2010 Motor vehicle km (billions), 1997–2010 (GB) 520 190 510 180 500 170 490 160 480 150 470 140 460 130 450 120 440 110 430 100 420 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 200 Source: Society of Motor Manufacturers and Traders © Institute for Fiscal Studies 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 Increased fuel efficiency... Source: Department for Transport What’s behind the decline? ... have combined to reduce fuel sales Sales of vehicle fuel, billion litres, 1997–98 to 2010–11 50 45 40 Diesel 35 30 25 20 15 Petrol 10 5 © Institute for Fiscal Studies 2010–11 2009–10 2008–09 2007–08 2006–07 2005–06 2004–05 2003–04 Source: HMRC UK Trade Info data 2002–03 2001–02 2000–01 1999–00 1998–99 1997–98 0 What’s behind the decline? More efficiency & falling real duty means each km is taxed less 7 65 6.5 60 6 55 5.5 50 5 45 4.5 40 4 35 3.5 30 3 Source: IFS calculations from DfT and ONS data, deflated using all-items RPI index © Institute for Fiscal Studies Real receipts (p/km, 2010 prices) 70 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 Real duty (p/litre, 2010 prices) Average duty rate and receipts per kilometre, 1993–2010 (2010 prices) Real duty Real receipts per km What’s behind the decline? Vehicle numbers up, but VED per vehicle down as efficiency rises 270 34 255 32 240 30 225 28 210 26 195 24 180 22 165 20 150 Source: IFS calculations from DfT and ONS data, deflated using all-items RPI index © Institute for Fiscal Studies Receipts/vehicle (£, 2010 prices) 36 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 Registered vehicles (millions) Registered vehicles and real VED receipts per vehicle, 1993–2010 (2010 prices) Registered vehicles Real VED per vehicle The economic rationale for road pricing is clear Distribution of marginal external costs of road use (pence/km), 2010 250 Pence per kilometre 225 200 175 150 125 100 75 50 25 0 0% 10% 20% 30% 40% 50% 60% 70% 80% Cumulative proportion of road use Fuel duty per km Source: IFS calculations from DfT (2010) estimates © Institute for Fiscal Studies Marginal external cost 90% 100% But fiscal pressure may be spur for reform • Economic case is well-known, certainly since Eddington (2006) • Would need ever higher real duty to offset revenue loss – Increasingly regressive if poor households have less efficient cars – Duty becomes ever-worse instrument to target external costs • Road use may provide more secure tax base than vehicles & fuel • CCC (2010) estimates: – Fleet efficiency 168g CO2/km (2011) to 76g (2030) – 60% new car sales electric (zero fuel) by 2030 – Road use 516 billion vehicle km (2011) to 637 billion (2030) • Government should recognise this and start to lay ground now – Road user charging should be largely offset by cuts to fuel duty – Need to make the case for reform: inaction not a neutral policy! © Institute for Fiscal Studies