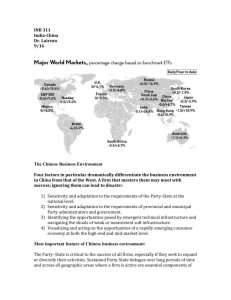

THE ROLE OF FOREIGN-INVESTED ENTERPRISES IN THE CHINESE ECONOMY: AN INSTITUTIONAL

advertisement