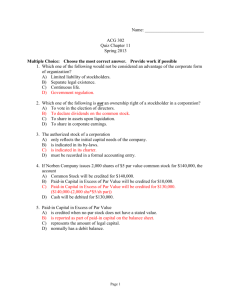

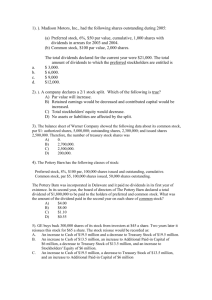

13 Corporations: Organization, Stock Transactions, and

advertisement

1 Click to edit Master title style 13 Corporations: Organization, Stock Transactions, and Dividends 1 2 Click to edit Master title style After studying this chapter, you should be able to: 1. Describe the nature of the corporate form of organization. 2. Describe the two main sources of stockholders’ equity. 3. Describe and illustrate the characteristics of stock, classes of stock, and entries for issuing stock. 2 3 Click to edit Master title style After studying this chapter, you should be able to: 4. Journalize the entries for cash dividends and stock dividends. 5. Journalize the entries for treasury stock transactions. 6. Describe and illustrate the reporting of stockholders’ equity. 7. Describe the effect of stock splits on corporate financial statements. 3 4 Click to edit Master title style Objective 1 13-1 Describe the nature of the corporate form of organization. 4 5 Characteristics of a Corporation Click to edit Master title style 13-1 A corporation is a legal entity, distinct and separate from the individuals who create and operate it. As a legal entity, a corporation may acquire, own, and dispose of property in its own name. 5 6 Click to edit Master title style 13-1 The stockholders or shareholders who own the stock own the corporation. Corporations whose shares of stock are traded in public markets are called public corporations. 6 7 Click to edit Master title style 13-1 Corporations whose shares are not traded publicly are usually owned by a small group of investors and are called nonpublic or private corporations. The stockholders of all corporation have limited liability. 7 8 Click to edit Master title style 13-1 The stockholders control a corporation by electing a board of directors and board of Commissioners. The board meets periodically to establish corporate policy. It also selects the chief executive officer (CEO) and other major officers. 8 9 Click to edit Master title style Organizational Structure of a Corporation in Indonesia 13-1 Stockholders Board of Directors Board of Commissioners Officers Employees 9 10 Advantages of the Corporate Form Click to edit Master title style 13-1 A corporation exists separately from its owners. A corporation’s life is separate from its owners; therefore, it exists indefinitely. The corporate form is suited for raising large amounts of money from stockholders. (Continued) 10 11 Advantages of the Corporate Form Click to edit Master title style 13-1 A corporation sells shares of ownership, called stock. Stockholders can transfer their shares of stock to other stockholders. A corporation’s creditors usually may not go beyond the assets of the corporation to satisfy their claims. (Concluded) 11 12 Disadvantages of the Corporate Form Click to edit Master title style Stockholders control management through a board of directors (in Indonesia, troughs a board of commissioners). As a separate legal entity, the corporation is subject to taxation. Thus, net income distributed as dividends will be taxed at both the corporate and individual levels. Corporations must satisfy many regulatory requirements. 13-1 12 13 Forming a Corporation In Indonesia Click to edit Master title style 13-1 • First step, the founders need to check if their proposed name of the company has not been used by other. • Second step, All founders need to sign the Deed of Establishment before a public notary. • Third step, the public notary then will file application of establishment with the Minister of Law and Human Rights. This process can be done on-line, but only public notary have access to the web site. • Fourth step, such establishment and ratification will then be published in the Supplement to State Gazette of the Republic of Indonesia. 