Newspapers in Times of Low Adversiting Revenues ∗ Charles Angelucci and Julia Cag´

advertisement

Newspapers in Times of Low Adversiting Revenues∗

Charles Angelucci†and Julia Cagé‡

Columbia University and Sciences Po Paris

November 4, 2015

Abstract

Newspaper subscribers are typically charged a lower per issue price than occasional

buyers. This difference in prices has recently increased. This paper posits that this tendency may be interpreted as a response to the continuing drop in advertising revenues.

We investigate how the reliance on advertising revenues interacts with the incentives

newspapers have to adopt subscriber-based readerships. More precisely, we investigate

theoretically and empirically the determinants of second-degree price discrimination in

two-sided markets. We build a model in which a newspaper must attract both readers and advertisers. Readers are uncertain as to their future benefit from reading, and

heterogeneous in their taste for reading. Advertisers are heterogeneous in their outside

option, taste for subscribers, and taste for occasional buyers. To estimate empirically

the effect of the advertisers’ side of the industry on price discrimination on the readers’

side, we use a “quasi-natural experiment”. We exploit the introduction of advertisement on French Television in 1968, which we treat as a negative shock on advertising

revenues of daily national newspapers (treated group), but not on daily local newspapers (control group). We build a new dataset on French local newspapers between

1960 and 1974 and perform a Differences-in-Differences analysis. We find robust evidence of increased price discrimination as a result of a drop in advertising revenues.

Keywords: price discrimination; two-sided markets; newspaper markets; advertising

JEL: C33, L11, M13

∗

This paper was previously circulated under the title “Price Discrimination in a Two-Sided Market: Theory

and Evidence from the Newspaper Industry”. We gratefully acknowledge the many helpful comments and

suggestions from Ariel Pakes, Valeria Rueda, Andrei Veiga, Glen Weyl and Alex White. We are also grateful

to seminar participants at Harvard University, INSEAD, the London School of Economics, Namur University,

the Paris School of Economics, Sciences Po Paris, SHUFE in Shanghai, Stockholm University and Warwick

University. Maikol Cerda and Charlotte Coutand provided outstanding research assistance. We gratefully

acknowledge financial support from the NET Institute (www.NETinst.org) and the Paris School of Economics.

All errors remain our own.

†

Columbia University, ca2630 [at] columbia [dot] edu.

‡

Sciences Po Paris, julia [dot] cage [at] sciencespo [dot] fr.

1

1

Introduction

The newspaper industry is a canonical example of a two-sided market: newspapers serve two

distinct groups of consumers – readers and advertisers, where each group cares about the

presence and characteristics of the other. The resulting network effects lead to subtle pricing

policies that have received much attention recently (see for instance Rochet and Tirole, 2003;

Weyl, 2010). One feature of newspapers’ pricing policies is the observed price discrimination

between subscribers and occasional buyers; subscribers are typically charged a lower per

issue price than occasional buyers, and these price differences appear not to be explained

by cost differences entirely. Furthermore, this difference in prices has recently increased and

newspapers tend now to favor a more subscriber-based readership. This paper posits that this

tendency may be interpreted as a response to the industry’s state of distress, itself in part

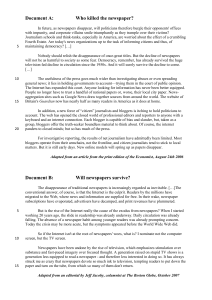

attributed to the continuing drop in adverting revenues. In the United States for example,

we indeed observe a decline in newspaper advertising revenues (as a share of GDP) since the

second half of the 1950’s, decline that has been sharper since the beginning of the 2000’s

(Figure 11 ). We also observe a decrease in newspapers’ reliance on advertising revenues (the

0

.2

% GDP

.4

.6

.8

share of advertising in newspaper total revenues).

1950

1960

1970

1980

1990

2000

2010

Notes: This Figure represents the evolution of newspaper advertising revenues as a share of GDP in the United States

between 1950 and 2013. Data on newspaper revenues is from the Newspaper Association of America (NAA). GDP data

is from the World Development Indicators (WDI).

Figure 1: Newspaper advertising revenues as a share of GDP in the United States, 1950-2103

In this paper we investigate how the reliance on advertising revenues interacts with the

incentives newspapers have to adopt subscriber-based readerships. To this end, we first extend recent models of multi-sided industries to incorporate the scope for second-degree price

1

Figure B.1 in the online Appendix represents the evolution of newspaper advertising revenues in the United

States over the same period in billion dollars.

2

discrimination between subscribers and occasional buyers. We then carry out an empirical

analysis using a “quasi-natural experiment” and a new dataset on the French local newspaper

industry that we build from archives data.

We build a general model of a two-sided market in which a monopolist newspaper repeatedly interacts with a continuum of readers and a continuum of advertisers. Newspapers can

be purchased by readers either by subscription or at the newsstand on a day-by-day basis.

Independently of the presence of advertisers, the scope for price discrimination stems from

(i) the readers’ uncertainty regarding their exact willingness to pay in future periods and (ii)

the readers’ heterogeneity in their average willingness to pay. Readers with a high average

willingness to pay subscribe at a low per unit price, while others buy the newspaper at a high

price whenever their willingness to pay is high.2

Advertisers are heterogenous in (i) their taste for subscribers, (ii) their taste for occasional readers, and (iii) their outside option (i.e., their payoff when placing ads on alternative

platforms). The challenge is to disentangle how the presence of advertisers affects the prices

charged to readers. We characterize the optimal pricing formulas of the newspaper, as well

as the readers and advertisers’ demands. These formulas are intuitive and in the spirit of

Weyl (2010). When choosing its prices, aside from taking into account the various marginal

costs and demand elasticities, the newspaper must cater to (i) the average taste of marginal

readers – those indifferent between subscribing or buying occasionally on the one hand, and

those indifferent between buying occasionally or never on the other – and (ii) the average

taste of marginal advertisers for both subscribers and non subscribers, as well as their outside

options.

On the empirical side, the main empirical challenge is to isolate the “advertising revenue”

effect on price discrimination. To this end, we follow an empirical strategy in the spirit of an

event study. We exploit the introduction of advertisement on French Television in October

1968 by treating it as an exogenous negative shock on the advertising side of newspapers.

Television is state-owned in France from 1945 to 1981. The introduction of advertisement

on television was decided by law, despite strong resistances by the newspaper industry. This

introduction leads to an exogenous shock that shifts exclusively the incentives to price discriminate stemming from advertising revenues. Indeed, reader heterogeneity and the various

marginal costs of producing and delivering newspapers were not affected. To the best of our

knowledge, we are the first to use this “quasi-natural” experiment.3

Our identifying assumption is that the negative shock on advertising revenues has affected

mostly national daily newspapers, and to a lower extent local daily newspapers. Indeed, while

2

This rationale for price discrimination was first introduced by Glazer and Hassin (1982), but in a model

without advertisers.

3

Filistrucchi et al. (2012) considers the “reverse” experiment: they analyze the effects of the advertising

ban on French public television in 2009. They find that it did not favour private TV channels at the expense

of public ones. They do not investigate how it affects newspapers nor price discrimination, however.

3

national newspaper advertisement consists mostly of commercial advertisements that are relatively close substitutes to those broadcasted on television (national brands, etc), a large share

of advertisements in local newspapers is instead local in nature (local commercial advertisements and classified advertisements). We document a substitution effect of advertisements

from national (but not local) newspapers to television by studying the actual content of the

advertisements broadcasted on television and of the advertisements published in newspapers

before and after the introduction of advertisement on TV.

