“We shall squeeze ... until the pips squeak” Gemma Tetlow

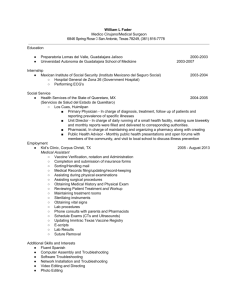

advertisement

“We shall squeeze ... until the pips squeak” Gemma Tetlow Post-Spending Round Briefing, 27 June 2013 © Institute for Fiscal Studies The outlook for total spending £ billion (2013–14 prices) 800 Total public spending AME DEL 700 600 500 400 300 200 100 © Institute for Fiscal Studies Note: DEL and AME figures from 2013–14 adjusted for changes for local government funding for Business Rates Retention and Council Tax Benefit localisation. 2017–18 2016–17 2015–16 2014–15 2013–14 2012–13 2011–12 2010–11 2009–10 2008–09 2007–08 2006–07 2005–06 2004–05 2003–04 2002–03 2001–02 2000–01 1999–00 1998–99 0 Overview of spending plans for 2015–16 • Reallocation from capital AME to capital DEL – “Financial transaction” – Decreases AME and increases DEL by £3 billion – Reduces the apparent cut to DEL compared to what was suggested in March • Average DEL cut of 2.1% in real terms across departments in 2015–16 – On top of 8.3% average cut between 2010–11 and 2014–15 – Implies 10.3% average cumulative cut over five years • Pain has not been equally shared – Capital spending increased while current spending cut (unlike SR2010) – Departmental priorities largely the same as in SR 2010 – Some departments set to be cut by more than a third over five years © Institute for Fiscal Studies Additional cuts averaging 2.1% announced yesterday for 2015–16... International Development Transport NHS (Health) Home Office Education Energy and Climate Change Defence Total DEL Business, Innovation and Skills Justice Foreign and Commonwealth Office Environment, Food and Rural Affairs CLG Local Government Culture, Media and Sport Work and Pensions CLG Communities -80 5.9 1.4 0.1 -0.9 -1.1 -1.8 -2.1 -2.1 -3.0 -8.7 -9.3 -10.7 -11.5 -15.8 -21.2 -29.6 -60 -40 -20 0 20 Real budget increase 2014–15 to 2015–16 © Institute for Fiscal Studies Note: Figures show cumulative change in total DEL after economy-wide inflation. 40 Come on top of cumulative cut to DEL averaging 8.3% over SR2010... International Development Transport NHS (Health) Home Office Education Energy and Climate Change Defence Total DEL Business, Innovation and Skills Justice Foreign and Commonwealth Office Environment, Food and Rural Affairs CLG Local Government Culture, Media and Sport Work and Pensions CLG Communities -80 28.0 -1.1 4.1 -23.5 -7.4 -3.1 -7.0 -8.3 -23.6 -27.8 -50.4 -25.6 -26.5 -34.7 -21.7 -44.0 -60 -40 -20 0 20 Real budget increase 2010–11 to 2014–15 © Institute for Fiscal Studies Note: Figures show cumulative change in total DEL after economy-wide inflation. 40 The art of obfuscation • Figures for Departmental Expenditure Limits published yesterday for 2014–15 differ quite significantly from figures published in Budget 2013 for some departments 1. Change in where some grants sit – Police grant transferred from Local Government to Home Office (£3 billion) – Learning disabilities and health grant moved from NHS to Local Government (£1.4 billion) – Other transfers occurred from Education and Transport to Local Government 2. Localisation of council tax benefit now incorporated in DCLG Local Government budget – moves £4.3 billion of spending • For now, the first point hampers a comparison of historic and forecast departmental budgets © Institute for Fiscal Studies Estimated cumulative 5-year cut International Development Transport NHS (Health) Home Office Education Energy and Climate Change Defence Total DEL Business, Innovation and Skills Justice Foreign and Commonwealth Office Environment, Food and Rural Affairs CLG Local Government Culture, Media and Sport Work and Pensions CLG Communities -80 35.5 0.3 4.2 -24.1 -8.4 -4.8 -8.9 -10.3 -25.9 -34.1 -55.1 -33.6 -35.0 -45.0 -38.3 -60.6 -60 -40 -20 0 20 Real budget increase 2010–11 to 2015–16 © Institute for Fiscal Studies Note: Figures show cumulative change in total DEL after economy-wide inflation. 40 1992-93 1993-94 1994-95 1995-96 1996-97 1997-98 1998-99 1999-00 2000-01 2001-02 2002-03 2003-04 2004-05 2005-06 2006-07 2007-08 2008-09 2009-10 2010-11 2011-12 2012-13 2013-14 2014-15 2015-16 2016-17 2017-18 Percentage of national income Public Sector Net Investment Average: 1.8% 3.5% 3.0% Outturns © Institute for Fiscal Studies Average: 1.7% 4.0% Forecasts 2.5% 2.0% 1.5% 1.0% 0.5% 0.0% Further cuts are expected beyond March 2016 (1) • Total spending approximately frozen in real terms – But AME spending rising, in the absence of further policy action – Implies further cuts to DELs • If no further tax increases or AME cuts announced – Total DEL would have to be cut by 7.9% over two years – If continue ‘protecting’ NHS, schools, ODA, unprotected areas would have to be cut by 15.0% – Implies cumulative cut to unprotected areas over 7 years of 32.9% • If want to avoid any further DEL cuts – Additional £25 billion of tax increases or AME cuts required © Institute for Fiscal Studies Beyond SR 2013: Trade off between DEL cuts and other policy action Tax increase or social security spending cut, £ billion (2013–14 terms) 40 Total DEL 35 ‘Unprotected DEL’ 30 No real cuts to total DEL: £25 billion policy action 25 20 15 10 Total DEL cut at same rate as over SR2010: £10 billion policy action 5 0 No new tax rise or social security cuts: 7.9% total DEL cut -5 -10 -15% -10% -5% 0% Real change in departmental spending, 2015–16 to 2017–18 © Institute for Fiscal Studies 5% Further cuts are expected beyond March 2016 (2) • If no further tax increases or AME cuts announced – Total DEL would have to be cut by 7.9% over two years – If continue ‘protecting’ NHS, schools, ODA, unprotected areas would have to be cut by 15.0% – Implies cumulative cut to unprotected areas over 7 years of 32.9% • If want to avoid any further DEL cuts – Additional £25 billion of tax increases or AME cuts required • If continue cutting DEL at same rate as between 2010–11 and 2015–16 (average 2.4% a year) – Additional £10 billion of tax increases or AME cuts required • Additional £3.7bn a year also has to be found from 2016–17 for higher public sector employer National Insurance contributions © Institute for Fiscal Studies Conclusions • Departmental spending cuts averaging 2.1% announced for 2015– 16 – Capital spending increased, while current spending cut – Cuts unevenly spread, with priorities largely unchanged since SR 2010 – Some departments have fared noticeably better this time: Home Office, Transport • Cumulative cut over five years from 2010–11 now averages 10.3% – 18.5% across unprotected areas – Some departments will see cuts of more than a third: Justice, Communities, DEFRA, Foreign Office • Further cuts likely in 2016–17 and 2017–18 – If no further tax increases or AME cuts announced, total DEL would have to be cut by 7.9% over two years © Institute for Fiscal Studies