13 14 Examples of Corporations and Their States of Incorporation Click to edit Master title style 13-1 14 14 15 Organization Structure of a Corporation Click to edit Master title style 13-1 Costs may be incurred in organizing a corporation. The recording of a corporation’s organizing costs of Rp8,500,000 on January 5 is shown below: Jan. 5 Organizational Expense Cash 8 500 000 8 500 000 Paid costs of organizing the corporation. 15 15 16 Click to edit Master title style Objective 2 13-2 Describe the two main sources of stockholders’ equity. 16 17 Click to edit Master title style 13-2 The owner’s equity in a corporation is called stockholders’ equity, shareholders’ equity, shareholders’ investment, or capital. 17 18 Stockholders’ Equity Click to edit Master title style 13-2 The two sources of capital found in the Stockholders’ Equity section of a balance sheet are paid-in capital or contributed capital (capital contributed to the corporation by stockholders and others) and retained earnings (net income retained in the business). 18 19 Stockholders’ Equity Section of a Corporate Balance Sheet Click to edit Master title style 13-2 Stockholders’ Equity Paid-in capital: Common stock Rp330,000,000 Retained earnings 80,000,000 Total stockholders’ equity Rp410,000,000 If there is only one class of stock, the account is entitled Common Stock or Capital Stock. 19 19 20 Click to edit Master title style 13-2 A debit balance in Retained Earnings is called a deficit. Such a balance results from accumulated net losses. 20 21 Click to edit Master title style Objective 3 13-3 Describe and illustrate the characteristics of stock, classes of stock, and entries for issuing stock. 21 22 Characteristics of Stock Click to edit Master title style 13-3 The number of shares of stock that a corporation is authorized to issue is stated in the charter. A corporation may reacquire some of the stock that has been issued. The stock remaining in the hands of stockholders is then called outstanding stock. 22 23 Click to edit Master title style 13-3 Shares of stock are often assigned a monetary amount, called par. Corporations may issue stock certificates to stockholders to document their ownership. Some corporations have stopped issuing stock certificates except on special request. 23 24 Click to edit Master title style 13-3 Stock issued without a par is called no-par stock. Some states require the board of directors to assign a stated value to no-par stock. Some state laws require that corporations maintain a minimum stockholder contribution, called legal capital, to protect creditors. 24 25 Number of Shares Authorized, Issued, and Outstanding Click to edit Master title style 13-3 Outstanding Issued Outstanding Authorized Issued 25 25 26 Major Rights That Accompany Ownership of a Share of Stock Click to edit Master title style 13-3 1. The right to vote in matters concerning the corporation. 2. The right to share in distributions of earnings. 3. The right to share in assets on liquidation. 26 27 Two Primary Classes of Paid-In Capital Click to edit Master title style 13-3 The two primary classes of paid-in capital are common stock and preferred stock. The primary attractiveness of preferred stocks is that they are preferred over common as to dividends. 27 28 Click to edit Master title style 13-3 A corporation has 1,000 shares of Rp4,000 preferred stock and 4,000 shares of common stock outstanding. The net income, amount of earnings retained, and the amount of earnings distributed are as follows: 2006 Net income Amount retained Amount distributed Rp22,000,000 2007 2008 Rp20,000,000 Rp9,000,000 Rp62,000,000 10,000,000 6,000,000 40,000,000 Rp10,000,000 Rp3,000,000 28 28 29 Dividends to Common and Preferred Stock Click to edit Master title style Amount distributed Preferred dividen (1,000 shares) Common dividend (4,000 shares) Dividends per share: Preferred stock Common stock 2006 Rp10,000,000 4,000,000 6,000,000 2007 Rp3,000,000 