Problem Set #6: Income Inequality & Growth II Question 1

advertisement

University of Warwick

EC9A2 Advanced Macroeconomic Analysis

Problem Set #6: Income Inequality & Growth II

Jorge F. Chavez∗

December 3, 2012

Question 1

Consider the Galor-Zeira (1993) model. The population size of each generation is normalized

to 1, where Lt is the number of unskilled workers, Et is the number of skilled workers, and

Et + Lt = 1. The return to physical capital is R, the wage rate for unskilled workers is wu , the

wage rate of skilled workers is ws , and the cost of education is h.

(i) Individuals cannot borrow in order to invest in human capital: (θ = ∞)

(a) Find the dynamical system governing the evolution of transfers within a dynasty:

bit+1 = ϕ(bit ).

i

. Assume that we − wu > Rh so

Solution. Solving the individual’s UMP we know that bit+1 = βIt+1

that investing in education is profitable. Then:

{

bit+1

i

= βIt+1

=

[

(

)]

β we + R bit − h

ifbit ≥ h

[

]

β wu + Rbit

ifbit < h

( )

≡ φ bit

(1)

(2)

(b) Define sufficient conditions on ws and wu that assure that initial wealth distribution has

an effect on output in the long run. Show in a figure the dynamical system under these

conditions.

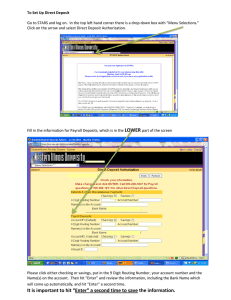

Solution. The situation we are looking for is depicted in figure 1. We need:

i. β(we − wu ) > βwu ⇔ we − wu > Rh, so that the intercept of the second piece is higher than

the intercept of the first piece of the φ(bit ) function. We had already stated this assumption.

ii. Rβ < 1 so that we make sure that both pieces will intersect the 45o degree line.

∗

e-mail:j.chavez-cotrado@warwick.ac.uk

1

EC9A2 (Fall 2012)

Problem Set # 6

iii. For a poverty trap we need the M kink in figure 1 to be below the 45o degree line. That is:

)

(

[ u

]

1

i

u

u

lim β w + Rbt = β [w + Rh] < h ⇒ w < h

−R

β

bit →h

iv. For the high-income steady state, we need the N kink in figure 1 to be above the 45o degree

line. That is , we need:

βwe > h ⇒ we >

h

β

Figure 1: Dynamic system bit+1 = φ(bit )

45o

bit+1

B

N

β (we − Rh)

M

βwu

0

A

bL

h

bH

bit

(c) Suppose now that in each period ε > 0 skilled individuals decide to leave their offspring

with no bequest: bit = 0. Under the restrictions on the parameters from part b, what will

characterize the long run income distribution in the economy?

Solution. Suppose assumptions in part (b) hold. This means that there is no social mobility (individuals from poor families cannot invest in education). Now each period there is an proportion

ϵ ∈ [0, 1] that exogenously decide to leave their offspring no bequests (bit = 0). Therefore:

Et+1 = (1 − ϵ) Et

This implies that limt→∞ Et+1 = 0. This is, in the long-run the whole population will be unskilled.

√

(d) Suppose now that wtu = A/ Lt . For a very small ϵ, find conditions on the parameters that

assure that the initial wealth distribution has an effect on the economy in the long-run.

i.e., conditions such that there are two locally stable steady states that the economy can

converge to. (Remember that the size of the working population is 1).

Solution. Recall that for the poverty trap we need wu < h(1/β − R), while for the high-income

steady state we need we > h/β. Only the first condition will be affected by the dynamics introduced

by ϵ and by the dependence of wu on Lt .

Jorge F. Chávez

2

EC9A2 (Fall 2012)

Problem Set # 6

• If Lt → 1 then wtu → A. In this case, to maintain the poverty trap we need A < h(1/β − R).

• For a Lt sufficiently small we could have

= wtu > h(1/β − R), so that the poverty trap will

(

)

disappear. Hence, there exists a cutoff L̂ such that √A = h β1 − R . Solving, we get:

√A

Lt

L̂

(

L̂ =

Aβ

we − Rh

)2

That is, as long as L0 ≥ L̂, we will have a poverty trap (provided that A < h(1/β − R)).

