1 | P a g e Page | 1

advertisement

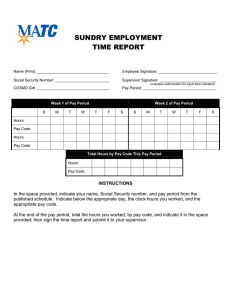

1|Page Report By: Surbhi Bagaria – surbhi@dynamiclevels.com Page | 1 Cosmo Films- A Turnaround Story Page 2 Cosmo Films Ltd 3 Company Background 4 Product Portfolio 5 Packaging Industry-India 6 Factors affecting Growth 8 Company Financials 9 Peer Comparison 13 Shareholding Pattern 14 Company Future Outlook 15 Cost Optimization 16 Cosmo Valuation & Investment Rationale 17 Source: Company, www.dynamiclevels.com CMP Rs 360 Target: 450 FY17P/E: 8.9x Cosmo Films Ltd. Cosmo Films Ltd is a leading manufacturer in flexible packaging with wide range of products in its portfolio. It was the first to manufacture Bi-axially Oriented Polypropylene Films (BOPP) in India with 20% market share. Cosmo has manufacturing units in India, Korea, Japan and US and customers across 80 countries around the globe. Dynamic Levels is positive on the prospects on Cosmo films as: In FY 16 the Cosmo maintained its topline at par compared to last year but reduced the expenditure by 100 Cr from 1577 Cr to 1465 Cr as the cost of raw materials went down from 1122 Cr to 1002 Cr due to fall in crude oil price which is a major part of expenditure for packaging industry. Finance Cost went down by 9.8 Cr from 39.88 Cr to 30.18 Cr indicating reduction in debt of the Cosmo. PAT increased from 27.66 Cr to 96.24 Cr i.e. up by 248% YoY whereas price has gone up by 386% from low of 84 to 408. The share is still trading at a low PE of 8.91 compared to Industry PE of 18.73 To reduce the impact to crude price volatility COSMO is shifting its focus to specialty. India Ratings Upgrades Cosmo Films long term credit rating to ‘IND A’ from previous rating of ‘IND A-’ COSMO global BOPP specialist has announced plans to install a new BOPP line at the Karjan plant site near Vadodara by 2017 which will increase the annual production capacity by around 40%. Demand for BOPP films is expected to increase especially in FMCG sector Page 3 COSMO FILMS Share Price Performance EXCHANGE SYMBOL COSMOFILMS Current Price * 361.60 Face Value 10 52 Week High 408 (11-5-16) 52 Week Low 83.95 (11-5-15) Life Time high 408 (11-5-16) Life Time low 3.62 (04-9-98) Average Daily 13.68 Movement Average Volume 335331 1 Month Return 22.68 (%) P/E Ratio (x) 8.91 Book Value 195.22 Market Cap(Cr) 770.45 % of Promoter NIL holding pledged Current Capitalization (Millions) Share Price (inr) 369.1 Shares Out. 194 Market Capitalization 7,175.3 (inr) - Cash & Short Term 323.5 Investments + Total Debt 3,439.5 + Pref. Equity 0.0 + Total Minority Interest 0.0 = Total Enterprise Value 10,291.3 (INR) Book Value of Common 4,562.7 Equity + Pref. Equity 0.0 + Total Minority Interest 0.0 + Total Debt 3,439.5 = Total Capital 8,002.2 Company Background: Source: Company, www.dynamiclevels.com Established in 1981, Cosmo Films Limited is one of the largest manufacturers of Biaxially Oriented Polypropylene (BOPP) Films in the world. With manufacturing units in India, Korea, & USA, Cosmo has a BOPP manufacturing capacity of 136,000 TPA and a sales turnover of USD 215 Million (INR 1.472 Billion) in FY 2014-15. Cosmo is the largest BOPP films exporter from India and the world's largest manufacturer of thermal lamination films. Cosmo offers a comprehensive range of BOPP Films for flexible packaging, lamination, labelling and industrial applications, including speciality films such as high barrier films, velvet thermal lamination films and direct thermal printable films. Apart from a dominant share in the Indian market, Cosmo exports to more than 80 countries worldwide. Cosmo's customer base includes the leading global flexible packaging and label face stock manufacturers like Amcor, Constantia, Huhtamaki, Avery Dennison etc., which service brands like Pepsico, Coca Cola, Unlilever, P&G, CP, Reckitt Benckiser, Nestle, Mars etc. Cosmo also has an extensive network of channel partners across the world for distribution of its range of lamination films. Key Advantages of COSMO are: 1. Experience and expertise of producing BOPP films for more than three decades 2. Widest portfolio of BOPP based packaging, labels and lamination films 3. Multiple lines for providing