3,000,000 0 2008 Rp22,000,000 4,000,000 18,000,000 Rp4,000 Rp1,500 Rp3,000 none Rp4,000 Rp4500 13-3 29 30 13-3 Click to edit Master title style Example Exercise 13-1 PT Cahaya Sakti has stock 20,000 shares of 1% preferred stock of Rp100,000 par and 100,000 shares of Rp50,000 par common stock. The following amounts were distributed as dividends: Year 1: Rp10,000,000 Year 2: 25,000,000 Year 3: 80,000,000 Determine the dividends per share for preferred and common stock for each year. 30 30 31 13-3 Click to edit Master title style Follow My Example 13-1 Year 1 Amount distributed Preferred dividend (20,000 shares) Common dividend (100,000 shares) Dividends per share: Preferred Common stock Rp10,000,000 10,000,000 Rp 0 Rp500 None For Practice: PE 13-1A, PE 13-1B Year 2 Year 3 Rp25,000,000 Rp80,000,000 20,000,000 20,000,000 Rp 5,000,000 Rp60,000,000 Rp1,000 Rp500 Rp1,000 Rp600 31 31 32 Issuing Stock Click to edit Master title style 13-3 A corporation is authorized to issue 10,000 shares of preferred stock, Rp100,000 par, and 100,000 shares of common stock, Rp20,000 par. One-half of each class of authorized shares is issued at par for cash. Cash Preferred Stock Common Stock Issued preferred stock and 1 500 000 000 500 000 000 1 000 000 000 common stock at par for cash. 32 32 33 Click to edit Master title style 13-3 When a stock is issued for a price that is more than its par, the stock has sold at a premium. When stock is issued for a price that is less than its par, the stock has sold at a discount. 33 34 Premium on Stock Click to edit Master title style 13-3 PT Cahaya Cemerlang issues 2,000 shares of Rp50,000 par preferred stock for cash at Rp55,000. Cash Preferred Stock 110 000 000 100 000 000 Paid-in Capital in Excess of Par—Preferred Stock Issued Rp50,000 par preferred stock at Rp55,000. 10 000 000 34 34 35 13-3 Click to edit Master title style A corporation acquired land for which the fair market value cannot be determined. The corporation issued 10,000 shares of Rp10,000 par common that has a current market value of Rp12,000 in exchange for the land. Land 120 000 000 Common Stock Paid-in Capital in Excess of Par 100 000 000 20 000 000 Issued Rp10,000 par common stock valued at Rp12,000 per share, for land. 35 35 36 No-Par Stock Click to edit Master title style 13-3 A corporation issues 10,000 shares of nopar common stock at Rp40,000 a share. Cash Common Stock Issued 10,000 shares of nopar common stock at Rp40,000. 400 000 000 400 000 000 36 36 37 Click to edit Master title style 13-3 At a later date, the corporation issues 1,000 additional shares at Rp36,000. Cash 36 000 000 Common Stock Issued 1,000 shares of no-par 36 000 000 common stock at Rp36,000. 37 37 38 Stated Value Click to edit Master title style 13-3 Some states require that the entire proceeds from the issue of no-par stock be recorded as legal capital. In other states, no-par stock may be assigned a stated value per share. 38 39 Stated Value Click to edit Master title style 13-3 Using the same data as we used for par the transaction is recorded as follows: Cash 400 000 000 Common Stock Paid-in Capital in Excess of Stated Value 250 000 000 150 000 000 Issued 10,000 shares of nopar common at Rp40,000. Stated value, Rp25,000. 39 39 40 Click to edit Master title style 13-3 The corporation issued 1,000 shares of no-par common stock at Rp36,000 (stated value, Rp25,000). Cash 36 000 000 Common Stock Paid-in Capital in Excess of Stated Value 25 000 000 11 000 000 Issued 1,000 shares of no- par common at $36. Stated value, $25. 40 40 41 13-3 Click to edit Master title style Example Exercise 13-2 On March 6, Limerick Corporation issued for cash 15,000 shares of no-par common stock at Rp30,000. On April 13, Limerick issued at par 1,000 shares of 4%, Rp40,000 par preferred stock for cash. On May 19, Limerick issued for cash 15,000 shares of 4%, Rp40,000 par preferred stock at Rp42,000. Journalize the entries to record the March 6, April 13, and May 19 transactions. 