When L0 < L̂, there is no poverty trap and here Lt will converge to some value L̄ which implies

that the number of people that become skilled from t to t + 1 equals the number of people that

go from skilled to unskilled (because of the shock). The idea is that for a sufficiently small ϵ,

the condition that must guarantee this steady state is:

we − wu (L̄) = Rh

A

we − √

= Rh

L̄

Because otherwise, a fraction higher than ϵ will become skilled and the steady-state condition

will be violated. Then:

(

)2

A

L̄ =

we − Rh

(e) For each of the two steady states in part d, find (neglect ε in your calculations):

Solution.

Under the restrictions on A and we the economy could converge to two steady states: if L0 ≤ L̂ it

will converge to L̄ if L0 > L̂ it will converge to L = 1. Then:

If L0 ≤ L̂

If L0 > L̂

L:

1

L̄

wu :

A

we − Rh

b:

βA

1−βR

β(we −Rh)

1−βR

(ii) There is a perfect loan market: The young can lend and borrow from each other,

repaying when old, and the equilibrium interest rate between period t and t + 1, is rt+1 . Hint:

the equilibrium interest rate that clears the loan market can not be less then R − 1. (In this part

wtu = wu and ε = 0).

(f) Find the dynamical system governing the evolution of output, Yt , over time, where Yt =

we Et + wu Ut + RKt :

Yt+1 = ψ(Yt ).

Present ψ(Yt ) in a figure. (Note that you should distinguish between two ranges of Yt :

βYt < h, and βYt ≥ h).

Jorge F. Chávez

3

EC9A2 (Fall 2012)

Problem Set # 6

Solution. We need to distinguish between two cases:

• Case 1: βYt < h

In this case, the economy as a whole will no have enough resources to finance education to every

individual. Because we are working under the assumption of perfect markets, there will be no

investing in physical capital and so K = 01 . For this we need 1 + rt+1 > R, otherwise some

individuals willing to borrow money to invest in human capital will be left aside. In equilibrium

a fraction βYt /h will invest in human capital while the rest 1 − βYt /h will remain unskilled:

(

)

(

)

βYt

βYt

Yt+1 = wu 1 −

+ ws

h

h

Appendix A1 derives this result from first principles.

• Case 2: βYt ≥ h

In this case, the economy as a whole is capable of financing everyone’s need of credit for investing

in human capital and what is more, there is room for a surplus of (aggregate) bequests, which

means that there is room for investing in physical capital. The fact that all individuals are now

skilled (because they are not credit constrained) implies that:

Yt+1 = ws + R (βYt − h)

Once again, this outcome can also be derived from first principles. See Appendix A2.

In sum:

Yt+1

(

)

(

)

wu 1 − βYt + ws βYt

h

h

=

s

w + R (βY − h)

t

ifβYt < h

ifβYt ≥ h

(g) What is the interest rate for loans between period t and t + 1, rt+1 , for βYt < h and for

βYt > h?

Solution. If βYt < h we need to impose conditions that assure that individuals will find it more

attractive to invest in human capital for individuals to be indifferent between investing in human

capital and lending their surplus to others. Also, to make sure that there is no one invests in physical

capital, the return R must be lower than 1 + rt+1 , otherwise there markets will not clear as some

individuals will prefer to invest in K than to lend to other individuals who demand loans to finance

their education. That is:

(1 + rt+1 ) h = ws − wu > Rh

Finally, if βYt ≥ h then we will need (1 + rt+1 ) = R, otherwise individuals will not invest in physical

capital (if (1 + rt+1 ) > R and loan markets will not clear if (1 + rt+1 ) < R.

1

This means that we need to assume a production function in which capital is not essential for production.

Jorge F. Chávez

4

EC9A2 (Fall 2012)

Problem Set # 6

Question 2

Consider the Maoz-Moav 1999 model, with the following production function:

Yt = we Et + wu Lt

The cost of education, hi , is uniformly distributed in the unit interval. Assume that β(we −wu ) <

1 (this assumption assures that ĥi < 1, i = u, e)

(a) Find the dynamical system governing the evolution of Et , Et+1 = ϕ(Et ). What is the steady

state level of Et ?

Solution. Solving the UMP problem and taking into account the discrete nature of the investment

decision in education, we can find a cutoff level of hit , such that individuals will be indifferent between

investing or not in education:

[ e

u ]

wt+1 − wt+1

ĥit = bit

e

wt+1

s

u

= ws . Also recall that homoethetic preferences imply thtat bit+1 =

= wu and wt+1

Here wt+1

i

i

βIt+1 = βwt+1 . [Hence, ]an individual from an educated family will invest in education if and only if

hit ≤ ĥe = βwe

we −wu

we

capital if and only if

Et+1

hit

. Similarly, an individual from an uneducated family will invest in human

[ e u]

w −w

. Note that both cutoffs are the same for all individuals.