National newspapers, for which national ads are likely to provide a significant fraction of

revenue, are more likely to respond to the negative shock on national advertising than local

newspaper, for which national ad-revenue is likely not their major source of revenue. We

thus use national newspapers as our “treated group”, and local newspapers as our “control

group”. Using novel annual data on local and national newspapers between 1960 and 1974,

we compare the pre-1968-to-post-1968 change in price discrimination by national daily newspapers to the change in price discrimination by local daily newspapers over the same period

(Difference-in-Difference estimation). We show that national newspapers, due to their greater

reliance on national-ad revenue, experience a larger drop in advertising rates and advertising

revenues than local newspapers after the introduction of advertisement on television. This

drop propagates to the reader side of the newspaper market. We find that the decrease in

advertising revenues leads to an increase in the extent of price discrimination, i.e., newspapers adopt a more subscriber-based readership as a consequence of the drop in advertising

revenues. This increase in price discrimination is driven by a decrease in the price charged

to subscribers. As a consequence, we find that the number of subscribers and the share of

subscribers in the total circulation increase after the shock. Our results are robust to a range

of alternative specifications and controls.

Our proposed interpretation of these empirical findings is that, while newspapers have

a preference for subscribers – having more subscribers allow them to increase their total

circulation, and to build consumer loyalty –, advertisers tend to prefer unit buyers. As a consequence, when advertising revenues play an important role, newspapers tend to distort their

pricing strategies in favor of unit buyers. On the contrary, when advertising revenues fall (e.g.

after the 1968 French reform), they revert to their own profit-maximizing pricing strategies

(independent of the advertising side of the market), i.e. they increase price discrimination in

favor of subscribers.

Various explanations may help rationalize advertisers’ preference for unit buyers. First, the

newsstand helps subscribers increase their reach: whereas a subscription goes to one person

or one household, a newsstand copy of a newspaper reaches more people. Next, consumers

buying at the newsstand have a real interest in the newspaper – the newsstand buyer is

probably likely to spend more time reading the newspaper than the comparable subscriber.

4

While these points have been raised by a number of consultants in the industry, to the extent

of our knowledge, we are the first to show empirically that it is indeed the case. Moreover,

the theoretical predictions of our model are in line with these preferences.

Our findings may have important implications for the 21st century newspaper industry. In

particular they shed light on the observed current tendency for newspapers to favor subscriberbased readerships through low subscription prices. According to our results, this tendency may

be rationalised by the continuous decline in advertising revenues as a result of the competition

stemming from Internet.4 Additionally, to the extent that suscribers and unit buyers are

different social and political groups (an issue that we do not directly adress in this paper),

rising price discimination could contribute to a more polarized access to information and to

diverging turnout rates by socio-economic groups.

Literature review This paper builds on the seminal model by Glazer and Hassin (1982)

who first study price discrimination by newspapers based on consumers uncertainty.5 We

introduce the advertising side in the profit function of newspapers and discuss how the reliance

on advertising revenues interacts with price discrimination on the reader side. Moreover, we

estimate this interaction empirically. This relates our paper to the growing literature that

examines empirically the determinants of price discrimination. A number of papers investigate

the role of competition. Seminal contributions include Borenstein (1991) on retail gasoline

markets and Borenstein and Rose (1994) on airline tickets. More recent articles include Busse

and Rysman (2005) who investigate pricing in Yellow pages advertising, Gerardi and Shapiro

(2009) who reexamine air ticket price discrimination, Dai et al. (2012) who study the nonmonotonicity of the effect of competition on price discrimination using data from the U.S.

airline, and Seim and Viard (2011) who study nonlinear pricing in cellular telecommunication

markets. To the exception of Gil and Riera-Crichton (2011) who empirically tests the relation

between price discrimination and competition in the two-sided market setting of the Spanish

local television industry, all theses articles study one-sided markets.6 Our paper aims on the

contrary at understanding the consequences of network effects on price discrimination.

Carroni (2015) provides a model of behaviour-based price discrimination – firms offer

different prices to consumers according to their past purchase behaviour – in the context

4

While Athey et al. (2013) explore theoretically the extent to which greater consumer switching facilitated

by online consumption of news explains the recent collapse in advertising revenue; Gentzkow (2014) investigate

how Internet has reduced the return news outlets can earn by selling the attention of their consumers to

advertisers.

5

On the economics of subscription sales, see also Gabszewicz and Sonnac (1997); Morton and Oster (2003);

Resende and Ferioli (2014).

6

Marcus Asplund Rickard Eriksson (2008), using evidence from Swedish newspapers, show that more competitive markets have a higher incidence on third-degree price discrimination. But they abstract from the

advertising side of the newspaper market.

5

of two-sided markets.7 There also exists a very recent vein of research that examines the

role of consumers’ bounded rationality on price discrimination via subscription (see Grubb,

2012, for an insightful review). Prominent contributions to this literature are DellaVigna and

Malmendier (2004) for contracts in health sport centers and Grubb (2009) for cellular phone

service plans. Although we recognize that bounded rationality may play a role in consumers’

decision as to subscribe or not to a newspaper, the scope for price discrimination in our

model instead stems from informational considerations. In addition, our aggregated data do

not allow us to investigate this issue.

Our paper also relates to the literature on two-sided markets. Rochet and Tirole (2003)

provide a widely applicable model of two-sided markets and discuss markets for advertising,

credit cards, software and web portal usage. Weyl (2010) and White and Weyl (2010) further

extend two-sided market models.8 Naturally, much work on two-sided markets has focused on

the media industry. Argentesi and Filistrucchi (2007) develop an analysis to estimate market

power in the Italian newspaper industry, but do not consider price discrimination on the reader

side, just like Kaiser and Wright (2006) who estimate a model of competition in the German

market for magazine readership and avertising. Seamans and Zhu (2014) look at the impact

of the entry of Craig’s list on local newspapers’ pricing policies and find that this negative

shock on the advertisement side of newspapers had led to an increase in subscription prices, a

result consistent with previous theoretical studies that show that an increase in competition

on one side of a two-sided market can lead to an increase in price on the other side (Godes

et al., 2009; Hagiu, 2009).

We contribute to this recent line of research by introducing price discrimination on one side

of the market. Seamans and Zhu (2014) find an increase in subscription price as a result of the

negative shock on the advertisement side; on the contrary, we obtain that the subscription

price decreases. But while they only focus on subscribers, we also take into account unit

buyers, which helps rationalize our finding. Our paper makes an important contribution by

investigating advertisers’ preferences for unit buyers compared to subscribers. Advertisers’

preference for unit buyers explains why newspapers react to the negative shock by decreasing

the subscription price. Price discrimination matters on the reader side. To the best of

our knowledge, Liu and Serfes (2013) is the only paper investigating price discrimination in

two-sided markets. However, their modeling approach does not fit well with the newspaper

industry as they consider perfect price discrimination on both sides in a Hotelling framework.

Our paper is the first theoretical and empirical analysis of second-degree price discrimination

7

For a dynamic model of duopolistic competition under behaviour-based price discrimination, but in onesided setting, see Caillaud and Nijs (2014).

8

Anderson and Coate (2000) study broadcast markets in which retailers pay for advertising to reach consumers, and where consumers dislike advertising. Rysman (2004) provides an empirical analysis of the market

for yellow pages. Jin and Rysman (2013) study US sports card conventions pricing though the lens of the

two-sided market theory.

6

in a two-sided market.

Finally, this research project is a contribution to the empirical literature on media using

historical data to understand the evolution of the newspaper industry and its impact on

society. In a paper investigating the effect of newspapers entry and exit, Gentzkow et al.

(2011) find that newspaper entry has a robust positive effect on political participation in the

United States. Cagé (2014) finds in the French context that competition has a negative effect.