flexibility in operations 4. Multiple warehousing facilities for providing just-in-time services across the globe 5. Dedicated BOPP films R&D infrastructure 6. Dedicated account management teams for key global accounts COMPANY PROFILE OF COSMO Date of Incorporation 07-Oct-1976 Date of Listing 28-Feb-1995 Management Name Designation H N Sinor Additional Director Ashish Guha Independent Director H K Agrawal Independent Director Pratip Chaudhuri Independent Director Alpana Parida Non Independent Director Registered Office Address 1008, DLF Tower-A,Jasola District Centre,110025,New Delhi,Delhi,India Website http://www.cosmofilms.com Cosmo Films Clientele includes: Product Portfolio: Page 4 Source: Company, www.dynamiclevels.com Page 5 Source: Company, www.dynamiclevels.com Packaging Industry- India The Indian Packaging Institute estimates that the packaging industry in India is worth USD 24 billion and growing at more than 15% p.a. India’s share of USD 24.6 billion in the USD 77 billion global packaging industry is a considerable share with a promising scope for further growth. India ranks 2nd in terms of growth (with a growth rate of 14%-15%) with China leading the growth race at 18% annual growth. Both countries are way ahead of the competition even at a global level because the global packaging industry growth rate is merely 3%-5%. Such stats clearly indicate the potential that the industry has for becoming a global player. However, there are certain issues that are creating obstacles for the industry. Increasing global competition. The only way for India to meet the global competition is to conform to internationally accepted standards in packaging. Rejection of products at the destination: India has a good export scenario wherein several products are sent to global markets. However, India does not have packaging specifications for most of the exportable commodities. This is one of the reasons for rejection of products at the destination. The world today is not divided by boundaries when it comes to business and trade. During the national conference on ‘Make in India — Packaging Transportation of Hazardous Goods and UN Certification’, N.C. Saha, director – Indian Institute of Packaging, said, “The Union ministry of commerce has constituted a standing committee to formulate the packaging specifications for 500 exportable commodities over the next year. By March 2016, IIP will develop packaging specifications for tea, coffee, spices, cut flowers, marine products, table eggs, fresh fruits and vegetables.” Challenges for Packaging Industry Rapid changes in technology Shortage and Rising cost of raw material Costly Skilled Manpower Rising input costs Highly inadequate credit flow Lack of Market Access & Advanced technology Lack of exposure to Best Management and Manufacturing Practices Lack of 100% commitment to the quality standards Lack of Marketing, Distribution and Branding Non-availability of skilled manpower IIP (Indian Institute of Packaging) is an autonomous body established under the Ministry of Commerce and Industry. It has been given the responsibility of developing packaging specifications by 2016 in line with global packaging standards for 500 exportable commodities including tea, coffee, spices, cut flowers, marine products, table eggs, fresh fruits and vegetables. Being a member of the UN, it has become important for India to comply with the regulations, especially after mandating the UN certification for packaging of goods catering to international market. Maybe these changes would provide the means for leveraging the use of flexible plastic packaging that has dominated the Indian packaging Industry till now. Page 6 Source: Company, www.dynamiclevels.com Although traditional packaging options exist, the shift to flexible packaging has been a more recent change arising out of better visual appeal, cost effectiveness, and sturdiness of the packaging material. India needs to capitalize on its strengths in packaging solutions (flexible packaging) and high export potential to become a global player. By focusing on a globally compliant approach, it would be possible for India to increase profits as well as come up as a prominent