Company Tax Issues Steve Bond

advertisement

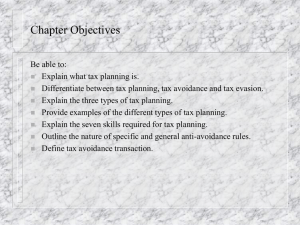

Company Tax Issues Steve Bond Introduction • Pressures on UK corporation tax revenue • Two revenue-raising measures • Clampdown on tax avoidance • Tax increases on North Sea oil International Pressures • UK relies more on corporate tax revenues than most developed countries • Government projections show a significant increase in corporate tax revenues • International developments may make that difficult to achieve • Tax competition • European Court of Justice Trends in Corporate Tax Rates • Clear downward trend in corporate income tax rates in developed countries over last 20 years • Gordon Brown cut the UK corporation tax rate in 1997 and 1999, but no change since then • Despite EU enlargement, and recent cuts in Austria, Finland, Germany, Greece, Holland Trends in Corporate Tax Rates UK G7 EU-15 1996 33 43.5 38.1 1999 30 39.8 35.9 2005 30 36.3 30.1 EU-25 26.3 Trends in Corporate Tax Rates • 6 of the EU-15 countries now have a lower corporate tax rate than the UK • If downward trend continues elsewhere, some doubt as to whether UK can sustain 30% corporation tax rate, and remain an attractive location for international companies European Court of Justice • Another threat comes from the ECJ • EU Treaty Articles enshrine non-discrimination, free movement of capital, and freedom of establishment • Allow companies to challenge the legality of national tax structures • Increasing importance • Particularly for international companies European Court of Justice • Already an important influence on recent reforms to UK corporation tax • Extension of transfer pricing rules • Taxation of finance leases • 2005 Marks and Spencer case • Tax relief for losses made by some EU subsidiaries • But only in very limited circumstances Current Challenges • Cadbury Schweppes • Challenge to application of CFC rules within EU • CFC rules allow governments to tax subsidiaries located in low tax jurisdictions directly • Threat to UK revenue if this allows UK companies to make more effective use of tax haven regimes outside the EU • By routing profits through EU countries with less effective CFC rules Current Challenges • Franked Investment Income GLO • Challenge to ‘credit system’ • Dividends received from overseas subsidiaries are taxed, with credit for foreign corporate taxes paid • Dividends received from UK subsidiaries are not taxed • If this challenge succeeds, UK could either adopt an exemption system for foreign-source dividends • Or apply UK corporation tax to dividends received from UK subsidiaries The Squeeze on Corporate Tax Revenue • International developments question the sustainability of current level of corporation tax receipts • Non-North Sea corporation tax raising 2.9% of national income in 2005-06 • Government medium term projections show that increasing to 3.3% of national income • May prove difficult to achieve, or risk having a detrimental impact on investment in the UK Revenue-raising Measures • This background provides some insight into recent measures designed to increase corporate tax revenues • The tax avoidance agenda • Tax increases on North Sea oil Tax Avoidance • Clear increase in Government efforts to tackle tax avoidance • Measures announced since 2002 Budget alone estimated to raise £4.5bn this year • Important developments include • 2004 statement by Paymaster General • Tax Avoidance Disclosure rules • ‘Tax in the Boardroom’ agenda Closing the ‘tax gap’ • ‘Tax gap’ – between what the authorities actually collect, and what they estimate they should be collecting • New anti-avoidance measures are continually needed to prevent gap widening, as new avoidance schemes are developed • But current initiatives seem to be aimed at narrowing the gap Changing the terms • Traditional distinction between illegal tax evasion and legal tax avoidance or tax planning • Some forms of avoidance are now tarred with some of the disapproval traditionally reserved for evasion • Imprecise distinction between acceptable and unacceptable forms of tax planning 2004 Statement by PMG • Crackdown on schemes to avoid tax and NICs on rewards from employment, particularly City-style bonus payments • Threat to apply anti-avoidance legislation retrospectively, should future schemes ‘frustrate our intention that employers and employees should pay the proper amount of tax and NICs on the rewards of employment’ Tax Complexity and Tax Avoidance • Relatively simple to apply this approach to employee earnings, where nature of the tax base is relatively straightforward to define • Much harder in cases like business profits, where the (UK) tax base is much harder to specify • Complexity breeds opportunities for avoidance Tax Complexity and Tax Avoidance • Complex legislation leaves more