≤ ĥu = βwu

we

( )

( )

= Et F ĥe + Lt F ĥu

(

)

(

)

= Et Pr hit ≤ ĥe + (1 − Et ) Pr hit ≤ ĥu

Given uniform distribution:

[ e

]

[ e

]

u

u

e w −w

u w −w

Et+1 = Et βw

+ (1 − Et ) βw

we

we

[(

)

]

[

]

wu

wu

e

u

u

= Et β 1 − e (w − w ) +βw 1 − e

w

w

|

{z

}

| {z }

A

B

Hence in steady state:

Ē =

B

1−A

(b) How is the slope and the intercept of the dynamical system, ϕ′ (Et ) and ϕ(0), affected by a

decline in wu ? (assume 2wu < we ). Explain the different economic effects of wu on investment

decisions. hint: think of the effect of changes in wu on ϕ(1).

Solution. Recall:

Jorge F. Chávez

5

EC9A2 (Fall 2012)

Problem Set # 6

Effect on the slope:

2β

∂A

= e (we − wu ) (−1) < 0

∂wu

w

Effect on the intercept:

]

[

∂B

2wu

=

β

1

−

> 0Because 2wu < we

∂wu

we

Now, regarding the effect of an increase in wu on investment decisions, we can see how such

change affects the cutoffs for educated and for uneducated individuals. It is easy to see that

∂ ĥe

∂wu < 0 (this is a substitution effect: now the option of becoming unskilled is relatively

u

∂ ĥ

more attractive), and because of the assumption that 2wu < we , ∂w

u > 0 (this is an income

effect: income for unskilled is increased and therefore more people will be able to afford the

cost of education).

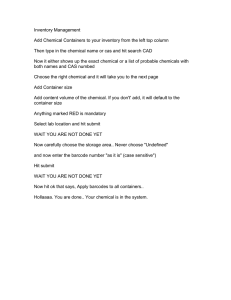

That is, the gap between the cutoffs is reduced with an increase in wu as shown in figure 2.

To see which effect dominates, we can follow the hint and see the effect on ϕ(1) = β(we −wu )

(that is, the number of educated people tomorrow when everyone is educated today. It is

easy to see that ∂ϕ(1)

∂wu = −β < 0, which suggest that the substitution effect dominates.

Figure 2: The gap effect of wu ↑

Gap 2

Gap 1

0

ĥu1

ĥu2

ĥe2

ĥe1

As wu ↑ these area additional

As wu ↑ these area additional

indiv. from uneducated families

indiv. from educated families

that are able to invest in

education

that will stop investing in

education

1

(c) Suppose that a perfect loan market is introduced into the economy. Individuals can borrow

from other young individuals in order to finance their education. Denote Ē as the steady

state education level. What are the values of ĥu and ĥe ? What is the equilibrium interest

rate as a function of Ē and wages?

Solution. Allowing for borrowing, the individual’s UMP is now:

{

}

max

log cit + (1 − β) log cit+1 + β log bit+1

{cit ,cit+1 ,bit+1 ,Bti }

s.t.

cit + δ i hit ≤ bit + Bti

i

cit+1 + bit+1 ≤ wt+1

− Rt+1 Bti

cit , cit+1 , bit+1 ≥ 0

Bti ≥ −H

Jorge F. Chávez

6

EC9A2 (Fall 2012)

Problem Set # 6

where Bti is the borrowing (Bti < 0) or lending (Bti > 0) decision and H is an (for now) exogenous

borrowing limit.2

As usual we can solve the problem backwards. At time t + 1 solves, given an optimal choice for time

t decision variables:

{

( i )

( i

)

}

i

i

v wt+1

≡

max

(1

−

β)

log

w

−

R

t+1 Bt − bt+1 + β log bt+1

t+1

i

i

i

0≤bt+1 ≤wt+1 −Rt+1 Bt

Solving for interior solution3 :

[ i

]

− Rt+1 Bti

bit+1 = β wt+1

Hence:

( i )

v wt+1

( i

[ i

])

( [ i

])

= (1 − β) log wt+1

− Rt+1 Bt − β wt+1

− Rt+1 Bti + β log β wt+1

− Rt+1 Bti

)

( i

= log wt+1

− Rt+1 Bti + M

where M = (1 + β) log(1 + β) + β log(β) is a constant term.

