BAIN SOUTHEAST ASIA PRIVATE EQUITY BRIEF

advertisement

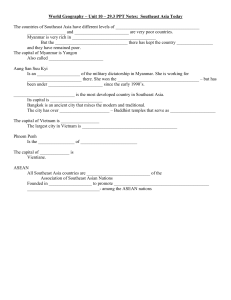

BAIN SOUTHEAST ASIA PRIVATE EQUITY BRIEF Investors remain eager to tap Southeast Asia’s potential It’s hard to conclude from the headline numbers that the market for private equity (PE) in Southeast Asia was anything but a disappointment in 2012. After several years of high expectations for a burst of investment activity in the fast-growing region, deal value fell by 16% to US$4.9 billion, the number of deals dropped to just 321 and local fund-raising slowed to a trickle (see Figure 1). Company and the Singapore Venture Capital & Private Equity Association (SVCA). Despite the decline in deal volume, there were several important developments in 2012 that should unlock more activity—including a strong increase in exit volume and moderation in return expectations among investors. Whether 2013 will be the year the break comes is difficult to predict, but given the region’s obvious potential, it seems only a matter of time. Little has changed to alter the region’s upbeat growth story. Investor enthusiasm runs high, and funds are under pressure to put unspent capital to work. Yet like much of the PE landscape globally, Southeast Asia remains in a holding pattern as firms struggle with intense competition, shaky macroeconomic conditions and region-specific challenges. What’s clear is that PE and venture capital (VC) investors are flocking to Southeast Asia for very good reasons. Spanning 10 nations from Myanmar to Singapore, the region boasts a fast-growing middle class, an abundance of resources and relatively stable, open economies that are hungry for new investment. With a combined nominal GDP of US$2.3 trillion, it is on track to rise from the world’s eighth-largest economy to fourth over the next two decades. Primed for a breakout An attractive alternative to China and India Nevertheless, we still believe Southeast Asia is primed for a breakout based on our analysis of the market’s core drivers and the results from a joint survey by Bain & Increasingly, the region’s potential is drawing investors who see it as an attractive alternative to China and India. After raising substantial capital aimed at those two coun- Figure 1: Despite high expectations, 2012 was a mixed year for private equity in Southeast Asia But a strong increase in exits returned approximately US$16 billion to investors Deals declined 16% in 2012 Southeast Asia—addressed deal market Deal value Deal count $20B 100 80 15 Southeast Asia—addressed deal market Exit value Exit count $20B 100 $16 15 60 10 $8 60 10 $8 40 $6 $6 5 $5 20 0 0 2008 80 $14 2009 2010 2011 2012 40 $6 $5 5 $4 20 0 0 2008 Notes: Exits and investments with announced deal value >$10M only, done in APAC; excludes real estate, hotels and lodging, infrastructure and large domestic transfers from SWF to government Sources: AVCJ (database extracted on February 5, 2013) 2009 2010 2011 2012 tries, general partners have failed recently to generate expected returns amid struggles to both close new deals and find exits there. Hoping to keep their allocations to Asia consistent, frustrated investors have shifted their interest southward. That has prompted PE firms to scour the Southeast Asian economies for deals, with a special emphasis on Indonesia. The result has been an explosion in competition, emboldening sellers to seek higher valuations (see Figure 2). Buoyant equity markets in Southeast Asian countries have led to soaring public asset prices. And the influx of PE firms looking for deals has collided with growing interest among cash-rich corporate buyers, creating inflated price multiples. Amid a growing mismatch in expectations between buyers and sellers—particularly in red-hot Indonesia—firms have held fire, concerned about meeting high-return targets. Pressure to do deals is increasing The situation has put PE firms under increasing pressure to make something happen. Not only have they had trouble putting new money to work, but because of sluggish exit volume from 2009 through 2011, anxious limited partners have received minimal returns of capital until very recently. The average age of PE portfolios in Southeast Asia has grown to 4.3 years in 2012 from 3.6 years in 2010, as deals over five years old have nearly tripled to almost 45% of the total. The good news is that improvement is already on the way. Exit volume escaped the doldrums in 2012, soaring to US$15.6 billion in 2012 from US$5.7 billion a year earlier.2 The substantial return of capital is a strong indicator of a viable PE cycle in Southeast Asia, which should ease anxiety. Results from the 2013 Bain/SVCA Southeast Asia Private Equity Research Survey also show that investors are slowly becoming more realistic about what they can expect from these markets. Five years ago, more than 70% of investors were demanding returns of greater than 20%, while this year two-thirds of the respondents were looking for something closer to 16% (see Figure 3). That remains a high expectation globally, but should make it easier for PE and VC investors to find