In their recent work on competition and ideological diversity Gentzkow et al. (2014) estimate

a model of newspaper demand, entry, and political affiliation choice, in which newspapers

compete for both readers and advertisers. In this paper, we use historical data and a quasinatural experiment to estimate empirically the effect of the advertisers’ side of the industry

on price discrimination on the readers’ side.

The remainder of the paper is organized as follows. Section 2 develops a model of seconddegree price discrimination by a platform. Section 3 introduces the new dataset we built

for this study and provides descriptive statistics. In Section 4, we discuss the historical

context of the introduction of advertisement on French Television in 1968, and document a

substitution effect from national newspapers advertisements to advertisements broadcasted

on television. In Section 5 we estimate the effect of the advertising side of newspapers on

price discrimination on the reader side using a Differences-in-Differences analysis based on

the introduction of advertisement on French Television. Section 6 concludes.

2

Two-sided markets and second-degree price discrimination

We build a simple model of a two-sided market in which the platform (i.e., the newspaper)

engages in second-degree price discrimination on one side of the market.

2.1

Set-up

Consider the interaction between a monopoly newspaper, a continuum of readers of mass one

(side R of the industry), and a continuum of advertisers of mass one (side A). The newspaper

produces n distinct issues during the period of interest. Let t denote a given date/issue, where

t = 1, ..., n. Readers can either subscribe to the newspaper to receive all n issues, or buy some

issues on occasions. We refer to S as the subset of readers who choose to subscribe, and O as

the subset of readers who choose to be occasional readers.

Newspaper The profit-maximizing monopoly newspaper chooses price pi to charge group

i = O, S, A. We denote by ci the per-issue newspaper’s (constant) marginal cost of serving

group i. We do not model the actual production of news, and thus implicitly assume that the

newspaper produces content that is of interest to at least some readers.

7

Readers

The payoff to reader i from reading the newspaper at date t is given by:

R

Ui,t

= θi − γi N A + t − pi ,

(1)

where θi denotes reader i’s taste for reading, γi N A denotes reader i’s taste/distaste for the

quantity N A of ads in the newspaper, and where t captures a shock common to all readers

at date t (e.g., the holding of elections). We assume the pair (θi , γi ) is drawn according to

joint pdf f R (θ, γ), where each parameter has support going from minus to plus infinity.

Furthermore, t is drawn according to U [, ] and is i.i.d. across dates/issues. At each

date t = 1, ..., n, reader i, if she has not subscribed, observes the realization of t before

deciding whether to purchase the newspaper. Not subscribing therefore allows readers to

make informed purchasing decisions. By contrast, readers who choose to subscribe make

their decision prior to observing all n future realizations of . We assume readers have an

outside option equal to 0.

Let UiS denote reader i’s expected payoff when subscribing. For a given per-unit subscription price pS , it is equal to:9

UiS

=

n

X

Pr θi − γi N A + t ≥ 0 E θi − γi N A + t | θi − γi N A + t ≥ 0 − npS ,

t=1

2

n max θi + − γi N A , 0

− npS .

=

2

( − )

A subscriber does not necessarily read all n issues of the newspaper. Instead, Pr θi − γi N A + t ≥ 0

measures the probability that a given subscriber i reads the newspaper on a given t. The

price pS plays no role in this decision because it is already sunk by the time the decision to

read an issue comes. Naturally, though, a necessary condition for reader i to subscribe in the

first place is that (2.1) is nonnegative.

The expected payoff of a reader who chooses to be an occasional reader is equal to:

UiO =

n

X

Pr θi − γi N A + t − pO ≥ 0 E θi − γi N A + t − pO | θi − γi N A + t − pO ≥ 0 ,

t=1

(2)

NA

=

−

n max θi + − γi

2

( − )

2

pO , 0

.

Not surprisingly, the decision to purchase an issue of the newspaper depends on the price

pO . We refer to occasional readers who make a purchase with positive probability as “active”

occasional readers.

Anticipating on the computation of the demand functions, note that for some readers to

9

We assume readers do not discount future payoffs to simplify expressions.

8

subscribe, it must be the case that the per-unit subscription price

pO . If pO >

pS

n

pS

n

is lower than the price

, all readers choose not to subscribe (i) to enjoy the lower per-unit price pO

and (ii) to retain the ability not to purchase the newspaper on some dates. In the following,

we let ΘS denote the subset of readers who choose to subscribe, and ΘO the subset of readers

who choose to be “active” occasional readers. Also, ΘS (γ) denotes the subset of readers who

choose to subscribe within the set of readers with parameter γ, and ΘO (γ) denotes the subset

of active occasional readers within the set of readers with parameter γ (recall that readers are

heterogeneous on two dimensions).

If, at the optimum, the pair of prices pS , pO is such that some readers choose to become

subscribers and others to be active occasional readers—i.e., the case of empirical interest,

then, within the set of readers with parameter γ, the readers who choose to subscribe are

such that their taste for reading θ is higher than or equal to:

θ̃1 (θ) = γN A +

pS

pO

+

− .

2

( − ) pO

(3)

The threshold θ̃1 (θ) is increasing in γ, increasing in pS , and decreasing in pO . Readers who

decide to subscribe are those with high taste for reading: those who would often purchase

the newspaper at price pO but are given the opportunity to buy it at a lower price through

the subscription plan.10 By contrast, occasional readers are those with an average taste for

reading: they are willing to purchase the newspaper only when the shock is sufficiently high.

Advertisers

We assume advertisers choose between either (i) placing an ad in the newspa-

per for the n issues at price npA , or (ii) never placing an ad. The expected payoff to advertiser

j of placing an ad in the newspaper is equal to:

UjA

=

n X

h i

h

i

O

bSj E N̂tS + bO

E

N̂

− npA ,

j

t

(4)

t=1

where

∞

h i Z

E N̂tS =

−∞

Z

∞

=

−∞

Z

f R (γ, θ) Pr t ≥ γi N A − θi dθi dγi

− γ i N A − θi

f (γ, θ)

−

ΘS (γi )

Z

(5)

ΘS (γi )

R

dθi dγi ,

10

The highest number of subscribers the newspaper can attract is achieved by setting pS = 0. However, even

when pS = 0 not all readers choose to subscribe. Specifically, all readers whose payoffs are such that they can

derive positive utility from reading for at least some values of choose to subscribe, and the rest is indifferent

between subscribing (but never actually reading an issue) and never buying an issue. In other words, if pS = 0,

all “active” readers—those such that θ − γN A + ≥ 0 —choose to subscribe.

9

and where

∞

h

i Z

E N̂tO =

Z

−∞

Z

∞

f R (γ, θ) Pr t ≥ γi N A + pO − θi dθi dγi

− γ i N A + p O − θi

f (γ, θ)

−

ΘO (γi )

Z

=

−∞

(6)

ΘO (γi )

R

dθi dγi .

h i

E N̂ S denotes the expected number of subscribers who actually read the newspaper, ∀t.

h

i

Similarly, E N̂ O denotes the expected number of active occasional readers, ∀t. Advertisers

only care about readers who actually read the newspaper. Specifically, the parameter bSj

captures advertiser j’s taste for active subscribers and bO

j captures advertiser j’s taste for

active occasional readers. In addition, we assume advertiser j has outside option uA

j . The

A

A bS , bO , uA , where each parameter is

3-tuple (bSj , bO

j , uj ) is drawn according to joint pdf f

drawn from support going from minus infinity to plus infinity. We assume away any price

discrimination by the newspaper on the advertisers’ side of the industry. Advertiser j places

an ad in the newspaper for n issues at price npA if and only if:

n X

i

h

h i

O

− npA ≥ uA

bSj E N̂ S + bO

j .

j E N̂

(7)

t=1

2.2

The newspaper’s problem

We first compute the three relevant demand functions; that is, the demand for subscriptions,

the expected demand per issue at the newsstand, and the demand for advertising slots.