41 41 42 13-3 Click to edit Master title style Follow My Example 13-2 Mar. 6 Cash 450,000,000 Common Stock (15,000 shares x Rp30,000) Apr. 13 Cash 450,000,000 40,000,000 Preferred Stock (1,000 shares x Rp40,000) May 19 Cash 40,000,000 630,000,000 Preferred Stock Paid-in Capital in Excess of Par (15,000 shares x Rp42,000) 600,000,000 30,000,000 42 42 For Practice: PE 13-2A, PE 13-2B 43 Click to edit Master title style Objective 4 13-4 Journalize the entries for cash dividends and stock dividends. 43 44 Cash Dividends Click to edit Master title style 13-4 A cash distribution of earnings by a corporation to its stockholders is called a cash dividend. There are usually three conditions that a corporation must meet to pay a cash dividend. 1. Sufficient retained earnings 2. Sufficient cash 3. Formal action by the board of directors 44 45 Three Important Dividend Dates Click to edit Master title style 13-4 First is the date of declaration. Assume that on December 1, PT Herlambang declares a Rp42,500,000 dividend (Rp12,500,000 to the 5,000 preferred stockholders and Rp30,000,000 to the 100,000 common stockholders). 45 46 Click to edit Master title style 13-4 PT Herlambang records the Rp42,500,000 liability on the declaration date. Dec. 1 Cash Dividends Cash Dividends Payable 42 500 000 42 500 000 Declared cash dividend. 46 46 47 Three Important Dividend Dates Click to edit Master title style 13-4 The second important date is the date of record. For Hiber Corporation this would be December 10. No entry is required since this date merely determines which stockholders will receive the dividend. 47 48 Three Important Dividend Dates Click to edit Master title style 13-4 The third important date is the date of payment. On January 2, PT Herlambang issues dividend checks. Jan. 2 Cash Dividends Payable Cash 42 500 000 42 500 000 Paid cash dividend. 48 48 49 13-4 Click to edit Master title style Example Exercise 13-3 The important dates in connection with a cash dividend of Rp75,000,000 on a corporation’s common stock are February 26, March 30, and April 2. Journalize the entries required on each date. Follow My Example 13-3 Feb. 26 Cash Dividends Cash Dividends Payable 75,000,000 75,000,000 Mar. 30 No entry required. Apr. 2 Cash Dividends Payable Cash For Practice: PE 13-3A, PE 13-3B 75,000,000 75,000,000 49 49 50 Stock Dividends Click to edit Master title style 13-4 A distribution of dividends to stockholders in the form of the firm’s own shares is called a stock dividend. 50 51 Click to edit Master title style 13-4 On December 15, the board of directors of PT Herlambang declares a 5% stock dividend of 100,000 shares (2,000,000 shares x 5%) to be issued on January 10 to stockholders of record on December 31. The market price on the declaration date is Rp31,000 a share. 51 52 Click to edit Master title style 13-4 The entry to record the declaration of the 5 percent stock dividend is as follows: Dec. 15 Stock Dividend (100,000 x Rp31,000 market) 3,100 000 000 Stock Dividend Distributable 2,000 000 000 Paid-in Capital in Excess of Par—Common Stock 1,100 000 000 Declared 5% (100,000 share) stock dividend on Rp20,000 par common stock with a market value of Rp31,000 per share. 52 52 53 Click to edit Master title style 13-4 On January 10, the number of shares outstanding is increased by 100,000. The following entry records the issue of the stock: Jan. 10 Stock Dividends Distributable Common Stock 2,000 000 000 2,000 000 000 Issued stock for the stock dividend. 53 53 54 13-4 Click to edit Master title style Example Exercise 13-4 Vienna Highlights Corporation has 150,000 shares of Rp100,000 par common stock outstanding. On June 14, Vienna Highlights declared a 4% stock dividend to be issued August 15 to stockholders of record on July 1. The market price of the stock was Rp110,000 a share on June 14. Journalize the entries required on June 14, July 1, and August 15. 