5 Accounting Systems 1

advertisement

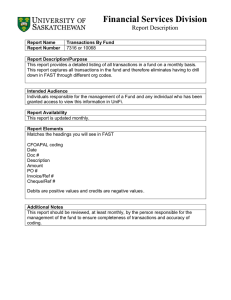

5 Accounting Systems 1 After studying this chapter, you should be able to: 1. Define an accounting system and describe its implementation. 2. Journalize and post transactions in a manual accounting system that uses subsidiary ledgers and special journals. 2 After studying this chapter, you should be able to: 3. Describe and give examples of additional subsidiary ledgers and modified special journals. 4. Apply computerized accounting to the revenue and collection cycle. 5. Describe the basic features of e-commerce. 3 5-1 Objective 1 Define an accounting system and describe its implementation. 4 Accounting Systems Growth Process 5-1 55 Three Step Process as a Business Grows and Changes 5-1 Step 1: Analysis Identify the needs of those who use the business’s financial information. Determine how the system should provide this information. 6 5-1 Step 2: Design The system is designed so that it meets the users’ needs. Step 3: Implementation The system is implemented and used. 7 Feedback 5-1 Once a system has been implemented, feedback, or input from the users of the information can be used to analyze and improve the system. 8 Internal Controls 5-1 Internal controls are policies and procedures that protect assets from misuse, ensure that business information is accurate, and ensure that laws and regulations are being followed. 9 Processing Methods 5-1 Processing methods are the means by which the system collects, summarizes, and reports accounting information. These methods may be either manual or computerized. 10 5-2 Objective 2 Journalize and post transactions in a manual accounting system that uses subsidiary ledgers and special journals. 11 5-2 A large number of individual accounts with a common characteristic can be grouped together in a separate ledger called a subsidiary ledger. 12 5-2 The primary ledger, which contains all of the balance sheet and income statement accounts, is called a general ledger. 13 5-2 Each subsidiary ledger is represented in the general ledger by a summarizing account, called a controlling account. 14 5-2 The individual customers’ accounts are arranged in alphabetical order in a subsidiary ledger called the accounts receivable subsidiary ledger or customers ledger. 15 5-2 The individual creditors’ accounts are arranged in alphabetical order in a subsidiary ledger called the accounts payable subsidiary ledger, or creditors ledger. 16 5-2 General Ledger and Subsidiary Ledgers General Ledger Cash 11 Accounts Receivable Subsidiary Ledger Accts. Rec. 12 Customer Accounts A B C Supplies 14 Accounts Payable Subsidiary Ledger Accts. Pay. 21 Creditor Accounts A B C D D 17 17 5-2 Special Journals SELLING Providing services on account recorded in Revenue journal Receipt of cash from any source recorded in Cash receipts journal 18 18 5-2 Special Journals BUYING Purchase of items on account recorded in Purchases journal Payment of cash for any purpose recorded in Cash payments journal 19 19 Special Journals 5-2 The all-purpose two-column journal, called the general journal or simply the journal can be used for entries that do not fit into any of the special journals. 20 5-2 The revenue journal is used for recording fees earned on account. Cash fees earned would be recorded in the cash receipts journal. 