economy in the world’s trade scenario. International Business Opportunity Export Business Opportunity Import Facilitation and Sourcing Contract manufacturing Opportunity with Overseas Companies Technology Transfer & Joint Ventures Opportunities Advanced Machineries, Equipments and Technology Collaborations and Strategic Alliances Patented Technology and New Projects Overseas Exhibition Participation Opportunities and Finance Facility Page 7 Source: Company, www.dynamiclevels.com Factors Affecting Growth of Packaging Industry in India 1. Urbanization Modern technology is now an integral part of nation's society today with high-end package usage increasing rapidly. As consumerism is rising, rural India is also slowly changing into more of an urban society. industrialization and expected emergence of the organized retail industry is fuelling the growth of packaging industry. 2. Increasing Health Consciousness As people are becoming more health conscious, there is a growing trend towards wellpacked, branded products rather than the loose and unpackaged formats. Today even a common man is conscious about the food intake he consumes in day-to-day life. 3. Low Purchasing Power resulting in Purchase of Small Packets India being a growing country, purchasing power capacity of Indian consumers is lower; the consumer goods come in small, affordable packages. Products like toothpaste, fairness creams in laminated pouches are highly innovative and are not used elsewhere. Low priced sachets have proved to be extremely popular in smaller towns and villages, where people do not prefer to buy larger packs due to financial constraints. 4. Indian Economy Experiencing Good Growth Prospects The Indian economy is growing at a promising rate, with growth of outputs in agriculture, industry and tertiary sectors. Overall economic growth has proved to be beneficial for the consumer goods market, with more and more products becoming affordable to a larger section of the population. 5. Changing Food Habits amongst Indians Changing lifestyles and lesser time to spend in kitchens are resulting in more incidence of eating away from homes resulting in explosive growth of restaurants and fast food outlets all over the country. Demand for products like pasta, soups, and noodles in India, is fuelling the growth of packaging industry in India. 6. New areas: One area that has been identified as having good market potential is equipment for manufacturing aluminum beverage cans. Machinery for cleaning and drying containers; automatic high speed labeling machines and capping machines; sealing machines for cans, boxes, and other containers; machinery for filling, and closing bottles and cans; packing/wrapping machines; and moulding machines also offer good prospects. Page 8 Source: Company, www.dynamiclevels.com Company Financials: Income Statement (in Mn) FY 2014 FY 2015 FY 2016 14,683.6 10,968.8 33.1 453.2 2,591.5 14,046.6 637.0 363.8 25.2 338.6 316.4 (18.0) 37.0 (55.0) (55.0) 16,467.8 12,498.8 29.4 345.4 2,860.2 15,733.8 734.0 331.1 10.3 320.8 31.0 382.2 105.6 276.6 276.6 16,155.8 11,418.0 356.8 2,824.8 14,599.6 1,556.2 315.8 1,240.4 278.0 962.4 962.4 NI to Common Incl Extra Items (55.0) 276.6 962.4 Abnormal Losses (Gains) Tax Effect on Abnormal Items NI to Common Excl. Extra Items Basic EPS Dividends per Share Payout Ratio % 286.8 (97.5) 134.3 (2.83) 1.0 - (33.3) 9.2 252.5 14.23 3.5 24.6 69.4 (24.0) 1,007.8 49.50 10.0 20.2 Total Revenue Selling General & Admin Exp. R & D Exp. Depreciation & Amort. Other Operating Expense/(Income) Operating Expense., Total Operating Income Interest Expense Interest Income Net Interest Exp. Other Non-Operating Inc. (Exp.) EBT Excl. Unusual Items Income Tax Expense Earnings from Cont. Ops. Minority Int. in Earnings Net Income WACC Equity Cost of Equity Weight of Equity Debt Cost of Debt Weight of Debt WACC Page 9 FY 2012 FY 2013 FY 2014 FY 2015 FY 2016 11.2% 9.9% 11.9% 12.5% 13.2% 28.4% 20.8% 14.3% 23.4% 62.2% Income Statement Analysis: 1. In FY 16 the Cosmo maintained its topline at par compared to last year but reduced the expenditure by 1000 Mn as the cost of raw materials went down due to fall in crude oil price which is a major part of expenditure for packaging industry. 