Midterm #1

advertisement

Name:_______________________

Midterm #1 – EconS 425 (February 20th, 2015)

Question #1 [25 Points]

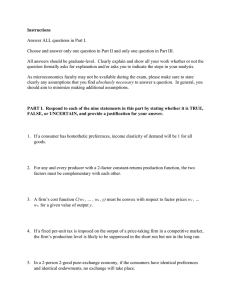

Player 2

L

R

Player 1

L

(9,9)

(0,8)

R

(8,0)

(7,7)

a) By inspection, what are the pure strategy Nash equilibria?

b) Find the additional mixed strategy equilibrium by using the fact that if a player is willing to

mix between two or more strategies, she will be indifferent between them in equilibrium.

Assume p is the probability that player 1 selects L and q is the probability that player 2 selects

L.

c) Draw the best-response correspondences. Where do they intersect?

Solution

a) NE={(L,L), (R,R)}

b) Assume P is the probability that player 1 selects L and q is the probability that player 2

selects L. Hence:

EU1(L)=9q+0(1-q)=9q

EU1(R)=8q+7(1-q)= q+7

Hence player 1 chooses L if EU1(L)> EU1(R). That is, if 9q> q+7 or q>7/8.

In addition,

EU2(L)=9p+0(1-p)=9p

EU2(R)=8p+7(1-p)= p+7

Hence player 2 chooses L if EU2(L)> EU2(R). That is, if 9p> p+7 or p>7/8.

Therefore players’ best response function are :

R1(q)=

R (p=0) if q<7/8

Randomizes between L & R (p(0,1) if q=7/8

L (p=1) if q>7/8

R2(p)=

R (q=0) if p<7/8

Randomizes between L & R (p(0,1) if p=7/8

L (q=1) if p>7/8

The MSNE is player 1 randomizes between L and R if q=7/8 and player 2 randomizes between

L and R if p=7/8

c)

p

1

7/8

7/8

1

q

1

Question #2 [25 Points]

In Tacoma, WA there are two suppliers of distilled water, labeled as firm Aqua and firm Blue.

Distilled water is considered to be a homogenous good. Let p denote the price per gallon, qA

quantity sold by firm Aqua, and qB the quantity sold by firm Blue. Both firms are located close to

a spring so the only production cost is the cost of bottling. Formally, each firm bears a

production cost of cA = cB = $3 per one gallon of water.

Tacoma’s aggregate inverse demand function for distilled water is given by p = 12-Q =12-qA-qB,

where Q = qA +qB denotes the aggregate industry supply of distilled water in Tacoma. Solve the

following problems:

a) Solve for firm A's best-response function, qA = RA(qB). Also solve for firm B's best-response

function, qB = RB(qA). Show your derivations.

b) Solve for the Cournot equilibrium output levels qcA and qcB. State which firm sells more water

(if any) and why.

Solution:

a) The best-response functions are given by

qA(qB) =(9- qB)/2 and qB(qA) =(9- qA)/2

b) The above best-response functions constitute two linear equations with two variables, qA and

qB. The unique solution is qcA= qcB= 3 gallons. Both firms produce the same amount since

there equally efficient in the sense that the bear identical production costs.

Question #3 (25 points)

Firms A and B can choose to adopt a new technology (N) or to adhere to their old technology

(O). Formally, firms' action sets are: tA {N,O} and tB {N,O}. The table below exhibits the

profit made by each firm under different technology choices.

Firm B

Firm A

New Technology

Old Technology

New

(200,0)

(0,200)

Old

(50,100)

(100,50)

a) Write down the best-response functions of firms A and B, tA = RA(tB) and tB = RB(tA)

b) Draw the tree of a two-stage extensive-form game in which firm A chooses its technology

tA in stage I, and Firm B chooses its tB in stage II (after observing the choice made by firm

A). Make sure that you indicate firms' profits at the termination points on the tree. Solve for

the subgame-perfect equilibrium of this game. Provide a short proof or an explanation

justifying your answer.

c) Draw the tree of a two-stage extensive-form game in which firm B chooses its technology

tB in stage I and Firm A chooses its tA in stage II (after observing the choice made by firm

B). Solve for the subgame-perfect equilibrium of this game.

d) Compare the equilibrium firms' profit levels of the games played in (b) and in (c).

Conclude under which game firm A earns a higher profit. Briefly explain your answer.