21 5-2 Posting the Revenue Journal Page 35 Revenue Journal Date 2008 1 Mar. 2 2 6 3 18 4 27 Invoice No. Account Debited 615 Accessories by Sintha 616 RapZone 617 Web Cantina 618 Accessories by Sintha Post Ref. Accts. Rec. – Debit Fees Earned – Credit 2 200 000 1 1 750 000 2 2 650 000 3 3 000 000 4 5 5 6 6 @solusinet 22 22 5-2 Page 35 Revenue Journal Date 2008 1 Mar. 2 2 6 3 18 4 5 6 27 Invoice No. Post Ref. Account Debited 615 Accessories by Sintha 616 RapZone 617 Web Cantina 618 Accts. Rec. – Debit Fees Earned – Credit 2 200 000 1 1 750 000 2 2 650 000 3 3 000 000 4 Accessories by Claire Accounts Receivable Subsidiary Ledger Accessories by Sintha Date Item P.R. Debit Credit Balance 5 6 2008 Mar. 2 R35 2,200,000 2,200,000 23 23 5-2 Page 35 Revenue Journal Date 2008 1 Mar. 2 2 6 3 18 4 5 6 27 Invoice No. Post Ref. Account Debited 615 Accessories by Sintha 616 RapZone 617 Web Cantina 618 Accts. Rec. – Debit Fees Earned – Credit 2 200 000 1 1 750 000 2 2 650 000 3 3 000 000 4 Accessories by Claire Accounts Receivable Subsidiary Ledger Accessories by Sintha Date Item P.R. Debit Credit Balance 5 6 2008 Mar. 2 R35 2,200,000 2,200,000 24 24 5-2 Page 35 Revenue Journal Date 2008 1 Mar. 2 2 6 3 18 4 27 Invoice No. Account Debited 615 Accessories by Sintha 616 RapZone 617 Web Cantina 618 Accessories by Sintha Post Ref. Accts. Rec. – Debit Fees Earned – Credit 2 200 000 1 1 750 000 2 2 650 000 3 3 000 000 4 5 5 6 6 25 25 5-2 Exhibit 2 Revenue Journal Page 35 Revenue Journal Date 2008 1 Mar. 2 2 6 3 18 4 27 5 31 6 Invoice No. Account Debited 615 Accessories by Sintha 616 RapZone 617 Web Cantina 618 Accessories by Sintha Post Ref. Accts. Rec. – Debit Fees Earned – Credit 2 200 000 1 1 750 000 2 2 650 000 3 3 000 000 4 9 600 000 5 6 26 26 5-2 The debit total is posted from the revenue journal to Accounts Receivable in the general ledger. ACCOUNT Accounts Receivable Date Item Post. Ref. Account No. 12 Balance Dr. Cr. Dr. Cr. 2008 Mar. 1Balance 31 3 400 000 R35 9 600 000 Revenue Journal, page 35 13 000 000 27 27 5-2 Page 35 Revenue Journal Date 2008 1 Mar. 2 2 6 3 18 4 27 5 31 Invoice No. Account Debited 615 Accessories by Sintha 616 RapZone 617 Web Cantina 618 Accessories by Sintha Post Ref. Accts. Rec. – Debit Fees Earned – Credit 6 Indicates a debit posting of Rp9,600,000 to Accounts Receivable (General Ledger Account 12) 2 200 000 1 1 750 000 2 2 650 000 3 3 000 000 4 9 600 000 5 (12) 6 28 28 5-2 The credit total is posted from the revenue journal to Fees Earned in the general ledger. ACCOUNT Fees Earned Date Item Account No. 41 Post. Ref. Balance Dr. Cr. Dr. Cr. 2008 Mar. 31 R35 Revenue Journal, page 35 9 600 000 9 600 000 29 29 5-2 Page 35 Revenue Journal Date 2008 1 Mar. 2 2 6 3 18 4 27 5 31 6 Invoice No. Account Debited 615 Accessories by Sintha 616 RapZone 617 Web Cantina 618 Accessories by Sintha Post Ref. Accts. Rec. – Debit Fees Earned – Credit 2 200 000 1 1 750 000 2 2 650 000 3 3 000 000 4 9 600 000 (12) (41) Indicates a credit posting of Rp9,600,000 to Fees Earned (General Ledger Account 41) 5 6 30 30 5-2 Example Exercise 5-1 The following revenue transactions occurred during December: Dec. 5 Invoice No. 302 to Budiman for services provided on account, Rp5,000,000. Dec. 9 Invoice No. 303 to JoJo Enterprises for services provided on account, Rp2,100,000. Dec. 15 Invoice No. 304 to Double D, Inc. for services provided on account, Rp3,250,000. Record these transactions in a revenue journal as illustrated in Exhibit 2. 