2. PAT increased from 276.6 Mn to 962.4 Mn i.e up by 248% YoY whereas price has gone up by whereas price has gone up by 386% from low of 84 to 408. 3. The share is still trading at a low PE of 8.91 compared to Industry PE of 18.73 4. Reserves of the company have gone up by 20%. 5. Cosmo reported a PAT loss of Rs 55 Mn in FY14 due to a onetime forex loss of Rs 287 Mn. Cost of Equity Weight of Equity Cost of Debt 8.9% 5.7% 11.9% 7.8% 7.8% 71.6% 79.2% 85.7% 76.6% 37.8% 9.5% 6.6% 11.9% 8.9% Weight of Debt 11.2% Source: Company, www.dynamiclevels.com Balance Sheet (In Mn) ASSETS Cash And Equivalents Short Term Investments Total Cash & ST Investments Accounts & Notes Receivable Total Receivables Inventories Prepaid Exp. Restricted Cash Other Current Assets Total Current Assets Net Property, Plant & Equipment Long-term Investments Other Long-Term Assets Total Assets LIABILITIES Short-term Borrowings Accounts Payable Other Current Liabilities Total Current Liabilities Long-Term Debt Other Non-Current Liabilities Total Liabilities Minority Interest Additional Paid In Capital Comprehensive Inc. and Other Total Equity Total Liabilities And Equity Supplemental Items Total Shares Out. on Filing Date Total Shares Out. on Balance Sheet Date Book Value/Share Tangible Book Value Tangible Book Value/Share Total Debt Net Debt Page 10 FY 2014 FY 2015 FY 2016 549.7 50.0 599.7 1,382.6 1,382.6 2,024.4 14.2 740.7 4,761.6 6,327.6 42.1 376.3 11,507.6 183.2 183.2 1,219.5 1,219.5 1,795.4 48.8 7.8 780.4 4,035.1 6,056.0 414.4 253.5 10,759.0 323.5 323.5 1,174.4 1,174.4 1,720.4 837.7 4,056.0 6,592.7 770.3 11,419.0 2,693.2 1,323.2 199.8 4,216.2 3,175.6 2,511.3 1,214.4 269.0 3,994.7 2,386.2 1,209.3 1,591.7 1,037.0 3,838.0 2,230.2 516.0 7,907.8 507.0 3,092.8 3,599.8 11,507.6 571.9 6,952.8 507.0 3,299.2 3,806.2 10,759.0 788.1 6,856.3 194.4 4,368.3 4,562.7 11,419.0 19.4 19.4 185.2 3,541.9 182.2 5,868.8 5,269.1 19.4 19.4 195.8 3,767.2 193.8 4,897.5 4,714.3 19.4 19.4 234.7 4,562.7 234.7 3,439.5 3,116.0 Balance Sheet Analysis Company’s long term investment has increased from 42 Mn to 770 Mn in 2 years. Cosmo has reduced its short term borrowings Cosmo has reduced its long term debt by 30% from 3175 to 2230 Mn Book value has increased from 185 to 234 per share Total debt has gone down by 41% which is very positive for the Co. Source: Company, www.dynamiclevels.com Cash Flow ( In Mn) FY 2013 FY 2014 FY 2015 Net Income 113.3 (55.0) 276.6 Depreciation & Amort., Total 388.1 453.2 345.4 Other Non-Cash Adj (58.3) 46.4 112.2 Changes in Non-Cash Capital 268.6 (224.2) 293.9 Cash from Ops. 711.7 220.4 1,028.1 (1,658.1) (888.3) (477.8) Sale of Property, Plant, and Equipment 112.2 133.0 103.6 Cash Acquisitions (93.7) - (59.3) - - - Invest. in Marketable & Equity Securt. (93.7) - (59.3) Other Investing Activities 276.7 17.0 50.8 (1,456.6) (738.3) (442.0) 142.7 22.4 (345.5) Long-Term Debt Issued 1,170.6 1,267.2 158.7 Long-Term Debt Repaid (584.5) (645.5) (675.0) 728.8 644.1 (861.8) Pref. Dividends Paid (113.0) (56.9) (22.7) Total Dividends Paid (113.0) (56.9) (22.7) 38.6 - - Cash from Financing 654.4 587.2 (884.5) Net Change in Cash (90.5) 69.3 (298.4) Cash Interest Paid 256.4 393.4 328.6 Cash Taxes Paid 100.3 (24.9) 52.4 Free Cash Flow (946.4) (667.9) 550.3 Capital Expenditure Proceeds from Investment Cash from Investing Net Short Term Debt Issued/Repaid Total Debt Issued/Repaid Other Financing Activities Page 11 Cash Flow Analysis: Cash from Operation is increasing evey year Cosmo is reducing its capital expenditure YoY. Cosmo reduced its Long term debt by 861 Mn In FY16 Free cash flow turned positive from negative in FY15 and FY14 Source: Company, www.dynamiclevels.com Ratios Profitability Return on Assets Return on Capital Return on Equity Margin Analysis EBITDA Margin EBIT Margin Earnings from Cont. Ops Margin Net Income Margin Normalized Net Income Margin Free Cash Flow Margin Asset Turnover Total Asset Turnover Fixed Asset Turnover Accounts Receivable Turnover Short Term Liquidity Current Ratio Quick Ratio Cash from Ops. To Curr Liab Avg. Days Sales Out. Avg. Days Payable Out. Long Term Solvency Total Debt/Equity Total Debt/Capital LT