viable deals. Figure 2: Pressure on PE and VC firms is building as competition for new deals increases and portfolios age Exclusive deals have almost disappeared SE Asia PE portfolio is aging Number of competitive bidders seen on deals in Southeast Asia (% of respondents) Asia Age of Southeast Asia PE current portfolio holdings by year; addressed deal value as of December 31st 100% 100% No competitive bidder $46B $50B $53B 2010 2011 2012 3.6 3.9 4.3 <1 year 80 80 60 60 1–2 years 2–3 years 1–2 competitive bidders 3–4 years 40 40 20 20 3+ competitive bidders 0 2011 >5 years 0 2012 Average age: Source: 2013 Bain/SVA Southeast Asia Private Equity Research Survey 4–5years Figure 3: PE and VC investors expect deal activity to increase and appear willing to accept lower returns Southeast Asia PE and VC market is expected to grow… …partly driven by lower return expectations Expectation on change in importance of Southeast Asia (% of respondents) Expected fund activity in 2013 versus 2012 (% respondents) IRR seen as acceptable in Southeast Asia PE market (% of respondents) 100% 100% 100% 6%–10% 11%–15% 80 16%–20% 80 No significant change 80 Less important 60 60 40 40 More important 20 20 Decline No significant change 60 Increase 10%–30% 40 Increase 31%–50% >20% 20 Increase >50% 0 0 2013 0 2013 5 years ago 2012 Source: 2013 Bain/SVA Southeast Asia Private Equity Research Survey Investor sentiment remains buoyant Most important, interest in the region continues to build. Survey respondents predict increased deal activity, and nearly two-thirds said Southeast Asia is becoming more important in their investment strategies (see Figure 3). Indonesia will likely dominate interest, but investment will broaden in Singapore, Malaysia, Thailand, the Philippines and Vietnam. A balance of growth deals and buyout or control positions will account for most of the activity, and the hottest sectors will likely be consumer, healthcare and energy, according to respondents. Exit activity, meanwhile, should stay on the upswing. Given the corporate interest in the region, we expect trade exits to continue as the most viable channel, with secondary exits likely to surge from a small base. The IPO market will undoubtedly remain volatile in the region, but three large offerings in Malaysia last year signaled significant improvement. Survey respondents expect continued headwinds, but they will vary by market (see Figure 4). Investors targeting Indonesia worry most about seller price expectations; for instance, difficulty in finding attractive companies is the biggest concern in Singapore, Thailand and Malaysia. How to rise above the crowd As we noted in last year’s report, differentiation will be the key for PE firms hoping to thrive in Southeast Asia amid heavy competition. Limited partners are increasingly evaluating general partners on their ability to consistently return capital and produce steady top-quartile results. In a crowded market, firms will need to address several crucial areas: • Find and nurture the best talent. PE firms should prioritize bolstering their own on-the-ground teams and focus on developing top-level operating management at target companies. • Focus intently on value creation. Developing a clear and viable exit strategy from day one is crucial amid finicky markets, as is working closely with management to hit growth and profitability targets. • Develop creative ways to source deals. Intense competition means firms must also increase proprietary Figure 4: The perceived challenges to closing new deals vary by country Top three constraints in getting deals done per country (% of respondents) 100% 91% 91% 87% 86% 83% 80 76% 73% 70% 64% 71% 61% 60 55% 45% 53% 44% 40 20 0 Singapore Finding attractive companies Malaysia Thailand Indonesia Vietnam Issue #1 Issue #1 Issue #1 Finding attractive companies Seller price expectations Bad corporate governance Seller price expectations Competition Bad corporate governance Uncertain economic environment 2012 responses Source: 2013 Bain/SVA Southeast Asia Private Equity Research Survey deal flow by improving research, honing sector specialization, sharpening local resources and forging co-investments with limited partners. Given the fundamentals and burgeoning interest in the region, we’re convinced PE activity in Southeast Asia will soon begin to accelerate. But in a hotly competitive environment, the spoils will not be divided evenly. As the market heats up, the winners will be the firms that find the best opportunities, build strong companies and deliver steady returns to investors. By Suvir Varma 1 Calculations for PE deal value and exit value include data from the six major Southeast Asian economies: Singapore, Indonesia, Thailand, Malaysia, Philippines and Vietnam. 2 Ibid Key contacts in Bain’s Private Equity practice in Southeast Asia: Suvir Varma (suvir.varma@bain.com) Sebastien Lamy (sebastien.lamy@bain.com) Key contacts for Singapore Venture Capital & Private Equity Association (SVCA): Jeff Chi (jeff.chi@vickersventure.com) Doris Yee (ed@svca.org.sg) For additional information, visit www.bain.com