31 5-2 Follow My Example 5-1 Page Revenue Journal Date 1 Dec. 5 2 9 3 15 Invoice No. Account Debited 302 Budiman 303 JoJo Enterprises 304 Double D Inc. Post Ref. Accts. Rec. – Debit Fees Earned – Credit 5 000 000 1 2 100 000 2 4 3 250 000 3 4 5 5 6 6 For Practice: PE 5-1A, PE 5-1B 32 Cash Receipts Journal 5-2 All transactions that involve the receipt of cash are recorded in a cash receipts journal. Every entry recorded in the cash receipts journal will involve a debit to the “Cash Dr.” column. 33 5-2 Cash Receipts Journal and Postings CASH RECEIPTS JOURNAL Date Page 14 Post Ref. Account Credited 2008 42 Mar. 1 Rent Revenue Other Accounts Accounts Receivable Cr. Cr. 400,000 19 Web Cantina 28 Accessories by Sintha 30 RapZone Cash Dr. 400,000 3,400,000 3,400,000 2,200,000 2,200,000 1,750,000 1,750,000 GENERAL LEDGER ACCOUNT Rent Revenue @solusinet Date Item P.R. Debit Acct. No. 42 Credit Cr. Bal. 2008 Mar. 1 CR14 400,000 400,000 34 34 5-2 CASH RECEIPTS JOURNAL Date Page 14 Post Ref. Account Credited 2008 42 Mar. 1 Rent Revenue Other Accounts Accounts Receivable Cr. Cr. 400,000 19 Web Cantina 28 Accessories by Sintha 30 RapZone Cash Dr. 400,000 3,400,000 3,400,000 2,200,000 2,200,000 1,750,000 1,750,000 Accounts Receivable Subsidiary Ledger Web Cantina Date Item P.R. Debit Credit Balance 2008 Mar. 1 Bal. 3,400,000 18 R35 2,650,000 6,050,000 CR14 19 3,400,000 2,650,000 35 35 5-2 After all journalizing and posting for the month to individual accounts is complete, the columns are totaled. 36 5-2 Posted Cash Receipts Journal CASH RECEIPTS JOURNAL Date 2008 Mar. 1 19 28 30 Account Credited Rent Revenue Web Cantina Accessories by Sintha RapZone Page 14 Post Ref. 42 Other Accounts Accounts Receivable Cr. Cr. 400,000 Cash Dr. 400,000 3,400,000 2,200,000 1,750,000 7,350,000 400,000 3,400,000 2,200,000 1,750,000 7,750,000 ( ) (12) (11) A checkmark indicates that the items in this column are posted individually. 37 37 5-2 After posting, the total amount of the accounts in the accounts receivable subsidiary ledger should match the balance in the general ledger’s Accounts Receivable account. 38 5-2 Accounts Receivable—(Controlling) Balance, March 1, 2008 Rp3,400,000 Total debits (from revenue journal) 9,600,000 Total credits (from cash receipts journal) (7,350,000) Balance, March 31, 2008 Rp5,650,000 SolusiNet Customer Balance Summary Report, March 31, 2008 Accessories By Sintha RapZone Web Cantina Total accounts receivable Rp3,000,000 0 2,650,000 Rp5,650,000 39 39 5-2 Example Exercise 5-2 The debits and credits from two transactions are presented in the following customer account: NAME Mitra Prima ADDRESS Date Jalan Raden Saleh No.94 Item July 1 Bal. 7 Inv. 35 31 Inv. 31 P.R. R12 CR4 Dr. Cr. 86 122 Balance 625,000 711,000 589,000 Describe each transaction and the source of each posting. 40 5-2 Follow My Example 5-2 July 7 Provided Rp86,000 services on account to Mitra Prima, itemized on invoice 35. Amount posted from page 12 of the revenue journal. July 31 Cash of Rp122,000 was collected from Mitra Prima (invoice 31). Amount posted from page 4 of the cash receipts journal. For Practice: PE 5-2A, PE 5-2B 41 5-2 The purchases journal is designed for recording all purchases on account. 42 5-2 Journalizing in the Purchases Journal Date Account Credited PURCHASES JOURNAL Accts. Other Post Payable Supplies Accounts Ref. Cr. Dr. Dr. Page 11 Post Ref. Amount 2008 Mar. 3 7 12 19 27 Toko Husin Toko Desiana Jujur Toko Desiana Toko Husin 600,000 600,000 420,000 420,000 2,800,000 Off. Equip. 1,450,000 1,450,000 960,000 960,000 2,800 @solusinet 43 43 5-2 Note that the March 12 purchase of office equipment for Rp2,800,000 is recorded as a debit in the “Other Accounts Dr.” column. Also note that the account title is written in for proper posting. 