Debt/Equity LT Debt/Capital Total Liabilities/Total Assets EBIT / Interest Exp. EBITDA / Interest Exp. (EBITDA-CAPEX) / Interest Exp. Total Debt/EBITDA Net Debt/EBITDA Page 12 FY 2014 FY 2015 FY 2016 -0.5% 2.1% -1.6% 2.5% 8.7% 5.7% 14.3% 7.5% 23.0% 7.4% 4.3% 4.3% 6.6% 11.8% 4.5% 9.6% 4.5% 9.6% Ratio Analysis: Profitability ratios indicate that Cosmo’s Returns have improved YoY, indicating that the management is efficiently using its assets to generate earnings and Cosmo is able to generate good return with the money shareholders have invested -0.4% 0.9% 1.7% 1.5% 6.0% 6.2% -4.5% 3.3% -- Cosmo’s margins have improved which is an indication the revenue that is left with the Company after it has deducted all the expenses has increased YoY. 1.3x 2.4x 11.0x 1.5x 2.7x 12.7x 1.5x 2.6x 13.5x Asset Turnover ratio indicates that Cosmo is efficiently deploying its assets to generate the revenue. 1.1x 0.5x 0.1x 1.0x 0.4x 0.0x 1.1x 0.4x 0.1x 33.2x -- 28.8x 40.2x 27.1x -- 163.0% 128.7% 75.4% 62.0% 56.3% 43.0% 88.2% 62.7% 48.9% 33.5% 27.4% 27.9% 32.1% 27.5% 26.4% 1.75x 3.00x 0.55x 2.22x 3.26x 1.82x 5.16x 6.34x -- 5.38x 4.83x 4.54x 4.37x 1.80x 1.63x Cosmo’s Short term liquidity is in stress as it is not able to meet the industry standards of minimum 2, which signifies that the Company might have liquidity problems in paying its short term debt on time. Cosmo has high Debt which has decreased YoY, it is a positive sign for the Cosmo as it is reducing its debt Source: Company, www.dynamiclevels.com Peer Comparison Company Name: COSMO FILMS LTD Latest Fiscal Year: 03/2016 52-Week High 408.00 52-Week High Date 5/11/2016 52-Week Low 90.00 52-Week Low Date 5/12/2015 Daily Volume 263,141 Current Price: 368.50 52-Week High % Change -9.7% 52-Week Low % Change 335.3% Total Common Shares (M) 19.4 Market Capitalization 7,163.7 Total Debt 3,439.5 Minority Interest Cash and Equivalents 323.5 Current Enterprise Value 10,279.7 UFLEX LTD 03/2015 201.70 12/1/2015 112.00 6/12/2015 112,729 185.90 -7.8% 66.0% 72.2 13,424.1 22,099.8 7.5 1,858.6 28,246.7 JINDAL POLY FILM 03/2015 612.00 11/4/2015 230.00 6/12/2015 68,967 521.30 -14.8% 126.7% 42.0 21,919.5 18,271.3 4,682.9 2,426.0 41,649.2 Leverage/Coverage Ratios COSMO FILMS UFLEX LTD LTD Total Debt / Equity % 75.38% 73.5% Total Debt / Capital % 42.98% 42.3% Total Debt / EBITDA 1.798x 2.9x Net Debt / EBITDA 1.629x 2.7x EBITDA / Int. Expense 6.339x 5.0x JINDAL POLY FILM 108.1% 45.8% 2.8x 2.4x 10.1x INSTRUMENT COSMO FILMS MOLD TEK ESSEL PROPACK UFLEX JINDAL POLY MANAKSIA Peer Analysis: Cosmo has highest volume compared to its peers Cosmo has given highest return compared to its peers from 52 week low of 335% Cosmo has lowest Debt compared to its peers Leverage ratios show that Cosmo is very placed in the market compared to its peers 1M 3M 6M 1Y 5.97 13.7 10.83 -0.03 5.52 -5.99 56.93 -30.76 31.22 29.94 30.51 6.08 33.44 -28.2 18.95 8.09 -0.76 -14.11 309.43 -17.04 44.38 52.98 78.87 -19.9 Movt Post Budget 64.74 52.38 41.81 36.66 34.38 4.67 cosmo Cosmo has given highest return among its peers in last 1 year of 309% Page 13 Source: Company, www.dynamiclevels.com Shareholding Pattern Shareholding Pattern Promoter and Promoter Group (%) Indian Foreign Institutions (%) FII DII Non Institutions (%) Bodies Corporate Others Custodians Total no. of shares (cr.) Mar-16 43.51 43.51 NIL 2.14 2.05 0.09 54.35 NIL 53.36 0.99 1.94 Dec-15 43.51 43.51 NIL 1.06 0.16 0.90 55.43 NIL 55.43 NIL 1.94 Sep-15 43.51 43.51 NIL 1.71 0.08 1.64 54.78 7.94 46.84 NIL 1.94 Jun-15 42.84 42.84 NIL 1.01 0.02 0.99 56.15 7.34 48.81 NIL 1.94 Mar-15 42.84 42.84 NIL 0.99 0.02 0.96 56.17 6.89 49.28 NIL 1.94 FII’s have increased their stake in FY16 from 0.02 to 2.05 Persons holding securities more than 1% of total number of shares under category Public Shareholding. Ambrish Jaipuria Ashok Jaipuria Parvasi Enterprises Ltd Sunrise Manufacturing Co Ltd Anil Kumar Goel Bodies Corporate Foreign Individuals or NRI Category Promoters Promoters Promoters Promoters NonPromoters NonPromoters NonPromoters Mar-16 Dec-15 Sep-15 Jun-15 Mar-15 2.84 2.42 15.69 21.95 3.42 8.72 1.82 2.84 2.42 15.02 21.94 3.32 9.94 4.89 2.84 2.42 15.69 21.95 3.27 NIL NIL 2.84 2.42 15.02 21.95 3.27 NIL NIL 2.84 