Demand functions

The number of subscribers is equal to:

N

S

S

O

A

p ,p ,N

Z

∞

Z

=

−∞

f R (γ, θ) dθi dγi .

(8)

ΘS (γi )

The number of subscribers is determined by the subscription price pS , the newsstand price

pO , and the number of ads N A . Similarly, the expected number of occasional readers per-issue

is equal to:

N

O

O

S

p ,p ,N

A

Z

∞

=

−∞

− γ i N A + p O − θi

f (γ, θ)

−

ΘO (γi )

Z

R

dθi dγi .

(9)

The expected number of occasional readers is determined by the subscription price pS , the

newsstand price pO , and the number of ads N A . On the other side of the industry, the number

10

of ads is equal to:

N

A

h

E N̂

S

i

h

, E N̂

O

i

A

,p

Z

∞

Z

O

A

Z n(bSj E [N̂ S ]+bO

j E [N̂ ])−np

∞

=

−∞

−∞

S O

f bS , bO , uA duA

j dbj dbj .

−∞

(10)

The number of ads is determined by the ad price pA , the expected number of active subscribers

h i

h

i

E N̂ S , and the expected number of active occasional readers E N̂ O .

Under regularity conditions, the system (8)-(9)-(10) has a unique solution characterizing

demands as a function of pO , pS , pA :

DS = dS pO , pS , pA ,

DO = dO pO , pS , pA ,

DA = dA pO , pS , pA ,

where DO is the expected demand stemming from occasional readers, ∀t.

The newspaper’s profit function is given by:

Π = ΠO + ΠS + ΠA

(11)

= n pO − c0 dO pO , pS , pA + n pS − cS dS pO , pS , pA + n pA − cA dA pO , pS , pA .

Note that, unlike advertisers, the newspaper cares about the total number of subscribers,

as opposed to the active number of subscribers. In the following, let ipj be the price pj

elasticity of demand di , where i, j = O, S, A. The next proposition states the newspaper’s

optimal pricing rule in case, at the optimum, the sets ΘS and ΘO are nonempty—that is, the

case of empirical interest. The formulas are obtained by rearranging the first-order conditions

of the newspaper’s problem.

Proposition 1 If it is optimal for the newspaper to sell its content both to subscribers and

occasional readers, the newspaper prices are given by the following augmented mark-up formulas:

pO = cO

S

S

p =c

pA = cA

O

pO

1 + O

pO

SpS

1 + SpS

A

pA

1 + A

pA

− pS − cS

O

O

− p −c

SpO

1 + O

pO

− pO − cO

O

pS

1 + SpS

O

pA

1 + A

pA

A

dS

dA

pO

A

A

−

p

−

c

dO

dO

1 + O

pO

A

dO

dA

pS

A

A

−

p

−

c

dS

1 + SpS dS

SpA dS

dO

S

S

−

p

−

c

dA

dA

1 + A

pA

Each price pi , for i = O, S, A, is determined by the standard markup rule (i.e., the term

11

i i

ci 1+p i ), augmented to take into account the impact of a change in pi on the other two groups

pi

of consumers. Observe that the ability for the newspaper to price discriminate between

subscribers and occasional readers leads to prices being chosen as if there were three distinct

sides to this industry—subscribers, occasional readers, and advertisers—where the number of

active participants in each each side of the industry impacts the other two sides. Specifically,

the number of advertisers impacts the readers’ payoffs, and similarly the number of readers

impacts the advertisers’ payoffs. However, in addition to these standard effects, the price

charged to occasional readers affects the number of subscribers, and the price charged to

subscribers affects the number of occasional readers. In other words, when a platform in a

two-sided industry can engage in second-degree price discrimination within one side of the

industry, the optimal pricing rules are qualitatively identical to those that would emerge if

the industry had three distinct sides.

Observe also that the newspaper would engage in second degree price discrimination even

if there were no advertisers (to see this, set dA = 0 in the formulas of pS and pO ). Readers

with a high taste for reading would buy every issue of the newspaper at the newsstand at

price pO (even when t = 0) if subscribing was not possible. Because subscribing is instead

possible, and because pS < pO , these readers prefer subscribing to enjoy the lower average

price. Readers with an average taste for reading instead have a low enough gross payoff when

t = 0 that it is not interesting for them to have all n issues be delivered to their home; they

prefer buying it only when t = x, even though the per issue price p is higher. Here lies

the scope for price discrimination. Setting pS < pO means extracting less surplus from the

readers with a rather high taste for reading (those who would have bought the newspaper at

the newsstand anyway), but allows the platform to extract more surplus from the informed

consumers; i.e., those who buy only when t = x. It is thus these informational differences

that the newspaper exploits through second-degree price discrimination. In other words, it

is not the presence of advertisers that explains the existence of price discrimination in this

model; though advertisers will certainly affect its extent.

2.3

Explaining the empirical results

One empirical result we have that our model explains well is the following. We observe that as

newspapers decrease the subscription price (and leave unchanged the per unit price), the share

of subscribers increases but the total number of readers is little affected. This is completely

in line with our model of price discrimination. In our model, the readers indifferent between

subscribing and being occasional readers base their decision on both pO and pS . In particular,

there exists a threshold θ̃1 pO , pS such that all readers whose taste for reading is larger than

θ̃1 subscribe, and the rest do not. Moreover, within the set of readers who do not subscribe,

their purchasing decision depends only on pO . In other words, there exists a threshold θ̃0 pO

12

h

i

such that all readers whose taste for reading belongs to θ̃0 pO , θ̃1 pO , pS

sometimes

O

buy the newspapers, and those whose taste for reading is below θ̃0 p never purchase the

newspaper. As is clear, a change in pS alone affects the composition of readers between

subscribers and non subscribers, but not the total number of readers.

More generally, obtaining the result that the newspaper readjusts towards more subscribers

following the shock is not conceptually difficult to understand (independently of whether this

is achieved by increasing or decreasing prices). It must be the case, prior to the shock,

that marginal advertisers – those indifferent between placing an ad or not – were putting

a higher weight on occasional buyers than the newspaper. Following the negative shock on

advertisers – which, inevitably, leads to the newspaper catering less to what advertisers want

– the newspaper readjusts its readership towards more subscribers. This effect is reinforced

in case the newly marginal advertisers – i.e., following the shock – also put more weight on

subscribers than occasional readers. But even if the latter does not hold, we expect the first

force to dominate.

Obtaining the result that prices charged to readers decrease following a negative shock on

the advertisers’ side is not straightforward. This is because there is a very strong force that

suggests that, following the shock, the newspaper should pay less attention to what advertisers

want (i.e., more readers), since it can make less money out of them. Several explanations can

however be advanced.

First, there is also a negative shock on the readers side (in addition to that on the advertisers’ side), which leads to the newspaper decreasing prices to readers. This, however,

does not seem like the right explanation in our case, because it seems hard to believe that the

shock was more pronounced on the readers’ side than on the advertisers’ side. There was no

change in the number nor in the quality of the programs broadcasted on Television after the

introduction of advertisement.

Second, if we assume that (i) readers dislike ads and (ii) advertisers dislike (other) ads,

an explanation is possible. Prior to the shock, the advertisers’ willingness to pay for a slot in

the newspaper is high, and higher the lower the number of other ads. As a result, prior to

the shock, the newspaper is in the best of all possible worlds: it is able to put few ads in its

pages (which is good for readers) and charge a premium for it. Readers like the fact that so

few ads are present, and are thus also charged a high price. Following the negative shock on

advertisers, it could be that advertisers are no longer willing to pay a lot for “exclusivity”,

so that the newspaper stops granting them exclusivity and increases the quantity of ads as a

result. Because readers dislike ads, they must be charged a lower price to be compensated.