44 5-2 Date Account Credited PURCHASES JOURNAL Accts. Other Post Payable Supplies Accounts Ref. Cr. Dr. Dr. Page 11 Post Ref. Amount 2008 Mar. 3 7 12 19 27 Toko Husin Toko Desiana Jujur Toko Desiana Toko Husin 600,000 600,000 420,000 420,000 2,800,000 Off. Equip. 1,450,000 1,450,000 960,000 960,000 2,800,000 45 45 5-2 Posting the Purchases Journal Date Account Credited PURCHASES JOURNAL Accts. Other Post Payable Supplies Accounts Ref. Cr. Dr. Dr. Page 11 Post Ref. Amount 2008 Mar. 3 7 12 19 27 Toko Husin Toko Desiana Jujur Toko Desiana Toko Husin 600,000 600,000 420,000 420,000 2,800,000 Off. Equip. 1,450,000 1,450,000 Accounts960,000 Payable 960,000 Subsidiary Ledger 2,800,000 Toko Husin Date Item P.R. Dr. Cr. Balance 2008 Mar 3 P11 600,000 600,000 46 46 5-2 Date Account Credited PURCHASES JOURNAL Accts. Post Payable Supplies Ref. Cr. Dr. Page 11 Other Accounts Dr. Post Ref. Amount 18 2,800,000 2008 Mar. 3 7 12 19 27 Toko Husin Toko Desiana Jujur Toko Desiana Toko Husin 600,000 600,000 420,000 420,000 2,800,000 Off. Equip. 1,450,000 1,450,000 960,000 960,000 Office Equipment (Account 18 in the general ledger) is debited for Rp2,800,000. 47 47 5-2 At the end of March, all columns are totaled and equality of debits and credits is verified. Then the total amount in the “Accounts Payable Cr.” and “Supplies Dr.” columns are posted. Because Office Equipment was posted earlier, the Rp2,800,000 total is not posted. 48 5-2 Date PURCHASES JOURNAL Accts. Post Payable Supplies Account Credited Ref. Cr. Dr. Page 11 Other Accounts Dr. Post Ref. Amount 18 2,800,000 2008 Mar. 3 7 12 19 27 31 Toko Husin Toko Desiana Jujur Toko Desiana Toko Husin 600,000 600,000 420,000 420,000 2,800,000 Off. Equip. 1,450,000 1,450,000 960,000 960,000 6,230,000 3,430,000 ( 21 ) ( ) 2,800,000 ( ) GENERAL LEDGER ACCOUNT Accounts Payable Date Item P.R. Debit Credit 2008 Mar. 1 Bal 31 P11 No. 21 Balance 1,230,000 6,230,000 7,460,000 49 49 5-2 Date PURCHASES JOURNAL Accts. Post Payable Supplies Account Credited Ref. Cr. Dr. Page 11 Other Accounts Dr. Post Ref. Amount 18 2,800,000 2008 Mar. 3 7 12 19 27 31 Toko Husin Toko Desiana Jujur Toko Desiana Toko Husin 600,000 600,000 420,000 420,000 2,800,000 Off. Equip. 1,450,000 1,450,000 960,000 960,000 6,230,000 3,430,000 ( 21 ) ( 14 ) 2,800,000 ( ) GENERAL LEDGER ACCOUNT Supplies Date Item P.R. Debit Credit 2008 Mar. 1 Bal 31 P11 3,430,000 No. 14 Balance 2,500,000 5,930,000 50 50 5-2 Example Exercise 5-3 The following purchase transactions occurred during October for Helping Hand Cleaners: Oct. 11 Purchased cleaning supplies for Rp235,000, on account, from General Supplies. 19 Purchased cleaning supplies for Rp110,000, on account, from Hutama Supplies. 24 Purchased office equipment for Rp850,000, on account, from Office Warehouse. Record these transactions in a purchases journal as illustrated at the top of Exhibit 5. 51 5-2 Follow My Example 5-3 Date Oct. 11 19 24 Account Credited General Supplies Hutama Supplies Office Warehouse PURCHASES JOURNAL Accts. Other Post Payable Supplies Accounts Ref. Cr. Dr. Dr. 235,000 235,000 110,000 110,000 850,000 Off. Equip. For Practice: PE 5-3A, PE 5-3B Post Ref. 18 Amount 850,000 52 Cash Payments Journal 5-2 All transactions involving a credit to Cash are recorded in the cash payments journal. 