The Role of Taxation in the Decision Process

advertisement

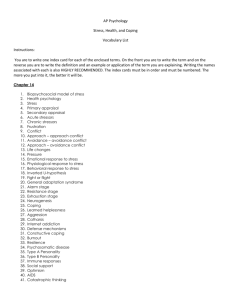

Chapter Objectives Be able to: Explain what tax planning is. Differentiate between tax planning, tax avoidance and tax evasion. Explain the three types of tax planning. Provide examples of the different types of tax planning. Explain the seven skills required for tax planning. Outline the nature of specific and general anti-avoidance rules. Define tax avoidance transaction. What is Tax Planning Tax planning is the legitimate arranging of one’s financial activities in a manner that reduces or defers the retained tax cost. Tax evasion is the commission or omission of an act with the intent to deceive and is easily distinguished from tax planning. Tax avoidance is the grey area between tax planning and tax evasion and involves transactions which, while legal in themselves, are planned and carried out mainly to avoid, reduce or defer tax payable under the law. In some cases, the transactions do not reflect the real facts of the situation and may be regarded as an abuse of the system. When the CCRA perceives tax avoidance transactions to be abusive, it will attempt to deny the resulting benefits. Types of Tax Planning Tax planning will follow into one of the following categories: 1) shifting income from one period to another 2) transferring income to another entity or alternative taxpayer 3) converting the nature of income from one type to another Expenditures should also be considered. When carrying out tax planning, it is important to consider factors other than just income taxes, such as: the time value of money, financing requirements, and anticipating future events. Tax planning does not consist of a definitive list of rules and, thus, one must test alternative courses of action with a view to achieving specific financial goals. Skills Required for Tax Planning In order to implement tax planning activities, it is necessary to develop the following skills: Ability to Understand tax system fundamentals Anticipate an investment’s complete cycle from beginning to end Be flexible in considering different courses of action Speculate on unanticipated events Apply compound interest concepts Put the tax factor into perspective as one of many factors Use a global approach including all affected parties Restrictions on Tax Planning The ITA specifically prohibits a number of activities and these prohibitions are called anti-avoidance rules. The ITA also has a general rule that attempts to state, in general terms, what is considered to be unacceptable activity. The tax authorities are particularly concerned with transactions between non-arms length parties since they are often not motivated by normal market forces. The general anti-avoidance rule (GAAR) stipulates that when a person is involved in an avoidance transaction, tax will be adjusted to deny the benefit that would have resulted from the transaction or series of transactions. A transaction will not be considered an avoidance transaction if its primary objective is for bona fide business, investment or family purposes.