Container Port Of UK (英国集装箱港口)

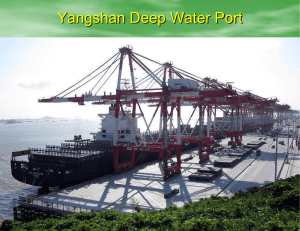

advertisement

Container Port Of UK (英国集装箱港口) 一、The world trade for container transportation demand 二、British major container ports World Trade(Billion Dollar) 16000 14000 12000 10000 8000 Year 6000 4000 2000 0 1999 2003 2005 2006 2008 Trade and globalization, promoted the rapid rise of global trade One of the largest container ports in Europe——Felixstowe 一、Port of Felixstowe(PFL) profile 二、Felixstowe Facilities • Currently has nine of container berths , length 3972meters and depth is 15 meters. • 50,000m² of covered warehousing on a 22 acre site equipped to handle almost anything • Newly racked food grade warehousing • Temperature controlled facility • Covered marshalling areas with multi-loading bays with dock levellers • Extensive outdoor storage facilities • 24 hour CCTV security 三、The advantage and the main routes of port Felixstowe • The superior geographical position makes the current status of Felix's port • Main routes to UK others ports and Europe and world’s other ports 四、Main goods through port of Felixstowe Northeast emerging container port -Teesport • The reason of Teesport port emerging • Location of Teesport • Container port Facilities The End Thank You 2009-06-05 YANGSHAN DEEP SEA PORT UPDATE • BLUE PLAN OF YANGSHAN (XIAO YANGSHAN) PROJECT • SPECIFICATIONS OF YANGSHAN TERMINAL • SIPG’S OBJECTIVES FOR YANGSHAN PHASE I • MARKETING/OPERATIONAL CONCERNS • TARIFF ANALYSIS – WGQ vs YANGSHAN • CARRIERS’ GENERAL FEEDBACK Blue Plan Of Yangshan Terminal Yangshan Develop Plan (XiaoYangshan Part) Area Wharf function Length (M) Berth Throughput (teu) Forecast construction ship/ferry 1,000 coastal/river feeder 1,350 8 2,000,000 Y2010 container terminal 1,500 5 2,500,000 Y2009 container terminal (phase I) 1,600 5 3,000,000 Y2005 container terminal (phase II) 1,400 4 2,500,000 Y2006 container terminal (phase III) 2,600 7 5,000,000 Y2007-2008 LNG ship 1,650 Oil tank 1,900 29 15,000,000 Western Part Yangshan Mid part Eastern part Total 13,000 Organization Of Yangshan Terminal – Phase I Terminal Operator: Shanghai Shengdong International Container Terminal Co.,Ltd (SSICT) Investor: Shanghai Port Container Company (SPC) Shanghai International Port (Group) Co.,Ltd (SIPG) 51% 49% - Terminal specifications – Phase I 18 22nd Sep,2005 M/V “Clementine Maersk” test berthing on Yangshan Phase I terminal. 30th Nov,2005 TNWA CEX M/V “APL Iris” made her first calling on Yangshan Phase I terminal. Investment Of Yangshan Terminal – Phase II Investor: Hutchison Whampoa AP Moller Maersk SIPG COSCO China Shipping 32% 32% 16% 10% 10% - DONGHAI BRIDGE Spans 32KM with 2 way 6 lanes (exclude 2 parking lanes) Function for transportation, power/water supplies and communication Yearly capacity of movements 4 millions teus (design capacity) Linked up on 25th of May 2005 and was opened for traffic in Middle of Nov.2005. No toll fee after opening - LUCHAOGANG AREA Industrial Area: about 200km Harbor New City: about 100km Connect with Yangshan Inter’l Port through “DONGHAI” Bridge Simultaneous development of Port, Urban Area, Industrial Area and Bridge with respective emphasis, to make this area a key composite of Shanghai Inter’l Shipping Center Lingang Group is the developer of Lingang Industrial Area, undertaking the tasks of infrastructure construction and commercial development. Layout Plan Rail Station Luchaogang Town Supporting Area (Phase I) Int’l Carrying Trade Composite Usage Service & Trade Int’l Procurement & Distribution Advantages ation • Policy - Most favorable and open policy in china • Land - Comparatively abundant Low cost • Labour - Low cost Supported with industry research & learning base • Freight - Fast multimodal transport with efficient operation to lower inland transportation cost • Operation - Search for top strategic partnership • Scale - combination of both tax and tax-free business Simultaneous development of the Logistics zone, the port and the equipment industrial area • Information Flow - Integrated Speedy Customs Clearance, transparent government affairs, and online services Integrated information with the support of related sectorsC ompetitive SIPG’s Objectives For Yangshan Phase I ENSURE A SMOOTH PHASE I OPERATION FOR THE YANGSHAN PROJECT ACHIEVE 2.7-3 MILLIONS THROUGHPUT IN 2006 TO PRESENT A BRILLIANT FEAT & PREDICT TO 3.5 MILLIONS BY END OF 2007 SET A FAIR PLAN TO MOVE INTER-TERMINAL SERVICE TO PHASE I BY EACH INDIVIDUAL NEGOTIATION WITH CARRIERS ALL EUROPE STRINGS ARE SELECTED AS PHASE I CALLERS >>> THE BACKGROUND INFORMATIONS AS FOLLOW Inter asia 28.7% Austria 2.3% Domitic 1,154,349 T/S 2,014,018 Inter Asia 4,171,065 Austria 327,829 Latin.America 1.6% Africa 1.5% North.America 23.9% MED 5.1% EU 2,146,541 Latin America 236,438 Russia 78,962 MED 739,065 Africa 213,057 North America 3,472,214 Russia 0.5% EU 14.7% T/S 13.8% Domistic 7.9% ABOVE PIE-CHART INDICATES SHANGHAI CONTAINER THROUGHPUT BY TRADE WISE IN 2004 2.14 MILLION TEUS FOR EUROPE ON LINEHAULS + 0.8 MILLION TEUS FM TRANSHIPMENT, TOGETHER WITH REASONABLE VOLUME GROWTH WILL SUPPORT TO TARGET OF 2.7-3 MILLIONS EXISTING SERVICES WILL BE MOVED TO YANGSHAN PHASE I Service Code Current terminal TA TD TNWA CEX G.Alliance Loop D G.Alliance Loop B G.Alliance Loop F CS/ZIM AEX2 CS AEX1 LT CEM CMA FAL CYHK AE1 CYHK AE2 CYHK PDM MSL AE7 MSC SILK PIL/WANHAI FES CSAV AME WGQ Phase I WGQ Phase I WGQ Phase II WGQ Phase I WGQ Phase II WGQ Phase II WGQ Phase II WGQ Phase IV WGQ Phase V WGQ Phase V WGQ Phase IV WGQ Phase IV WGQ Phase IV WGQ Phase IV WGQ Phase V Wed Sat Sun Thu Mon Thu Sat Mon Sat Sat Wed Sat Sun Fri Wed Thu Sun Mon Fri Tue Fri Sun Tue Sun Sun Thu Sun Mon Sat Thu ALLIANCE /SLOT PARTNER SERVICE TNWA CEX LOOP B G.Alliance LOOP D LOOP F CS/ZIM AEX2 CS AEX1 LT CEM CMA FAL AE1 CYHK AE2 PDM MSL AE7 MSC SILK PIL/WANHAI FES CSAV AME MON TUE WED THU FRI SAT SUN MON Marketing Concerns - CARGO FLOW FOR IMPORT/EXPORT Exaggerate market competition in EU service due to slot increment - Deep port allow much more loading without draft limitation - Deep port stimulate carrier to allocate more big ships Trucking cost impact (Incremental cost to customers) Origin/Distance Trucking cost 20' Trucking cost 40' Jiang Su area Zhe Jiang area (Around 100 km) (Around 40 km) usd 80 usd 30 usd 100 usd 40 - Feeder service could be more requested in Jiangsu area - Possible cargo(ex Zhejiang origins) will migrate to Ningbo port Exaggerate market competition in EU service due to slot increment - Deep port allow much more loading without draft limitation - Deep port stimulate carrier to allocate more big ships Trucking cost impact (Incremental cost to customers) Origin/Distance Trucking cost 20' Trucking cost 40' Jiang Su area Zhe Jiang area (Around 100 km) (Around 40 km) usd 80 usd 30 usd 100 usd 40 - Feeder service could be more requested in Jiangsu area - Possible cargo(ex Zhejiang origins) will migrate to Ningbo port T/S operation for river feeder in WGQ - River barge service cut-off for export will be advanced by 2 days - Total transit time will be increased - Sea-going feeder