First period:

max

{

Bti ∈[−H,+∞)

)

( i )}

(

log bit + Bti − δ i hit + v wt+1

Solving for interior solution4 :

[

]

i

− Rt+1 bit − δ i hit

wt+1

i

Bt =

2Rt+1

i

∈ {we , wu }:

Now we use wt+1

Bte

=

Btu

=

[

]

we − Rt+1 bit − hit

2Rt+1

wu − Rt+1 bit

2Rt+1

Individuals will choose to invest in human capital if and only if:

(

)

(

)

log bit + Bte − 1 × hit + log (we − Rt+1 Bte ) > log bit + Btu − 0 × hit + log (wu − Rt+1 Btu ) (3)

After some algebra (see Appendix A3), condition (3) becomes:

(

(

))

(

)

(

)

log we + Rt+1 bit − hit > log wu + Rt+1 bit

⇔ we + Rt+1 bit − hit > wu + Rt+1 bit (4)

Hence, there exists a cutoff level ĥit such that the individual will invest in education if an only if

2

3

4

This is to prevent Ponzi games. The idea is that the agent can borrow only up to his ability to repay. Perhaps

next period you will be dealing with such constraint. Now is a mere formality here.

Is easy to see that this is the only plausible solution

Here we have only 1 corner. I think the way to rule out the corner would be to show that hitting it (borrowing

−H would imply no consumption.

Jorge F. Chávez

7

EC9A2 (Fall 2012)

Problem Set # 6

hit < ĥit . We can get ĥit from:

(

)

we + Rt+1 bit − ĥit = wu + Rt+1 bit

Then:

ĥit =

we − wu

= ĥe = ĥu

Rt+1

Then the law of motion of Et+1 is:

Et+1 = Et ĥt + (1 − Et ) ĥt = ĥt

Finally, in steady-state:

Ē =¯

ˆh =

we − wu

R̄

⇒

R̄ =

we − wu

Ē

(d) Discuss the efficiency implications of the market for loans.

Solution. The introduction of a “perfect loan market” implies that the cutoff for investing in education is now independent of the individual’s dynastic origin (i.e. their parent’s level of education and

therefore their level of bequest). The individual’s investment decision is now a function of only its

idiosyncratic realization of the cost of education hit . This implies that more individuals are allowed

to acquire education and become skilled, relative to the case in which there were two cutoffs.

The efficiency gain comes from the fact that, by introducing a single cutoff, perfect loan markets

imply that now some “rich” individuals with relatively high educational cost—who before would have

invested in education in the case with no perfect loans market—decide not to invest in human capital

and lend their bequests instead to individuals that are unable to finance the cost of education. That

is there is a reallocation of resources towards a more efficient usage.

(e) Find the dynamical system governing the evolution of Et for the model with a market

for loans. (you may assume, for sake of simplifying your analysis, that individuals do not

consume in their first period, i.e., ut = (1 − β) log ct+1 + β log bt+1 ).

Solution. If consumption when young ctt does not enter the utility function, and assuming homothetic

i

preferences, individuals will bequeath a constant share of their income: bit+1 = βIt+1

. Then, the

aggregate amount the economy invests in education is at time t is the sum of all bequests in the

economy:

∫ 1

∫ 1

i

Iti = BYt

βIt = β

0

0

On the other hand, the aggregate cost of investment will be the sum of all costs effectively paid by

individuals who invest in education, that is by individuals with hit < ĥt which in equilibrium must

be equal to BYt :

∫

ĥt

BYt =

0

Jorge F. Chávez

ĥ

( )

1 ( )2 t

1 ( )2

ĥt

hit f hit di = hit =

2

2

0

8

EC9A2 (Fall 2012)

Problem Set # 6

Then, using ĥt = Et+1 and Yt = we Et + wu (1 − Et ) we get:

2βYt = (Et+1 )

2

⇔

1/2

Et+1 = 2β[we Et + wu (1 − Et )]

Finally because Et+1 cannot be greater than 1:

{

}

1/2

Et+1 = min 1, 2β[we Et + wu (1 − Et )]

Jorge F. Chávez

9

EC9A2 (Fall 2012)

Problem Set # 6

Question 3

Consider an overlapping generations economy in which individuals consume and may invest in

education in the first period of their lives. They work and consume in the second period. The

population size of each generation is 1. Individuals receive in their first period a transfer from

the government bt which they use for consumption and investment in education. The transfer to

the young is financed by an income tax on the working population (individuals in their second

life period). The tax rate is τ.

