Mind the gap Paul Johnson © Institute for Fiscal Studies

advertisement

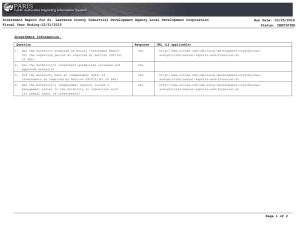

Mind the gap Paul Johnson © Institute for Fiscal Studies 1997-98 1998-99 1999-00 2000-01 2001-02 2002-03 2003-04 2004-05 2005-06 2006-07 2007-08 2008-09 2009-10 2010-11 2011-12 2012-13 2013-14 2014-15 2015-16 2016-17 2017-18 2018-19 2019-20 2020-21 % of national income Tax and spending 1997-2020 48 46 44 42 40 38 36 34 32 30 © Institute for Fiscal Studies 1997-98 1998-99 1999-00 2000-01 2001-02 2002-03 2003-04 2004-05 2005-06 2006-07 2007-08 2008-09 2009-10 2010-11 2011-12 2012-13 2013-14 2014-15 2015-16 2016-17 2017-18 2018-19 2019-20 2020-21 % of national income Tax and spending 1997-2020 48 46 44 42 40 38 36 34 32 30 © Institute for Fiscal Studies Tax receipts in 2015-16 6% 4% 5% 27% Income tax 5% NICS VAT Fuel duty 7% Other indirect taxes Corporation tax Council tax 6% Business rates Capital taxes Other taxes 4% 18% 18% 2020–21 2019–20 2018–19 2017–18 2016–17 2015–16 2014–15 2013–14 2012–13 2011–12 2010–11 2009–10 2008–09 2007–08 Share of national income (2007–08 = 100) Changing shares since 2007-08 120 110 100 90 Indirect taxes 80 70 60 50 2020–21 2019–20 2018–19 2017–18 2016–17 2015–16 2014–15 2013–14 2012–13 2011–12 2010–11 2009–10 2008–09 2007–08 Share of national income (2007–08 = 100) Changing shares since 2007-08 120 110 Indirect taxes 100 90 Property taxes 80 70 Personal income taxes 60 50 2020–21 2019–20 2018–19 2017–18 2016–17 2015–16 2014–15 2013–14 2012–13 2011–12 2010–11 2009–10 2008–09 2007–08 Share of national income (2007–08 = 100) Changing shares since 2007-08 120 110 Indirect taxes 100 Capital taxes 90 80 Property taxes 70 Personal income taxes 60 50 2020–21 2019–20 2018–19 2017–18 2016–17 2015–16 2014–15 2013–14 2012–13 2011–12 2010–11 2009–10 2008–09 2007–08 Share of national income (2007–08 = 100) Changing shares since 2007-08 120 110 Indirect taxes 100 Capital taxes 90 Property taxes 80 Personal income taxes 70 Corporation taxes 60 50 Recession Corporation taxes 2020-21 2018-19 2016-17 2014–15 2012–13 2010–11 2008–09 2006–07 2004–05 2002–03 2000–01 1998–99 1996–97 1994–95 1992–93 1990–91 1988–89 1986–87 1984–85 1982–83 1980–81 1978–79 % of national income Corporation tax revenues – finally on a declining trend? 6% 5% 4% 3% 2% 1% 0% 2020–21 2014–15 2013–14 2012–13 2011–12 2010–11 2009–10 2008–09 2007–08 2006–07 2005–06 % of national income The role of banks 0.6% 0.5% 0.4% 0.3% Bank surcharge Bank levy 0.2% Corporation tax 0.1% 0.0% North Sea oil revenue projections 14 12 £bn, current prices 10 8 June Budget 2010 6 4 2 Budget 2011 0 © Institute for Fiscal Studies 2020-21 2019-20 2018-19 2017-18 2016-17 2015-16 2014-15 2013-14 2012-13 2011-12 2010-11 -2 North Sea oil revenue projections 14 12 £bn, current prices 10 June Budget 2010 8 Budget 2011 6 Budget 2012 4 Budget 2013 Budget 2014 2 Budget 2015 0 Budget 2016 © Institute for Fiscal Studies 2020-21 2019-20 2018-19 2017-18 2016-17 2015-16 2014-15 2013-14 2012-13 2011-12 2010-11 -2 Growing dependence on the very rich 100 90 70 60 50 Top 1% 40 90th–99th percentiles 50th–90th percentiles 30 20 10 2015–16 2010–11 2007–08 2000–01 1990–91 0 1978–79 % of income tax receipts 80 Policy risk • £8 billion cost of increasing personal allowance and higher rate threshold as promised in manifesto • OBR assumes fuel duties rise with inflation – Failure to do that this year makes that look unlikely • Other thresholds frozen in cash terms – 40% more additional rate taxpayers since April 2010 – 50% increase over next five years in numbers losing child benefit • Increasing reliance on small and new taxes increases complexity – Over £7bn in entirely new taxes by 2020 • DPT, bank tax, apprenticeship levy, sugar tax © Institute for Fiscal Studies Economic risk • £260 billion of income tax and NI receipts, highly sensitive to earnings growth – Recent combination of high employment and low earnings growth has hit revenues hard • Specific risks to – Stamp duties – depending on the housing market – Capital taxes – depending on the stock market © Institute for Fiscal Studies Big choices • What is the strategy for fuel taxes? • Are we in new equilibrium with lower CT revenues? • What risks does reliance on the very rich bring? • Will reluctance to increase major taxes continue to lead to more and more smaller taxes – And associated complexity • Is tax and spending at 37% of national income sustainable into the long term?