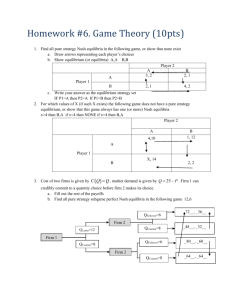

Instructions Answer ALL questions in Part I.

advertisement

Instructions

Answer ALL questions in Part I.

Choose and answer only one question in Part II and only one question in Part III.

All answers should be graduate-level. Clearly explain and show all your work whether or not the

question formally asks for explanation and/or asks you to indicate the steps in your analysis.

As microeconomics faculty may not be available during the exam, please make sure to state

clearly any assumptions that you find absolutely necessary to answer a question. In general, you

should aim to minimize making additional assumptions.

PART I. Respond to each of the nine statements in this part by stating whether it is TRUE,

FALSE, or UNCERTAIN, and provide a justification for your answer.

1. If a consumer has homothetic preferences, income elasticity of demand will be 1 for all

goods.

2. For any and every producer with a 2-factor constant-returns production function, the two

factors must be complementary with each other.

3. A firm’s cost function C(w1 , … , wn , y) must be convex with respect to factor prices w1 , …

wn for a given value of output y.

4. If a fixed per-unit tax is imposed on the output of a price-taking firm in a competitive market,

the firm’s production level is likely to be suppressed in the short run but not in the long run.

5. In a 2-person 2-good pure-exchange economy, if the consumers have identical preferences

and identical endowments, no exchange will take place.

6. Because of the Revenue Equivalence Theorem, auction design is irrelevant—each auction

with private values yields ex ante the same predicted outcome.

7. The regular Cournot and Bertrand models (with homogeneous goods and without capacity

constraints) assume a fixed, exogenously determined number of firms. True, false, or

uncertain: if the number of firms is endogenous to the models, then both models predict the

same number of entrants into the market.

8. In a finitely repeated 2x2 Prisoner’s Dilemma (with common knowledge about payoffs, types

and length of games), no discount rates exist so that cooperation, at least for some periods, is

part of a subgame-perfect Nash equilibrium.

9. In a Second-Price auction with independently distributed (over 0, 1 ) values and a random

draw in case of a tie,

1,

0∀ ∈ 2, … , is an equilibrium.

PART II. Answer ONE of the following two questions.

10. Consider a consumer in a 2-good world whose preferences are represented by the utility

function U(x1,x2) = x11/3 + x21/3 defined on R2+ , and who faces the usual budget constraint with

budget level m and positive prices p1 and p2.

a. Are this consumer’s preferences monotonic? Convex? Homothetic?

b. Sketch a set of indifference curves for this consumer.

c. State the first-order necessary conditions for the consumer’s utility maximization problem.

d. Are there conditions under which this consumer will choose a corner solution? Explain.

e. Using the first-order conditions, derive the demand function for good 1.

f. Using your result from part e., derive an expression for the own-price substitution effect

∂h1/∂p1 where h1 is the consumer’s compensated (Hicksian) demand function for good 1.

g. Show that compensated demand for good 1 is non-increasing in p1, and homogeneous of

degree 0 in prices.

11. Consider a firm with a 2-factor production function f(x1,x2) = x11/2 + x21/2 defined on R2+.

Suppose the firm aims to maximize profit by choice of x1 and x2. Let the factor prices be w =

(w1, w2) and the output price be p.

a. State the profit maximization problem and the first-order necessary conditions.

b. Are the second-order sufficient conditions satisfied? Explain.

c. What is the elasticity of scale for this firm’s technology? What information does it give, and

how is it consistent with your conclusion in part b.?

d. Derive the firm’s factor demand functions xi(w,p), supply function y(w,p), and profit function

π(w,p).

e. Derive the firm’s cost function c(w,y).

f. Reconsider the firm’s profit-max problem to be stated as max py – c(w,y), with choice variable

y. State the first order condition and derive the supply function y(w,p), showing that it matches

your result in part d.

g. Show that the supply function is non-decreasing in p and homogenous of degree 0 in (w,p).

PART III. Answer ONE of the following two questions.

12. Assume a duopoly with inverse demand functions

,

,

and

,

and cost functions

with

and

0,

as quantity choices of firms 1 and 2,

0, and

.

a. What is the interpretation of ?

b. Solve for the Cournot equilibrium

,

and prices

,

.

c. Now consider the demand functions that are consistent with the inverse demand functions

above:

,

and

,

, with

.

Solve now for the Bertrand equilibrium

,

.

d. With

1 draw the Cournot and Bertrand prices as functions of for 1

1.

i.

What is the intuition for the slope of the functions?

ii.

For which are the prices identical, and what is the intuition behind that?

iii.

How come we did not observe identical prices in the regular Bertrand and Cournot

models with homogeneous goods (and without capacity constraints)?

e. Incomplete information: Now consider the inverse demand functions from above again, with

,

,

,

). Also,

1.

1 (which means

In this part, nature moves first and chooses

10 or

5 with equal probability. Firm 1

can observe the actual state of demand (and that is common knowledge), but firm 2 knows

only the distribution.

i.

What are firm 1’s profit and best-response functions if it observes High Demand

,

10

]?

[

ii.

What are firm 1’s profit and best-response functions if it observes Low Demand

[

,

5

]?

iii.

What are firm 2’s profit and best-response functions?

iv.

Show that the Bayesian Nash equilibrium of this duopoly game is approximately

( , , ) = (3.42, 0.92, 2.17)

13. Consider the following two-player “best-shot” public-good game: two players ∈ 1, 2 each

decide whether or not to contribute to a public good: ∈ 0, 1 . If player contributes (

1),

then incurs a cost of 0

1 (cost is the same for both players). If one or both contribute,

then the public good is provided and each player receives a benefit , which depends on the

player’s type , with ∈ 0,1 . Thus, the payoff of player can be written as

,

For parts a-b, assume that the types are common knowledge.

a. Present the game in normal form.

b. If the game is played simultaneously, what are the Nash equilibria in pure and mixed

strategies? Calculate the payoffs in each equilibrium.

For the rest of this problem assume that each player cannot observe the other player’s type

anymore and knows only that the type is independently and randomly chosen by nature at the

start of the game from a uniform distribution over (0,1) (of course, players know their own type).

that

We are now searching for a Bayesian Nash equilibrium. Each player uses a strategy

maps from (0,1) into {0,1} (the space for the contribution ).

1 (contribution). What are then player ’s

c. Let be the probability that player chooses

expected payoffs from contribution and not contribution? Show that her threshold , so that

for each

she would contribute (and of course for

she would not contribute), is

.

d. We are now searching for two thresholds such that for each player

0 1 . With that

is a Bayesian Nash equilibrium. Note that player will contribute if

information, and knowing that is uniformly distributed on 0,1 , we can replace the in

the equation for threshold above.

Show/explain that

and that player ’s best response is

e. Given the best-response functions

.

f. Provide intuition for the result in part e.

and, correspondingly,

1 , show now that

.