53 5-2 CASH PAYMENTS JOURNAL Date 2008 Mar. 2 Ck. No. 150 Account Debited Rent Expense Other Accounts Post Accounts Payable Ref. Dr. Dr. 1,600,000 PAGE 7 Cash Cr 1,600,000 On March 2, issued Check 150 for rent of Rp1,600,000. @solusinet 54 54 5-2 CASH PAYMENTS JOURNAL Date 2008 Mar. 2 15 Ck. No. 150 151 Account Debited Rent Expense Guntur Other Accounts Post Accounts Payable Ref. Dr. Dr. 1,600,000 PAGE 7 Cash Cr 1,600,000 1,230,000 1,230,000 On March 15, issued Check 151 to Guntur on account, Rp1,230,000. 55 55 5-2 Let’s post to the accounts payable subsidiary ledger at this time to keep the creditors’ account current. 56 5-2 CASH PAYMENTS JOURNAL Date 2008 Mar. 2 15 Ck. No. Account Debited PAGE 7 Other Accounts Post Accounts Payable Ref. Dr. Dr. 150 Rent Expense 151 Guntur 1,600,000 Cash Cr 1,600,000 1,230,000 1,230,000 Accounts Payable Subsidiary Ledger Grayco Supplies Date 2008 Mar. 3 15 Item P.R. Dr. Bal. Cr. Balance 1,230,000 CP7 1,230,000 --- 57 57 5-2 CASH PAYMENTS JOURNAL Date 2008 Mar. 2 15 21 22 30 31 Ck. No. 150 151 152 153 154 155 Account Debited Rent Expense Guntur Jujur. Toko Desiana Utilities Expense Toko Husin PAGE 7 Other Accounts Post Accounts Payable Ref. Dr. Dr. 1,600,000 1,230,000 2,800,000 420,000 1,050,000 600,000 Cash Cr 1,600,000 1,230,000 2,800,000 420,000 1,050,000 600,000 Journalize the remainder of March’s cash disbursements. 58 58 5-2 Date 2008 Mar. 2 15 21 22 30 31 Ck. No. 150 151 152 153 154 155 PAGE 7 CASH PAYMENTS JOURNAL Other Accounts Post Accounts Payable Cash Cr Account Debited Ref. Dr. Dr. Rent Expense Grayco Supplies Guntur Jewett Business Sys. Jujur Donnelly Supplies Toko Desiana Utilities Expense Howard Supplies Toko Husin 1,600 1,600,000 1,230 1,230,000 2,800 2,800,000 420 420,000 1,050 1,050,000 600 600,000 1,600 1,600,000 1,230 1,230,000 2,800 2,800,000 420 420,000 1,050 1,050,000 600 600,000 Journalized remainder of Post tothe individual March’s cash disbursements. creditor’s accounts. 5921 59 5-2 Date 2008 Mar. 2 15 21 22 30 31 31 Ck. No. 150 151 152 153 154 155 PAGE 7 CASH PAYMENTS JOURNAL Other Accounts Post Accounts Payable Cash Cr Account Debited Ref. Dr. Dr. Rent Expense Grayco Supplies Guntur Jewett Business Sys. Jujur Donnelly Supplies Toko Desiana Utilities Expense Howard Supplies Toko Husin 1,600 1,600,000 1,230 1,230,000 2,800 2,800,000 420 420,000 1,050 1,050,000 600 600,000 2,650,000 5,050,000 1,600 1,600,000 1,230 1,230,000 2,800 2,800,000 420 420,000 1,050 1,050,000 600 600,000 7,700,000 The journal is ruled, summed, and verified for equality of debits and the “Cash Cr.” column. 60 60 5-2 Date Ck. No. PAGE 7 CASH PAYMENTS JOURNAL Other Accounts Post Accounts Payable Cash Cr Account Debited Ref. Dr. Dr. 2008 1,600 1,600 52 1,600,000 Mar. 2 150 Rent Expense 1,600,000 Grayco Supplies 1,230 1,230,000 1,230 15 151 Guntur 1,230,000 Jewett Business Sys. 2,800 2,800,000 2,800 21 152 Jujur 2,800,000 Donnelly Supplies 420 420 22 153 Toko Desiana 420,000 420,000 1,050 1,050 30 154 Utilities Expense 1,050,000 54 1,050,000 Howard Supplies 600 600 31 155 Toko Husin 600,000 600,000 31 in the “Other Accounts Dr.” 2,650,000 5,050,000 7,700,000 Items ( ) (21) (11) column are posted. Then the totals for “Accounts Payable Dr.” and “Cash Cr.” are posted. 61 61 5-2 Accounts Payable Control and Subsidiary Ledger Accounts Payable— (Control) Balance, March 1, 2008 Total credits (from purchases journal) Total debits (from cash payments journal) Balance, March 31, 2008 Toko Desiana Guntur Toko Husin Jujur Total Rp1,230,000 6,230,000 (5,050,000) Rp2,410,000 SolusiNet Supplier Balance Summary Report March 31, 2008 Rp1,450,000 0 960,000 0 Rp2,410,000 62 5-2 Example Exercise 5-4 The debits and credits from two transactions are presented in the following creditor’s (supplier’s) account: NAME Lusiana ADDRESS Date Aug. 1 12 22 Jalan Palmerah Selatan No.10 Item P.R. Dr. Cr. Balance Bal. 320,000 Bill 101 CP36 200,000 120,000 Bill 106 P16 140,000 260,000 Describe each transaction and the source of each posting. 