Third, we could envision a competition effect. When television starts competing for advertisers with newspapers, newspapers have no choice but to offer a “better” product to

advertisers, that is, more readers (which is achieved by setting lower reader prices). Writ-

13

ing down a model that replicates this intuition is not immediate, as increased competition

depresses ad prices, and thus lowers the incentives for newspapers to cater to advertisers’

preferences.

3

Industry and data characteristics

In this section, we briefly introduce the new dataset we built for this study and describe the

newspaper industry characteristics. We discuss further details of the construction of the data

in the online Appendix Section A.

3.1

Newspaper industry characteristics

The French daily newspaper industry is divided into two sub-industries: the local daily newspaper industry and the national daily newspaper industry. During our period of interest

(1960-1974), there are around 100 (national and local) daily general information newspapers.

There are 12 national newspapers at the beginning of the period and 10 at the end.11

The total national newspaper circulation is stable during this time period, with around 4.2

million copies sold every day. The number of local newspapers during the same period varies

around 90, with a total circulation amounting to around 7.8 million copies (see Cagé (2014)

for more details on the historical evolution of the French local daily newspapers industry).

On average, the circulation of national daily newspapers amounts to nearly 350,000 copies a

day and the one of local daily newspapers to 100,000. Copies are sold either at the newsstand

to unit buyers or through subscription. The average share of unit buyers is 70%.12 As

expected, the price charged to subscribers is lower than the price paid by unit buyers at

the newsstand. The average price ratio is 0.86. (Table 1 provides descriptive statistics on

newspaper prices, revenues and costs as well as on circulation and newspaper content for the

entire daily newspaper industry.13 )

Overall, national daily newspapers generate 67.5 million francs (e71.4 million) in total

revenues each year, and local daily newspapers 19.9 million francs (e20.4 million). These

revenues come from sales and from advertising. On average, between 1960 and 1974, the

share of advertising revenues in total revenues is 45%. The quantity of advertisement in

newspapers represents around 3 pages per newspaper issue, i.e., 19% of the content of the

newspaper.

11

Libération and Paris Presse exit the industry respectively in 1964 and in 1970.

The statistical discrepancy between the share of unit buyers and the share of subscribers – that do not

sum up to 100 – stems from the fact that a number of copies is distributed for free every day.

13

In the online Appendix, we present these descriptive statistics separately for national – Table C.1 – and

local – Table C.2 – daily newspapers.

12

14

15

0.40

0.35

0.87

8.50

10.12

4.19

5.51

45

9.49

39

0.37

57,655

75

22

307

15

12

3

17

26.51

12.89

13.53

45

25.67

65

0.85

135,387

70

27

307

16

12

3

19

Median

0.43

0.38

0.86

11.95

Mean

7

4

4

10

178,522

23

22

12

38.04

67

6.21

38.40

22.03

18.45

11

0.20

0.17

0.07

11.06

sd

2

2

0

2

1,725

2

1

218

0.07

1

-36.89

0.10

0.06

0.03

6

0.10

0.08

0.17

0.75

Min

66

34

32

62

1,143,676

100

98

365

261.37

326

41.42

247.12

181.27

123.87

82

2.40

0.94

1.25

50.00

Max

996

996

997

996

973

971

968

970

958

840

952

962

968

964

962

1,043

967

967

662

Obs

Notes: The Table gives summary statistics. Time period is 1960-1974. Variables are values for newspapers. The observations are at the newspaper/year level.

Unit price and subscription price per issue are in francs. Revenues and costs are in million francs.

Prices

Unit buyer price

Subscription price

Price ratio

Display ad rate (listed price)

Revenues

Total revenues

Revenues from advertising

Revenues from sales

Share of advertising in total revenues (%)

Expenditures

Total expenditures

Number of journalists

Profit

Circulation

Total circulation

Share of unit buyers (%)

Share of subscribers (%)

Frequency (issues/52weeks)

Content

Number of pages

News hole (nonadvertising space)

Advertising space

Share of advertising

Table 1: Summary statistics: Newspapers

3.2

County demographics and economic data

While national daily newspapers circulate (by definition) in the entire country, the natural

news market for a local daily newspaper in France is a county.14 A number of newspapers

circulate across nearby counties, however.15

Table 2 presents summary statistics on county demographics and economic data (with

information by county on the total number of full time workers, the total number of firms and

the aggregate corporate tax).

3.3

Data

We collect an annual balanced panel dataset on local and national newspapers in France

between 1960 and 1974. The data is paper data that we digitize and merge from the French

Ministry of Information’s non-publicly available records in the National archives. Newspapers

were asked by the Ministry of Information to report annually on revenues and expenses. We

collect data by having direct access to their responses to these queries.

Local and national newspapers Our dataset includes data for 61 of the local newspapers,

i.e., more than three quarters of the local daily newspapers industry in 1971. These newspapers are the only ones for which the data is available in the archives. They represent on

average more than 87% of the total local daily newspaper circulation. Our sample of national

newspapers include all the 10 national newspapers circulating between 1960 and 1974.

Price, cost and revenue data

For the 71 newspapers described above we collect data on

prices with information on unit price, subscription price, and the number of issues per year.

This allows us to compute a measure of price discrimination. We also have data on revenues

(from sales and from advertising), and on costs, as well as data on the number of journalists.

Finally, we have data on circulation with the share of unit buyers and the share of subscribers.

Advertising prices and quantity A change in advertising revenues can be driven by

either or both a change in advertising prices or a change in advertising quantity. We collect

data on both the price and the quantity of advertising in order to disentangle the two effects.

A first source of information for advertising prices are the listed prices per advertising slot.

We digitize this data from “Tarif Media”, an annual publication that provides information

regarding advertising prices. However, a downside of using listed prices is that discounts are

common in this industry. Price lists are hence a relevant measure of advertising prices as long

14

A county (“dpartement” in French) is a French administrative division. The median land area of a county

is 2,303 sq mi, which is slightly more than three-and-half times the median land area of a county in the United

States. There are 95 counties in metropolitan France.

15

In 1968, 54% of the local daily newspapers circulate in only one county; 12% in two.

16

17

66.9

6.5

3.5

10,536

92

389,516

14,202

53,165

24

67.1

6.9

4.0

11,086

192

516,023

19,810

95,586

110

Median

25,233

172,996

613

3.8

3.4

1.9

3,060

470

420,726

sd

Notes: The Table gives summary statistics. Time period is 1960-1974. The observations are at the county/year level.

County demographics

Percent of population over 20

Percent of population with secondary education or higher

Percent of senior executives and knowledge workers

Average annual wage (in francs)

Income tax (in million francs)

Population

Economic data

Number of firms

Number of full time workers

Corporate tax (in million francs)

Mean

2,985

3,289

0

57.0

1.7

0.2

5,736

4

75,173

Min

Table 2: Summary statistics: County demographics and Economic data

262,854

2,690,000

9,438

98.4

25.6

16.4

25,156

5,200

2,856,531

Max

455

912

824

1,423

1,407

1,425

912

824

1,425

Obs

as we assume that the potential bias between list prices and actual prices does not differ too

much across newspapers and over time.

Given this caveat, we use another measure of advertising price common in the literature,

which consists of the total advertising revenues divided by the newspaper circulation. The two

measures are strongly correlated (the correlation between them is equal to .5 and is significant

at the 1% level).

We collect data on the amount of advertisement per issue directly from the paper version

of the newspapers available in the French National Library. For each year and each newspaper, we study the content of the newspaper issues during an entire week (the third week of

March16 ). We measure the quantity of advertisement on each page. We thus have information

on the total amount of advertisements in the newspaper, and on the share of the newspaper

that is devoted to advertisement.