Production is given by:

Yt = we Et + wu Ut

where we > wu , Et is the number of skilled workers in period t, and Ut = 1 − Et is the number

of unskilled workers in t. Therefore

bt = τ Yt

Individuals’ preferences are represented by the utility function,

u = log cy + log co

where cy is consumption when young (first period) and co is consumption when old (second

period).

To become a skilled worker an individual has to purchase education when young. The cost of

education of individual i, hi is indivisible. The cost of education in the population is uniformly

distributed in the unit interval.

There is no capital market in the economy. Individuals can not borrow or lend. It is also

impossible to store goods from one period to the next.

(a) Find the dynamical system governing the evolution of Et . (Note that your dynamical system

should reflect the fact that Et ≤ 1 for all t ).

Solution. The UMP is:

{

}

i,t

max

log ci,t

t + log ct+1

2

{ctt ,ctt+1 }∈R+

s.t.

i i,t

ci,t

t + δ ht ≤ bt

i,t

i,t

ct+1 ≤ (1 − τ ) It+1

Note that because population is normalized to 1, all individuals receive the same level of transfers bt

and:

∫ 1

bt di = bt = βYt

0

The UMP can be rewritten as discrete variable optimization problem:

{ (

)

(

)}

i,t

i i,t

max

log

b

−

δ

h

+

log

[1

−

τ

]

I

t

t

t+1

i

δ ∈{0,1}

Jorge F. Chávez

10

EC9A2 (Fall 2012)

Problem Set # 6

We then need to compare the level of utility that the individual with realization of education cost

hit would ge if she invests in education with the level of utility if she does not invest:

(

)

log bt − hi,t

+ log ([1 − τ ] we ) > log (bt ) + log ([1 − τ ] wu )

t

)

(

> wu bt . Hence, the individual will invest in

It is easy to see that this reduces to we bt − hi,t

t

education if and only if it gets hit below a cutoff value ĥt :

[ e

]

w − wu

hi,t

<

b

≡ ĥt

t

t

we

Then, using the assumption that hit is distributed uniform with support [0, 1]:

Et+1 = ĥt Et + ĥt (1 − Et ) = ĥt

which implies:

[

Et+1

= τ Yt

we − wu

we

]

(5)

[

= τ (we Et + wu (1 − Et ))

we − wu

we

]

(6)

where I am using the fact that bt = βYt : and Yt = we Et + wu (1 − Et )

Finally, after some rearrangements:

[

]

2

wu e

τ (we − wu )

Et+1 =

E

+

τ

(w − wu ) ≡ φ(Et )

t

we

we

(b) Find a sufficient condition on τ that assures that Et < 1 for all t.

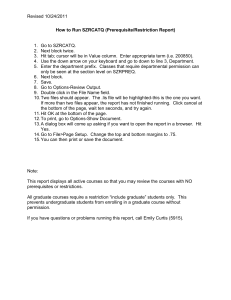

Solution. Note that the slope and intercept of the linear function φ(Et ) are both positive. To ensure

that we always keep Et ≤ 1 we need to make sure that φ(1) ≤ 1. Note that having a slope less that

1 is not sufficient for Et ≤ 1 as is illustrated by the red phase curve in figure 3 (for Et close to 1, we

see that Et+1 > 1). Then we need:

[

2

τ (we − wu )

we

]

<1 ⇔

ϕ (1) = τ (we − wu ) < 1 ⇔

τ<

we

2

(we − wu )

1

τ<

e

(w − wu )

(c) Suppose now that there exists a perfect loan market. (The young can lend and borrow from

each other, repaying when old, and the equilibrium interest rate between period t and t + 1,

Rt+1 , assures that the demand for loans is equal to the supply.). Find Rt+1 as a function of

we , wu , τ and Et+1.