63 5-2 Follow My Example 5-4 Aug. 12 Paid Rp200,000 to Lusiana on account (Bill 101). Amount posted from page CP36 of the cash payments journal. Aug. 22 Purchased Rp140,000 of services on account from Lusiana itemized on Bill 106. Amount posted from page P16 of the purchases journal. For Practice: PE 5-4A, PE 5-4B 64 5-3 Objective 3 Describe and give examples of additional subsidiary ledgers and modified special journals. 65 Modified Special Journals 5-3 A business may modify its special journals by adding one or more columns for recording transactions that occur frequently. 66 5-3 @solusinet On November 2, SolusiNet issued Invoice No. 842 to Tulus Abadi for Rp4,770,000, which included sales taxes of Rp270,000. 67 5-3 Modified Revenue Journal Page 40 Revenue Journal Date 2008 Nov. 2 Invoice No. 842 Account Debited Tulus Abadi Accts. Rec. Fees Earned Sales Tax. Pay PR Dr. Cr. Cr. 4 770 000 4 500 000 270 000 @solusinet 68 68 5-3 Page 40 Revenue Journal Date 2008 Nov. 2 Invoice No. 842 Account Debited Tulus Abadi Accts. Rec. Fees Earned Sales Tax. Pay PR Dr. Cr. Cr. 4 770 000 4 500 000 270 000 Rp4,770,000 is debited to Tulus Abadi in the accounts payable subsidiary ledger 69 69 5-3 Page 40 Revenue Journal Date 2008 Nov. 2 Invoice No. 842 Account Debited Litten Co. Accts. Rec. Fees Earned Sales Tax. Pay PR Dr. Cr. Cr. 4 770 000 4 500 000 270 000 A checkmark indicates that the amount has been posted. 70 70 5-3 On November 3, issued Invoice No. 843 to Kumbang for Rp1,166,000, which included sales taxes of Rp66,000. 71 5-3 Page 40 Revenue Journal Date 2008 Nov. 2 3 Invoice No. 842 843 Account Debited Tulus Abadi Kumbang Accts. Rec. Fees Earned Sales Tax. Pay PR Dr. Cr. Cr. 4 770 000 1 166 000 4 500 000 1 100 000 270 000 66 000 72 72 5-3 Example Exercise 5-5 The state of Tennessee has a 7% sales tax. Sukmajaya, had two revenue transactions as follows: Aug. 3 Issued Invoice No. 58 to Helena Company for services provided on account, Rp1,400,000, plus VAT 19 Issued Invoice No. 59 to Kalam Enterprises for services provided on account, Rp900,000, plus VAT. Record these transactions in a revenue journal as illustrated in the previous section. 73 5-3 Follow My Example 5-5 Revenue Journal Invoice No. Date Aug. 3 19 Account Debited 58 Helena 59 Kalam Accts. Rec. Fees Earned Sales Tax. Pay PR Dr. Cr. Cr. 1 540 000 990 000 For Practice: PE 5-5A, PE 5-5B 1 400 000 900 000 140 000 90 000 74 5-4 Objective 4 Apply computerized accounting to the revenue and collection cycle. 75 5-4 Database A database collects, stores, and organizes information in a retrievable format. 76 5-4 77 77 5-4 At any time, managers may request reports from the software. 1) The customer balance summary. 2) The fees earned by customer detail. 3) The cash receipts. 78 5-5 Objective 5 Describe the basic features of e-commerce. 79 5-5 e-Commerce Using the Internet to perform business transactions is termed e-commerce. 80 5-5 B2C When transactions are between a company and a consumer, it is termed B2C (business-toconsumer) e-commerce. 81 5-5 Three more advanced areas where the Internet is being used for business purposes are: Supply chain management (SCM) Consumer relationship management (CRM) Product life-cycle management (PLM) 82