Finally, for a subset of newspapers, we also collect information on the type of advertisements in the newspapers and obtain information on the category of each advertisement (e.g.

alimentation, automobile, household electrical goods,...) as well as on the brand advertising

in the newspaper.

4

Background on the introduction of advertisement on French

Television

The model we built in the previous section provided us with a general framework with which

to think about the determinants of pricing policies by newspapers, including the extent of

price discrimination. In this section, we study empirically how price discrimination varies

with advertising revenues. The empirical strategy we follow is in the spirit of an event study.

We exploit the introduction of advertisement on French Television in October 1968 as an

exogenous negative shock on the advertising side of newspapers. To the best of our knowledge,

we are the first to use this quasi-natural experiment.

In this section, we first present some historical background on the introduction of advertising on French Television in 1968, and then document a substitution effect from advertisement

in national newspapers to advertisement on television.

4.1

French Television in 1968

French Television is state-owned from 1945 to 1981.17 A national agency – the “Office de

Radiodiffusion-Télévision Française” (ORTF) – is in charge of providing radio and television

16

The choice of the third week of March was dictated by the fact that this is the week used by the INSEE

to run all its surveys.

17

During this period all TV channels are privately-owned in the US, while in the UK two TV channels are

state-owned (BBC 1 and BBC 2) and one is private (ITV).

18

content.18 Only one channel (“La première chaı̂ne” – the “First Channel”) is available until

1963. A second TV channel (“La deuxième chaı̂ne” – the “Second Channel”) is introduced in

1964 and a third one (“La troisième chaı̂ne” – the “Third Channel”) in 1972. TV penetration

is increasing at the time: in 1970, nearly 70% of the French households own a television

(Parasie, 2010).

Channels are financed mostly through a fee (redevance) until 1968. By law, commercial or

brand advertising is forbidden, with the exception of “collective advertising”. Collective ads

promote products, say fruits, without mention of a brand.19 They were not very important

however. In 1959 for example, the time devoted to collective advertising is only of five hours

and ten minutes per year (Parasie, 2010).

The transition to color on the Second Channel and the need to produce an increasing

number of programs means that the ORTF experiences severe financial difficulties – it is “on

the edge of the abyss” (Bellanger, 1969).20 Secretly decided by the French Government in

March 1965, the introduction of advertisement on television is made public on October 20th

1967, thereby provoking a strong controversy both in Parliament and within the Newspaper

Industry. The then Prime Minister George Pompidou argues that the ORTF has no choice

but to find new sources of revenues to develop the Second Channel and eventually create a

third one. He also argues that the introduction of advertisement on television will “revitalize

the production by giving to our firms the possibility to develop their domestic market, essential

support to any exporter activity.” (address in Parliament on April 24, 1968).21

4.2

A threat to newspapers?

Left-leaning political parties and the newspaper industry were firmly against the reform.

The Federation of the Democratic and Socialist Left (“Fédération de la gauche démocrate et

socialiste”) – a conglomerate of French left-wing non-Communist forces – introduced various

bills to ban commercial advertising on television by arguing that it would lead to a decrease in

the quality of television content. More importantly – and consistently with the identification

strategy we use in this paper –, very much present is the idea that the reform would lead

to a decrease in newspaper advertising revenue.22 In fact, already in 1964, the Minister

18

The first national agency, the “Radiodiffusion Française” (RDF), is created in 1945. It is eventually

renamed “Radiodiffusion-Télévision Française” (RTF) in 1949 and replaced by the ORTF in 1964.

19

These are allowed since the 1950’s and are also referred to as “compensatory advertising” (“publicité

compensée”), where the term“compensatory” captures the fact that the ORTF would receive a compensation

in exchange for the broadcast (Duchet, 2005). Not only advertisers have to constitute associations, but an

advertising campaign also needs the approval of the supervisory Ministry (e.g., the Ministry of Agriculture for

oranges).

20

Beginning on October 1st 1967, the Second Channel broadcasts twelve hours a week of programs in color.

21

Commercial advertising is allowed much earlier in almost all other developed countries: it is allowed in

1941 in the US, in 1955 in the UK, in 1956 in Germany, and in 1957 in Italy and Spain (Parasie, 2010).

22

The Federation of the Democratic and Socialist Left argues that the government wishes to introduce

advertising on television so as to weaken newspapers, the only independent media (Parasie, 2010). In an

19

of Information of the time, Alain Peyrefitte, was aware of this issue and claimed that the

introduction of advertising on television would be worth considering only if the press could

survive it (Bellanger, 1969).

Newspapers were similarly against the reform as they anticipate a decrease in their advertising revenues. And indeed, as underlined by Bellanger (1969), “in terms of national

advertising (...) in a limited market, any drain leads to a decrease in the advertising revenues

which the press lives off”. The Federation and the Confederation of the French Press estimated in a report that the press would lose between 40 and 50% of its advertising revenues,

i.e., between 20 and 40% of total revenues depending on the newspaper.

4.3

A substitution effect

Despite these strong resistances from the newspaper industry and the opposition, the first

commercial advertisement is broadcasted on French Television in October 1968. The time

devoted to advertising is of 2 minutes per day in 1968 – only on the First Channel –, 4

in 1969, 8 in 1970 (i.e. 2,720 minutes per year) – year in which advertising is introduced

on the Second Channel, and more than 12 in 1971 (Bellanger, 1969). Advertising revenues

generated by the ORTF increase by 69 million francs (77 (constant 2009) million euros23 )

between 1967 and 1968 and by 197 million francs (e201 million) between 1968 and 1969. In

1971, advertising revenues represent 22% of the ORTF total revenues (Bellanger, 1969). Did

this increase lead to a symmetric decrease in newspaper advertising revenues?

In order to provide a sense of the effect of the introduction of advertisement on television

on the advertising revenues of local and national daily newspapers, we first provide aggregate

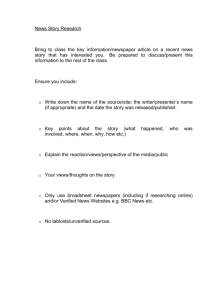

evidence at the industry level.24 Total advertising revenues of national daily newspapers

decrease by 21 million francs (e45 million) between 1967 and 1968, and then stabilize around

500 million francs. While the advertising market is expanding in France between 1967 and

1974, national newspapers advertising revenues are actually decreasing. On the contrary, local

newspaper advertising revenues increase during the same period (Figure 2). Moreover, the

share of national daily newspapers in total advertising revenues decreases from 14% in 1967

to 11% in 1974, as shown in Figure 3.

The introduction of advertisement on television in 1968 can thus be considered as a significant negative shock on the advertisers’ side of the national newspaper industry. Why did it

address to the Parliament on April 24 1968, Jacques Chambaz (from the Communist Party) claims that “the

introduction of commercial advertisement on television is but a new way to deal a blow to the broadsheet

newspapers that you consider not docile and flexible enough.”

23

In the remainder of the paper, to save on space, we simply use the terminology “euros” when refering to

“constant 2009 euros”.

24

In Section 5, we provide econometric evidence of this shock, computing differences-in-differences estimates

to show that this shock affects negatively the advertising revenues of the national daily newspapers, but not

those of the local daily newspapers.

20

1,000

Million euros (constant 2009)

400

600

800

200

0

1967

1974

National news

1967

1974

1967

Local news

1974

Television

Notes: The Figure shows for 1967 and 1974 the value of advertising revenues in France by media outlets (local and

national daily newspapers, and total) in million euros (constant 2009). Data is from the “Institut de Recherches et

d’Etudes Publicitaires” (IREP), a French research institute devoted to the study of advertising.