54 54 55 13-4 Click to edit Master title style Follow My Example 13-4 June 14 Stock Dividends (150,000 x 4% x Rp110,000) 660,000,000 July Stock Dividends Distributable (6,000 x Rp100,000) Paid-in Capital in Excess of Par— Common Stock (Rp660,000,000 – Rp600,000,000) 1 No entry required. Aug. 15 Stock Dividend Distributable Common Stock 600,000,000 60,000,000 600,000,000 600,000,000 55 55 For Practice: PE 13-4A, PE 13-4B 56 Click to edit Master title style Objective 5 13-5 Journalize the entries for treasury stock transactions. 56 57 Treasury Stock Transactions Click to edit Master title style 13-5 Occasionally, a corporation buys back its own stock to provide shares for resale to employees, for reissuing as a bonus to employees, or for supporting the market price of the stock. This stock is referred to as treasury stock. 57 58 Click to edit Master title style 13-5 On January 5, a firm purchased 1,000 shares of treasury stock (common stock, Rp25,000 par) at Rp45,000 per share. The cost method for accounting for treasury stock is used. Treasury Stock Cash 45 000 000 45 000 000 Purchased 1,000 shares of treasury stock at Rp45,000. 58 58 59 Click to edit Master title style 13-5 Later, 200 shares of treasury stock were sold for Rp60,000 per share. Cash 12 000 000 Treasury Stock* 9 000 000 Paid-in Capital from Sale of Treasury Stock 3 000 000 Sold 200 of treasury stock at Rp60,000. *The amount debited to Treasury Stock per share when purchased is the amount per share that must be credited to that account when sold. 59 59 60 Click to edit Master title style 13-5 Sold 200 shares of treasury stock at Rp40,000 per share. Cash 8 000 000 Paid-in Capital from Sale of Treasury Stock Treasury Stock 1 000 000 9 000 000 Sold 200 of treasury stock at Rp40,000. 60 60 61 13-5 Click to edit Master title style Example Exercise 13-5 On May 3, PT Budiraharja reacquired 3,200 shares of its common stock at Rp42,000 per share. On July 22, PT Budiraharja sold 2,000 of the reacquired shares at Rp47,000 per share. On August 30, PT Budiraharja sold the remaining shares at Rp40,000 per share. Journalize the transactions of May 3, July 22, and August 30. 61 61 62 13-5 Click to edit Master title style Follow My Example 13-5 May 3 Treasury Stock (3,200 x Rp42,000) Cash 134,400,000 134,400,000 July 22 Cash (2,000 x Rp47,000) 94,000,000 Treasury Stock (2,000 x Rp42,000) 84,000,000 Paid-in Capital from Sale of Treasury Stock [2,000 x (Rp47,000 – Rp42,000)] 10,000,000 Aug. 30 Cash (1,200 x Rp40,000) Paid-in Capital from Sale of Treasury Stock [1,200 x (Rp42,000 – Rp40,000)] Treasury Stock (1,200 x Rp42,000) 48,000,000 2,400,000 50,400,000 62 62 For Practice: PE 13-5A, PE 13-5B 63 Click to edit Master title style Objective 6 13-6 Describe and illustrate the reporting of stockholders’ equity. 63 64 Stockholders’ Equity Section of a Balance Sheet Click to edit Master title style 13-6 PT Tarumanegara Balance Sheet December 31, 2008 Stockholder's Equity Paid-in Capital Preferred 10% stock, Rp50,000 par (2,000 shares authorized and issued) Excess of issue price over par Common stock, Rp20,000 par (50,000 shares authorized, 45,000 shares issued) Excess of issue price over par From sale of treasury stock Total Paid-in capital Retained earnings Total Deduct treasury stock (600 shares at cost) Total stockholders equity Rp100,000,000 10,000,000 Rp900,000,000 190,000,000 Rp110,000,000 1,090,000,000 2,000,000 Rp1,202,000,000 350,000,000 Rp1,552,000,000 27,000,000 Rp1,525,000,000 64 65 13-6 Click to edit Master title style Example Exercise 13-6 Using the following accounts and balances, prepare the Stockholders’ Equity section of the balance sheet. Forty thousand shares of common stock are authorized and 5,000 shares have been reacquired. Common Stock, Rp50,000 par Rp1,500,000,000 Paid-in Capital in Excess of Par 160,000,000 Paid-in Capital