2.42 14.89 20.36 3.13 NIL NIL Promoters of COSMO have kept their investment constant throughout the year Page 14 Source: Company, www.dynamiclevels.com Cosmo Future Outlook FY11-13 was a challenging for the BOPP industry, it witnessed slowdown due to fall in demand resulting in deltas getting crunched. Most players in the industry reported a 60-80% dip in profitability. However, Cosmo Films was able to buck the trend through cost optimization & changing production in favour of higher margin products. Improved profitability YoY negative to positive. The BOPP industry is expected to grow at a CAGR of 8.5% by FY 20 on the back of the rising penetration of packaged foods and disposable income. Capability to substitute other flexible packaging materials such as BOPET, BOPA and other specialty films, specially coated label papers and aluminum foils provides a superior edge to BOPP over other packaging products. BOPP also helps to improve the shelf life of packaged products. The management has indicated that it plans to increase the production of higher value added variants of BOPP along with thermal and coating films, the contribution of which is expected to increase to 25% by FY18. COSMO expects to increase in utilisations from 67% in FY15 to 70% by FY18 led by various technological up gradation initiatives that the company is carrying out in its manufacturing facilities Fluctuating EBITDA margin and PAT margin expected to stabilize due to cost optimization and improving product mix Page 15 Source: Company, www.dynamiclevels.com Cost Optimization to increase Profitability (a) Upgradation of old manufacturing equipment which was earlier consuming higher power per unit of output. With upgradation in manufacturing lines the power consumption per unit of output has reduced from 2 Rs/kg to 0.6 Rs/kg. Accordingly, the power cost as a percentage of revenues has reduced from 7.5% in FY09 to 6% in FY15. (b) The technological upgradation has helped to control manpower requirements to support the expanded capacity resulting in higher operating efficiencies. (c) Improving operations at the US facility which posted a negative EBITDA of Rs 29 crore in FY 2014-15 owing to labour issues in the US plant. The management has cleared hurdles in the US and is confident that the EBITDA loss would reduce to 6.5 crore in FY 2015-16. (d) Shift to value added products to stabilize margins at higher levels. (e) Shift in focus from traditional products like non tape and taped films to modern techniques like specialty and semi specialty films. These have higher margins and could boost EBITDA margins of the company going forward. (f) SEZ tax benefit to boost profitability: The Shendra plant, which is dedicated to handle the export requirements of the company, is located in the Special Economic Zone (SEZ), close to Aurangabad. Cosmo will get Tax benefit like no income tax for 5 years etc would accrue to the comany since the plant is located in a SEZ. Tax benefits would lower the company’s effective tax rate to the range of 23 to 25%. Key Risks faced by Cosmo are: (a) Fluctuations in the prices of commodities like PET chips could result in volatility in margins and the company might incur inventory losses in the event of a sharp downfall. (b) Delay in commissioning of the new capacity which is expected to be completed by April 2018 could lead to lower than estimated revenues. Page 16 Source: Company, www.dynamiclevels.com COSMO Valuations & Investment Rationale An improving trend visible over the last few years due to: Improving Product Mix towards Value Add, with consequently better margins Sustainable reduction in variable cost (approx INR 25-30 crores pa) Increase in production volume by improving existing manufacturing lines efficiency USA Subsidiary Turnaround, leading to better consolidated results New planned capacity expansion by 44% with one of the world’s largest and most efficient production capability at low financing cost would further help higher asset turnover along with improved ratios. Global annual BOPP demand is estimated to be approx 7.8 million MT. The global demand and supply are broadly balanced except China. Currently India BOPP production