Figure 2: Advertising revenues by media outlets, 1967 & 1974

1967

1974

11%

14%

20%

21%

12%

National daily newspapers

TV

Radio

Cinema

Local daily newspapers

Magazines

Outdoor

Others

Notes: The Figure shows for 1967 and 1974 the share of total advertising revenues representend by type each media

outlet (national daily newspapers; local daily newspapers; magazines; television; radio; cinema; outdoor; and others).

Data is from the “Institut de Recherches et d’Etudes Publicitaires” (IREP), a French research institute devoted to the

study of advertising.

Figure 3: Share of total advertising revenues by media outlets, 1967 & 1974

21

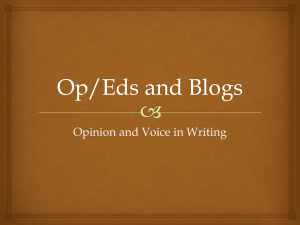

1,500

Number of advertisements

500

1,000

0

1968

1969

1970

1971

1972

1973

1974

Notes: The Figure shows the total number of new advertisements broadcasted every year on French Television between

1968 and 1974.

Figure 4: Number of new advertisements broadcasted on Television, 1968-1974

mainly affect national newspapers? Because the nature of advertising varies between national

and local newspapers. In particular, advertisements in national newspapers are mostly commercial advertisements that are relatively close substitutes to those broadcasted on television,

while a large share of advertisements in local newspapers are local in nature (local commercial

advertisements and classified advertisements).

4.3.1

Classifying advertisements

To document the substitution effect from advertisements published in national newspapers to

advertisements broadcasted on television, we created 25 advertisement categories: food and

drink, automobile, household electrical good, clothing,...

Television

We collect data on all the advertisements broadcasted on French Television

between 1968 and 1974 from the website of the Institut National de l’Audiovisuel (INA –

National Audiovisual Institute). For each advertisement, we have information on the exact

date of its first diffusion, its length as well as its category. Between 1968 and 1974, 7,337

different advertisements were broadcasted on television (142 in 1968, 919 in 1969 and more

than 1,000 per year for every following year, as shown in Figure 4). Online Appendix Figure

B.4 illustrates the prevelance of certain kind of categories compared to others on television

(e.g. 34% of all the advertisements broadcasted on French television in 1971 were for food

and non-alcoholic drink).

22

Newspapers In order to compare the advertisements broadcasted on television with the

ones published in newspapers, we similarly classify all the advertisements published in newspapers by categories. More precisely, for a subset of newspapers (four national newspapers25

and five local newspapers26 ), we classify all the advertisements published in the newspaper

between 1963 and 1972. To do so, we use the same method as the one described above for

the quantity of advertising (third week of March). Moreover, for each advertisement in newspapers, we classify it as local or not. According to our findings, 24% of the advertisements in

national newspapers are local advertisements, much less than in local newspapers where they

represent 44% of total advertisements.27

4.3.2

Anecdotal evidence

We document the existence of a substitution effect between advertisements in national newspapers and advertisements on television. Between 1960 and 1974, this substitution pattern

appears very clearly, as illustrated in Figure 5.

5

Empirical analysis

5.1

Estimation strategy

We use our panel data to compute differences-in-differences (DD) estimates of the effect of the

introduction of advertisement on television. Our identifying assumption is that the negative

shock on advertising revenues has affected mostly national daily newspapers, and to a lower

extent local daily newspapers. Indeed, as highlighted above, while national newspaper advertisement consists mostly of commercial advertisements that are relatively close substitutes to

those broadcasted on television, a large share of advertisements in local newspapers is instead

local in nature. Hence national newspapers are more likely to respond to the negative shock on

national advertising than local newspaper. We thus use national newspapers as our “treated

group”, and local newspapers as our “control group”, and compare the pre-1968-to-post-1968

change in prices of national daily newspapers to the change in prices of local daily newspapers

over the same period.

Let Dnational news be an indicator variable for national newspapers and Dafter be a time

dummy that switches on for observations post 1968 (i.e., after the introduction of advertisement on television). Our analysis is based on the following regression equation:

25

France Soir, L’Aurore, Le Figaro and Le Monde

La Liberté De Normandie, La Marseillaise, Le Maine Libre, Le Méridional and Le Midi Libre.

27

These estimates are consistent with existing aggregate data on revenues: according to IREP, the share of

local advertisements in advertising revenues of local daily newspapers was equal to 43% in 1967.

26

23

1965

1966

1967

1968

year

1969

1970

1971

40

30

20

10

1972

0

Total number of advertisements on TV

5

4

3

2

1

10

0

1964

Electronic devices and computer hardware (share)

0

Share of advertisements in National Newspapers (%)

30

20

3

2

1

0

Number of advertisements on TV

4

40

Number of advertisements in National Newspapers

Electronic devices and computer hardware (number)

1964

1965

1966

1967

1968

year

1969

National Newspapers (number)

National Newspapers (share)

Television

Television

1970

1971

1972

OTC Drugs (share)

1965

1966

1967

1968

year

1969

1970

1971

1972

10

5

0

1964

1965

1966

1967

1968

year

1969

National Newspapers (number)

National Newspapers (share)

Television

Television

(c) OTC drugs (number)

Total number of advertisements on TV

3

2.5

2

1.5

1

.5

0

15

10

5

0

Number of advertisements on TV

4

3

2

1

0

1964

15

OTC Drugs (number)

Share of advertisements in National Newspapers (%)

(b) Electronic devices and computer hardware

(share)

Number of advertisements in National Newspapers

(a) Electronic devices and computer hardware

(number)

1970

1971

1972

(d) OTC drugs (share)

Figure 5: Anecdotal evidence: substitution from advertisements in national newspapers to

advertisements on television

24

yn,t = α + β1 Dafter + β2 (Dafter ∗ Dnational news )

(12)

+λn + γt + n,t

where n indexes newspapers and t indexes years (t = 1960, ...1974). For all specifications in

our analysis, we introducte fixed effects for each newspaper (λn ) as well as time dummies (γt ).

This prevents cross-sectional variations from driving our results. n,t is a newspaper-countyyear shock.

yn,t is our outcome of interest. We first consider the log of the price ratio (defined as the

subscription price per issue divided by the unit price) as our dependent variable. We assume

that the difference in prices charged to unit buyers and subscribers is entirely due to price

discrimination and use the price ratio as our measure of price discrimination (Clerides, 2004).

Obviously, part of the difference between the prices charged to unit buyers and subscribers

may be driven by differences in costs, in particular costs of delivery. However, our assumption

is valid in the DD setting as long as the introduction of advertisement on television did not

affect costs of delivery.

Due to the inclusion of newspapers and year fixed effects, the coefficient β2 – our coefficient

of interest – measures the annual price ratio effect for national newspapers of the introduction

of advertisement on television compared to the general evolution of the price ratio for local

newspapers. The key identifying assumption here is that price trends would be the same for

both categories of newspapers (local and national) in the absence of treatment. The treatment

induces a deviation from this common trend. Figure 6 provides strong visual evidence of

treatment and control newspapers with a common underlying trend, and a treatment effect

that induces a sharp deviation from this trend. Note that, given local newspapers may also

have suffered from the shock – but to a lower extent given their lower reliance on national-ad

revenue – our estimates are a lower bound.

Finally, the unbiasedness of the DD estimates requires the strict exogeneity of the introduction of advertisement on television. As we underline above, French Television is state-owned

from 1945 to 1981. There is thus no interaction between television owners and newspaper

owners, be they national or local. The introduction of advertising on television was decided

unilaterally by the French government to answer the concerns of the ORTF. It is exogenous

to the newspaper industry.