Solution

2

a)

b) From firm B's best response function given above, if tA = N, tB(N) = O, in which case

firm A earns ∏A (N,O) = 0. Instead, if tA = O, tB(O) = N, in which case firm A earns ∏A

(O,N) = 50 > 0. Therefore, the subgame-perfect equilibrium for this game is:

Note: Although there is no Nash equilibrium of the normal-form game a SPE of extensiveform game does exist, because the extensive-form game is somewhat different than the

normal-form game.

Firm A

N

O

Firm B

Firm B

N

c)

O

(200,0)

N

O

(0,200) (50,100)

(100,50)

From firm A's best response function given above, if tB = N, tA(N) = N, in which case firm B

earns ∏B (N,N) = 0. Instead, if tB = O, tA(O) = O, in which case firm B earns ∏B(O,O) = 50 >

0. Therefore, the subgame-perfect equilibrium for this game is:

Firm B

N

O

Firm A

N

(200,0)

Firm A

O

N

(50,100) (0,200)

O

(100,50)

3

d) In the game (ii) ∏A (O,N) = 50 and ∏B (O,N) = 100. In the game (iii) ∏A (O;O) = 100 >

50 and ∏B (O,O) = 50. This game is interesting because A has a first-mover disadvantage.

Not every game yields this result. This is because A would like to “match" B's technology,

whereas B gains from introducing a different technology. By letting B making the first

choice, A is able to match its technology choice with B's choice.

Question #4 (25 points)

The demand function for concert tickets to be played by the Seattle symphony orchestra varies

between nonstudents (N) and students (S). Formally, the two inverse demand functions of the

two consumer groups are given by

pN = 12 - qN and pS = 6 - qS.

Thus, at any given consumption level nonstudents are willing to pay a higher price than students.

Assume that the orchestra's total cost function is C(Q) = 10 + 2Q where Q = qN + qS is to total

number of tickets sold. Solve the following problems.

a) Suppose the orchestra is able to price discriminate between the two consumer groups by asking

students to present their student ID cards to be eligible for a student discount. Compute the profitmaximizing prices pN and pS, the number of tickets sold to each group of consumers, and total

monopoly profit.

b) Suppose now the local mafia has distributed a large number of fake student ID cards, so

basically every resident has a student ID card regardless of whether the resident is a student or

not. Compute the profit-maximizing price, the number of tickets sold to each group of

consumers, and total profit assuming that the monopoly orchestra is unable to price

discriminate.

c) By how much the orchestra enhances its profit from the introduction student discounted

tickets compared with the profit generated from selling a single uniform ticket price to both

consumer groups.

Solution

a) Equating the marginal revenue to marginal cost in the market for nonstudents yields MRN

= 12 - 2qN = 2, hence, qN = 5. Therefore, pN = 12- 5 = $7. Similarly, in the market for

students MRS = 6 - 2qS = 2, hence, qS = 2. Therefore, pS =6-2 = $4 < pN. Thus, students

indeed receive a discount of pN-pS = 7-4 = $3.

Next, combined total profit from selling in both markets is πD = (7-2)5 + (4- 2)2- 10 =

$19.

b) We first check how much profit can be earned if the seller sets a sufficiently low price so

the entire market is served. To compute this, we first must find the aggregate market

demand curve. Inverting the two demand curves yield qN = 12- p and qS = 6- p. The

aggregate demand curve is then Q = qN + qS = 18- 2p. The resulting inverse aggregate

demand function and the marginal revenue function are

Solving MR=9-Q=2=MC yields Q=7, therefore, p=(18-7)/2=11/2<6. Altogether, the

profit when both markets are served is

4

We are now able to compute the profit assuming that the monopoly sets a sufficiently

high price so only nonstudents can “afford” to purchase concert tickets. Thus, under a

sufficiently high price, qS = 0, and the monopoly solves MRN(qN) = 12-2qN = 2 yielding

qN = 5. The price should set to p = 12-5 = $7. Actually, we have already calculated these

figures in the analysis of price discrimination above. What is important to check is that p

= 7 > 6 which is the intercept of the students' inverse demand function. Hence, students

don't buy at this price. Total profit is then given by

Since

, the monopoly earns a higher profit when setting a sufficiently

high price so only nonstudents purchase concert tickets.

c) The gain from price discrimination is therefore

Question #5 [Bonus: 15 Points]

From Proposition 6.2 we know that: “A Bertrand equilibrium price is

and

, if the medium of exchange is continuous and if the firm have the same cost structure,

(

).” Provide a proof of this proposition by considering three cases: (1)

,

(2)

and (3)

Solution

Please check page 110 Shy’s textbook.

5