capability is estimated at approx 500k MT pa. India domestic BOPP consumption is approx 390k MT pa and export from India is about 110k MT pa. Indian BOPP Industry has been growing at almost double of the India’s GDP growth rate. Considering low packaged food penetration in India and rising personal disposable income, the Industry is estimated to grow fast. Investment in organized retail industry and change in pack format from rigid to flexible is going to further add to increasing demand. Based on capacity addition announced in India, new capacity expected in the Industry may not be able to address growing India demand. On current India BOPP Industry demand base, one new line each year may not be sufficient to address India’s growing demand. Strong domestic and global demand is helping efficient capacity utilization. In line with strong demand fundamentals, Cosmo Films is implementing an increase in capacity by 60k MT p.a. with 10.4 meter width state of art BOPP line, which is one of the lowest cost producing line in the world. We initiate coverage on Cosmo Films Ltd as a BUY @320-340 with a target of Rs 450 representing a potential upside of 30% from the buy price. COSMO FILMS is trading at a low PE of 8.9. We are positive on the company prospects due to: Capacity expansion which will lead to growth in volume, Diversified product portfolio to reduce risk Improving EBITDA and profitability margins and Reducing Long term DEBT of the Co. Page 17 Source: Company, www.dynamiclevels.com Disclaimer: Research Disclaimer and Disclosure inter-alia as required under Securities and Exchange Board of India (Research Analysts) Regulations, 2014. Dynamic Equities Pvt. Ltd. is a member of National Stock Exchange of India Ltd. (NSEIL), Bombay Stock Exchange Ltd (BSE), Multi Stock Exchange of India Ltd (MCXSX) and also a depository participant with National Securities Depository Ltd (NSDL) and Central Depository Services Ltd.(CDSL). Dynamic is engaged in the business of Stock Broking, Depository Services, Investment Advisory Services and Portfolio Management Services. Dynamic Equities Pvt. Ltd. is holding company of Dynamic Commodities Pvt. Ltd. , a member of Multi Commodities Exchange (MCX) & National Commodity & Derivatives Exchange Ltd.(NCDEX). We hereby declare that our activities were neither suspended nor we have defaulted with any stock exchange authority with whom we are registered. SEBI, Exchanges and Depositories have conducted the routine inspection and based on their observations have issued advise letters or levied minor penalty on for certain operational deviations. Answers to the Best of the knowledge and belief of Dynamic/ its Associates/ Research Analyst who prepared this report DYANMIC/its Associates/ Research Analyst/ his Relative have any financial interest in the subject company? No DYANMIC/its Associates/ Research Analyst/ his Relative have actual/beneficial ownership of one per cent or more securities of the subject company? No DYANMIC/its Associates/ Research Analyst/ his Relative have any other material conflict of interest at the time of publication of the research report or at the time of public appearance? No DYANMIC/its Associates/ Research Analyst/ his Relative have received any compensation from the subject company in the past twelve months? No DYANMIC/its Associates/ Research Analyst/ his Relative have managed or co-managed public offering of securities for the subject company in the past twelve months? No DYANMIC/its Associates/ Research Analyst/ his Relative have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months? No DYANMIC/its Associates/ Research Analyst/ his Relative have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months? No DYANMIC/its Associates/ Research Analyst/ his Relative have received any compensation or other benefits from the Subject Company or third party in connection with the research report? No DYANMIC/its Associates/ Research Analyst/ his Relative have served as an officer, director or employee of the subject company? No DYANMIC/its Associates/ Research Analyst/ his Relative have been engaged in market making activity for the subject company? No General Disclaimer: - This Research