5.2

5.2.1

Results

The effect on prices

Table 3 reports estimates of equation (14). Our outcomes of interest are the different prices

charged by newspapers: the price ratio (column 1), the subscription price (column 2), the unit

25

.9

.85

Price ratio

.8

.75

1974

1973

1972

1971

1970

1969

1968

1967

1966

1965

1964

1963

1962

1961

1960

.7

Year

Average price ratio - National newspapers

Average price ratio - Local newspapers

Figure 6: Descriptive evidence: Changes in price discrimination

buyer price (column 3) and the advertising price (columns 4 and 5). We find a 10% decrease

in the price ratio – our measure of price discrimination – of national newspapers compared

to local newspapers following the introduction of advertisement on television. This decrease

is statistically significant at the 1% level.

This decrease is driven by a decrease in the subscription price (column 2): following the

introduction of advertisement on television, the subscription price decreases by 12%. There

is no statistically significant change in the unit price.

Regarding advertising prices, we find a 28% decrease following the shock, whether we use

our listed price measure of advertising prices (column 5), or the total advertising revenues

normalized by circulation (column 4). This decrease is consistent with the view that the

introduction of advertisement on television can be considered as a negative shock on the

advertising side for national daily newspapers.

The equation errors may be correlated in this set of price equations. We thus estimate the

system of prices using seemingly unrelated regression (SUR) analysis. We find that the errors

are correlated. Table 4 presents the results. Similarly to the results in Table 3, we find that

the introduction of advertisment on television leads to a decrease in the subscrition price and

in the advertising price of national newspapers compared to local newspapers. The results

are of similar order of magnitude than the one we obtain above, and statistically significant

at the 1% level.

26

Table 3: Baseline estimation: Prices

Advertising prices

Post-1968

National x Post-1968

R-sq

Observations

Price ratio

-0.01

(0.02)

-0.12∗∗∗

(0.01)

0.46

967

Subscription price

1.29∗∗∗

(0.01)

-0.12∗∗∗

(0.01)

0.98

967

Unit price

1.30∗∗∗

(0.02)

-0.01

(0.02)

0.98

967

Ad revenues / circulation

1.36∗∗∗

(0.04)

-0.25∗∗∗

(0.06)

0.91

968

Listed price

0.48∗∗∗

(0.13)

-0.25∗∗∗

(0.06)

0.89

662

Notes: * p<0.10, ** p<0.05, *** p<0.01. Standard errors in parentheses are robust. Time period is 1960-74.

Models are estimated using OLS estimations. All the estimations include newspaper and year fixed effects.

Variables are described in more details in the text.

Table 4: Seemingly unrelated regression: Prices

Subscription price

Post-1968

National x Post-1968

Unit price

Post-1968

National x Post-1968

Ad revenues / circulation

Post-1968

National x Post-1968

Subscription price

Subscription price

0.77∗∗∗

(0.01)

-0.12∗∗∗

(0.01)

1.26∗∗∗

(0.07)

-0.13∗∗∗

(0.02)

1.05∗∗∗

(0.01)

-0.01

(0.01)

1.03∗∗∗

(0.08)

-0.02

(0.02)

1.36∗∗∗

(0.04)

-0.25∗∗∗

(0.04)

Listed price

Post-1968

National x Post-1968

R-sq

Observations

0.98

964

1.70∗∗∗

(0.38)

-0.26∗∗∗

(0.09)

0.97

635

Notes: * p<0.10, ** p<0.05, *** p<0.01. Time period is 1960-74. Models are estimated using Zellner

Seemingly Unrelated Regression technique. All the estimations include newspaper and year fixed effects.

Variables are described in more details in the text.

27

Table 5: Baseline estimation: Circulation

Number unit buyers

Post-1968

National x Post-1968

∗∗

-0.09

(0.04)

-0.01

(0.05)

Unit price

Subscription price

R-sq

Observations

0.99

971

-0.00

(0.09)

-0.01

(0.04)

-0.11

(0.09)

0.02

(0.10)

0.99

966

Number subscribers

Share subscribers

-0.10

(0.06)

0.14∗∗

(0.06)

-0.09

(0.06)

0.16∗∗∗

(0.06)

0.97

968

-0.11

(0.16)

0.13∗∗

(0.06)

0.10

(0.09)

-0.10

(0.11)

0.97

963

0.96

968

-0.20

(0.14)

0.15∗∗

(0.06)

0.17∗∗

(0.09)

-0.10

(0.10)

0.96

963

Notes: * p<0.10, ** p<0.05, *** p<0.01. Standard errors in parentheses are clustered by newspaper. Time

period is 1960-74. Models are estimated using OLS estimations. All the estimations include newspaper and

year fixed effects. Variables are described in more details in the text.

5.2.2

The effect on circulation

To which extent does this change in price discrimination affect the demand for newspapers?

We estimate the impact of the introduction of advertisement on television on the number

of unit buyers and the number of subscribers. Table 5 presents the results. We obtain a

statistically significant increase in the number of subscribers which goes up by 13 to 14%

(columns 5 and 6). The number of unit buyers stays unchanged; as a result the share of

subscribers in total circulation increases as a consequence of the shock.

5.2.3

The effect on revenues

Hence the introduction of advertisement on television negatively affected the subscription

price and the advertising price of national newspapers compared to local newspapers, but it

leads to an increase in the number of subscribers. We then turn to its effect on revenues

(both from sales and from advertising), as well as on profit. Table 6 presents the results. We

find that the shock leads to a 13% decrease in total revenues. This decrease comes both from

a decrease in the revenues from sales (of 10%) and from a more important decrease in the

revenues from advertising (of 27%).28 As a result, the advertising share in total revenues also

decreases after the shock. This is also the case of newspaper profits which fall by 45%.

The decrease in advertising revenues comes from the decline in the price of advertising. In

Table 7, we present estimations of the effect of the introduction of advertisement on television

on the content of newspapers. We find no statistically significant result; in particular, the

number of advertising pages in newspapers stays constant. Hence as a consequence, with a

28

As for prices, the equations may be related through the correlation in the errors. We thus estimate the

effect on sale and advertising revenues using SUR. Table D.1 in the online Appendix shows that our results

are robust to this alternative estimation strategy.

28

Table 6: Baseline estimation: Revenues

Revenues

Post-1968

National x Post-1968

R-sq

Observations

Total

1.12∗∗∗

(0.04)

-0.13∗∗∗

(0.05)

0.99

962

From sales

1.22∗∗∗

(0.04)

-0.10∗∗∗

(0.04)

0.99

964

From advertising

1.34∗∗∗

(0.06)

-0.27∗∗∗

(0.07)

0.98

968

Advertising share

0.14∗∗∗

(0.03)

-0.14∗∗∗

(0.04)

0.86

962

Profit

0.91∗∗∗

(0.33)

-0.45∗

(0.24)

0.74

627

Notes: * p<0.10, ** p<0.05, *** p<0.01. Standard errors in parentheses are robust. Time period is 1960-74.

Models are estimated using OLS estimations. All the estimations include newspaper and year fixed effects.

Variables are described in more details in the text.

Table 7: Baseline estimation: Content

Post-1968

National x Post-1968

R-sq

Observations

Number of pages

0.42∗∗∗

(0.03)

0.00

(0.03)

0.94

996

News hole

0.35∗∗∗

(0.03)

-0.03

(0.03)

0.91

996

Advertising space

0.62∗∗∗

(0.07)

-0.01

(0.05)

0.87

996

Share of advertising

0.21∗∗∗

(0.06)

-0.00

(0.04)

0.74

996

Notes: * p<0.10, ** p<0.05, *** p<0.01. Standard errors in parentheses are robust. Time period is 1960-74.

Models are estimated using OLS estimations. All the estimations include newspaper and year fixed effects.

Variables are described in more details in the text.

smaller price and an unchanged quantity, advertising revenues decrease after the introduction.

5.3

Interpretation of the results