will raise up its rate (at a later stage) Limited/Increased cost for international T/S at this stage Wayport shipment influence - EU wayport service meet competition from WGQ direct service - Wayport service for EU in WGQ challenge EU in Yangshan Empties return – inbound laden Most inbound clients prefer to return to PUDONG depots but they all predict depots in LUCHAOGANG will become popular once phase II & III start to operate Operational Concerns Vessel Operation - No draft limitation - Flexible berthing/sailing time - Less steaming time by saving along 10hrs - Weather impact is an uncertain factor on terminal operation Export Cargo - Customs pre-declaration is required before gate-in - Tax refund can be applied upon cargoes’ in terminal - More spending on truckage/time for land transportation - Bridge risk by weather factors and traffic condition Import Cargo - No penalty due to late customs declaration - Free port policy declaration - More spending on truckage/time for land transportation - Bridge risk by weather factors and traffic condition Empty Reposition - 2 Scenario offered by SIPG for empty repositioning: to WGQ (by barge) to Luchao port (by trucking) - Higher reposition cost from Yangshan terminal to Pudong depot(Appr. USD90/wagon) - Export empty picking up in Luchao area is needed to develop gradually Inland and Coastal T/S Service - ‘Marine shuttle buses’ are set for inland river feeder’s T/S at WGQ (3 Gangs per Day) - Extra cost/time spending on T/S between WGQ and SSICT for export - For export, CY-cut is to be advanced by 2 days at WGQ - Weather/sea condition impact (if marine shuttle bus suspend by bad weather) - Steaming is saved for costal feeder service Un-containerized cargo operation - Floating crane dispatch from inner port is with difficulty - Shipper’s barges for break bulk are not sea-going vessel - Bridge transportation over the sea is another big risk Tariff Analysis - WGQ vs Yangshan (In RMB) Pilot Fee (Cost Down) Normal Day Holiday / Night Holiday night Surcharge WGQ YangShan 0.765*NRT 1.148*NRT 1.530*NRT 4,000 0.530*NRT 0.795*NRT 1.060*NRT NIL Tug Fee (Cost Down) LOA WGQ YangShan 95 <L< 122 <L< 155 <L< 180 <L< 220 <L< 280 <L 18,400 18,000 33,100 22,200 35,200 28,800 42,200 32,200 55,600 38,900 45,800 Stevedoring Charge (Cost Down) Container Type 20F 20E 20DG 20RF 20E(RF) 40F 40E 40DG 40RF 40E(RF) WGQ 1(05/06) 467.2 322.9 513.8 513.8 355.9 700.9 484.3 770.8 770.8 533.7 / / / / / / / / / / WGQ 2/4/5(05/06) 513.9 355.2 565.2 565.2 391.5 771.0 532.7 847.9 847.9 587.1 468.1 323.6 514.7 514.7 356.6 702.2 485.3 772.2 772.2 534.8 / / / / / / / / / / 514.9 356.0 566.2 566.2 392.3 772.4 533.8 849.4 849.4 588.3 YangShan 425.5 294.1 467.9 467.9 324.1 638.3 441.1 702.0 702.0 486.1 Stevedoring charge in WGQ to be increased by 10% fm 2006 “Marine Shuttle Bus” T/S charges at WGQ (Cost Up) - By Shuttle Feeder: RMB350/RMB575 PER S2/S4 - By Shuttle Trucking: RMB500/RMB750 PER S2/S4 Other port Charge (no change) (Mooring/Unmooring, Hatch cover moving, Wharfage, Fresh water supply, Tally fee, Harbour due, Tonnage due…etc.) Carriers’ General Feedback A fair shifting plan by using same trade service Yearly workable days of terminal is still the key concern even 339 days is announced by SIPG Seeking more cost absorbing by SIPG for T/S operations & empty reposition between WGQ & Yangshan, and extension of free storage at port or Luchaogang areas Gradually development of empty picking up for export shipment in Luchaogang depots Most carrier plan to set on-site office in Yangshan terminal area