Report (hereinafter called “Report”) is meant solely for use by the recipient and is not for circulation. This Report does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. The recommendations, if any, made herein are expression of views and/or opinions and should not be deemed or construed to be neither advice for the purpose of purchase or sale of any security, derivatives or any other security through Dynamic nor any solicitation or offering of any investment /trading opportunity on behalf of the issuer(s) of the respective security (ies) referred to herein. These information / opinions / views are not meant to serve as a professional investment guide for the readers. No action is solicited based upon the information provided herein. Recipients of this Report should rely on information/data arising out of their own investigations. Readers are advised to seek independent professional advice and arrive at an informed trading/investment decision before executing any trades or making any investments. This Report has been prepared on the basis of publicly available information, internally developed data and other sources believed by Dynamic to be reliable. Dynamic or its directors, employees, affiliates or representatives do not assume any responsibility for, or warrant the accuracy, completeness, adequacy and reliability of such information / opinions / views. While due care has been taken to ensure that the disclosures and opinions given are fair and reasonable, none of the directors, employees, affiliates or representatives of Dynamic shall be liable for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including loss profits arising in any way whatsoever from the information / opinions / views contained in this Report. The price and value of the investments referred to in this Report and the income from them may go down as well as up, and investors may realize losses on any investments. Past performance is not a guide for future performance. Dynamic levels do not provide tax advice to its clients, and all investors are strongly advised to consult with their tax advisers regarding taxation aspects of any potential investment. Opinions expressed are our current opinions as of the date appearing on this Research only. We do not undertake to advise you as to any change of our views expressed in this Report. User should keep this risk in mind and not hold dynamic levels, its employees and associates responsible for any losses, damages of any type whatsoever. Dynamic and its associates or employees may; (a) from time to time, have long or short positions in, and buy or sell the investments in/ security of company (ies) mentioned herein and it may not be construed as potential conflict of interest with respect to any recommendation and related information and opinions. Without limiting any of the foregoing, in no event shall Dynamic and its associates or employees or any third party involved in, or related to computing or compiling the information have any liability for any damages of any kind. We and our affiliates/associates, officers, directors, and employees, Research Analyst(including relatives) worldwide may: (a) from time to time, have long or short positions in, and buy or sell the securities thereof, of company (ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the subject company/company (ies) discussed herein or act as advisor to such company (ies) or have other potential/material conflict of interest with respect to any recommendation and related information and opinions at the time of publication of Research Report. Dynamic may have proprietary long/short position in the above mentioned scrip(s) and therefore may be considered as interested. The views provided herein are general in nature and does not consider risk appetite or investment objective of particular investor; readers are requested to take independent professional advice before investing. This should not be construed as invitation or solicitation to do business with Dynamic. Dynamic Equities Pvt. Ltd. are also engaged in Proprietary Trading apart from Client Business. https://www.dynamiclevels.com/en/disclaimer Page 18 Source: Company, www.dynamiclevels.com