Handout Machinery rental problem Jorge F. Chavez April 28, 2012

advertisement

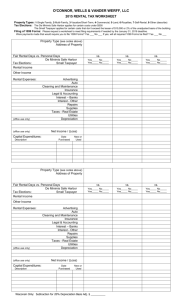

Handout Machinery rental problem∗ Jorge F. Chavez April 28, 2012 A machinery rental firm is contemplating the purchase of an earth mover. Earth movers are available at £150, 000 each. Annual nominal depreciation on the earth mover is 20%. The annual nominal interest rate is 5%. Annual inflation, which raise the prices of all goods uniformly, is 3%. (a) Assume that the project will last only one period. What is the rental price that would make the rental firms purchase of the earth mover profitable? Explain your reasoning. Answer. The firm buys the machine at the beginning of the period and to rent it, it will take into account all costs associated with the project, which here are assumed to be only the opportunity cost, the machine’s value depreciation, and the capital loss/gain that comes as a consequence of inflation: Depreciation Opp. cost Capital loss → → → 0.20 × £150, 000 = 30, 000 0.05 × £150, 000 = 7, 500 −0.03 × £150, 000 = −4, 500 At the end of the period, the firm liquidates the project and obtains the machine’s replacement value. The way the firm will get normal profits is by charging a price of £30, 000 + £7, 500 − £4, 500 = £33, 000. In this setting whether the investor decides to effectively re-invest part of the proceedings from renting the machine to restore the machine’s original value before liquidating the project (i.e. before selling it) is irrelevant. If it does, then at the end of the singleperiod the firm will recover the machine’s original value (£150, 000) in which case it will also recover its reinvestment. Otherwise, it will only recover 80% of the original value (£120, 000). The important thing is that the depreciation cost is taken into account at the time of identifying all costs associated with the project for the pricing decision. (b) Suppose the government imposes a 12% sales tax on the rental firm. How does this affect your answer to (a)? How would your answer differ in the case of a 12% profits ∗ Problem 7.2 in Coursework 2011/2012 1 tax? Explain your reasoning. Answer. Under the assumptions used for part (a), in the case of a sales tax, the firm will have to charge a higher rental price as it is the after-tax price the one that should be taken into account. In this case, the firm needs to cover costs for £33, 000 to break-even so the rental price it must charge per machine rented should be higher. The new rental price is then: (1 − 0.12)P = 33, 000 P = 37, 500 If instead we apply a tax on profits, then the break-even per-unit rental price of £33, 000 that we found in part (a) would be unchanged because at that point profits are exactly zero and therefore there will be no tax burden. The tax will only affect additional positive profits. (c) Now suppose that the project will have an infinite horizon (i.e. the firm will rent the machinery for ever). Consider a rental firm that has 10 new earth movers and no other assets or costs. Suppose it can charge a rental price of £40, 000 (after tax) for each machine, and expects this market rate to persist indefinitely, also rising with the rate of inflation. Suggest a figure for the market value of this firm. Answer. For this part assume that the firm effectively must re-invest part of its proceedings in order to restore the beginning-of-period value of each machine. The sequence of events is as follows: • At the beginning of year t, the firm rents a machine which is valued V and charges a rental price P . • At the end of the year (suppose on the 30th of December), the rented machine is returned to the firm. At this point depreciation has already taken effect and therefore the value of the machine is now 80% of V . The firm then needs to reinvest an amount equal to 0.20V (assume that this reinvestment is necessary to replace worn parts and to clean the machine so that it is left as “brand new”). • In the last day of the year (the 31st of December), the value of the machine is adjusted (along with all other prices in the economy) for inflation. That means that the value of the machine for period t + 1 is (1 + π)V . Note that the fact that the value of the machine is restored every end-of-period to account for depreciation and is adjusted for inflation implies that the per unit breakeven price will also change each period. The value we found in part (a) of £33, 000 is valid only for the first period. Then, using the nominal interest rate to discount future flows1 , the firm’s net present 1 Recall that the exact version of the Fischer equation is (1 + it ) = (1 + rt )(1 + πte ) (the approximate version is it ≈ rt + πte ). 2 Table 1: Summary of calculations Time t=0 (invest) Machine Value 150 t=1 150(1 + π) Op. Op. t=2 150(1 + π)2 Op. t=3 150(1 + π)3 Op. .. . .. . Costs Depreciation: 0.20(150) Cost + K loss: 0.02(150) Total: 33 Depreciation: 0.20(150(1 + π)) Cost + K loss: 0.02(150(1 + π)) Total: 33(1 + π) Depreciation: 0.20(150(1 + π)2 ) Cost + K loss: 0.02(150(1 + π)2 ) Total: 33(1 + π)2 Depreciation: 0.20(150(1 + π)3 ) Cost + K loss: 0.02(150(1 + π)3 ) Total: 33(1 + π)3 .. .. . . Revenues 40 Net flow 7 40(1 + π) 7(1 + π) 40(1 + π)2 7(1 + π)2 40(1 + π)3 7(1 + π)3 .. . .. . value for the ten machines is (in thousands of pounds): NPV 70 (1 + π) 70(1 + π)2 70(1 + π)3 + + + ... (1 + r) (1 + π) (1 + r)2 (1 + π)2 (1 + r)3 (1 + π)3 ( ) 1 1 1 = −1, 500 + 70 + 70 + + + ... 1 + r (1 + r)2 (1 + r)3 70 = −1, 500 + 70 + r = 2070 = −1, 500 + 70 + Table 1 summarizes all relevant calculations. (d) Calculate a Tobin’s Q coefficient for the firm in part (c). Answer. Tobin’s Q is defined as market value divided by replacement value of the firm’s capital. In this case the replacement value (at time 0) of the ten machines bought by the rental firm is 10 × £150, 000 = £1.5million. The firm’s market value equals its net present value. Therefore Q = 2.07/1.5 > 1 which signals that the firm should acquire more capital. 3