room for dispute about the intention of the law • And for creative attempts to find arrangements that fall within the letter of the law, if not its spirit • Hence unsurprising that tax avoidance is a big issue in areas such as the taxation of international companies and the financial sector Tax Avoidance Disclosure • Introduced in 2004, and subsequently strengthened • Requires early disclosure to tax authorities of certain kinds of tax planning schemes • Had produced around 600 direct tax disclosures and 750 indirect tax disclosures by autumn 2005 • And raft of blocking measures in 2005 Budget and 2004 and 2005 Pre-Budget Reports Tax Avoidance Disclosure • Clearly working from Government’s perspective • Generating information needed to take action • Cost is an outpouring of targeted antiavoidance measures • Taxpayers, and especially companies, must ensure their arrangements do not fall foul of these additional provisions ‘Tax in the Boardroom’ Agenda • Attempt by HMRC to raise awareness among senior management of large companies of risk to their reputation • HMRC officials wrote directly to chairmen of UK’s largest 500 companies in autumn 2005 • Seeking greater dialogue over management of tax issues and ‘tax risk’ ‘Tax in the Boardroom’ Agenda • Perception that HMRC is seeking to increase pressure on companies by raising questions about tax strategies at boardroom level • Emphasis on ‘tax risk’ looks like an attempt to increase uncertainty about the borderline between acceptable and unacceptable forms of tax planning ‘Tax in the Boardroom’ Agenda • This may succeed in raising revenue in the short term, but at what cost? • One of the attractions of the UK as a location for internationally mobile companies and individuals is its reputation for efficient and transparent tax administration • Any damage to this reputation may be difficult to reverse Tax Avoidance Initiatives • Tension between demands that companies pay their ‘fair share’ of taxation, and aim for a globally competitive tax system • Barrage of targeted anti-avoidance measures may contribute to former objective, but risks undermining the latter • Extension of this approach can nevertheless be expected in the 2006 Budget North Sea Taxation • Significant recent increases • 2002: 10% supplementary rate of corporation tax; reform raised around £0.5bn per year • 2005: change to timing of tax payments; one-off gain of £1.1bn in 2005-06 • 2006: increase in supplementary rate of corporation tax to 20%; raises around £2bn per year from 2006-07 onwards 2002: Structural Reform • 2002 reform introduced a desirable structure for the taxation of new fields • Single tax, corporation tax, at 40% rate • 100% first-year allowance for investment • Broadly neutral impact on investment decisions, so long as investors believe tax rate will remain constant • Fear of a rising tax rate is bad news for investment; tax rate on future profits higher than current tax relief for investment spending 2005: Opportunistic Tax Hikes • 2005 Budget: brought tax payments forward • Main effect was to shift a £1.1bn instalment payment from April 2006 to January 2006 • Conveniently boosting revenue for 2005-06 2005: Opportunistic Tax Hikes • 2005 Budget: brought tax payments forward • Main effect was to shift a £1.1bn instalment payment from April 2006 to January 2006 • Conveniently boosting revenue for 2005-06 • Only a cynic would think this had anything to do with meeting the Golden Rule 2005: Opportunistic Tax Hikes • 2005 Pre-Budget Report: corporation tax rate for North Sea operations raised to 50% • More significant and permanent tax increase, raising around £2bn per year from 2006-07 • Impact on investment comes not so much from the 50% tax rate, but from the fear that the North Sea is now seen as a soft target for further tax increases Striking a Balance? • Budget 2002: ‘a regime that raises a fair share of revenue and encourages long-term investment’ • 2005 Pre-Budget Report: ‘striking the right balance between producers and consumers … to promote investment and ensure fairness for taxpayers’ A Secure Basis for Planning? • Budget 2002: ‘a more secure basis on which companies can plan for the future’ • Two tax rises in the last year alone! • 2005 Pre-Budget Report: ‘there will be no further increases in North Sea oil taxation during the life of this Parliament’ • Unclear how far this promise will go towards restoring investors’ confidence in the North Sea tax regime Conclusions • Tax increases on North Sea oil and gas, and more aggressive stance on tax avoidance, are part of a campaign to sustain and if possible increase corporate tax revenues • International developments are pushing in the opposite direction • Very difficult to balance this aim with desire to maintain an internationally competitive tax system