Jorge F. Chávez

11

EC9A2 (Fall 2012)

Problem Set # 6

Figure 3: Dynamic system Et+1 = φ(Et )

45o

Et+1

1.2

1.0

0.8

0.6

0.4

τ

wu

we

A

e

(w − wu )

0.2

0

0.2

0.4

0.6

0.8

1.0

1.2

1.4 Et

Solution. The problem is now:

{

}

max

log ci,t

+ log ci,t

t

t+1

2

{ctt ,ctt+1 ,Bti,t }∈R+

s.t.

i i

i

ci,t

t + δ ht ≤ bt + Bt

i,t

i

ci,t

t+1 + Rt+1 Bt ≤ (1 − τ ) It+1

cit , cit+1 ≥ 0

Bti ≥ −H

We can put everything in terms of the borrowing decision Bti,t and to solve the problem taking as

given the investment in education decision:

{ (

)

(

)}

i,t

i,t

i,t

i i

max

log

b

+

B

−

δ

h

+

log

(1

−

τ

)

I

−

R

B

t

t+1 t

t

t

t+1

i,t

i,t

0≤Bt ≤bt −δ i ht

Solving for interior solution we find:

(

)

i,t

bt − δ i hit Rt+1 − It+1

(1 − τ )

i,t

Bt =

2Rt+1

As usual the individual decides whether to invest in education if and only if:

(

)

(

)

i,t

i,t

i,t

i

log bt + Bt,δ

+ log (1 − τ ) It+1

− Rt+1 Bt,δ

i =1 − ht

i =1

(

)

(

)

i,t

i,t

i,t

i

> log bt + Bt,δ

+ log (1 − τ ) It+1

− Rt+1 Bt,δ

i =0 − ht

i =0

Jorge F. Chávez

12

EC9A2 (Fall 2012)

Problem Set # 6

where:

i,t

Bt,δ

i =1

=

i,t

Bt,δ

i =0

=

(

)

bt − hit Rt+1 − we (1 − τ )

2Rt+1

bt Rt+1 − wu (1 − τ )

2Rt+1

This can be solved in exactly the same fashion as in question 2, part (c) (see appendix). The end

result is the cutoff ĥt :

hit <

(we − wu ) (1 − τ )

≡ ĥt

Rt+1

Finally, because ĥt = Et+1 :

(we − wu ) (1 − τ )

Et+1

Rt+1 =

(7)

(d) Find the dynamical system governing the evolution of Et under the assumption that a perfect

loan market exists, and there is no consumption in the first life period.

Solution. If there is no consumption in the first period, then all tax revenues will be allocated to

finance the accumulation of human capital (supply of funds). As in question 2, part (c), this amount

must equal the demand for investment:

∫

ĥt

τ Yt =

0

ĥ

( )

1 ( )2 t

1

1 ( )2

2

hit f hit di = hit =

ĥt = (Et+1 )

2

2

2

0

Then, using Yt = we Et + wu (1 − Et ):

2

(Et+1 ) = 2τ [we Et + wu (1 − Et )]

which implies:

Et+1 = (2τ [we Et + wu (1 − Et )])

1/2

Once again, Et+1 cannot be greater than 1, so:

{

}

1/2

Et+1 = min 1, (2τ [we Et + wu (1 − Et )])

Finally, plugging the above condition into (7), the expression we wanted to find is:

Rt+1 =

(we − wu ) (1 − τ )

1/2

(2τ [we Et + wu (1 − Et )])

(e) Explain why a negative effect of the tax on the incentive to purchase education does not

appear in both of the dynamical systems (with and without loans).

Jorge F. Chávez

13

EC9A2 (Fall 2012)

Problem Set # 6

Solution. Without loans the dynamical system is:

[

]

2

τ (we − wu )

wu

Et+1 =

Et + τ e (we − wu ) ≡ φ(Et )

e

w

w

While with loans, the dynamical system is:

{

}

1/2

Et+1 = min 1, (2τ [we Et + wu (1 − Et )])

Jorge F. Chávez

14

EC9A2 (Fall 2012)

Problem Set # 6

Appendix

A1 Aggregation when βYt < h

i , thus:

UMP implies that bit+1 = βIt+1

bit+1

[

]

β wu + (1 + rt+1 ) bit

bit < b̂

[ s

(

)] i [ )

i

=

β

w

−

(1

+

r

)

h

−

b

bt ∈ b̂, h

t+1

t

[

(

)]

β ws + (1 + rt+1 ) bit − h

bit ≥ h

≡ φ(bit )

Because population is normalized to 1, we can assume that there is a continuum of individuals

along the [0, 1] range, with mass equal 1. Furthermore, we can assume

[ )that in principle there

i

i

is a measure N1 of individuals with bt < b̂, a measure N2 with bt ∈ b̂, h and a measure N3 of

rich individuals, with bit ≥ h. Note that:

∫

∫

1

1

i

βIt+1

di

bit+1 di =

0

0

[∫

∫

i

It+1

di

= β

+

i∈N1

]

∫

i

It+1

di

i

It+1

di

+

i∈N2

i∈N3

= βYt+1

Then:

∫

[

βYt+1 =

u

β w + (1 +

rt+1 ) bit

]

∫

i∈N1

∫

[

(

)]

β ws − (1 + rt+1 ) h − bit

di +

i∈N2

[

(

)]

β ws + (1 + rt+1 ) bit − h

+

i∈N3

[

=

]

∫

u

bit di

w N1 + (1 + rt+1 )

[

]

∫

+ w N2 − (1 + rt+1 ) hN2 + (1 + rt+1 )

s

i∈N1

bit di

i∈N2

[

]

∫

+ w N3 − (1 + rt+1 ) hN3 + (1 + rt+1 )

s

bit di

i∈N3

{∫

3

∑

u

s

= w N1 + w (N2 + N3 ) + (1 + rt+1 )

j=1

Jorge F. Chávez

}

bit di

− (N2 + N3 ) h

i∈Nj

15

EC9A2 (Fall 2012)

Problem Set # 6

where the term in brackets in the last equality will be zero as loan markets clear:

∫

∫

∫

i

i

βIt di +

βIt di +

βIti di − (N2 + N3 ) h = 0

i∈N1

i∈N2

i∈N3

where I am using the fact that bit = βIti . Finally:

[∫

]

∫

∫

i

i

i

β

It di +

It di +

It di − (N2 + N3 ) h = βYt − (1 − N1 ) h = 0

i∈N1

i∈N2

i∈N3

where I am using N1 = 1 − N2 − N3 . Then 1 − N1 =

(

)

(

)

βYt

u

s βYt

Yt+1 = w 1 −

+w

h

h

βYt

h

and finally,

A2 Aggregation when βYt ≥ h

In this case, all individuals will bequeath following the third piece of the φ(bit ) function. Hence,

aggregating:

∫ 1

∫ 1

[

(

)]

i

β

It+1 di =

β ws + (1 + rt+1 ) bit − h di

0

0

Using the fact that

∫1

0

adi = a

(∫

s

∫1

0

)

1

bit di

Yt+1 = w + R

di = a × 1 = a for some constant a ∈ R

−h

0

= ws + R (βYt − h)

A3 Derivation for condition 4 in question 2, part (c)

We had:

(

)

(

)

log bit + Bte − 1 × hit + log (we − Rt+1 Bte ) > log bit + Btu − 0 × hit + log (wu − Rt+1 Btu )

Replacing Bte and Btu :

Bte

=

Btu =

Jorge F. Chávez

]

[

we − Rt+1 bit − hit

2Rt+1

wu − Rt+1 bit

2Rt+1

16

EC9A2 (Fall 2012)

Problem Set # 6

(

)

(

[

])

we −Rt+1 [bit −hit ]

we −Rt+1 [bit −hit ]

i

i

e

log bt +

− ht + log w − Rt+1

2Rt+1

2Rt+1

(

)

(

[ u

])

u −R

i

i

w

b

w

−R

b

t+1 t

t+1 t

+ log wu − Rt+1

> log bit + 2Rt+1

2Rt+1

Rearranging a little bit we get:

(

log

(

(

))

(

))

( u

)

( u

)

we + Rt+1 bit − hit

we + Rt+1 bit − hit

w + Rt+1 bit

w + Rt+1 bit

+log

> log

+log

2Rt+1

2

2Rt+1

2

(8)

Note that we can play a little bit with the properties of logarithms to get:

(

log

)

(

(

)

(

))

we + Rt+1 bit − hit

we + Rt+1 bit − hit

Rt+1

= log

+ log Rt+1

2Rt+1

2Rt+1

)

( u

( u

)

w + Rt+1 bit

w + Rt+1 bit

= log

log

Rt+1

+ log Rt+1

2Rt+1

2Rt+1

which are the last term of the LHS and the last term of the RHS of inequality (8). Then we end

up having the following condition:

[

)

([

( i

) ]2

]

i

e

u+R

i 2

w + Rt+1 bt − ht

w

b

t+!

t

log

Rt+1

Rt+1 > log

2Rt+1

2Rt+1

Jorge F. Chávez

17