from Sale of Treasury Stock 44,000,000 Retained Earnings 4,395,000,000 Treasury Stock 120,000,000 65 65 66 13-6 Click to edit Master title style Follow My Example 13-6 Stockholders’ Equity Paid-in capital: Common stock, Rp50,000 par (40,000 shares authorized, 30,000 shares issued) Excess of issue price over par Rp1,500,000,000 160,000,000 Rp1,660,000,000 From sale of treasury stock 44,000,000 Total paid-in capital Rp1,704,000,000 Retained earnings 4,395,000,000 Total Rp6,099,000,000 Deduct treasury stock (5,000 shares at cost) 120,000,000 Total stockholders’ equity Rp5,979,000,000 66 66 For Practice: PE 13-6A, PE 13-6B 67 Retained Earnings Statement Click to edit Master title style 13-6 PT Tarumanegara Retained Earnings Statement For the Year Ended December 31, 2008 Retained earnings, January 1, 2008 Net Income Less dividens: Preferred stock Rp10,000,000 Common stock 65,000,000 Increase in retained earnings Retained earnings, December 31, 2008 Rp245,000,000 Rp180,000,000 75,000,000 105,000,000 Rp350,000,000 67 68 Restrictions Click to edit Master title style 13-6 The retained earnings available for use as dividends may be limited by the actions of a corporation’s board of directors. These amounts, called restrictions or appropriations, remain part of the retained earnings. However, they must be disclosed, usually in the notes to the financial statements. 68 69 Statement of Stockholders’ Equity Click to edit Master title style 13-6 PT Tarumanegara Statement of Stockholder's Equity For the Year Ended December 31, 2008 Balance, January 1, 2008 Net Income Dividens on preferred stock Dividens on common stock Issuance of additional common stock Purchase of treasury stock Balance, December 31, 2008 Preferred Stock Rp100,000,000 Rp100,000,000 Common Stock Rp850,000,000 Additional Paid-in Capital Rp177,000,000 50,000,000 25,000,000 Rp900,000,000 Rp202,000,000 Retained Earnings Rp245,000,000 180,000,000 (10,000,000) (65,000,000) Rp350,000,000 Treasury Stock Rp(17,000,000) (10,000,000) Rp(27,000,000) Total Rp1,355,000,000 180,000,000 (10,000,000) (65,000,000) 75,000,000 (10,000,000) Rp1,525,000,000 69 70 13-6 Click to edit Master title style Example Exercise 13-7 PT Kamera Jakarta. reported the following results for the year ending March 31, 2008: Retained earnings, April 1, 2007 Rp3,338,500,000 Net income 461,500,000 Cash dividends declared 80,000,000 Stock dividends declared 120,000,000 Prepare a retained earnings statement for the fiscal year ended March 31, 2008. 70 70 71 13-6 Click to edit Master title style Follow My Example 13-7 PT KAMERA JAKARTA RETAINED EARNINGS STATEMENT For the Year Ended March 31, 2008 Retained earnings, April 1, 2007 Rp3,338,500,000 Net income Rp461,500,000 Less dividends declared 200,000,000 Increase in retained earnings 261,500,000 Retained earnings, March 31, 2008 Rp3,600,000,000 71 71 For Practice: PE 13-6A, PE 13-6B 72 Click to edit Master title style Objective 7 13-7 Describe the effect of stock splits on corporate financial statements. 72 73 Stock Splits Click to edit Master title style 13-7 A corporation sometimes reduces the par or stated value of their common stock and issues a proportionate number of additional shares. This process is called a stock split. 73 74 Click to edit Master title style 13-7 PT Rojali has 10,000 shares of Rp100,000 par common stock outstanding with a current market price of Rp150,000 per share. The board of directors declares a 5-for-1 stock split. 74 75 Click to edit Master title style BEFORE STOCK SPLIT 13-7 AFTER 5:1 STOCK SPLIT 4 shares, Rp100,000 par 20 shares, Rp20,000 par $400 total par value $400 total par value 75 75 76 Click to edit Master title style 13-7 Since a stock split changes only the par or stated value and the number of shares outstanding, it is not recorded by a journal entry. The details of the stock split are normally disclosed in the notes to the financial statements. 76